EDGEWOOD, FLA. — SRS Real Estate Partners’ Investment Properties Group has arranged the $7.5 million sale of Edgewood Isle, a 78,647-square-foot, multi-tenant neighborhood retail center located in Edgewood. Kevin Yaryan, Kyle Stonis and Pierce Mayson of SRS represented the seller, an entity doing business as Dundurn USA Inc. LLC, in the transaction. Salim Valiani of Marcus & Millichap represented the buyer, an Orlando-based entity managed by Marcus & Millichap. Edgewood Isle is anchored by Dollar Tree, and has tenants including Cornerstone Hospice, Pizza Hut and Pinch-A-Penny: Pool, Patio and Spa. The shopping center is situated roughly five miles south of the downtown area, four miles from Orlando International Airport and six miles from Universal Orlando Resort. The property also has proximity to major highways, such as the Florida Turnpike and the Beachline Expressway.

Florida

WEST MELBOURNE, FLA. — JLL Capital Markets has arranged the sale of The Haven at West Melbourne, a three-story, garden-style multifamily community located in West Melbourne. JT Capital purchased the Space Coast property for $84.7 million. Ken Delvillar and Jay Ballard of JLL represented the seller, Irvine, Calif.-based Passco Cos., in the transaction. Melissa Marcolini Quinn, Lee Weaver, Rob Rothaug and Emily Moallem of JLL represented the borrower in arranging an undisclosed amount of debt and equity financing for the acquisition. The Haven at West Melbourne includes 13 buildings total, and offers one-, two- and three-bedroom floorplans with an average unit size of 1,164 square feet. Unit features include full-sized washers and dryers, walk-in closets, window coverings, nine-foot ceilings, hardwood-style vinyl flooring, granite countertops and private balconies or sunrooms. Community amenities include a pool and sundeck, outdoor gourmet kitchen, fitness center, business center, children’s play park, billiards room, sand volleyball court, dog park and a car care center. Located at 4550 Explorer Drive, the property is situated close to employers including L3Harris, Collins Aerospace, Northrop Grumman, Patrick Air Force Base, Lockheed Martin and Blue Origin. The property is also situated 5.3 miles from downtown Melbourne, 3.4 miles from the Florida …

DAVIE, FLA. — Sunny Isles Beach, Fla.-based RK Centers has acquired Lakeside Town Shops, a 79,746-square-foot retail property in Davie. The sales price was $28.7 million, or $361 per square foot. An entity known as Lakeside Town Shops LLC, which is managed by Columbia, S.C.-based Edens, was the seller. Dennis Carson of CBRE represented the seller and the buyer in the transaction. Lakeside Town Shops features three buildings on 10.3 acres. The property was 98 percent leased at the time of sale to 25 tenants, including Dollar Tree, Ross Dress for Less, Target SuperCenter and Chick-fil-A. Located at 5800 South University Drive, the property is situated 9.1 miles from Hollywood, 24.7 miles from Miami Beach and 7.6 miles from Miami Gardens. Lakeside Town Shops is also located 23.9 miles from Miami International Airport and 33.3 miles from the University of Miami.

GAINESVILLE, FLA. — Rosewood Realty Group has arranged the $76.9 million sale of Evergreen Uptown Village, a 322-unit multifamily development in Gainesville. The property sold for $238,975 per unit. Jay Weiner of Rosewood Realty Group represented both the buyer, West Shore, and the seller, Evergreen Residential LLC, both of which are based in Boston. Built in 2004, Evergreen Uptown Village is a three-story property with a total of 478,542 square feet. The property offers one-, two- and three-bedroom floorplans with a unit size range of 810 to 1,606 square feet. Community amenities include a pool, fitness center and 450 outdoor parking spots, as well as 7,700 square feet of retail space on the ground level featuring a hair salon and a vacant restaurant. Located at 3780 NW 24th Blvd., the property is situated 5.1 miles from downtown Gainesville and about four miles from the University of Florida campus.

BRANDON, FLA. — Tampa-based ZMR Capital has acquired two multifamily properties in Brandon in two separate transactions totaling $53.3 million. The two adjacent properties, Brandon Oaks and Palms at Paradise, total 285 units. The seller(s) was not disclosed. Built in 1974, Brandon Oaks is a 160-unit community located near the intersection of North Parson and East Clay avenues at 110 Summerfield Way, about 12.2 miles east of Tampa. Built in 1981, Palms at Paradise is a 125-unit community that is located adjacent to Brandon Oaks at 512 Camino Real Court. Both communities feature one-, two- and three-bedroom floorplans with community amenities such as swimming pools, barbecue and picnic areas, playgrounds and resident clubhouses. ZMR Capital plans to combine the two properties and renovate the exterior to improve curb appeal, as well as upgrade apartment interiors with new countertops and cabinetry, stainless steel appliances and plank flooring.

ST. PETERSBURG, FLA. — An affiliate of Walton Street Capital LLC in partnership with St. Petersburg-based Stoneweg US LLC has acquired Waterview Echelon, a 226-unit, Class A multifamily property located in St. Petersburg. The sales price and seller were not disclosed. Built in 2021, the Waterview Echelon features a mix of one-, two- and three-bedroom apartments that were 99 percent occupied at the time of sale. Unit features include quartz countertops, stainless steel appliances, full-size washers and dryers in-unit and floor to ceiling windows with views of Tampa Bay. Community amenities feature an infinity pool with cabanas, gas grills and fire pits, fitness center, club lounge, single-use workspaces, covered parking and a private conference room. Located at 100 Main St. N., the property is situated adjacent to a Publix-anchored shopping center, 14.3 miles from downtown Tampa and 10.9 miles from downtown St. Petersburg. The property is also located within one mile of Carillon Office Park, which houses over 3 million square feet of office space.

MIAMI — Miami-based Mast Capital and Boston-based Rockpoint have bought a 2.8-acre site in Miami for $103 million. The site is located on the southern side of the Brickell Central Business District submarket. Construction on the project is slated for 2022. Mast Capital plans to build an 80-story condominium tower with 400 residences and two multifamily towers spanning 50 stories and 60 stories with a combined 850 apartments. The three residential towers will span 2.6 million square feet. Community amenities will include food and beverage services, 1,650 parking spaces and ground-floor retail on South Miami Avenue. Located at 1420 S Miami Ave., the development will be situated one mile from downtown Miami, 6.8 miles from University of Miami and 9.6 miles from Miami International Airport. The property is also near retailers and restaurants including Branca Café, PM Fish & Steak House and Publix.

SARASOTA, FLA. — Sarasota-based Benderson Development has purchased Sarasota County’s administration building in downtown Sarasota for $25 million. The deal allows the seller, Sarasota County, to lease back the space in the building for another four years. Sarasota County will be the only tenant at the building. Paul Carr, Todd Tolbert, Ken Krasnow and Brooke Berkowitz of Colliers arranged the sale of the 158,149-square-foot office property. Located at 1660 Ringling Blvd., the building is situated one mile from downtown Sarasota, 6.4 miles from Sarasota Beach and 57.6 miles from Tampa. The property is also close the Sarasota Art Museum, Whole Foods Market and Marie Selby Botanical Gardens Downtown Sarasota campus. Built in 1972, the property has been renovated several times over the years.

TAMPA, FLA. — Current Rocky Point LLC, an affiliate of Tampa-based Caspers Co., has acquired The Current Hotel, an Autograph Collection hotel by Marriott in Tampa. The price was $85 million. Dave Weymer, Michael Weinberg, Preston Reid and Wyatt Krapf of Berkadia Hotels & Hospitality represented the seller, Rocky Point Holdings LLC, in the transaction. American Momentum Bank provided a $55 million loan to the buyer. Built in 2019, The Current Hotel features 180 rooms, the Julian Restaurant, Rox Rooftop Bar and a lobby bar. The hotel property also includes a private beach, infinity pool and waterfront views from every guestroom. Located at 2545 N. Rocky Point Drive, the hotel is 4.8 miles from the Tampa International Airport, 0.5 miles from East Tampa Beach and 15 miles from Clearwater. The property is also situated near restaurants such as Whiskey Joe’s Bar & Grill and Oystercatchers.

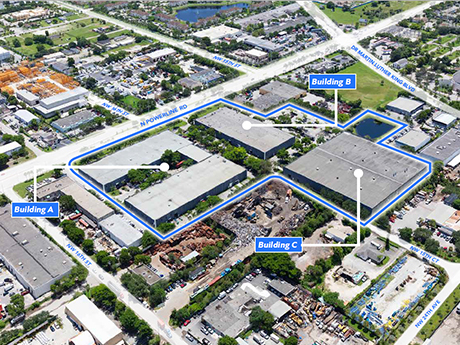

POMPANO BEACH, FLA. — Bridge Industrial has purchased Pompano Beach Commerce Park, a 336,852-square-foot industrial campus in Pompano Beach. Jose Lobon of CBRE National Partners represented the undisclosed seller in the transaction. The price was not disclosed. Located on Powerline Road, Pompano Beach Commerce Park comprises three buildings spanning 140,094 square feet, 124,894 square feet and 71,864 square feet, respectively. The facilities include features such as 24-foot clear heights and multiple points of ingress and egress along its 800 feet of linear frontage on Powerline Road. Following the acquisition, Bridge Industrial plans to launch a comprehensive capital improvement program at the property, including upgrades to the landscaping, parking lot, signage and roof. The campus is located less than two miles from Interstate 95 and just 1.4 miles from the Florida Turnpike. The property also sits 15 miles from Port Everglades and the Fort Lauderdale-Hollywood International Airport, and approximately 40 miles from the Port of Miami and Miami International Airport.