WASHINGTON, D.C. — Tishman Speyer, along with property management firm Bozzuto, has launched preleasing at Residences at Mazza, a mixed-use development located at 5300 Wisconsin Ave. NW in Washington, D.C. Upon completion, the property will feature 321 apartments, townhomes and penthouses, as well as a 70,000-square-foot retail concourse that will soon be home to T.J. Maxx and Total Wine & More. Amenities will include a coworking lounge, rooftop sky lounge, fitness center, central courtyard with a lap pool and a media room. Monthly rental rates at Residences at Mazza range from $2,300 to $7,479, according to the property website. The development is situated within a block from the Friendship Heights Metro station and represents the first new apartment community to be built in D.C.’s Friendship Heights neighborhood since 2009, according to Tishman Speyer. The design team includes Danish architectural firm 3XN, landscape architect Parker Rodriguez and interior designer Michaelis Boyd.

District of Columbia

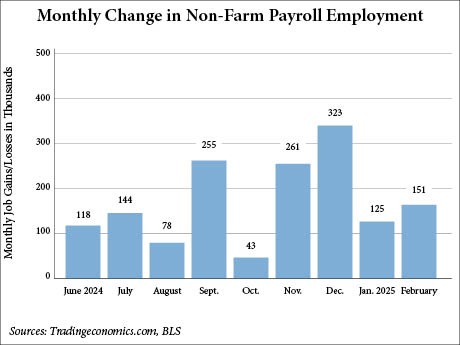

WASHINGTON, D.C. — The U.S. Bureau of Labor Statistics (BLS) has reported that U.S. employment growth totaled 151,000 in February, falling below the 170,000 figure projected by Dow Jones economists, according to CNBC. February job growth exceeded the previous month’s total, which was revised down by 18,000 jobs to 125,000. The BLS also revised December’s job growth upward, from 307,000 jobs to 323,000. The U.S. unemployment rate increased slightly to 4.1 percent. The healthcare sector led the way in job creation in February with 52,000 jobs, including gains in ambulatory healthcare services (+26,000), hospitals (+15,000) and nursing and residential care facilities (+12,000). The financial sector contributed 21,000 overall jobs, including gains to real estate, rental and leasing (+10,000) and insurance carriers (+5,000). Commercial banking lost 5,000 jobs. Additional sectors that contributed employment increases were transportation and warehousing (+18,000) and social assistance (+11,000). The BLS also reports that federal government employment declined by 10,000 while government payrolls simultaneously increased overall by 11,000. Additionally, retail employment declined by 6,000 jobs. Employment in the food-and-beverage industry declined by 15,000, largely due to strike activity by workers at restaurant chains such as Starbucks. On the contrary, warehouse clubs, supercenters and other general merchandise retailers …

Easterly Government ‘Remains Committed’ to Public-Private Partnership With Federal Government Amid DOGE Activity

by John Nelson

WASHINGTON, D.C. — Easterly Government Properties (NYSE: DEA), an office REIT that owns assets leased to the U.S. government and affiliates, has released its fourth-quarter 2024 results. The company exceeded its initial full-year guidance and achieved results at the upper end of raised guidance, with a net income of $20.6 million. In 2024 alone, Easterly purchased 10 properties either solely or in joint venture arrangements totaling $230 million. The company also expanded its investment strategy to include office properties leased to private sector government contractors and reduced its total portfolio energy consumption by 4 percent year-over-year. “We are pleased with the position of our portfolio,” said Darrell Crate, president and CEO of Easterly. Easterly has been directly affected by the recent activities of the Department of Government Efficiency (DOGE), a newly created federal department championed by Elon Musk, owner of Tesla, X (formerly Twitter) and SpaceX. According to multiple media outlets, DOGE has announced that it has terminated 2.3 million square feet of federal office leases and saved $145 million. DOGE is now targeting the termination or consolidation of nearly 100 more leases at government offices in several markets, most notably in the nation’s capital, according to The Wall Street Journal. …

WASHINGTON, D.C. — Marcus & Millichap has brokered the $4.3 million sale of 6400 Georgia Ave. NW, a 13-suite mixed-used property located in Washington, D.C. Situated in the northwestern neighborhood of Brightwood, the property totals 20,680 square feet across two floors. The first floor is fully leased with seven retail suites — including Subway and other long-term local businesses — that operate on a triple-net lease basis. The second floor features six office suites, all of which were vacant at the time of sale. According to LoopNet Inc., the property was built in 1952 and renovated in 2024 to include a new roof, sump pump and other building improvements. Lorenzo Wooten and Jacob Krens of Marcus & Millichap’s D.C. office marketed the property on behalf of the family that owned the property. The buyer was not disclosed.

WASHINGTON, D.C. — The Mortgage Bankers Association (MBA) is forecasting that total commercial and multifamily mortgage borrowing and lending will rise to $583 billion in 2025, which is a 16 percent increase from 2024’s estimated total of $503 billion. The Washington, D.C.-based organization made the announcement at its 2025 Commercial/Multifamily Finance Convention and Expo (CREF) event taking place in San Diego. Multifamily lending, which is calculated into the total figure, is expected to rise to $361 billion in 2025 — also a 16 percent increase from last year’s estimate of $312 billion. MBA anticipates originations in 2026 will increase to $709 billion in total commercial real estate lending, with $419 billion of that allocated to multifamily lending. “Given the strong pickup in origination activity at the end of 2024, it appears that at least some borrowers and lenders are ready to move,” said Mike Fratantoni, MBA’s senior vice president and chief economist. “MBA is forecasting that interest rates are going to stay within a trading range for the next few years. We expect an increase in originations across property types and capital sources, but certainly recognize the additional challenges posed by the large number of loans scheduled to mature in …

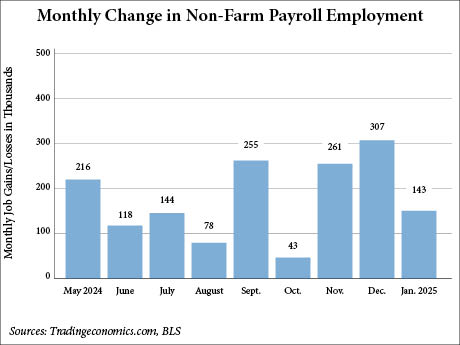

WASHINGTON, D.C. — The U.S. economy added 143,000 jobs in January, falling short of the 169,000 figure projected by economists surveyed by The Wall Street Journal. The U.S. Bureau of Labor Statistics (BLS) reports that employers added 111,000 private sector jobs, while government sector employment grew by 32,000. Meanwhile, the unemployment rate in January was 4 percent, down from 4.1 percent the prior month. The BLS noted that neither the wildfires in Southern California that began in early January nor the cold weather across much of the country for a significant portion of the month had any discernable impact on national payroll employment, hours and earnings. In January, job gains occurred in healthcare, retail trade and social assistance. Employment declined in the mining, quarrying, and the oil and gas extraction industry. More specifically, the healthcare sector added 44,000 jobs in January, including gains in hospitals (+14,000), nursing and residential care facilities (+13,000), and home health care services (+11,000). Job growth in healthcare averaged 57,000 per month in 2024. Retail trade employment increased by 34,000 in January. Job gains occurred in general merchandise retailers (+31,000) and furniture and home furnishings retailers (+5,000). Electronics and appliance retailers lost 7,000 jobs. Retail trade …

WASHINGTON, D.C. — Freshfields US LLP has signed a 117,000-square-foot lease at Midtown Center, a two-tower, 869,000-square-foot office property in downtown Washington, D.C. The global law firm will relocate its D.C. office from 700 13th St. NW to occupy floors six through eight in the West Tower at Midtown Center. Amy Bowser and Brooks Brown of CBRE represented the landlord, Carr Properties, in the lease negotiations, along with internal staffers Kaitlyn Rausse and Ryan Lopez. Rob Copito and Harry Stephens of CBRE represented Freshfields in the lease. Built in 2017, Midtown Center is now 80 percent occupied. Carr plans to add new amenities to the West Tower, including a rooftop penthouse and new conference and entertainment facilities. Existing amenities and features at Midtown Center include pedestrian bridges connecting the two towers, a two-level fitness center, rooftop terrace and restaurants on the ground level including Shoto, Grazie Nonna, Dauphines and Blue Bottle.

Jamestown Unloads Stake in Georgetown Renaissance Portfolio in DC to Acadia Realty Trust

by John Nelson

WASHINGTON, D.C. AND ALEXANDRIA, VA. — Atlanta-based Jamestown has sold its stake in The Georgetown Renaissance Portfolio, a collection of 22 boutique retail and residential buildings in Washington, D.C.’s Georgetown neighborhood and a lone property in nearby Alexandria, Va. New York-based Acadia Realty Trust, already a minor owner of the portfolio, purchased Jamestown’s stake for an undisclosed price. Eastdil Secured represented Jamestown in the transaction. Jamestown originally acquired its interest in The Georgetown Renaissance Portfolio in 2011. The firm had previously sold off a portion of its interest to EastBanc, which used acquisition funds from Acadia Realty Trust, back in 2016. The portfolio is now home to several retail and design brands such as B&B Italia, Poliform, Molteni, Lululemon, Patagonia and Design Within Reach.

In the summer of 2012, fresh out of college and starting my career in retail brokerage at KLNB, a seasoned retail broker-turned-developer warned me to consider other careers. “Retail is dying,” he said. “Why would people go to stores when it’s so easy to order online?” Well, it’s been 12 years since that moment, and I’m still waiting for the retail boogeyman to appear. As I write this, I’m happy to report he hasn’t arrived — and the data suggests he’s nowhere in sight. The Washington, D.C., metropolitan statistical area (MSA) is now in its tightest fundamental position on record due to limited new supply and continued demand from national, regional and franchised concepts. In the Washington, D.C. market, we have the second-lowest retail square footage per capita among major MSAs, with new retail supply representing just 0.4 percent of total inventory. This places the Capital Region in the bottom quartile of retail real estate inventory growth among national MSAs that have more than 100 million square feet of existing inventory. The result? Retail availability in the D.C. metro has decreased to 4.8 percent (compared to the national average of 4.7 percent), down from 5.1 percent year-over-year and 5.3 percent …

The Washington, D.C., office market is facing challenging times, marked by unprecedented vacancy rates, dwindling demand and a significant supply-demand imbalance. Within these constraints, the flight to quality trend is reshaping how investors and lenders view office assets and should lead to an inventory reclassification. The divide between high-quality assets and lesser properties widens almost daily, creating a bifurcated market with fierce competition for quality space. Meanwhile, older, less desirable properties languish, accumulating vacancies as they fail to meet current occupier expectations. Without intervention, the less desirable properties will continue to drag down the market’s perception, obscuring the success of top-tier spaces with a headline vacancy rate. To contribute to the stabilization of the market, office participants must acknowledge this divide and assess distressed assets not as liabilities, but as opportunities to reset and reclassify properties based on realistic usage and demand. Lenders are central to this process as they control a substantial portion of distressed office stock. After years of extending loans to stave off foreclosure during uncertain times, many are now realizing that relief is unlikely to materialize organically. As a result, foreclosures are already up 121 percent in 2024 year-to-date over 2023 in Washington, D.C. On average, …