While many cities grapple with a declining population, softening rents and a struggling office market, Miami is riding a wave of population growth and apartment demand. This stems from the usual factors — sun, lifestyle and low taxes — as well as something unprecedented: an influx of large office users. New-to-market office tenants are transforming Miami’s economy and helping offset the challenges of inflation and rising interest rates. Miami multifamily fundamentals remain strong, with plenty of liquidity in the market. Our economy is more diversified than ever, and this has made it one of the most desirable markets in the country. Supply and demand People and businesses fleeing states with higher taxes and longer pandemic restrictions helped fuel Miami’s population surge between 2020 and 2022 and led to record-breaking rent growth during that period. Miami has become a magnet for large financial and tech firms, with well-heeled companies like Starwood Property Trust, Citadel Securities, BlockChain and Blackstone Group taking new office space. All told, a record 57 companies relocated or expanded to Miami-Dade County last year. Between May 2022 and May 2023, Miami added over 83,000 jobs, more than a 4 percent increase. Miami’s unemployment rate as of May 2023 …

Florida

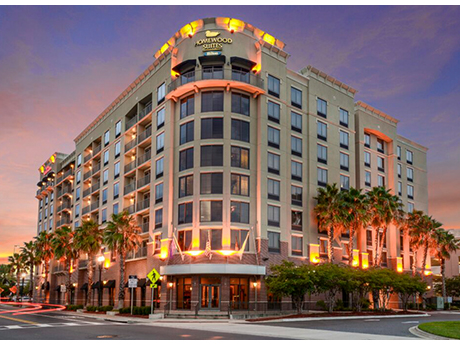

JACKSONVILLE, FLA. — Berkadia has arranged the $26 million refinancing of the leasehold interest in a 221-room dual-branded hotel in Jacksonville’s Southbank neighborhood. Built in 2009 along the St. Johns River, Hilton Garden Inn-Homewood Suites Jacksonville Downtown Southbank is an eight-story hotel located at 1201 Kings Ave. Amenities include an outdoor pool, fitness center, onsite restaurant, room service and meeting rooms. Michael Weinberg, Alec Fox and Lindsey deButts of Berkadia’s Hotels & Hospitality team secured the five-year loan through an undisclosed regional bank on behalf of the borrower, Excel Group.

MIAMI — Related Group and single-family residential investment firm W5 Group are nearing completion for the first co-living development in Miami’s Wynwood neighborhood. Located at 51 N.W. 28th St., the nine-story property, named i5 Wynwood, will feature 63 fully furnished apartments that comprise 217 private suites that are available for rent. Residents will have shared common areas including living spaces, communal kitchens and dining spaces. Residents can choose between three-bed/three-bath and four-bed/four-bath apartments that will feature queen-size beds, writing desks, multiple shelving units, modern light fixtures, dining tables and chairs, couches, coffee tables, entertainment consoles and flat-screen TVs. Related and W5 plan to launch preleasing in November with rental rates beginning at $1,895 per suite. The design-build team includes architect Arquitectonica and interior designer Michael Wolk. Amenities will include 3,900 square feet of ground-floor retail space surrounding a 6,600-square-foot shaded central courtyard, along with a rooftop pool, an indoor/outdoor gym and coworking and meeting spaces.

WEST PALM BEACH, FLA. — Boise Cascade Co., a publicly traded producer of engineered wood products and plywood, has purchased a new 120,000-square-foot distribution facility in West Palm Beach. Locally based Brown Distributing Co. sold the property for $31 million. The buyer’s Building Materials Distribution division will occupy the property, which is situated on an infill site totaling 9.8 acres at 1300 Allendale Road. Robert Smith, Kirk Nelson and Jeff Kelly of CBRE’s Industrial & Logistics team represented the seller in the transaction. NAI Miami represented the buyer. Built in 1987 along I-95, the facility includes 91,120 square feet of climate-controlled warehouse space and 20,000 square feet of office space across two stories.

MIAMI — CBRE has brokered the $49.3 million sale of Trail Plaza, a grocery-anchored shopping center located on 17 acres at the corner of SW 8th Street and SW 67th Avenue in west Miami. Boston-based Longpoint Realty Partners LP purchased the 181,558-square-foot shopping center from an unnamed client advised by MetLife Investment Management. Casey Rosen and Dennis Carson of CBRE represented the seller in the transaction. Built in 1987, Trail Plaza was 99 percent leased at the time of sale to tenants including grocer Fresco y Mas, Walgreens, Harbor Freight Tools, Party Depot and six outparcel tenants.

INDIAN HARBOUR BEACH, FLA. — The Sembler Co. has signed a 21,000-square-foot retail lease with Michaels for a new store at Causeway Shopping Center in Indian Harbour Beach, a suburb of Melbourne on Florida’s Space Coast. The 112,000-square-foot shopping center is owned by Forge Real Estate Partners III, a joint venture between Sembler and Forge Capital Partners. Sembler also handles leasing at Causeway, whose other tenants include Ross Dress for Less, Bealls Outlet, GNC and Panera Bread, among others. Michaels plans to open the new store before the end of the year. The store formerly housed an Office Depot, which closed in June.

Advenir Oakley to Develop 302-Unit Build-to-Rent Residential Project in Wildwood, Florida

by John Nelson

WILDWOOD, FLA. — Advenir Oakley Capital will begin development on LEO at Wildwood, a new multifamily development in Wildwood, part of The Villages MSA in Central Florida. Miami-based Advenir Living purchased the site in September 2022 in partnership with Birmingham-based Oakley Group for $8.5 million. Upon completion, LEO at Wildwood will feature standalone cottages with attached garages, duplexes, rowhouses and carriage houses. Residences will range from 782 to 1,300 square feet. Certified General Contractors will serve as the general contractor on the project, which was designed by Nequette Architecture & Design. Amenities will include a swimming pool, clubhouse with a 24-hour fitness center and coffee/water bar, internet lounge, pocket parks, a dog park, pet washing station and free Wi-Fi. Delivery of the first homes is scheduled for January 2025. Monthly rental rates will range from $1,900 to $2,700.

Trammell Crow, STAG Begin Construction on 300,000 SF Industrial Development Near Tampa

by John Nelson

GIBSONTON, FLA. — Trammell Crow Co. and STAG Industrial have begun construction on a two-building industrial development in metro Tampa totaling 300,000 square feet. The two single-story warehouses will be located at 100 and 200 Powell Road in Gibsonton, about 15 miles south of downtown Tampa. The warehouse at 100 Powell will span 160,000 square feet, and the facility at 200 Powell will total 140,000 square feet. The warehouses will be situated on separate sites spanning 18 acres and 12 acres, respectively, and will feature move-in ready office space, a truck court with ample trailer parking and 32-foot clear heights. Trammell Crow Co. and STAG plan to deliver the property in third-quarter 2024. CBRE’s Tampa office will lease the development on behalf of ownership. The design-build team includes architect of record C4 Architecture, general contractor Welbro Building Corp., civil engineer Atwell and LEED consultant DMS. Kris Courier and Gary Bauler of CBRE, along with Julia Silva of JLL, assisted in the deal.

Office America, Avanti Way Break Ground on Deco Green Mixed-Use Project in South Florida

by John Nelson

LAKE WORTH BEACH, FLA. — Two South Florida-based firms, Office America Group and Avanti Way Group, have broken ground on Deco Green, a mixed-use development in Lake Worth Beach. Located at 1715 N. Dixie Highway in Palm Beach County, the four-building property will comprise 125 residential units, 8,000 square feet of commercial space and 15,000 square feet of open green space. The property’s residences will be configured in one-, two- and three-bedroom floor plans ranging in size from 655 to 1,320 square feet. Amenities will include a rooftop lounge, modern fitness center, bike storage, playground and a dog park. The design-build team includes general contractor MGM Construction Group, architect Martin Architectural Group and landscape architect Andres Montero. Office America and Avanti Way expect to deliver Deco Green in first-quarter 2025.

Trinity Investments-Led Joint Venture Secures $750M Refinancing of Grande Lakes Orlando Resort

by John Nelson

ORLANDO, FLA. — A joint venture led by Trinity Investments has secured a $750 million loan for the refinancing of Grande Lakes Orlando Resort, a resort that includes two luxury hotels and a golf course. Situated on the south side of Orlando, the 409-acre development comprises the 582-room Ritz-Carlton hotel, the 1,010-room JW Marriott hotel and an 18-hole golf course designed by Greg Norman. An undisclosed lender provided the floating-rate CMBS loan to the Trinity-led joint venture, which acquired the resort in 2018. Since its acquisition, Grande Lakes Orlando Resort has undergone renovations to the rooms and public areas, as well as the addition of 12 guestrooms, new food-and-beverage experiences and a pool renovation that includes a new waterpark. Trinity estimates the renovations totaled $118 million.