WASHINGTON, D.C. — The Community Preservation Corp. (CPC) has arranged $26.7 million in construction financing for the rehabilitation and expansion of Townley Court, a 45-unit affordable housing community located in the Glover Park neighborhood of Washington, D.C. DC Green Bank and J.P. Morgan provided $15.7 million in combined financing for the project, while additional financing included $5.2 million from Amazon and $5.8 million from American Housing. Additionally, CPC Mortgage Co. originated a $15.7 million Freddie Mac loan under a Targeted Affordable Housing (TAH) forward commitment. The financing will fund renovations to the apartment’s 45 existing units, with plans to build an additional seven units, as well as solar panels, electric vehicle charging stations and energy-efficient building upgrades. The eco-friendly improvements are estimated to cut both the building’s utility costs and greenhouse gas emissions by nearly 10 percent, while also meeting the Enterprise Green Communities certification upon completion of the renovation. Completion is targeted for September 2026.

District of Columbia

WASHINGTON, D.C. — SRS Real Estate Partners has brokered the nearly $3 million sale of a restaurant property located at 301 Massachusetts Ave. in Washington, D.C.’s Capitol Hill neighborhood. Pupatella Neapolitan Pizza has occupied the 4,154-square-foot restaurant since fall 2024 on a triple-net lease. Rick Fernandez and Andrew Fallon of SRS represented the seller, a private owner based in New York City, in the transaction. The buyer was a local private investor. Both parties requested anonymity. Sandy Spring Bank provided an undisclosed amount of acquisition financing to the buyer. The restaurant was recently renovated and features 1,500 square feet of outdoor patio space.

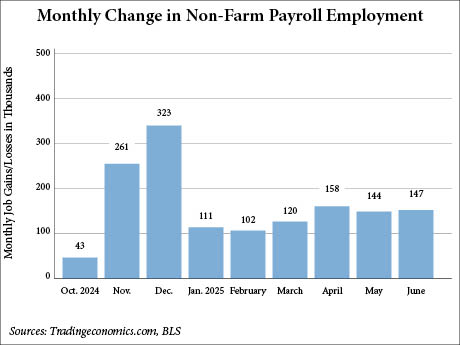

WASHINGTON, D.C. — The U.S. economy added 147,000 jobs in June, according to the U.S. Bureau of Labor Statistics (BLS). The monthly figure surpasses the estimated 110,000 jobs by Dow Jones economists, according to CNBC. The total also contrasts ADP’s report yesterday that the private sector lost 33,000 jobs in June, which CNBC reported was a surprise to economists who were forecasting an increase of 100,000 jobs. While surpassing expectations, the June total is on target with the average 146,000 jobs added over the prior 12 months, according to the BLS. The leading employment sector this past month was government, which added 73,000 jobs. State governments added 47,000 jobs, mostly in education (+40,000), and local governments added 23,000 jobs. Job losses continued at the federal level as 7,000 jobs were lost in June. Other sectors that saw job gains in June included healthcare (+39,000) and social assistance (+19,000). Employment changed little in most other fields, including construction, manufacturing, retail trade, transportation and warehousing, professional and business services and leisure and hospitality. The BLS also reported that the unemployment rate changed little at 4.1 percent, which marks 13 consecutive months where the unemployment rate has landed between 4 and 4.2 percent. …

WASHINGTON, D.C. — A partnership between Garfield Investments and Broad Creek Capital has acquired a 285,000-square-foot, eight-story office building located at 300 M St. SE in Washington, D.C.’s Navy Yard district. The seller and sales price were not disclosed. Bradley Allen of Eastdil brokered the transaction. Situated two blocks from the Navy Yard Metro Station and opposite the Washington Navy Yard, the property was 53 percent leased at the time of sale to tenants including defense firms and subcontractors of the U.S. Navy. The office building includes a 7,000-square-foot conference facility, fitness center, 24-hour security and 304 underground parking spaces. Garfield and Broad Creek have selected Greg Tomasso of Avison Young to handle leasing at 300 M.

JRK Property Holdings Acquires Two Apartment Communities in Los Angeles, Washington, D.C. for $315M

by Abby Cox

LOS ANGELES AND WASHINGTON, D.C. — Los Angeles-based JRK Property Holdings has acquired two apartment communities totaling 684 units, Chase Knolls in Los Angeles and WestEnd25 in Washington, D.C., in two separate transactions for a combined total of $315 million. Located on 14 acres in the Los Angeles neighborhood of Sherman Oaks, Chase Knolls is a 401-unit garden-style community that encompasses nearly two city blocks. The property was originally built in 1949 to include 260 Art Deco-inspired apartment homes across 19 one- and two-story residential buildings. In 2021, a new clubhouse and resort-style swimming pool were integrated into the community, along with 141 new units that were constructed to occupy six additional residential buildings. JRK also plans to make further enhancements to the complex to improve the community amenities and common areas. According to Cushman & Wakefield, which marketed the property for sale on behalf of the undisclosed seller, Chase Knolls is one of only 12 apartment communities exceeding 100 units built in Sherman Oaks over the past 75 years, a testament to the significant development hurdles in the area, such as limited land and high barriers to entry. The second property, WestEnd25, is a 283-unit high-rise apartment community that …

WASHINGTON, D.C. — Shorenstein Investment Advisers has purchased 901 K Street, a 219,956-square-foot trophy office building in Washington, D.C.’s East End submarket. The seller and sales price were not disclosed, but multiple media outlets report that Carr Properties sold the office building for $84 million. Tenants at 901 K Street include Microsoft, Baker Donelson and ViaSat. Shorenstein has selected Eli Barnes, Jonathan Wellborn and Will Stern of Avison Young to lease 901 K Street. Shorenstein plans to enhance the office building’s amenity offerings with a new conference facility and tenant lounge. Other amenities include a rooftop terrace with a catering kitchen for events, fitness center and a 222-space parking garage.

WASHINGTON, D.C. — Walker & Dunlop has arranged $106.3 million loan for the refinancing of Agora, an apartment community located in Washington, D.C. The borrower is locally based owner-operator WC Smith. Completed in 2018, Agora totals 334 units across 11 stories. The community marks the second phase of the larger development known as The Collective, which totals 1,138 apartments in the Capitol Riverfront neighborhood. The Collective also includes Park Chelsea, a 429-unit community, and The Garrett, which features 373 apartments and 5,000 square feet of coworking space. Amenities at The Collective include a Whole Foods Market, fitness center, spa rooms and an indoor golf simulator. The development is located within walking distance of Nationals Park, Audi Field and the Navy Yard. “Agora is a standout asset within their exceptional portfolio, and the swift rate lock, secured within 24 hours of the signed application, demonstrates our dedication to providing timely, customized solutions that ensure the best possible outcomes for our clients, says Connor Locke, managing director of multifamily finance at Walker & Dunlop. Walker & Dunlop also arranged financing for the other two phases of The Collective. In 2024, the firm originated more than $30 billion in debt financing. — Hayden Spiess

WASHINGTON, D.C. — The American Dental Education Association (ADEA) has signed a lease to relocate to the District Center at 555 12th St. NW in Washington, D.C. ADEA will occupy approximately 30,000 square feet, which is half of the fourth floor, beginning in the first quarter of 2026. ADEA’s headquarters is currently located at the Association of American Medical Colleges (AAMC) at 655 K St. NW in D.C. Andy Eichberg, Matt Pacinelli and John Klinke of Stream Realty Partners represented the landlord in the lease transaction. Susan Thomas and Thomas Brown of CBRE represented ADEA. District Center, owned by a joint venture between MetLife Investment Management and Norges Bank Investment Management, offers 850,000 square feet of office space and is 95 percent leased, with up to 6,500 square feet still available for lease. Amenities at the property include an atrium lounge, fitness center with group and personal training options, lockers, showers, ample bicycle storage and a rooftop sky lounge that spans 3,391 square feet with outdoor terraces. Retail and restaurant tenants at the center include Ristorante TOSCA, Celadon Spa & Salon, Saks OFF Fifth, Nordstrom Rack and Potbelly Sandwich Shop.

WASHINGTON D.C. — A joint venture between Henderson Park and Lowe has broken ground on an office-to-residential conversion project at 1250 Maryland Ave. in Washington, D.C. The project team includes architect Beyer Blinder Beller, interior designer KTGY, general contractor Balfour Beatty and landscape architect Oehme, van Sweden | OvS. Deutsche Bank provided a $180 million construction loan for the project. Built in 1992, the former Portals I development is an eight-story, 536,000-square-foot office building that will be transformed into an 11-story, 658,000-square-foot apartment complex. The additional three floors will be integrated into the building design to create large patios on the ninth and 11th floors. The 428-unit complex will also include 53,000 square feet of supporting retail and commercial space, as well as 428 parking spaces. Amenities at the development will include a rooftop resort-style terrace and swimming pool, resident lounge and coworking spaces, a two-story fitness center and dining and personal services offered on the ground floor. The redeveloped building has also been designed to meet LEED Gold specifications.

WASHINGTON, D.C. — Pearlmark has provided a $58 million mezzanine loan for the development of Portals IV, a 356-unit multifamily project underway in the Southwest Waterfront neighborhood of Washington, D.C. Pearlmark originated the loan via its investment fund, Pearlmark Mezzanine Realty Partners VI LP. David Webb and John Rehberger of CBRE arranged financing for the development, along with Mark Witt of Pearlmark. Kennedy Wilson provided the senior loan. The borrower and developer is Republic Properties, a subsidiary of the Republic Family of Cos. Portals IV is situated within walking distance of two Metro stations and will be the final addition to the Portals complex, a 3 million-square-foot mixed-use development that comprises three office buildings, one luxury apartment building and a hotel. Amenities at Portals IV will include a rooftop swimming pool and walkway, resident package locker room with dry cleaning pickup, fireplace lounge, fitness center and spin room, library, golf simulator, game room, coworking spaces, concierge services and a rooftop amenity lounge on the 13th floor. Outdoor grilling stations, private dining rooms, commercial laundry facilities and a coffee bar will also be available for resident use.