WASHINGTON, D.C. — The National Retail Federation (NRF) has reported that retail sales during last year’s holiday season totaled $886.7 billion, a 14.1 percent increase from 2020 ($777.3 billion). The 2021 numbers were greater than what the NRF had predicted and sets a new record despite ongoing problems such as supply chain issues and the spread of the COVID-19 Omicron variant. Retail sales were tracked from Nov. 1 to Dec. 31 and exclude data from automobile dealers, gas stations and restaurants. Retail sales fell by 2.7 percent seasonally adjusted in December from November but increased by 13.4 percent unadjusted year-over-year. The sector with the biggest sales gain during the holidays were clothing and clothing accessory stores, which saw an increase of 33.1 percent. Additionally, sporting goods stores were up 20.9 percent; general merchandise stores were up 15.2 percent; furniture and home furnishings stores were up 15 percent; building materials and garden supply stores increased its sales by 13.5 percent; and health and personal care stores were up 9.6 percent. Also online and other non-store sales were up 11.3 percent, which falls in line with NRF’s prediction made in October of a growth rate between 11 to 15 percent. “Consumers were …

District of Columbia

WASHINGTON, D.C. — The National Retail Federation released a statement on Thursday, Jan. 13 saying the organization agreed with the U.S. Supreme Court’s decision about vaccine mandates. The Supreme Court on Thursday blocked the Biden administration from passing a bill that would require employees at large private companies to either get the vaccine or get tested regularly for COVID-19, as well as wear masks in the workplace. The Biden administration’s vaccine mandate would require vaccinations for those who worked at a company with 100 or more employees. In a separate ruling, the court allowed a vaccine-mandate for healthcare workers in a ruling of 5-4. NRF joined more than 26 other trade associations last week to present oral arguments before the court on the legality of the mandate. “While NRF has maintained a strong and consistent position related to the importance of vaccines in helping to overcome this pandemic, the Supreme Court’s decision to stay OSHA’s onerous and unprecedented [Emergency Temporary Standard] ETS is a significant victory for employers,” says David French, NRF’s senior vice president of government relations. Many were worried that with vaccine requirements, some employees may rather quit than get the vaccine, ultimately causing higher unemployment numbers. After …

WASHINGTON, D.C. AND PENSACOLA, FLA. — A joint venture between Washington, D.C.-based National Real Estate Advisors (NREA) and Florida-based Catalyst Healthcare Real Estate has acquired two national healthcare portfolios totaling approximately 1.2 million square feet Together, the portfolios comprise 40 properties across 13 states, the majority of which are located in Sun Belt markets. At the time of sale, the portfolios had a combined occupancy rate of 92 percent. Of that 1.1 million square feet of occupied space, about 88 percent is leased to regional healthcare systems and physician groups. The acquisition and recapitalization represent a total investment of approximately $420 million. The sellers were also not disclosed. “These transactions underscore our commitment to investing in highly competitive, diverse markets that seek to generate long-term, healthy returns for our clients,” says Jeffrey Kanne, president and CEO of NREA. “This acquisition not only significantly scales our medical office portfolio but furthers our geographic diversification.” “Our joint venture strives to positively impact healthcare delivery by investing strategic capital with a partnership-like mentality,” adds Chad Henderson, founder and CEO of Catalyst. “The closing of the portfolios was a significant first step for our joint venture and paves the way for the future of …

The Washington, D.C., and Baltimore markets, when combined, represent the fourth-largest metropolitan region in the nation by population, and retailers are taking notice again. Grocery-anchored projects are the most prevalent in the headlines. For example, the first of nearly 20 Amazon Fresh locations has opened in the area. Additionally, Wegmans’ smaller format rollout plan is active with its first location in Stonebridge’s Carlyle Crossing in Alexandria opening spring 2022, along with Roadside Development’s City Ridge Project at the former Fanny Mae Headquarters in Northwest D.C. Former Shoppers Food Warehouse boxes also continue to get absorbed by new grocers. A less-covered sector of the grocery market is the international markets category, which remains very active in the region. There are 29 different banners across the region that exceed 10,000 square feet in size, with the newest entrant being Oh! Markets in Northern Virginia. Other international market newcomers, including 99Ranch and Enson Market, are also searching for space. With the immense ethnic diversity of the region, we expect investors to start taking notice of this sector with their acquisition appetite, just as they have in other regions like Texas and Florida. Publix, a customer favorite, is in the early stages of identifying …

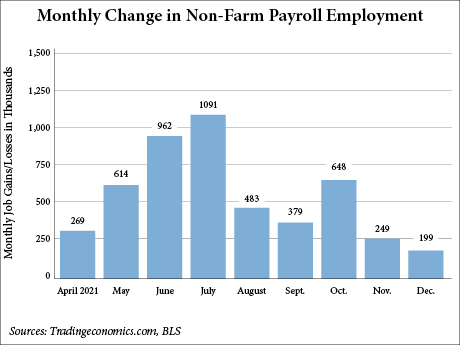

WASHINGTON, D.C. — Total nonfarm payroll employment rose by 199,000 jobs in December, while the unemployment rate declined from 4.2 percent in November to 3.9 percent, according to the U.S. Bureau of Labor Statistics (BLS) report that came out Friday, Jan. 7. A closer look at the data shows that employers added 211,000 private sector jobs, while the government shed 12,000 jobs. The employment numbers were much lower than the Dow Jones’ estimate of nonfarm payroll employment of 422,000 but the unemployment rate was below the predicted 4.1 percent rate, according to CNBC. In February 2020, the last full month not impacted by the COVID-19 pandemic, the unemployment rate was 3.5 percent. The news outlet also noted the BLS report included data from Dec. 12, which is when some of the highest reported cases of Omicron variant were found. The highest amount of job gains last month was in the leisure and hospitality sector, which increased by 53,000 jobs. Other notable job gains occurred in professional and business services (+43,000), manufacturing (+26,000), construction (+22,000) and in transportation and warehousing (+19,000). Last month, little to no change occurred in employment for the retail trade, financial activities, healthcare, government and information and …

WASHINGTON, D.C. — Lument has provided two Freddie Mac tax-exempt loans (TEL) totaling $16.9 million for the development of 1515 North Capitol Apartments, a 15-story affordable housing development in Washington, D.C. Construction for the project is slated to be complete in 27 months. The borrower is So Others Might Eat (SOME), a Washington, D.C.-based local nonprofit organization that provides services to those facing poverty and homelessness. 1515 North Capitol will feature 136 affordable studio units, with 75 units subsidized through D.C.’s Local Rental Supplement Program (LSRP), 61 units restricted to tenants earning 50 percent of area median income (AMI) and three units reserved for staff. The units features will include vinyl plank flooring, ranges with vented hoods, microwave ovens and garbage disposals. Community amenities will include a community room, conference and meeting rooms, classrooms, library, computer room, fitness center, bike storage, two roof terraces and a laundry room on every residential level. Lument structured two portions of debt for the Freddie Mac TEL. The first part of financing was in the amount of $11.8 million and featured a 17-year term and 40-year amortization schedule. The other loan was in the amount of $5.1 million based on the LSRP overhang to …

FAIRFAX, VA. — KBS has sold Willow Oaks Corporate Center, a 584,147-square-foot, Class A office park in Fairfax, which is about 18.7 miles west from Washington, D.C. Bridge Investment Group purchased the property for $106 million. KBS owned the property via KBS Real Estate Investment Trust II. Built in three phases in 1986, 1989 and 2003, Willow Oaks Corporate Center is a three-building office park located near the intersection of Route 50 and the Capital Beltway. The office center has obtained WiredScore Gold and Silver certifications, which has to do with the property’s wired infrastructure, internet connectivity and resilience. The property also features EV car-charging stations and an energy-management system. Building amenities include bike storage, an outdoor picnic area, carwash and detail service, private tenant balconies, concierge service and multiple bus shuttles. Located at 8281-8399 Willow Oaks Corporate Drive, the property is 7.4 miles from George Mason University, less than one mile from Inova Fairfax Hospital and 1.1 miles from the Mosaic District Town Center, a 31-acre mixed-use development with retail and dining options. The property is also situated near several retailers and restaurants such as Great Wall Supermarket, McDonald’s, Starbucks, Sweetwater Tavern and CVS/pharmacy. Under KBS’ previous ownership, the …

WASHINGTON, D.C. — Total nonfarm payroll employment rose by 210,000 in November, and the unemployment rate fell from 4.6 percent in October to 4.2 percent, the U.S. Bureau of Labor Statistics (BLS) reported today. The headline number was well below Wall Street expectations of 573,000 jobs, according to CNBC. Notable job gains occurred in the professional and business services, transportation and warehousing, construction and manufacturing employment sectors. Meanwhile, employment in retail trade declined by 20,400 in November from the prior month, according to BLS. Employment in leisure and hospitality changed little in November (+23,000), following large gains earlier in the year. The leisure and hospitality sector has added 2.4 million jobs thus far in 2021, but employment in the industry is down by 1.3 million, or 7.9 percent, since February 2020. Health care employment was relatively unchanged in November (+2,000). Within the industry, employment in ambulatory health care services continued to trend up (+17,000), while nursing and residential care facilities lost 11,000 jobs. Employment in health care is down by 450,000 since February 2020, with nursing and residential care facilities accounting for nearly all of the loss. In November, employment showed little change in other major industries, including mining, wholesale …

WASHINGTON, D.C. — A total of 199,000 Americans filed for first-time unemployment insurance assistance for the week that ended Nov. 20, the U.S. Department of Labor reported Wednesday. The claims were much lower than the revised 270,000 from the previous week, as well as lower than the 260,000 expected. Additionally, this week’s unemployment figure is the lowest level in 52 years, since November 1969. From the week that ended on Nov. 20 to the previous week, workers filing for initial unemployment benefits declined by 71,000. The four-week moving average hit a new pandemic-era low as well at 252,250 claims, a decrease of 21,000 from the previous week’s revised average. The Wall Street Journal reports that the decline of Delta variant cases, as well as a surge of job openings, has contributed to the lower unemployment numbers. There were 52 percent more job postings on Indeed.com, an online job-search engine, than there were before the pandemic in February 2020. The sudden decrease in unemployment claims may be due to the upcoming holiday season and the way seasonal adjustment is calculated. On a non-seasonally adjusted basis, initial claims for the past four weeks were up by 18,000 to 259,000. There were big …

WASHINGTON, D.C. — The Trump Organization has entered into an agreement with Miami-based investment firm CGI Merchant Group to sell its namesake hotel in the nation’s capital for $375 million, according to multiple news outlets including The Wall Street Journal, which broke the news. The Journal reports that the new ownership will remove the Trump name and signage from the 263-room luxury hotel, which opened in 2016 at 1100 Pennsylvania Ave., just a few blocks from The White House. The project was a redevelopment of a former U.S. Post Office building, which has served many functions since its construction in the late 1800s. Lastly, the business publication states that CGI Merchant Group has reached an agreement with Hilton Worldwide Holdings Inc. (NYSE: HLT) to operate the property under the Hilton Waldorf Astoria brand. The sale is expected to close in the fourth quarter, per the Journal. The hotel was valued at $212 million when it opened. At that time, the property housed the Benjamin Bar & Lounge, restaurant BLT Prime, The Spa by Ivanka Trump, a Brioni menswear boutique store and a 13,200-square-foot ballroom. The hotel includes a 4,000-square-foot presidential suite, which is located in the former Postmaster General’s office. …