CONYERS, GA. — JLL Capital Markets has arranged a $44.1 million financing package comprising joint venture equity and debt for the development of Dogwood Logistics Center, a 388,960-square-foot industrial property under development in Conyers, about 24 miles east of downtown Atlanta. Bobby Norwood, Mark Sixour, Hamp Gibbs and Streeter Simmons of JLL secured a $25.4 million construction loan through Pinnacle Financial Partners on behalf of the developer, Holder Properties. Hartford Investment Management Co. (HIMCO) provided $18.7 million in joint venture equity. Scheduled to deliver in summer 2026, Dogwood Logistics Center will feature two shallow-bay, rear-load buildings spanning 205,265 square feet and 187,593 square feet. The facilities will offer 36-foot clear heights, concrete tilt-wall construction, 60-foot dock bay depths, 210- to 230-foot building depths and TPO roofing. Additionally, the property will provide two exits along I-20. Dogwood Logistics Center marks Holder Properties’ second industrial project in 2025 with Pinnacle Financial Partners and HIMCO.

Georgia

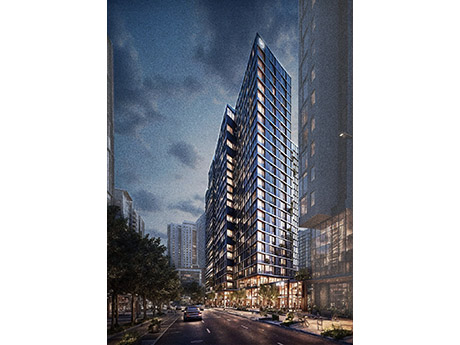

Core Spaces, Capstone to Break Ground on 1,600-Bed Student Housing Development Near Georgia Tech

by Abby Cox

ATLANTA — A joint venture between Core Spaces and Capstone Communities is set to break ground on a multi-phase mixed-use project located near the Georgia Tech campus in Midtown Atlanta. The first phase of the development — which is being led by Core Spaces — will include 1,600 beds of student housing and 5,000 square feet of ground floor retail. The community will also feature a third-floor amenity deck. Dwell Design Studio has been selected as the architect for Phase I, which is scheduled for completion in 2029. Capstone Communities will lead Phase II of the project, a timeline for which was not released.

MMCC Secures $4M Acquisition Financing for Dunwoody Village Retail Center in Metro Atlanta

by Abby Cox

DUNWOODY, GA. — Marcus & Millichap Capital Corp. (MMCC) has arranged $4 million in acquisition financing for Dunwoody Village, a 15,382-square-foot retail center located at 1610-1614 Mount Vernon Road in Dunwoody, a suburb of Atlanta. David Johnson of MMCC’s Atlanta office secured the loan with a national bank on behalf of a private client. The five-year loan includes a 6.41 percent interest rate with a 30-year amortization schedule. Shadow-anchored by The Fresh Market and Walgreens, Dunwoody Village features a mix of tenants including CVS Pharmacy, Chipotle Mexican Grill and a pet store.

ATLANTA — Simon has introduced 18 new and expanded retailers debuting at Lenox Square, a 1.5 million-square-foot retail destination located in Atlanta’s Buckhead district. Nine of the tenants are now open and operating at Lenox Square, including three expanding concepts: Rolex, Burberry and Ferragamo. The other six opened stores are Good American, AllSaints, Ray-Ban, Rowan, Starbucks Coffee and Claire’s. Nine more concepts are set to open later this year, including IWC, Panerai, Mejuri, Cole Haan, Garage, Lovisa, Levi’s, Kelly’s Cajun Grill and Great American Cookie Company/Marble Slab. David Vinehout serves as Simon’s vice president of leasing at Lenox Square and Phipps Plaza, another high-end shopping mall in Buckhead that Simon owns and operates. Lenox Square is anchored by Bloomingdale’s, Neiman Marcus and Macy’s and includes 250 specialty stores and several restaurants, including The Cheesecake Factory, North Italia and True Food Kitchen.

SAVANNAH, GA. — First National Realty Partners (FNRP) has opened a new 22,000-square-foot Ross Dress for Less store at McAlpin Square in Savannah. The 169,690-square-foot shopping center is located at 1900 E. Victory Drive and is anchored by Kroger. Other tenants include Goodwill and the U.S. Postal Service. Ross Dress for Less is backfilling a former Big Lots store following the latter retailer’s Chapter 11 filing. With the new store, McAlpin Square is 95 percent occupied.

DECATUR, GA. — Northwood Ravin plans to develop Halo, a 370-unit luxury apartment community in Decatur. The Charlotte-based developer plans to deliver first units next April and fully finish the five-story development by January 2027. Situated in the city’s East Decatur neighborhood, Halo will offer a mix of one-, two- and three-bedroom apartments, as well as retail and plaza space and live-work units with street-level entrances. Northwood Ravin is partnering with Eric Carlton of Oakhurst Realty Partners on the retail tenant mix. The first confirmed retail tenant is Galore Market, a neighborhood market concept from the creators of O4W Market near Krog Street Market. Planned amenities at Halo include a rooftop pool, more than 3,000 square feet of fitness space, including a private yoga studio and exercise room, gaming lawn, pergola with covered seating, outdoor movie projector, fire pit, a hidden bar with full service and surprise cocktail events, sports bar, golf simulator, pet spa and a community coworking club with an embedded coffee shop.

LOUISVILLE, KY. — GE Appliances, a Haier company, has unveiled plans to invest more than $3 billion in its U.S. operations over the next five years. The company plans to expand its air conditioning and water heating portfolio, increase production output across all product lines and further modernize its 11 U.S. manufacturing plants with new automation and capital equipment. The first phase of investments will begin at GE Appliances plants in Kentucky, Alabama, Georgia, Tennessee and South Carolina. Upon completion of the plan, Louisville-based GE Appliances will have invested $6.5 billion across its U.S. manufacturing plants and nationwide distribution network since 2016, which is the year that the company was sold by General Electric (NYSE: GE) to Haier. The new $3 billion announcement marks the second-largest investment in the company’s history. The GE Appliances plant in Camden, S.C., currently produces gas water heaters. With the new investment, electric and hybrid water heater manufacturing will be added, doubling the plant’s output and employment once the project is complete. The first phase will be implemented by early 2026. In December, GE Appliances will add two new models of air conditioners to its air and water product portfolio at its Selmer, Tenn., plant. …

DC Blox Secures $1.15B Construction Financing for Data Center Campus in Douglas County, Georgia

by John Nelson

DOUGLAS COUNTY, GA. — DC Blox has obtained $1.15 billion in construction financing for a new data center campus coming to Douglas County, which sits west of Atlanta. ING Capital LLC, Mizuho Bank Ltd. and Natixis Corporate & Investment Banking served as lead arrangers and joint bookrunners for the financing package. Other participating capital sources include First Citizens Bank, CoBank ACB, LBBW, Toronto-Dominion Bank, KeyBank and Huntington National Bank. The funds will support the development of a 120-megawatt (MW) data center and include campus expansion to support an additional 80 MW of space. The financing follows DC Blox securing a $265 million green loan and equity from Post Road Group for the project. DC Blox expects the campus, which will be utilized by cloud and AI users, to be available as early as 2027. The developer and operator has a data center underway in the county, as well as in Conyers, Ga., with a few more scattered around the Southeast.

LAWRENCEVILLE, GA. — North Carolina-based Prudent Growth Partners has acquired Sugarloaf Village, a 32,000-square-foot shopping center located in Lawrenceville, for $7.3 million. The seller was not disclosed. Situated approximately 30 miles northeast of downtown Atlanta, the property was originally built in 2008 and features a mix of 17 tenants including lifestyle retailers and service providers such as a nail salon, pet groomer and barber shop. Other nearby retailers include AT&T, Starbucks Coffee, Publix, Target, Marshalls, Aldi, The Home Depot, PetSmart, Hobby Lobby and Panera Bread.

SANDY SPRINGS, GA. — Life Time, a leading healthy lifestyle fitness brand, has opened its ninth athletic club in Atlanta in the northern suburb of Sandy Springs. Situated between the “King and Queen” office towers along the confluence of I-285 and Ga. Highway 400, Life Time Perimeter transformed the former Concourse Athletic Club into a three-story, 79,000-square-foot facility. The multimillion-dollar renovation includes eight outdoor pickleball courts, five tennis courts and a beach club-style swimming pool area. Other facilities include an expansive fitness floor with cardio equipment, resistance machines and free weights, as well as a recovery space that features water massage and cold therapy chairs. The club also offers more than 100 classes weekly, including barre, yoga and Pilates, a LifeCafe and a Kids Academy. Life Time Perimeter joins other area athletic clubs in the Atlanta submarket including Alpharetta, Sugarloaf, Johns Creek, Woodstock, Peachtree Corners, Buckhead and North Druid Hills, which opened in December 2024.