NEW YORK CITY — Global alternative investment firm Investcorp has completed the $400 million acquisition of an industrial portfolio located in markets across the Eastern and Western United States. The seller was not disclosed. Totaling 2.6 million square feet, the portfolio comprises 35 buildings across seven markets. Properties in the portfolio include a 76,000-square-foot, two-building portfolio in Philadelphia; a 44,000-square-foot building in New Jersey; 92,000 square feet across two buildings on Long Island; a 1.3 million-square-foot logistics portfolio in Sacramento, Calif.; 156,000 square feet across two buildings in Tampa, Fla.; a 115,000-square-foot, three-building portfolio in South Florida; and a 12-building, 814,000-square-foot portfolio on Atlanta’s north side. Average occupancy across the portfolio was at 97 percent as of October. According to Green Street Advisors, each of the seven markets associated with the portfolio saw strong demand growth in the industrial sector during the third quarter of 2025. The firm noted that new supply in these markets makes up less than 1.3 percent of current inventory. “Despite shifting trade dynamics and supply chain disruptions across the country, the U.S. industrial sector has retained its foundational strength,” says Herb Myers, global head of real assets at Investcorp. “This is particularly true for these and similar …

Georgia

Transwestern Acquires Development Site Near Port of Savannah, Plans 528,560 SF Industrial Development

by John Nelson

RINCON, GA. — Transwestern Development Co., along with joint venture partner Transwestern Investment Group, has purchased a 30.7-acre site in Effingham County on behalf of a separately managed account. The ownership group plans to develop two Class A industrial buildings on the site, which is situated within North Gate Industrial Park. The project will include a 240,560-square-foot rear-load building and a 288,000-square-foot front-load building, each designed with 36-foot clear heights, ESFR systems, dock-high doors, multiple points of ingress and egress, 2,500 square foot office suites and ample car parking and onsite trailer storage. Situated near the intersection of Ga. Highway 21 and Old Augusta Road in Rincon, the development will provide direct access to interstates 95 and 16 and offer drayage routes from the Garden City Terminal at the Port of Savannah. The project team includes The Conlan Co., Randall-Paulson Architects and Kern & Co. JLL will provide leasing services. Transwestern plans to begin construction before the end of the year and complete the shell of the two buildings by year-end 2026.

AUGUSTA, GA. — Dwight Mortgage Trust, an affiliate REIT of Dwight Capital, has provided a $41 million loan for the refinancing of Pointe Grand Reservation Way, a newly constructed, 264-unit apartment community located at 255 Reservation Way in Augusta. Josh Hoffman and Jonathan Pomper of Dwight Mortgage Trust originated the loan for the borrower, Winter Park, Fla.-based Hillpointe. The loan will refinance existing debt, fund an interest reserve, cover transaction costs and return built-up equity accumulated during construction. Pointe Grand Reservation Way features a clubhouse, resort-style pool, business center, fitness center, firepit, picnic area and electric vehicle charging stations.

DOUGLASVILLE, GA. — Lee & Associates has negotiated the sale of a 335,613-square-foot industrial facility located at 7555 Wood Road in the Atlanta suburb of Douglasville. The property features modern construction elements, high clear heights, multiple dock positions and functional warehouse space that can accommodate a variety of industrial users. The asset’s location also provides direct access to I-20 and I-285, as well as various regional transportation networks. Approximately 27,917 square feet of the facility is now available for lease. Billy Snowden of Lee & Associates represented the buyer in the transaction. Both the buyer and seller requested anonymity.

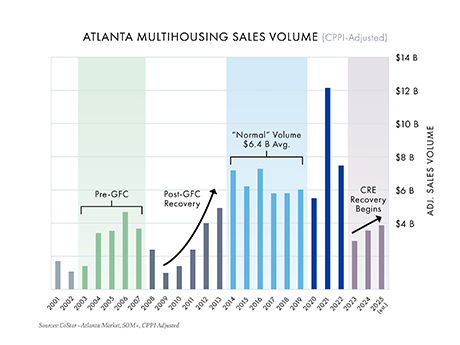

Atlanta’s multifamily market has been in a slump that would even make Braves fans wince. After peaking with record-breaking sales in 2021, volumes slid as borrowing costs climbed and supply piled up. But just like any good ballclub, the fundamentals matter, and the data suggests momentum is quietly building for a 2026 comeback season. Sales volume trends According to research from CoStar Group, institutional multifamily sales in Atlanta (transactions of $50 million or more) peaked in 2021 at $12.8 billion, driven by record pricing, historically low borrowing costs and robust rent growth. Since then, record supply, rising expenses and a sharp increase in borrowing costs have pushed sales volumes down by more than 70 percent, averaging just $3.5 billion annually over the past three years. While the broader U.S. economy has surged since 2022 — the S&P 500 has climbed 45 percent since fourth-quarter 2022 — commercial real estate has been searching for its bottom. Data now suggests that Atlanta has reached this inflection point, and history indicates increased activity and rising values in the years ahead. Parallels to the GFC Looking back at the global financial crisis (GFC) provides valuable context. The chart above (inflation-adjusted using Real Capital Analytics’ …

ATLANTA — Hunter Hotel Advisors has negotiated the sale of the Hyatt House Atlanta/Cobb Galleria, a 149-room, extended stay hotel located in Atlanta’s Cumberland/Galleria submarket. The property is situated in close proximity to Cobb Galleria Centre, Cumberland Mall, Cobb Energy Performing Arts Centre, The Battery Atlanta and Truist Park, home ballpark of the Atlanta Braves. Hospitality Asset Procurers (HAP) purchased the hotel and has selected its affiliate company, ROHM Group, to manage the hotel. The institutional seller and sales price were not disclosed. Mayank Patel of Hunter Hotel Advisors brokered the transaction.

KeyBank Arranges $72.8M Financing for Redevelopment of Atlanta Civic Center into Affordable Seniors Housing

by John Nelson

ATLANTA — KeyBank Community Development Lending and Investment (CDLI) has arranged $72.8 million in financing for a redevelopment phase of Atlanta Civic Center. The borrower, Civic Center Partners, is converting a portion of the property into a 148-unit affordable seniors housing community. Civic Center Partners — a joint venture between The Michaels Organization, Sophy Cos. and Republic Properties — is partnering with Atlanta Housing, which owns the Atlanta Civic Center, on the project. KeyBank CDLI provided a $39.1 million taxable construction loan and $25.2 million in federal low-income housing tax credit (LIHTC) equity. Key Commercial Mortgage Group originated an $8.5 million Fannie Mae MTEB permanent loan, and KeyBanc Capital Markets underwrote two series of tax-exempt bonds totaling $30 million. Upon completion, the senior living community will feature 30 units reserved for residents earning at or below 50 percent of the area median income (AMI); the remaining 118 units will be reserved for seniors earning at or below 60 percent of AMI. All units will be reserved for residents age 55 and older. Amenities at the community will include a lobby, package room, social service office, arts-and-crafts room, fitness center, community room, computer lounge and laundry room. Additionally, 500 square feet of …

If you’ve spent any time driving around Atlanta recently, you’ve probably noticed something. More development sites are returning with bulldozers and developers are taking down land parcels in the suburbs the size of small European countries. But this time, the approach is more strategic than ever. Gone are the days when a developer would carve out a shopping center for base rents less than $40 per square foot and call it a day. Today, some metro Atlanta developers are assembling larger tracts and creating hybrid projects that include multifamily housing, storage and even industrial uses in the back of the parcel, saving the front-facing road frontage for ground leases, build-to-suits and limited shop space. Automotive and restaurants concepts are clamoring for pads. The result? Those once-overlooked “front and center” pad sites and strip centers are suddenly the belle of the ball. The downside is paying too much on the buy side for the dirt for aggressively low caps rates. But all I can say for the rental rates that I’m seeing is “Wow.” Restaurants still lead In Atlanta’s retail market, restaurants continue to be the leading driver of leasing activity. According to observations, excluding junior box space, food-and-beverage deals made …

Foundry Commercial Arranges Office Headquarters Lease at Interlock in Atlanta for AMX Logistics

by John Nelson

ATLANTA — Foundry Commercial has arranged a 20,299-square-foot office lease at Interlock, a mixed-use development in Atlanta’s West Midtown district, for AMX Logistics, an asset trucking and third-party logistics firm. The new corporate headquarters lease is expected to create 200 net new jobs for AMX by the end of 2026. Phil Costabile and Lawrence Gellerstedt IV of Foundry represented the tenant in the lease transaction. Aileen Almassy and Will Porter of Partners Real Estate represented the landlord, SJC Ventures.

SANDY SPRINGS, GA. — Los Angeles-based Westwood Financial has purchased the retail component of Glenridge Square, a mixed-use development located at 5610 Glenridge Drive in Sandy Springs. The live-work-play property is situated adjacent to I-285 in Atlanta’s Central Perimeter submarket. The seller and sales price were not disclosed. Glenridge Square features 20,001 square feet of ground-level retail space that was 91 percent leased at the time of sale to tenants including Qdoba, Firehouse Subs, Blue Moon Pizza, Sushi Nami, Taziki’s Mediterranean, DaVinci’s Donuts, Venus Nail Lounge and Beauty Enhanced. The property also includes 168 apartments and 80,000 square feet of office space leased to tenants including Go2Foods’ headquarters (roughly 800 employees) and Haverty’s (about 3,000 employees). The offices and apartments were not included in the sale.