HOLLYWOOD, FLA. — FundRebel LLC is under contract to acquire Nine Hollywood, a mixed-use property currently underway in Hollywood, for $67 million. Situated on a 36,000-square-foot parcel, the development features 204 multifamily residential units, three levels of integrated parking and more than 7,000 square feet of retail space. Residences include apartments in studio, one- and two-bedroom layouts. Amenities at the property include a swimming pool, fitness center and business suites. Construction on the project is scheduled for completion in the fourth quarter of this year. The seller was not disclosed.

Florida

908 Group, BCDC Break Ground on 693-Bed Student Housing Project Near Florida State University

by John Nelson

TALLAHASSEE, FLA. — 908 Group and BCDC have formed a joint venture to develop a 693-bed student housing community adjacent to Florida State University (FSU) in Tallahassee. The unnamed, 182-unit property is the third development between the two firms and the fourth Tallahassee project for 908 Group. Pacific Life Insurance Co. is the primary lender for the project, with preferred equity provided by Nationwide. The project team includes general contractor Culpepper Construction Co., architectural firm Humphreys & Partners Architects and civil engineer Moore Bass Consulting. First move-ins are expected in August 2025 in time for the start of FSU’s 2025-2026 school year.

MIAMI — General contractor ANF Group has begun construction on Southpointe Vista, a two-phase affordable housing development in Miami that will total 332 units. McDowell Housing Partners is the developer of the two 10-story residential towers, which will be connected by a central paseo. Located at 21255 117th Court in the city’s Goulds neighborhood, the towers will feature studio, one- and two-bedroom residences reserved for households earning up to 70 percent of the area median income. Amenities will include community rooms, laundry facilities, a cybercafé, fitness room and onsite management offices, as well as two two-story parking garages. This project was partly funded through Miami-Dade County’s Public Housing and Community Development Department with $2.5 million in surtax funds. Southpointe Vista’s first tower is scheduled for completion in fourth-quarter 2024.

MIAMI — LORE Development Group, a newly formed development firm between Leste Group and Brazilian-based Opportunity Fundo de Investimento Imobiliário, has announced plans to develop a $500 million multifamily development in Miami’s Brickell district. Situated near Brickell City Centre, the 442,000-square-foot, unnamed property will be located at 1015 SW 1st Ave. and feature high-end amenities and 2,000 square feet of ground-floor retail space. The construction timeline and design-build team were not disclosed. LORE will source and acquire properties and work with third-party construction teams to build its projects. In South Florida, LORE plans to develop more than $1 billion in multifamily assets over the next five years.

MIAMI — Marcus & Millichap has brokered the $6.7 million sale of a freestanding store in west Miami that is leased to Walgreens. The 13,650-square-foot store is located on a 1.4-acre parcel at 16690 SW 88th St. and is an outparcel to Kendall Pointe, a shopping center anchored by Aldi and PetSmart. Built in 2004, the store is subject to a new 15-year triple-net lease with Walgreens. Jonathan De La Rosa and Eduardo Toledo of Marcus & Millichap’s Miami office represented the buyer, a local private investment firm, in the transaction. The seller was also not disclosed.

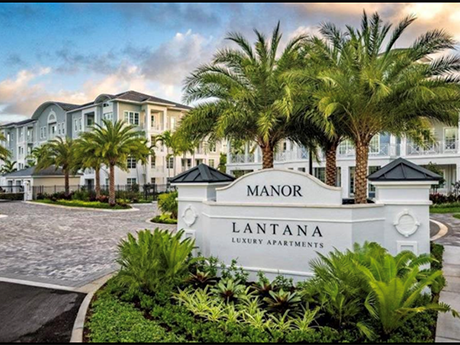

LANTANA, FLA. — The Praedium Group has acquired Manor Lantana, a 348-unit multifamily community located in Lantana, a city in South Florida’s Palm Beach County. Built in 2022, the property comprises four four-story buildings, 18 two-story villas featuring tuck-under garages and a two-story clubhouse. Apartments at the community average 1,164 square feet. Amenities include a spa, golf simulator and a fitness center. The seller and sales price were not disclosed.

Miami is a vivacious city renowned for its scenic beaches, sunny climate and dynamic nightlife. The South Florida city is also a hub for a flourishing retail industry, which serves an eclectic blend of both locals and visitors. Miami’s retail market is characterized by its diversity, with a broad spectrum of retailers ranging from luxurious, high-end boutiques to small, locally owned businesses. This range of retailers is a reflection of the city’s diverse population, which includes a sizable Hispanic community, as well as individuals from all corners of the globe. Consequently, Miami’s retailers must be adept at catering to a wide range of tastes. One of the most notable trends in the Miami retail market in recent years has been the growth of e-commerce. Like many other cities around the world, Miami has seen a significant increase in online shopping. This has presented both challenges and opportunities for retailers in the city. On the one hand, the rise of e-commerce has led to increased competition for brick-and-mortar retailers in Miami. Online retailers such as Amazon and Walmart have made it easier than ever for consumers to shop from the comfort of their own homes, and this has put pressure on …

Eight Retail Tenants Sign Leases to Occupy Promenade Along Lincoln Road in Miami Beach

by John Nelson

MIAMI BEACH, FLA. — Eight new retail tenants have signed leases on Lincoln Road in Miami Beach, a South Florida high street that features more than 200 shops, cafés, galleries and restaurants across eight blocks. Paris St. Germain, Habitat Hyett, The Cheesecake Factory, Ecco, BonBon Etc., Osteria da Fortunata, Voyage Luggage and Salt & Straw will open locations at the promenade beginning this summer. Lincoln Road is the most visited open-air retail destination in South Florida, having drawn more than 8 million visitors in 2022.

HOLLYWOOD, FLA. — Housing Trust Group (HTG) has broken ground on University Station, a $100 million mixed-use development, in a public-private partnership with the City of Hollywood. The project will comprise 216 units of workforce housing, a 635-space parking garage, retail space and new home for Barry University College of Nursing and Health Services. All of University Station’s apartments will be reserved for individuals and families at various income thresholds, including 22, 30, 40, 60, 70 and 80 percent of the area median income (AMI), with rents ranging from $374 to $1,634. The three-building development will be situated on 2.5 acres of city-owned land next to the future Broward Commuter Rail (BCR) South Station. Funding sources include LIHTC equity from Raymond James and debt from Bank of America and National Housing Trust Fund. The State of Florida and Broward County also contributed debt and civic funds for the project. The development team includes Corwil Architects and general contractor ANF Group Inc. HSQ Group will serve as the civil engineer, BNI Engineers will serve as the structural engineer and RPJ Inc. Consulting Engineers will serve as the MEP engineer. B. Pila Design Studio will handle interior design, and Witkin Hults + …

ORLANDO, FLA. — Plaza Advisors has negotiated the sale of Orlando Square, a 183,877-square-foot shopping center located at the southwest corner of Sand Lake Road and South Orange Blossom Trail in Orlando. The property was 85 percent leased at the time of sale to tenants including Ross Dress for Less, Office Depot, Ollie’s Bargain Outlet, Central Rock Gym, Chipotle Mexican Grill, Firehouse Subs, Bright Now Dental, Chick-fil-A and Chase Bank. Miami-based Core Investment Management purchased the center from an entity doing business as AGRE Orlando Square LLC. Plaza Advisors represented the seller in the transaction.