WASHINGTON, D.C. — The National Geographic Society has announced plans to open a 100,000-square-foot public attraction at its campus, which currently occupies a city block in downtown Washington, D.C. Dubbed the National Geographic Museum of Exploration, the attraction is scheduled to open in 2026. Upon completion, the venue will feature curated exhibitions, immersive and educational experiences, a 400-seat theater, restaurant and a retail store. The project team will include JLL, HITT Contracting and architect Hickok Cole. Design for the public attraction will feature a focus on accessibility, with instructional text in Braille, tactile and sensory maps, American Sign Language (ASL) interpretations of media, all-gender restrooms, wellness rooms and exhibition text in both English and Spanish. “The Museum of Exploration marks a historic chapter in the Society’s mission to advance exploration, science, education and storytelling,” says Jill Tiefenthaler, CEO of the National Geographic Society.

District of Columbia

WASHINGTON, D.C.— Law firm ArentFox Schiff has signed a 120,999-square foot lease at Midtown Center, an office building located in downtown Washington, D.C. The firm will relocate its D.C. headquarters to the 14-story property, occupying the entirety of three floors. Fannie Mae also recently signed a 340,000-square-foot lease at the building, which is owned by Carr Properties. The developer completed Midtown Center, which features two towers connected by three pedestrian buildings, in 2017. SHoP Architects designed the property.

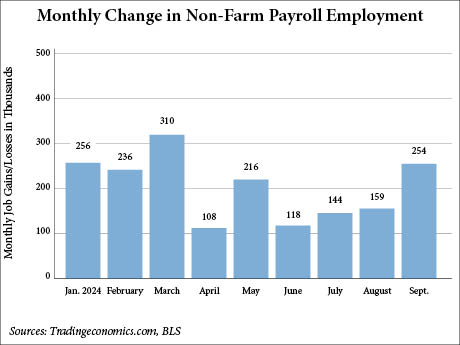

WASHINGTON, D.C. – The U.S. economy has added 254,000 nonfarm payroll jobs in September, according to the U.S. Bureau of Labor Statistics. CNBC reports that the total was over 100,000 more than what Dow Jones economists predicted for the month. The BLS also revised the previous two months by a total of 72,000, changing July’s total from 89,000 to 144,000 and August from 142,000 to 159,000. Additionally, the U.S. unemployment rate was minimally changed from 4.2 percent in August to 4.1 percent in September. Employment in food services and drinking places rose by 69,000 in September, which is substantially higher than the sector’s average monthly gain of 14,000 over the prior 12 months. Other employment sectors that saw gains include healthcare (45,000), government (31,000), social assistance (27,000) and construction (25,000). The BLS reported minimal changes in other employment sectors including professional and business services and manufacturing.

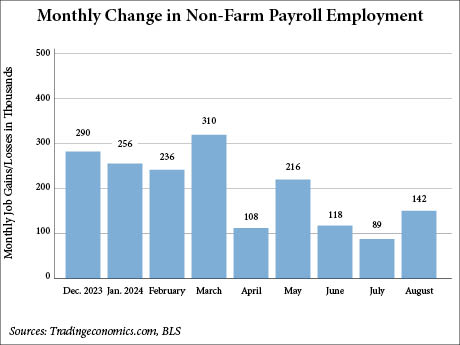

WASHINGTON, D.C. — The U.S. economy has added a total of 142,000 nonfarm payroll jobs in August, according to the U.S. Bureau of Labor Statistics (BLS). Though this marks an uptick relative to July’s revised figure of 89,000, CNBC reports that the number falls below expectations and reflects a slowdown in the labor market. Dow Jones economists previously predicted that the economy would add 161,000 jobs in August. Healthcare and construction saw notable gains in August, increasing by 31,000 and 34,000 jobs, respectively. Healthcare’s average monthly over the prior 12 months was 60,000. Employment gains in the social assistance sector slowed with 13,000 jobs added, which falls below the average monthly gain of 21,000. Employment in the manufacturing sector decreased by 24,000 positions, and other major industries saw little change. The unemployment rate changed little in August, falling to 4.2 percent. This aligns with predictions and marks a minimal decrease relative to the previous month, when the unemployment rate sat at 4.3 percent. Additionally, the BLS revised down the number of jobs added in June and July by a total of 86,000 fewer jobs. June was revised down from 179,000 to 118,000, and July was revised down from 114,000 to …

WASHINGTON, D.C. —The Mortgage Bankers Association (MBA) recently published that multifamily originations totaled $246.2 billion in 2023, a 49 percent decline compared to 2022 and below its April estimation of $264 billion. Additionally, the Washington, D.C.-based organization said that 51 percent of active lenders made five or fewer multifamily loans last year. While a step back in terms of loan volume, the multifamily sector still stands out relative to other property types as the sector represented more than 60 percent of all commercial real estate loans provided in 2023, according to an MBA report in April. Chris Flynn, senior vice president and multifamily chief underwriter for Fannie Mae Multifamily, says that it’s important to keep that in perspective as all loans for all commercial real estate asset classes declined in 2023. “Multifamily was seen as an attractive asset class among the commercial real estate sectors in 2023 and was viewed as relatively more stable, from an investment perspective, compared to office, retail, and industrial,” says Flynn. The agencies didn’t take any breaks last year as Fannie Mae and Freddie Mac combined to generate 42 percent of all 2023 multifamily loans, according to the MBA, which tracks loans made on multifamily …

Advance Auto Parts Agrees to Sell Worldpac Distribution Business to Carlyle for $1.5B

by Katie Sloan

RALEIGH, N.C. AND WASHINGTON, D.C. — Advance Auto Parts Inc. (NYSE: AAP) has agreed to sell Worldpac, the Raleigh-based company’s automotive parts wholesale distribution business, to funds managed by global investment firm Carlyle (NASDAQ: CG) for $1.5 billion in cash. Advance Auto Parts operated 321 Worldpac locations primarily within the United States as of the end of the second quarter. These warehouses, 135 of which are branded Autopart International, are generally larger than the company’s retail locations, averaging approximately 26,000 square feet. Worldpac offers over 293,000 parts for domestic and import vehicles and primarily serves professional customers such as vehicle repair shops, with services including same-day delivery of automotive parts through a fleet of company-owned vehicles. Over the past 12 months, these locations generated approximately $2.1 billion in revenue and $100 million in earnings before interest, taxes, depreciation and amortization (EBITDA). Advance expects to close the transaction before the end of the year, with Advance expecting net proceeds of approximately $1.2 billion after taxes and transaction fees. These proceeds will be used to strengthen the company’s balance sheet and invest in its core retail business, said Shane O’Kelly, president and CEO of Advance Auto Parts, during an earnings call earlier …

WASHINGTON, D.C. — The U.S. General Services Administration (GSA), along with the U.S. Department of Homeland Security, has awarded Clark Construction the $524 million contract to build the new headquarters for the Cybersecurity and Infrastructure Security Agency (CISA). The new 630,000-square-foot federal building will be located at the St. Elizabeths West Campus in Washington, D.C. As part of the Biden Administration’s goal to achieve net-zero emissions from federal buildings by 2045, the contract features $80 million to purchase low-embodied carbon construction materials including asphalt, concrete, glass and steel, as well as $35 million to meet high-performance green building standards. The new CISA building is designed to meet LEED Gold certification standards with sustainable features including chilled beams, a dedicated outside air system with energy recovery and demand-controlled ventilation, advanced lighting controls and a high-performance building envelope. The contract includes a nearly $115.9 million investment via the Inflation Reduction Act (IRA), making it the GSA’s largest single IRA investment to date. CNBC, citing data from the Massachusetts Institute of Technology (MIT) and the Rhodium Group, reports that companies have announced approximately $493 billion of investments in clean energy tech, infrastructure and electric vehicle manufacturing since the IRA was signed into law …

WASHINGTON, D.C. — Multifamily lending declined 49 percent year-over-year in 2023, according to a report by the Mortgage Bankers Association (MBA). Lenders provided a total $246.2 billion for apartment buildings with five or more units last year, with 51 percent of active lenders making five or fewer multifamily loans throughout the year. The Washington, D.C.-based organization previously estimated that multifamily originations totaled $264 billion. By volume, the top five multifamily lenders in 2023 included Berkadia, Walker & Dunlop, JP Morgan Chase & Co., CBRE and Greystone. Nearly half (42 percent) of the dollar volume went to the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac. “The analysis shows that even with the drop in activity, the multifamily lending market remains broad and deep, with more than 2,500 different lenders making more than 36,000 mortgage loans backed by multifamily properties,” says Jamie Woodwell, MBA’s head of commercial real estate research. The MBA report is based on its surveys of the larger multifamily lenders and the recently released Home Mortgage Disclosure Act (HMDA) data that covers multifamily loans made by many smaller lenders, particularly commercial banks.

WASHINGTON, D.C. — CBRE has negotiated a 7,282-square-foot office lease at 1050 17th Street, a trophy 11-story office building in Washington, D.C. Randy Harrell, Lara Nealon, Joe Coleman and Brittany Gosnell of CBRE represented the landlord, Hines, in the lease negotiations. Tucker Farman of JLL represented the tenant, Allsteel, a manufacturer of workplace furnishings and products. The LEED Gold-certified office building features a fitness center, 100-person multipurpose conference center and a lounge on the second floor. Other tenants at the 154,000-square-foot property include Davis Polk and Dweck Properties.

JLL Arranges $21.5M Sale of Office Building in DC, Buyer Plans Multifamily Conversion

by John Nelson

WASHINGTON, D.C. — JLL Capital Markets has arranged the $21.5 million sale of an office building located at 1201 Connecticut Ave. NW in the Dupont Circle neighborhood of Washington, D.C. The 12-story building comprises 190,385 square feet of Class B office space. Tom Hall, Matt Nicholson, Kevin Byrd, Jim Meisel, Andrew Weir and Dave Baker of JLL represented the seller, a subsidiary of BrightSpire Capital, in the transaction. An affiliate of Duball acquired the property, with plans to convert the development to a 161-unit multifamily community. Plans include the utilization of the ground-floor for retail space and the addition of a pool and amenity spaces to the roof. A development timeline was not disclosed.