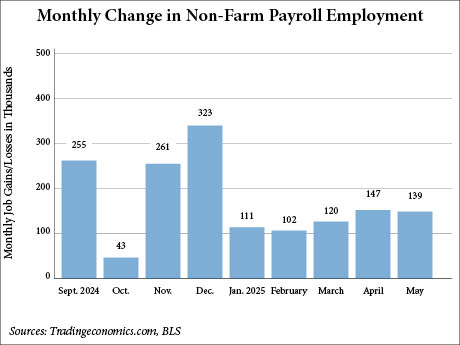

WASHINGTON, D.C. — The U.S. Bureau of Labor Statistics (BLS) has reported that U.S. employment growth totaled 139,000 jobs in May, slightly ahead of the 125,000 jobs that Dow Jones economists predicted, according to CNBC. The figure is also in line with the average monthly gain of 149,000 over the previous 12 months. The U.S. unemployment rate remained unchanged from April at 4.2 percent. The federal government lost 22,000 jobs in May, according to the BLS. Employment for the U.S. government has dwindled by 59,000 since January. The Trump administration, aided by its newly established Department of Government Efficiency (DOGE), has cut federal government jobs in an effort to improve efficiency and reduce government spending. The healthcare sector led all categories at 62,000 jobs added in May, with jobs gains occurring in in hospitals (+30,000), ambulatory health care services (+29,000) and skilled nursing care facilities (+6,000). The average monthly job gain in the healthcare sector over the previous 12 months is 44,000. Other sectors that saw job growth in May include leisure and hospitality (+48,000), local government (+21,000) and social assistance (+16,000). Employment showed little change in industries including mining, quarrying, and oil-and-gas extraction; construction; manufacturing; wholesale trade; retail trade; …

District of Columbia

WASHINGTON, D.C. — Between 2020 and July 1, 2024, Miami experienced a significant population surge, according to the latest estimates from the U.S. Census Bureau. The South Florida city’s population was 487,014 residents in 2024, which is a 10.1 percent increase from 2020 Census figures. In the same time frame, Atlanta saw a 4.3 percent rise in population, while Raleigh experienced an uptick of 6.8 percent. Washington, D.C. saw a 1.8 percent increase since 2020, and Nashville saw a 2.3 percent gain in residents. All of the above except Raleigh ranked in the top 10 nationally for new downtown apartments developed between 2020 and 2024, according to a report from RentCafe. Leading the pack was Washington, D.C., which has added nearly 23,000 apartments to the downtown supply since the pandemic. To calculate population growth within a city or town, the Census Bureau uses updated county-level data on housing units, as well as average household sizes in the surrounding county, to estimate the population of each city and town within that county. The estimate for people living in group quarters (such as dorms or nursing homes) is then included to the household population estimate to obtain the total resident population.

WASHINGTON, D.C. — Marx Realty has signed 16,000 square feet of new and expanded leases at The Herald, a 114,000-square-foot office building located at 1307 New York Ave. in Washington, D.C. The deals include two new leases: a 5,000-square-foot, eight-year lease with Auburn University’s non-partisan think tank McCrary Institute and a 3,200-square-foot, six-year deal with public policy strategy firm August Strategy Group. Additionally, an undisclosed government affairs agency has nearly doubled its footprint at The Herald, expanding by 7,800 square feet. The office building’s amenities include a rental 2023 Tesla Y car, 40-seat boardroom, café, lounge and a fitness center with boxing facilities, private workout rooms, Pelotons, Hydro rowers and a mirror fitness system.

Colliers Mortgage Arranges $5.7M HUD-Insured Loan for Refinancing of Stanton Park Apartments in D.C.

by John Nelson

WASHINGTON, D.C. — Colliers Mortgage has arranged a $5.7 million HUD-insured loan to refinance Stanton Park Apartments, a 62-unit affordable housing community located in Washington, D.C. As part of the refinance, the Non-Profit Community Development Corp. of Washington, D.C. (NPCDC) has obtained an extension for its use restriction to preserve its affordable housing options while operating under the Low-Income Housing Tax Credit (LIHTC) program. The HUD loan features a 35-year term and amortization schedule. Stanton Park Apartments comprises three one-bedroom units, 42 two-bedroom units and 17 three-bedroom units. Laundry facilities are located in each building, while disabled-accessible units contain an in-unit washer/dryer. Additional amenities at the property include barbecue and picnic areas and onsite parking.

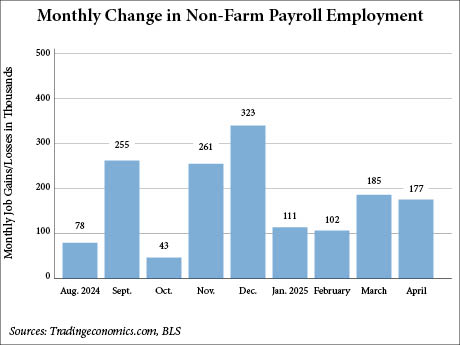

WASHINGTON, D.C. — The U.S. Bureau of Labor Statistics (BLS) has reported that U.S. employment growth totaled 177,000 jobs in April, which is above the estimated 133,000 figure projected by Dow Jones economists, according to CNBC. The media outlet reports that economists were predicting fewer domestic jobs to be created due to the Trump administration’s tariffs against U.S. trade partners including China. Additionally, the BLS found that the unemployment rate for April has remained unchanged at 4.2 percent. The BLS made some hefty downward revisions for the employment gains in February and March. The change in total nonfarm payroll employment for February was revised down by 15,000 (rom 117,000 to 102,000) and March was revised down by 43,000 (from 228,000 to 185,000). With these revisions, employment in February and March combined is 58,000 lower than previously reported. The healthcare sector led the way in job creation in April with 51,000 jobs, including gains in hospitals (+22,000) and ambulatory healthcare services (+21,000). Transportation and warehousing added 29,000 jobs, with gains in warehousing and storage (+10,000), couriers and messengers (+8,000) and air transportation (+3,000). The financial sector contributed 14,000 jobs last month. The industry has added 103,000 jobs overall since its trough …

WASHINGTON, D.C. — Easterly Government Properties Inc. has purchased a 289,873-square-foot civic office building in northeast Washington, D.C. The address, seller and sales price were not disclosed. The property was 98 percent leased at the time of sale to tenants including the District of Columbia Government, which recently extended its 237,118-square-foot lease at the building through 2038 with the option to renew for an additional five years. The District’s government agencies operating within the facility include the District of Columbia Public Schools and the Department of Energy & Environment, both of which have occupied the building since 2009. Other tenants include the U.S. federal government, which occupies 26,327 square feet under the General Services Administration (GSA) banner, and private tenants, which occupy 20,299 square feet. The civic building has a weighted average remaining lease term (WALT) of 11.6 years.

Hoffman, Madison Marquette Sell The Wharf in Southwest D.C. to PSP Investments at $1.8B Valuation

by John Nelson

WASHINGTON, D.C. — In two separate releases, co-developers Hoffman & Associates and Madison Marquette have announced that they sold their stake in The Wharf, a 3.5 million-square-foot mixed-use destination in southwest Washington, D.C. The Public Sector Pension Investment Board (PSP Investments), a pension fund investor based in Quebec, is now the sole owner of The Wharf, following more than a decade of having a minority stake in the development. The Wharf was constructed over the course of 15 years by Hoffman & Associates and Madison Marquette. The mixed-use neighborhood features a mile of waterfront development along the Potomac River. The sales price was not shared in either announcement, but Green Street News reports that Hoffman & Associates and Madison Marquette sold their stake at a $1.8 billion valuation. Previous components at The Wharf have sold in recent years and were thus not included in the sale to PSP Investments, including 300 condominiums, two office buildings and the Willard InterContinental Washington hotel, which Willard Investments purchased and rebranded in 2022. The Wharf was delivered by the sellers in two separate phases. Phase I opened in October 2017 and included three hotels, two multifamily and condominium buildings and 210,000 square feet of retail, …

WASHINGTON, D.C. — The NFL’s Washington Commanders have announced plans to develop a new football stadium in Washington, D.C., (“the District”), as well as a surrounding mixed-use destination. The team, which currently plays at FedEx Field in Landover, Md., has pledged to invest at least $2.7 billion into financing the project. The District has committed to a $500 million investment for the new stadium, which is expected to open in 2030. The site spans 180 acres within the Robert Francis Kennedy (RFK) campus on the city’s east side. The Commanders, formerly known as the Redskins, are developing the new 65,000-seat stadium in partnership with the District, which recently gained control of the campus via the D.C. Robert F. Kennedy Memorial Stadium Campus Revitalization Act. The legislation, which took effect in January, gave the District the ability to develop the campus for a mix of uses, lifting the restrictions that were in place under the previous lease. The legislation also required that 30 percent of the RFK campus be reserved for parks, trails and open space, not including a 32-acre riparian area along the Anacostia River. As part of the larger development, the Commanders plan to bring a variety of commercial …

WASHINGTON, D.C. — Akridge and National Real Estate Development have opened Colette and Everly, two luxury apartment buildings within The Stacks in the Buzzard Point neighborhood of Washington, D.C. With these openings, the mixed-use project’s first phase is now complete. Phase I of The Stacks totals nearly 1 million square feet and includes 1,116 multifamily units, more than 90,000 square feet of amenity spaces across three apartment buildings, roughly 22,000 square feet of public parks, approximately 40,000 square feet of retail space and 11,000 square feet of coworking space. First move-ins at Colette and Everly are slated for this month. The two buildings total 732 units. “Everly and Colette provide residents with some of the best water views in the region, as well as convenient access to the best of D.C., including The Wharf, Navy Yard and downtown,” says Adam Gooch, managing principal and chief development officer at Akridge. “Between these two new residential towers and their sister building, The Byron, which opened earlier this year, The Stacks offers three distinctive luxury living options to match residents’ needs.” Architecture firm Gensler designed Everly and was the broader design coordinator of The Stacks. Everly features 413 apartment units within a 14-story …

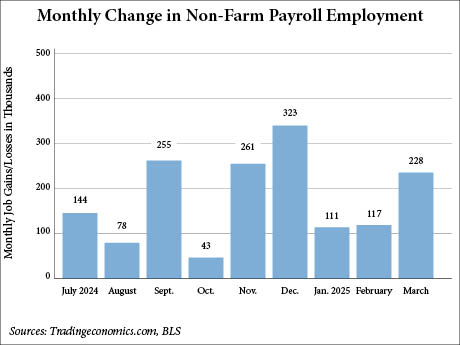

WASHINGTON, D.C. — The U.S. Bureau of Labor Statistics (BLS) has reported that employment growth totaled 228,000 in March, rising above the 140,000-figure projected by Dow Jones economists, according to CNBC. March job growth nearly doubled the previous month’s total, which was revised down by 34,000 to 117,000. The BLS also revised January’s job growth down by 14,000, from 125,000 to 111,000. The U.S. unemployment rate in March was 4.2 percent, up slightly from 4.1 percent in February. In March, job gains were concentrated in the healthcare, social assistance and transportation and warehousing sectors. More specifically, the healthcare sector added 54,000 jobs, including gains in ambulatory health services (+20,000), hospitals (+17,000) and nursing and residential care facilities (+17,000). Social assistance increased by 24,000 jobs, higher than the average monthly gain of 19,000 over the previous 12 months. Retail trade added 24,000 jobs in March — as workers returned from strike — to contribute to a gain in food-and-beverage retailers (+21,000). On the contrary, general merchandise retailers lost 5,000 jobs since February. The transportation and warehousing sector contributed 23,000 overall jobs, roughly double the prior 12-month average gain of 12,000. Meanwhile, a job loss in warehousing and storage (-9,000) partially offset …