ST. PETERSBURG, FLA. — Black Salmon and LD&D plan to co-develop Gallery Haus, a 23-story multifamily tower in the Tampa Bay city of St. Petersburg. The $115 million project will be located at 155 17th St. S, which is adjacent to the upcoming $6.5 billion overhaul of Tropicana Field, the home ballpark of the Tampa Bay Rays. Black Salmon and LD&D purchased the 0.8-acre site last month for a little more than $9 million. The duo plan to break ground on Gallery Haus in the fourth quarter. The project will include 10,000 square feet of amenities and coworking space, as well as 5,000 square feet of ground-level retail space.

Florida

Harrison Street, Michaels Sell 551-Bed Student Housing Community Near University of West Florida

by John Nelson

PENSACOLA, FLA. — A joint venture between Harrison Street and The Michaels Organization has sold The Next, a 551-bed student housing community located near the University of West Florida campus in Pensacola. CBRE National Student Housing’s Jaclyn Fitts, William Vonderfecht and Casey Schaefer represented the seller, in partnership with CBRE Jacksonville Multifamily’s Ryan Hixon. WFI acquired the property for an undisclosed price. The Next offers fully furnished units with bed-to-bath parity. Shared amenities include a clubhouse, game room, computer center, tanning station, resort-style swimming pool, fitness center and study rooms on each floor.

Pebb Capital Obtains $173M Construction Loan for Sundy Village Development in South Florida

by John Nelson

DELRAY BEACH, FLA. — Pebb Capital has obtained a $173 million construction loan for Sundy Village, a mixed-use development underway at 22 W. Atlantic Ave. in Delray Beach, a city in South Florida’s Palm Beach County. Monroe Capital and J.P. Morgan provided the construction loan. Pebb Capital broke ground on the $240 million development in early 2023 with plans for a summer 2024 opening. Sundy Village will feature more than 28,000 square feet of experiential retail space and 180,000 square feet of Class A offices, of which Pebb Capital has preleased 141,400 square feet. The tenant roster includes restaurants Barcelona Wine Bar and Double Knot and office tenant Vertical Bridge. Joe Freitas and John Criddle of CBRE oversee Sundy Village’s office leasing and Sara Wolfe of Vertical Real Estate handles retail leasing. The design-build team includes general contractor Bluewater Builders.

WEST PALM BEACH, FLA. — Colliers has brokered the $8.3 million sale of West Palm Medical Plaza, a medical office building located at 4700 N. Congress Ave. in West Palm Beach. The property is situated within walking distance of the HCA Florida JFK North Hospital. Mark Rubin, Bastian Schauer, Jake Stauber and Jared Mann of Colliers represented the seller, Triple Double Real Estate, in the transaction. The buyer, Orbvest, was not represented by a broker. The asset was fully leased at the time of sale.

FORT LAUDERDALE, FLA. — Bank OZK has provided a $220 million construction loan for Phase I of FAT Village, an 835,000-square-foot mixed-use development in Fort Lauderdale’s Flagler Village neighborhood. Plans for Phase I include 601 multifamily units, 180,000 square feet of creative office space and more than 70,000 square feet of retail space, including food-and-beverage offerings, shopping, entertainment, and art studios and galleries. FAT stands for Food Art Technology. FAT Village is located two blocks from the Brightline’s Fort Lauderdale high-speed commuter rail station, which connects Fort Lauderdale to Miami, West Palm Beach and Orlando. The developers say that this four-block creative enclave will serve as the reimagined epicenter of the city’s art-centric district. Hines and local partner Urban Street Development are developing the 5.6-acre project. “At a time when financing and construction starts have materially slowed, it’s gratifying to be in a position to move forward on FAT Village, which we believe will be a transformational development for Flagler Village and Fort Lauderdale,” says Alan Kennedy, managing director at Hines. “We look forward to creating a dynamic and engaging destination that honors and advances the neighborhood’s legacy while providing new living, working and recreational options to help the city …

JACKSONVILLE, FLA. — CBRE has brokered the sale of a 300,240-square-foot industrial building located at 9909 Pritchard Blvd. in Jacksonville. Newly constructed and dubbed Building 200, the property is situated within the master-planned Florida Gateway Logistic Park. The building features 36-foot clear heights, cross-dock loading, 86 dock doors, four drive-in doors, ESFR sprinkler systems, 168 car parking spaces and 138 trailer parking spaces. IPEX USA, a PVC and thermoplastic piping system supplier, fully occupies the property. Clarion Partners acquired the building in a joint venture with Diamond Realty Investments on behalf of a separate account. CT Realty sold the property for an undisclosed price. Jose Lobón, Trey Barry, Frank Fallon, Chris Riley, Royce Rose, Alain Bonvecchio and Gabriel Braun of CBRE represented the seller in the transaction.

HIALEAH, MIAMI AND WEST PALM BEACH, FLA. — Dollar Tree has opened three new stores in South Florida. The retailer now occupies 13,500 and 14,000 square feet in Hialeah and Miami, respectively. Dollar Tree has also opened a 9,000-square-foot store in West Palm Beach. Additionally, the retailer is currently underway on the development of two stores in Sunny Isles Beach and Lauderhill, Fla. Steve Miller of The Rotella Group represented Dollar Tree in the lease negotiations.

TAMPA, FLA. — CBRE has facilitated the sale of Sabal Pavilion, a 120,500-square-foot office property located at 3620 Queen Palm Drive in Tampa. Situated on 11.8 acres, the building is located at the entrance of Sabal Park, a master-planned business development. Amenities at the building include a cafeteria, fitness center and a tenant courtyard with an outdoor basketball court and grilling stations. Dale Peterson, Joe Chick, Courtney Snell and Nick Sharpe of CBRE Capital Markets represented the seller, CTO Realty Growth Inc., in the transaction. A Virginia-based private real estate company acquired the building for an undisclosed price. Ford Motor Credit has fully occupied the property since 2000. Recently, Ford Motor Credit executed a 91,401-square-foot sublease agreement with Cirkul Inc., a reusable water bottle manufacturer.

APOLLO BEACH, FLA. — SRS Real Estate Partners has arranged the sale of Apollo Beach Shoppes, a retail strip center situated on 1.9 acres at 6588 N. U.S. Highway 41 in Apollo Beach, a city in the Tampa Bay metro area. A Florida-based private investor acquired the 9,000-square-foot property for $6.2 million. Patrick Nutt, William Wamble and Daniel Becker of SRS represented the seller, a Florida-based investment and development group, in the transaction. Retailers at the three-tenant property include Trulieve, AT&T and Tijuana Flats.

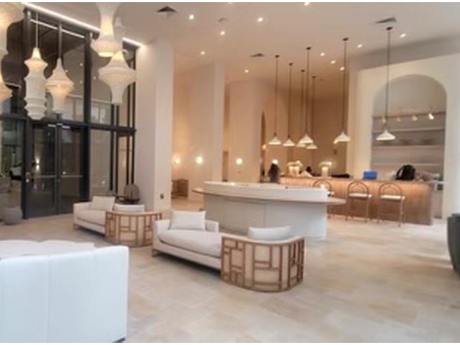

MIAMI — JLL has arranged a $115 million loan for the refinancing of Metro Edgewater, a new 32-story apartment tower in Miami’s Edgewater neighborhood. Jesse Wright, Elliott Throne, Kenny Cutler, Joshua Odessky and J.J. Hovenden of JLL arranged the financing through MF1 Capital on behalf of the borrower, a consortium between Lujeni Corp., Camino Capital Management and Building Block Realty. MF1’s team working on the deal included Michael Squires, Phil Pesant and Connor Pensabene. The 279-unit property comprises one-, two- and three-bedroom units averaging 955 square feet in size. Amenities include a hotel-style pool with cabanas and day beds, fitness center, live-work club room, sky lounge, private dining room and a coffee bar.