MIAMI — L&L Holding Co. and Oak Row Equities, with project partner Shorenstein Properties and co-investor Claure Group, have completed the vertical construction of a 12-story office tower situated within The Wynwood Plaza, a 1 million-square-foot mixed-use campus underway in the Wynwood Arts District of Miami. Upon completion, the office development will total 266,000 square feet and will feature touchless entry and elevator systems, a dedicated parking garage, fitness club, bar lounge, conference and collaboration spaces and an expansive rooftop. Tenants will include Claure Group and law firm Weitz & Luxenberg, which will occupy 25,400 and 18,000 square feet, respectively. Located at 95 N.W. 29th St., the Wynwood Plaza is scheduled for completion in the first quarter of 2025 and will feature 509 residential units, as well as 32,000 square feet of shops, cafes and restaurants.

Florida

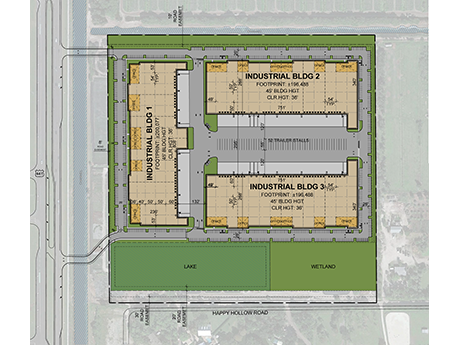

DELRAY BEACH, FLA. — BBX Logistics Properties and PCCP have formed a joint venture to develop BBX Park at Delray, a 672,533-square-foot logistics campus in Delray Beach. The joint venture has acquired 40 acres along U.S. Highway 441 for the project. Upon completion, the property will feature three buildings, with the first phase comprising a 200,000-square-foot building. Construction is scheduled to begin in the first quarter of 2024. BBX has contributed $2.9 million to the joint venture and plans to expend an additional $2.5 million in development costs.

Pebblebrook Completes $140M Refinancing for Margaritaville Hollywood Beach Resort in South Florida

by John Nelson

HOLLYWOOD, FLA. — Pebblebrook Hotel Trust has refinanced the Margaritaville Hollywood Beach Resort, a 369-room lodging property located at 111 N. Ocean Drive in South Florida. The hotel REIT purchased Margaritaville Hollywood in 2019 for $270 million. The new $140 million loan features a three-year term with two one-year extension options and a fixed interest rate of 7 percent. Wells Fargo Securities LLC served as the sole lead arranger for a syndicate of lenders for the loan, and Wells Fargo Bank NA will serve as administrative agent for the new mortgage. Pebblebrook Hotel Trust is using cash to repay the remaining $21.5 million from the previous CMBS loan. Built in 2015, Margaritaville Hollywood features 450 linear feet of direct beach frontage, food-and-beverage options, a spa, outdoor pools, kids club and entertainment venues.

MIAMI — McHugh Construction and Stiles Construction have topped off NEMA Miami, a 39-story luxury apartment tower underway at 2900 Biscayne Blvd. in downtown Miami. Crescent Heights is developing the project, which will comprise 588 apartments in studio, one-, two-and three-bedroom layouts, as well as ground-floor retail space, including a 42,030-square-foot Whole Foods Market store. Additionally, the development will feature a 748-spot parking garage, with 195 spots reserved for Whole Foods patrons. Designed by Arquitectonica, NEMA Miami’s amenities will include indoor and outdoor lounges, a swimming pool, sauna and steam rooms, event space and catering kitchen, private bar lounge and a fitness center. Rockwell Group is providing interior design services. The first move-ins are scheduled for next summer.

MIAMI BEACH, FLA. — Azora has purchased a retail building in the South Beach neighborhood of Miami Beach for $16 million. Located at 1000 17th St., the property totals 18,000 square feet. Azora acquired the property, which was fully leased at the time of sale, through its subsidiary Azora Exan. The buyer plans to maintain the current operation of the building, with gradual increases to rental rates. The seller was not disclosed.

Orlando remains one of the strongest multifamily markets nationally despite the slowdown being experienced in commercial real estate at large. Its strength is largely defined by growth in rent, supply, upcoming development opportunities, employment and the local economy, which have all contributed to healthy fundamentals. Being a top U.S. tourism destination has also helped with more than 74 million visitors coming to Orlando in 2022. Local tourism has created 212,000 jobs as of year-end 2021, and the city is home to nine world-renowned theme parks that are frequented by tourists. Orlando has also proven to be a very attractive and viable place to live long-term. The city is the fourth-largest in Florida, with an estimated population of more than 312,200 in 2023 and over 2 million within the metropolitan statistical area (MSA). The area’s population growth has supported multifamily growth opportunities, ensuring there is a vast renter pool and demand for the inventory that continues to be delivered. That has propelled rent growth up with submarkets like Colonial Town and Florida Center North, which are still posting year-over-year increases between 10 and 16 percent, significantly higher than the national average. Overall supply has also held up well with 6,103 units …

MIAMI — LCOR has announced plans for a 544-unit apartment tower located at 1775 Biscayne Blvd. in the Edgewater neighborhood of Miami, pending approval from the Miami Urban Development Review Board (UDRB). Upon completion, the development will feature studio, one-, two- and three-bedroom residences across 42 stories, as well as 50,000 square feet of amenity space, 10,000 square feet of ground-floor retail space and a 628-space parking garage. ODP Architects is designing the project, with interiors designed by KAS. Amenities will include a rooftop pool, fitness center, tenant lounges and coworking spaces and a gaming area. Construction is expected to begin in the second quarter of 2024. The project marks the firm’s first ground-up development in the state of Florida.

DAVENPORT, FLA. — Greystar Real Estate Partners has opened Ltd. Champions Ridge, an apartment community in Davenport, roughly 34 miles outside of Orlando. Marking the second Ltd.-branded property, the development features one-, two- and three-bedroom units ranging from 798 to 1,245 square feet. Amenities at the community include a swimming pool and gym. Rental rates will be lower than typical for Class A multifamily properties in the area, according to Greystar, with the company promising limited future rent increases.

Pinnacle Obtains $47.8M Financing for Affordable Housing Development in Hollywood, Florida

by John Nelson

HOLLYWOOD, FLA. — Pinnacle has obtained $47.8 million in financing for the development of the second phase of Pinnacle 441, a 100-unit affordable housing project in Hollywood. The eight-story building will be situated at 6028 Johnson St., a site that previously housed a trailer park and sits adjacent to Phase I of Pinnacle 441. Pinnacle plans to break ground on Phase II this month and wrap up construction in approximately 16 months. The property will feature one-, two- and three-bedroom units, as well as one live-work space with commercial frontage along Johnson Street. Units will be reserved for individuals and families earning up to 60 percent of Broward County’s median income. Amenities for both phases will include a fitness facility, virtual reality gaming room and indoor/covered outdoor lounge. Amenities unique to Phase II will include indoor meeting space and a cyber lounge. Funding sources for Phase II of Pinnacle 41 include tax credit equity financing and construction debt from Bank of America, tax-exempt bonds issued by Broward County Housing Finance Authority, permanent financing from Citibank, $10 million in gap financing from Broward County, $1 million from the City of Hollywood and $6.6 million from Florida Housing Finance Corp.

Cushman & Wakefield Arranges 128,450 SF Office Lease Renewal at Wells Fargo Center in Downtown Miami

by John Nelson

MIAMI — Cushman & Wakefield has arranged a 128,450-square-foot office lease renewal at Wells Fargo Center in downtown Miami on behalf of the landlord, an affiliate of MetLife Inc. The tenant is global law firm Greenberg Traurig, which occupies five floors at the 47-story tower. The lease renewal is the largest office lease in Miami over the past five years, according to Cushman & Wakefield. Brian Gale, Ryan Holtzman, Andrew Trench and Edward Quinon of Cushman & Wakefield represented the landlord in the lease negotiations. Michael Shuler, Jeremy Hakala and Clay Sidner of Newmark represented the tenant. Over the past nine months, the Cushman & Wakefield team has executed over 250,000 square feet of leasing transactions, bringing Wells Fargo Center to 93 percent occupancy.