ATLANTA — Multifamily developers are bracing for the uncertainty of 2024 as their projects are delivering into a landscape where new supply is outpacing demand by a significant margin. In the third quarter, a total of 114,000 new multifamily units were delivered in the United States compared to 82,100 absorbed, according to research from CBRE. The absorption figure is technically rebounding as it represents the highest quarterly figure since early 2022, but there is still a sizeable delta compared to supply growth. The trailing four-quarter total for U.S. multifamily deliveries stands at 376,500 units, which CBRE reports is the highest since it began tracking the metric 27 years ago. “This is historic supply,” said Todd Oglesby, managing director of Alliance Residential Co.’s Southeast division. “It’s at the highest levels since the 1980s.” Oglesby made his comments as part of a panel of developers at France Media’s InterFace Multifamily Southeast, an annual conference held on Thursday, Nov. 30 at the Westin Buckhead hotel in Atlanta. Chad Riddle, senior project manager at Bohler, moderated the panel entitled “Given the Interest Rate & Debt Market Environment, How Are Developers Making New Projects Pencil?” Throughout the full-day conference, several panelists mentioned that their firms’ …

Georgia

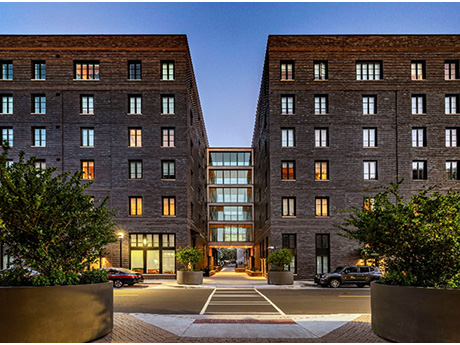

Tidal Delivers First Southeast Mass Timber Residential Project With 389-Unit Ann Street Lofts in Savannah

by John Nelson

SAVANNAH, GA. — Tidal Real Estate Partners, on behalf of investment vehicle Flank GP Fund I, has delivered Ann Street Lofts, a two-building residential development located at 110 Ann St. in downtown Savannah. The 389-unit property represents the first mass timber residential project in the Southeastern United States, according to Tidal. The developer and project architectural firm, LS3P, are targeting LEED Gold certification for Ann Street Lofts, which features a rooftop solar array and electric vehicle charging stations, as well as exposed timber columns, beams and ceilings throughout. Greystar manages the property, whose rental rates range from $1,712 to $3,902 per month, according to Apartments.com. Floor plans range from studios to four-bedroom apartments. Amenities include a pool, fitness center, clubhouse, movie theater, grilling areas, business center, onsite property management and maintenance, bicycle storage, pet play area and a pet washing station.

ATLANTA — Crescent Communities has opened Novel West Midtown, a 340-unit apartment community located at 1330 Fairmont Ave. in Atlanta. Situated in the city’s West Midtown district, the property features walking trails that connect to various hiking trails and a future connection to the Atlanta BeltLine; a dog park; saltwater pool with cabanas, hammocks and spa; outdoor kitchen; and a private courtyard with an elevated terrace view. Indoor amenities include a fitness center, coworking lounge, club room and a game room. The unit mix at Novel West Midtown includes studio, one-, two-, and three-bedroom residences, with 10 percent of homes designated as affordable housing. Rental rates range from $1,699 to $3,515 per month, according to Apartments.com.

EAST POINT, GA. — Global Real Estate Advisors (GREA) has brokered the $13.9 million sale of Phoenix Place Townhomes in East Point, about 3.5 miles from Hartsfield-Jackson Atlanta International Airport. Built in 1971 and located at 2420 Heaton Drive, the community comprises 144 units in one-, two- and three-bedroom floorplans. Green Forest Capital acquired the property from Pacific West Land. Taylor Brown, Mack Leath and Barden Brown of GREA represented the seller in the transaction.

CANTON, GA. — Madison Communities has broken ground on Madison Canton, a 252-unit multifamily community in Canton, roughly 40 miles north of Atlanta. Amenities at the property will include a clubhouse and fitness center, swimming pool, deck with grilling stations, dog park, dog wash and pickleball courts. Completion of the first units is scheduled for the second quarter of 2025. BenCo Construction, an affiliate of Madison Capital Group, will serve as general contractor for the project.

Waterloo, ICM Receive $40M Construction Financing for Industrial Development in Jackson, Georgia

by John Nelson

JACKSON, GA. — Waterloo Partners and ICM Asset Management have received $40 million in construction financing for the development of River Park 10, a speculative industrial project in Jackson, about 50 miles south of Atlanta via I-75. Upon completion, the property will total 825,000 square feet within the River Park E-Commerce Center master development. The joint venture acquired the site in September and plans to break ground immediately, with completion of construction scheduled for the third quarter of 2024. A syndication between Trustmark National Bank and Coastal State Bank provided the construction loan, and Sweld & Sweld provided joint venture equity. Patterson Real Estate Advisory Group arranged the financing on behalf of the borrowers.

SAVANNAH, GA. — CBRE has provided a $27.7 million acquisition loan for Canvas at Savannah, a 300-unit, garden-style affordable housing community located at 5110 Garrard Ave. in Savannah. Blake Cohen of CBRE’s Atlanta office originated the Freddie Mac loan on behalf of the borrower, Miami-based One Real Estate Investment. The seller was not disclosed. Built in 2003 and recently renovated, Canvas at Savannah features one-, two- and three-bedroom units averaging a little more than 1,000 square feet in size. Amenities include a fitness center, coffee bar, package lockers and a resort-style swimming pool.

North American Properties to Add Entertainment Elements to 2.4 MSF Avalon Project in Metro Atlanta

by John Nelson

ALPHARETTA, GA. — North American Properties (NAP) has announced plans for the addition of new entertainment elements at Avalon, a 2.4 million-square-foot mixed-use development located in the Atlanta suburb of Alpharetta. Construction is scheduled to begin in January 2024 and will include the addition of a raised, covered performance stage and an LED screen. The features will comprise 576 and 180 square feet, respectively. Avalon comprises 500,000 square feet of retail space, in addition to a hotel and office and residential space. NAP developed the project in 2012 and manages the property on behalf of PGIM, which acquired the development in 2016 for $500 million.

Trammell Crow, MetLife Break Ground on First Phase of 4.7 MSF Industrial Park Near Savannah

by John Nelson

RINCON, GA. — A joint venture between Trammell Crow Co. and MetLife Investment Management has broken ground on the first phase of Coastal Trade Center, a 4.7 million-square-foot industrial park in Rincon, a suburb of Savannah in Effingham County. The project will be situated on a 477-acre site about 15 miles northwest of the Port of Savannah. Set for completion in late 2024, Phase I of Coastal Trade Center will comprise three cross-dock facilities spanning 1.2 million square feet, 640,640 square feet and 473,760 square feet. Phase II will comprise two cross-dock facilities spanning 1.4 million square feet and 611,520 square feet, as well as a front-load facility totaling 362,880 square feet. Trammell Crow Co. and MetLife plan to break ground on Phase II upon completion of Phase I. Bennett Rudder, Ryan Hoyt, Chris Tomasulo and Lindsey Wilmot of JLL are handling the leasing assignment for Coastal Trade Center.

Connolly Signs Retail Tenants for $70M Parkside on Dresden Mixed-Use Project in Brookhaven, Georgia

by John Nelson

BROOKHAVEN, GA. — Connolly has recently signed new retail tenants at Parkside on Dresden, a $70 million mixed-use development underway in the Atlanta suburb of Brookhaven. The four-acre development is set to open in fall 2024 and will comprise the 183-unit Solis Dresden Village apartment community that Terwilliger Pappas is developing. The project will also include 32,000 square feet of retail and restaurant space that will be leased to tenants including Confab Kitchen and Bar, Honeysuckle Gelato, Café Vendome, Clean Juice, El Valle, MIRAE and F45 Training. Mindy Elms and Ed O’Connor of Lavista Associates Inc. are handling the retail leasing assignment at Parkside on Dresden on behalf of Connolly. The development will be situated at 1350 Dresden Drive between Caldwell Road and Parkside Drive, which is within walking distance to the Brookhaven-Oglethorpe MARTA station.