WASHINGTON, D.C. — Milbank, an international law firm, has signed a 65,000-square-foot lease at 1101 New York Avenue, a 388,000-square-foot office building in Washington, D.C.’s East End. The office building is now 94 percent leased to firms including A&O Shearman, National Retail Federation, EY and Bloomberg. Dale Schlather, Malcolm Marshall and Alson Offutt of Cushman & Wakefield represented Milbank in the lease deal. Kyle Luby, Matt Pacinelli, John Klinke and Tim McCarty of Stream Realty Partners represented the landlord, a partnership between Oxford Properties Group and Norges Bank Investment Management. Jim Potocki of Oxford Properties was also part of the leasing team at 1101 New York Avenue, which has 28,000 square feet of availability.

District of Columbia

WASHINGTON, D.C. — The Federal Housing Finance Agency (FHFA) has increased the multifamily loan purchase caps for Fannie Mae and Freddie Mac for their 2025 production. The two government-sponsored enterprises (GSEs) will each have caps of $73 billion, or $146 billion combined, which is a 4 percent increase from the 2024 caps of $70 billion apiece. Bob Broeksmit, president and CEO of the Mortgage Bankers Association (MBA), says that the move to increase the cap is fitting due to recent moves by the Federal Reserve, which has twice reduced the federal funds rate in recent months. “The 4 percent increase in the multifamily loan purchase caps to $73 billion for each GSE is appropriate, given the slightly improved market conditions and lending activity that’s expected next year due to the slow decline in interest rates,” says Broeksmit. The FHFA will continue to exclude multifamily loans that finance workforce housing communities from the 2025 cap and require the GSEs to have at least 50 percent of their multifamily originations finance “mission-driven” affordable housing. The FHFA will continue to monitor the multifamily mortgage market and “maintains the ability to raise the caps further if necessary to support liquidity in the market.” If …

WASHINGTON, D.C. — PRP has obtained a $291 million CMBS loan for the refinancing of a national logistics portfolio totaling more than 4.5 million square feet. Eastdil Secured arranged the single-asset single-borrower (SASB) loan through JP Morgan. The portfolio spans five newly constructed buildings in the industrial markets of Houston; Greenville-Spartanburg, S.C.; St. Louis, Ill.; and Birmingham, Ala. The properties were fully leased at the time of financing including to tenants including a global online retailer, a home improvement company and power tool manufacturer, according to Washington, D.C.-based PRP.

Commercial property owners in the District of Columbia are crawling out of a post-pandemic fog and into a new, harsh reality where office building values have plummeted, but property tax assessments remain perplexingly high. Realization comes slowly Immediately following the pandemic, many office property owners adopted a wait-and-see attitude toward the volatility permeating the sector, clinging to hopes that the rising popularity of remote work and similar office worker practices would prove temporary. Once the Federal Reserve began raising interest rates to combat generational inflation in 2022, however, hopes for a “return to normal” vanished and a grim reality set in. Recent transactions involving office properties in the District clearly indicate that investors recognize the negative impact these market forces have exerted on office building valuations and are now pricing those changes into the amounts they are willing to bid for acquisitions. These recent sales show office building values have declined by more than 50 percent from pre-pandemic levels. The other shoe began to drop on office market pricing in early 2023 with a rise in distress transactions, in which the office owner sells or forfeits the property to resolve some form of trouble, typically financial. These turnovers in ownership …

MBA: Third-Quarter Commercial, Multifamily Borrowing Increased 59 Percent Year-Over-Year

by John Nelson

WASHINGTON, D.C. — Commercial and multifamily mortgage loan originations increased 59 percent in the third quarter of 2024 compared to a year ago, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. The third-quarter volume also represents a 44 percent increase from the second quarter. There was a 510 percent year-over-year increase in the dollar volume of loans for healthcare properties, a 99 percent increase for hotel properties, 82 percent increase for retail properties, 57 percent increase for industrial properties and a 56 percent increase for multifamily properties. Office real estate originations decreased 3 percent from a year ago. Among investor types, the dollar volume of loans originated for commercial mortgage-backed securities (CMBS) increased by 260 percent year-over-year. There was a 69 percent increase for depository (i.e. bank) loans, a 62 percent increase for investor-driven lender loans, 31 percent increase in loans for life insurance companies and a 28 percent increase in loans from government-sponsored enterprises (GSEs, namely Fannie Mae and Freddie Mac). Jamie Woodwell, MBA’s head of commercial real estate research, says that lower interest rates due in part to the Federal Reserve’s 50-basis-point decrease in September were “a key driver” for the uptick …

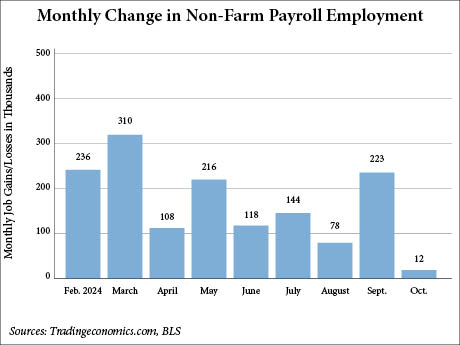

WASHINGTON, D.C. — The U.S. economy added 12,000 nonfarm payroll jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). This figure falls drastically short of expectations as CNBC reports that the Dow Jones economists previously predicted an increase of 100,000 jobs for the month. In its report, the BLS noted that strike activity significantly impacted employment in the manufacturing sector, which saw the loss of 46,000 jobs. Of those jobs, 44,000 were within the transportation equipment manufacturing field, reflecting the impact of the Boeing strike. Temporary help services, a subsect of professional and business services, saw a decline of 49,000 jobs in October. Government employment and healthcare added 40,000 and 52,000 jobs, respectively, while construction employment increased by a less significant 8,000 jobs. Other major industries saw little to no change. The BLS report also cited the potential impact of Hurricanes Helene and Milton on October’s employment situation, though it noted that “it is not possible to quantify the net effect on the over-the-month change in national employment, hours or earnings estimate.” The unemployment rate for October remained unchanged at 4.1 percent. According to Lawrence Yun, chief economist of the National Association of Realtors (NAR), the jobs …

WASHINGTON, D.C. — The Biden Administration has announced a $3 billion investment from the Inflation Reduction Act to improve port infrastructure and support an estimated 40,000 “good-paying and union jobs” at 55 ports across 27 states. According to The White House press, U.S. ports employ more than 100,000 union workers. The initiative, named The Clean Ports Program, is headlined by a $147 million investment for the Maryland Port Administration via grants and awards that will support 2,000 jobs, as well as fund the installation of zero-emission equipment, charging infrastructure and power improvements. Biden made the announcement yesterday at the Port of Baltimore, site of the Francis Scott Key Bridge collapse in March. The Clean Ports Program is expected to increase the demand for American manufactured electric cargo handling equipment and eliminate more than 3 million metric tons of carbon pollution over the first 10 years of implementation, which is equivalent to 391,220 homes’ energy use for one year. The program will fund new battery-electric and hydrogen-powered cargo handling equipment, drayage trucks, locomotives and vessels, as well as charging/fueling infrastructure and solar power installation.

WASHINGTON, D.C. — The National Geographic Society has announced plans to open a 100,000-square-foot public attraction at its campus, which currently occupies a city block in downtown Washington, D.C. Dubbed the National Geographic Museum of Exploration, the attraction is scheduled to open in 2026. Upon completion, the venue will feature curated exhibitions, immersive and educational experiences, a 400-seat theater, restaurant and a retail store. The project team will include JLL, HITT Contracting and architect Hickok Cole. Design for the public attraction will feature a focus on accessibility, with instructional text in Braille, tactile and sensory maps, American Sign Language (ASL) interpretations of media, all-gender restrooms, wellness rooms and exhibition text in both English and Spanish. “The Museum of Exploration marks a historic chapter in the Society’s mission to advance exploration, science, education and storytelling,” says Jill Tiefenthaler, CEO of the National Geographic Society.

WASHINGTON, D.C.— Law firm ArentFox Schiff has signed a 120,999-square foot lease at Midtown Center, an office building located in downtown Washington, D.C. The firm will relocate its D.C. headquarters to the 14-story property, occupying the entirety of three floors. Fannie Mae also recently signed a 340,000-square-foot lease at the building, which is owned by Carr Properties. The developer completed Midtown Center, which features two towers connected by three pedestrian buildings, in 2017. SHoP Architects designed the property.

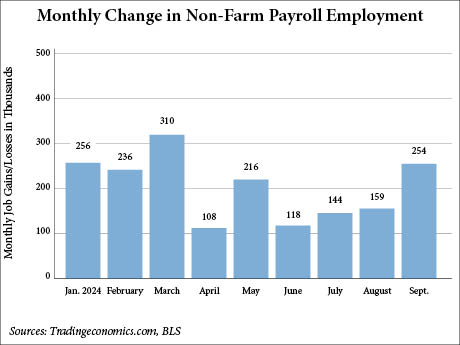

WASHINGTON, D.C. – The U.S. economy has added 254,000 nonfarm payroll jobs in September, according to the U.S. Bureau of Labor Statistics. CNBC reports that the total was over 100,000 more than what Dow Jones economists predicted for the month. The BLS also revised the previous two months by a total of 72,000, changing July’s total from 89,000 to 144,000 and August from 142,000 to 159,000. Additionally, the U.S. unemployment rate was minimally changed from 4.2 percent in August to 4.1 percent in September. Employment in food services and drinking places rose by 69,000 in September, which is substantially higher than the sector’s average monthly gain of 14,000 over the prior 12 months. Other employment sectors that saw gains include healthcare (45,000), government (31,000), social assistance (27,000) and construction (25,000). The BLS reported minimal changes in other employment sectors including professional and business services and manufacturing.