SAVANNAH, GA. — Barings and Charlotte-based Trinity Capital have broken ground on Phase II of Horizon 16 Industrial Park, a logistics park located at Jimmy Deloach Parkway and I-16 in Savannah. The second phase will span six buildings totaling 1.5 million square feet. Phase I of the park spans 1.1 million square feet across three buildings and is currently 74 percent leased to tenants including Ferguson and Harbor Freight. The design-build team for Phase II includes general contractor Evans and architectural firm Atlas. The co-developers have tapped William Lattimore of CBRE to lease the second phase of Horizon 16. Barings and Trinity Capital previously partnered to develop 85 Exchange, a 1.3 million-square-foot industrial park near Charlotte that is leased to tenants including Amazon.

Georgia

ATLANTA — Workspace Property Trust has signed Hyundai Capital America to a 45,000-square-foot office lease at 4100 Wildwood Parkway, a 100,000-square-foot office building located within the Wildwood Office Park in Atlanta’s Cumberland-Galleria submarket. Hyundai Capital America, the finance and loan partner of Hyundai, Kia and Genesis car brands, previously operated a call center out of this location. 4100 Wildwood Parkway features offices, onsite conference facilities, kitchens and recreational areas. Kirk Anders of Anders Commercial Properties and Bob Gibbons of REATA Commercial Realty represented the tenant in the lease negotiations. Wes Rudes represented Workspace on an internal basis.

SAVANNAH, GA. — The Home Depot has acquired its own 1.4 million-square-foot The Home Depot Distribution Center (DC) from the Savannah Economic Development Authority (SEDA). The facility is situated near the Port of Savannah. The sales price was not disclosed. SEDA has leased the center to The Home Depot since 1995. The acquisition includes 100 acres of adjacent land. The Home Depot DC supports hundreds of The Home Depot stores and typically employs around 250 associates. “This sale signals a significant, long-term commitment by The Home Depot to our region and the Georgia Ports Authority,” says Trip Tollison, president and CEO of SEDA. “We are honored that they continue to have great confidence in the Savannah region.”

ATLANTA — PGIM Real Estate has provided an $82.3 million, floating-rate loan for the refinancing of Mira at Midtown Union, a 355-unit multifamily property located in Midtown Atlanta. The borrower, a joint venture between MetLife Investment Management and StreetLights Residential, will use the loan proceeds to refinance existing debt and secure tenants for the available retail space. Tom Goodsite of PGIM Real Estate led financing efforts for the transaction. Delivered in 2022, the 26-story tower offers a unit mix of studios, one-, two- and three-bedroom floorplans that range from 496 square feet to 1,743 square feet in size. Amenities include a resort-style pool, resident lounge, sunset deck with fire pits and grills, pet spa and dog wash station, coworking spaces and a multi-room fitness center.

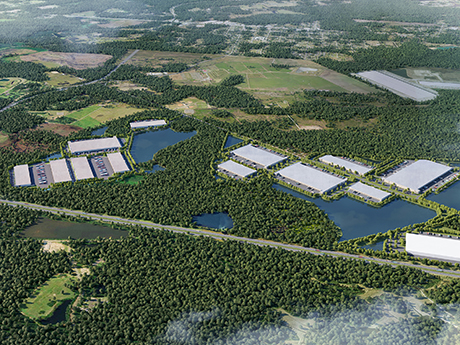

Trammell Crow Co., CBRE IM Deliver 1.5 MSF First Phase of Business Park in Pendergrass, Georgia

by John Nelson

PENDERGRASS, GA. — A joint venture between Trammell Crow Co. and CBRE IM has delivered Phase I of Jackson 85 North Business Park in Pendergrass, about 60 miles northeast of Atlanta. Situated on 215 acres, Phase I comprises two Class A warehouse buildings totaling 1.5 million square feet. Building 1 totals 538,450 square feet and Building 2 totals roughly 1 million square feet. The warehouses feature 40-foot clear heights, 185-foot concrete truck courts, parking space for vehicles and trailers, more than 290 dock door positions and four drive-in ramps. Additionally, the facilities include electrical service, an ESFR fire protection system, watertight roofing systems that can accommodate solar panels and 3,900 square feet of interior office space for each building. Phase II, which is currently underway, will include two warehouses spanning 210,080 square feet and 524,160 square feet. Phase II will also include a build-to-suit project up to 750,000 square feet. Wilson, Hull & Neal Real Estate is leading the marketing and leasing efforts for the project.

Jim Chapman Group to Begin Construction on 365-Unit Build-to-Rent Community in Richmond Hill, Georgia

by John Nelson

RICHMOND HILL, GA. — Georgia-based general contractor Jim Chapman Construction Group (JCCG) plans to soon begin construction on a 365-unit build-to-rent community in the Savannah suburb of Richmond Hill. The property will be situated on 48 acres in the larger 7,000-acre master-planned community of Heartwood at Richmond Hill and will be developed in two phases. Phase I of vertical construction is slated to begin in August. The development — which will contain 213 lots — comprises attached and freestanding homes with ranch-style and two-story floorplans. Phase II will immediately follow.

Northmarq Provides $36.5M Acquisition Financing for Multifamily Property in Grayson, Georgia

by John Nelson

GRAYSON, GA. — Northmarq’s Atlanta Debt + Equity team led by Faron Thompson and Van Glosson has provided $36.5 million in financing for the acquisition of The Dylan at Grayson, a 234-unit multifamily property in Grayson, a northeast suburb of Atlanta in Gwinnett County. Built in 2020, the four-story building offers one-, two- and three-bedroom floorplans that range in size from 687 square feet to 1,454 square feet, according to Apartments.com. Community amenities include a resort-style pool and sundeck, sand volleyball court, yoga studio, pet spa, dog park, coworking spaces, resident café, 24/7 fitness center, game room, fire pits, grill stations, outdoor greenspaces and electric vehicle charging stations. Northmarq originated the Freddie Mac loan on behalf of the borrower, Atlanta-based Inwood Holdings LLC. The loan features a seven-year term with a fixed interest rate and a 35-year amortization schedule.

Berkadia Arranges $28.3M HUD-Insured Construction Loan for Mixed-Income Community in Atlanta

by John Nelson

ATLANTA — Berkadia has arranged a $28.3 million HUD 221(d)(4) loan for the construction of Englewood Multifamily, a 200-unit mixed-income community underway in Atlanta’s Chosewood Park neighborhood. The non-recourse, fully amortizing loan features a construction-to-perm structure that covers the construction period followed by a 40-year amortization schedule. Carolyn Whatley and Angela Folkers of Berkadia’s FHA/HUD team originated the financing on behalf of the co-developers, The Benoit Group and the City of Atlanta’s Housing Authority (AHA). Englewood Multifamily is part of a 37-acre master-planned development and represents the second building within Phase I of the redevelopment of Englewood Manor on Atlanta’s southeast side. Englewood Multifamily’s development costs are estimated to exceed $86 million. The property will feature 80 percent of the units reserved for households earning 60 percent or less of AMI with the remainder rented at market rates. The community will also include 21,844 square feet of commercial space. The network of companies and organizations that are bringing the Englewood Multifamily development to fruition include the following:

BARTOW COUNTY, GA. — Hines and Aubrey Corp. plan to co-develop a new 10 million-square-foot mixed-use community in Bartow County, a northwest suburban node of Atlanta. The master-planned project, called Aubrey Village, will sit on 2,390 acres at the I-75 interchange with U.S. Route 411, which is located near multibillion-dollar plants underway for Hyundai-SK Battery and QCells. Once complete, the development will include new manufacturing, data center and logistics facilities, as well as a supermarket, shops, restaurants, hotels and a variety of residential properties that will accommodate 2,800 families. The industrial-zoned land spans 1,200 acres and will accommodate two industrial parks. Aubrey Village will also feature a network of trails, parks and walkways and a Bartow County public school. The project is projected to be completed over the next 10 to 12 years in several phases, with Hines expecting to break ground on the initial infrastructure later this year or in 2026. Jim Ramseur and Samantha Wheeler with Lee & Associates represented Aubrey Corp. in venture formation, and Ramseur Real Estate Advisors will act as the managing consultant for the co-developers’ commercial and residential parcels moving forward.

KENNESAW, GA — McShane Construction Co. has completed The Lacy at South Main, a 318-unit apartment complex located in downtown Kennesaw. The developer is Highpoint Development. Designed by Niles Bolton Associates, the four-story complex offers one-, two- and three-bedroom floor plans that range from 708 to 1,505 square feet in size, according to Apartments.com. Apartments are available for lease, with monthly rental rates beginning at $1,625. Amenities include a 24/7 fitness center, lounge, coffee bar, swimming pool, two courtyards, grilling stations, coworking spaces and a pet park. Additionally, the site offers controlled-access parking and electric vehicle charging stations. Situated on 19 acres, the complex is part of a larger mixed-use community that features 44 townhomes, a retail outparcel and a linear park space.