LUTZ, FLA. — Newmark has brokered the $49.6 million sale of Cypress Creek Town Center, a 240,211-square-foot shopping center located in Lutz, about 14 miles north of Tampa. Total Wine, Hobby Lobby, Burlington, HomeGoods, Badcock Furniture and Dollar Tree anchor the power retail center, which comprises four parcels that were fully leased at the time of sale. An undisclosed buyer acquired the center. Drew Fleming of Newmark arranged the sale on behalf of the seller, Chattanooga, Tenn.-based Hutton.

Florida

ORLANDO, FLA. — Tavistock Development has announced plans for Lake Nona West, a 405,000-square-foot shopping center to be located in the Lake Nona master-planned community in Orlando. Upon completion, the development will be situated on a 54-acre parcel and feature open-air shops, ground-level parking, outdoor entertainment spaces and public art. Tavistock has submitted site plans to the City of Orlando, and construction is scheduled to begin in 2024, with completion planned for fall 2025. Tenant announcements are expected this winter.

HIALEAH, FLA. — Terra has delivered Natura Gardens, a 460-unit, garden-style apartment community located on the west side of Hialeah, a suburb in northwest Miami-Dade County. The 23-acre property comprises 12 residential buildings with units ranging from one to three-bedrooms. Units range in size from 727 to 1,603 square feet and rental rates range from $2,000 to $3,350 per month. Natura Gardens is situated directly south of the planned American Dream mall in Miami Lakes and between I-75 and the Florida Turnpike. Amenities include a two-story clubhouse with a resort-style pool and spa; a covered kitchen prep area and grilling station, sink and refrigerator; outdoor tiki hut areas with hammocks, tables and umbrellas, and lounge chairs on beach sand; a media room, billiards and children’s playroom; a lounge with a bar and kitchen; modern fitness center with yoga, aerobics and spinning studios; a business center with coworking spaces and a coffee bar; a children’s “tot-lot: with recreational equipment and electronic charging stations; residents-only dog park and outdoor spaces including open lawns, lakes, preserves and mobile device charging stations throughout the entire community. The design team includes Pascual, Perez, Kiliddjian Architecture (PPK), with the development’s clubhouse and model units designed by …

Balfour Beatty Acquires 592-Bed Student Housing Community Near Florida State University

by John Nelson

TALLAHASSEE, FLA. — Balfour Beatty has acquired The Quarters at Tallahassee, a 592-bed student housing community located one mile from the Florida State University campus in Tallahassee. The property, which offers 168 units in a mix of six floor plans, has been rebranded Oktiv by the new ownership. Shared amenities at the community include a business center, clubhouse, fitness center, resort-style swimming pool, hot tub, sauna, study rooms and a yoga studio with on-demand classes. Berkadia secured acquisition financing for the transaction through an affiliate of Walton Street Capital. The seller and terms of the transaction were not disclosed. The community will be managed by Balfour Beatty’s internal residential management division, Balfour Beatty Communities.

LEESBURG, FLA. — SRS Real Estate Partners has brokered the $7.5 million sale of Leesburg Marketplace, an 81,071-square-foot shopping center located at 1101 W. North Blvd. in Leesburg. Kyle Stonis and Pierce Mayson of SRS represented the seller, a private investor based in Florida, in the transaction. The buyer was a Florida-based entity doing business as JTT Eagles LLC. Situated on 9.4 acres about 40 miles northwest of Orlando, Leesburg Marketplace was 90 percent leased at the time of sale to tenants including Ollie’s Bargain Outlet and Dollar Tree.

Integra Investments Acquires Shopping Center in Palm Beach County, Plans to Add Workforce Housing

by John Nelson

LANTANA, FLA. — Miami-based Integra Investments has purchased Lantana Village Square, a 165,000-square-foot shopping center located at 1001 S. Dixie Highway in Lantana, a town in South Florida’s Palm Beach County. The buyer plans to raze the center’s vacant K-Mart department store and develop workforce housing that is affordable for Lantana renters. The overall development is situated on a 19-acre site within one mile of South Palm Beach. Lantana Village Square’s existing retailers such as Winn-Dixie, Subway and H&R Block will remain, which will create a mixed-use community once the workforce housing component is complete. Integra is utilizing the State of Florida’s Live Local Act to help fund the development. Integra acquired Lantana Village Square from Saglo Development for $14.9 million. Bradesco Bank provided acquisition financing.

Walker & Dunlop Arranges $150M Refinancing for New Mixed-Use Property in Fort Lauderdale

by John Nelson

FORT LAUDERDALE, FLA. — Walker & Dunlop has arranged a $150 million loan for the refinancing of Quantum at Flagler Village, a newly built mixed-use development in Fort Lauderdale. The property houses two 15-story towers comprising 337 apartments, 20,884 square feet of retail space, a five-story parking garage and a nine-story Courtyard by Marriott hotel that features 137 rooms and a rooftop pool and bar. Joe Hercenberg led the Walker & Dunlop Capital Markets team that arranged a fixed-rate, five-year loan on behalf of the borrower, Prime Group US-PMG Asset Services. The loan refinances a construction loan that Walker & Dunlop closed four years ago.

Cushman & Wakefield Brokers Sale of 677,789 SF Industrial Park in Deerfield Beach, Florida

by John Nelson

DEERFIELD BEACH, FLA. — Cushman & Wakefield has brokered the sale of Quiet Waters Business Park, an infill industrial park in South Florida’s Deerfield Beach. PGIM Real Estate sold the seven-building, 677,789-square-foot property for an undisclosed price. The buyer was also not disclosed. Mike Davis, Dominic Montazemi, Rick Brugge, Rick Colon, Greg Miller, Cassandra Hernandez and Chloe Strada of Cushman & Wakefield represented the seller in the transaction. Matthew McAllister, Christopher Thomson, Chris Metzger and Rick Etner of Cushman & Wakefield’s South Florida Industrial Team will handle the property’s leasing assignment going forward. Quiet Waters is situated along the planned expansion of SW 10th Street, which will offer more direct connectivity to I-95, Sawgrass Expressway and the Florida Turnpike. The park houses 30 tenants and features a wide range of bay sizes with dock-high and grade-level loading.

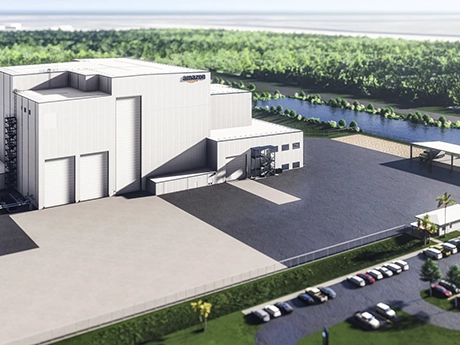

CAPE CANAVERAL, FLA. — Amazon is underway on the construction of a $120 million satellite processing facility at Space Florida’s Launch and Landing Facility within Kennedy Space Center in Cape Canaveral. Upon completion, the development will total 100,000 square feet with a 100-foot high bay clean room. The facility will be used to receive and prepare Blue Origin and United Launch Alliance (ULA) satellites as part of Amazon’s Project Kuiper, a 3,200-satellite project that will provide broadband connection to underserved communities globally. Amazon will use the facility to receive shipments, conduct final preparation ahead of launches, connect satellites to custom dispensers from space tech firm Beyond Gravity and integrate the loaded dispensers with launch vehicles. Amazon’s investment is expected to create 50 news jobs on Florida’s Space Coast. A timeline for delivery was not disclosed.

Northmarq Arranges $70M Refinancing for Two Multifamily Communities in Miami Lakes, Florida

by John Nelson

MIAMI LAKES, FLA. — Northmarq has arranged a $70 million loan for the refinancing of two multifamily communities located in Miami Lakes. Built in 1997 and 2000, the properties total 500 units. Jeff Robertson of Northmarq secured the 10-year permanent financing through Empower Annuity Life Insurance Co. on behalf of the borrower, Graham Cos. The names and addresses of the communities were not disclosed.