UPPER MARLBORO, MD. — Finmarc Management Inc. has sold Largo Town Center, a 280,000-square-foot power retail center in the Washington, D.C., suburb of Upper Marlboro, for $70 million. The Bethesda, Md.-based investment firm purchased the shopping center in 2019 when it was 80 percent occupied. John Donnelly of John C. Donnelly Inc. and Arthur Benjamin and Alex Alperstein of AdvisoRE LLC represented the buyer, an investment group led by Bethesda-based KPI Commercial LLC, in the transaction. Joseph Hoffman of Kelley Drye Warren provided legal services to Finmarc. During its nearly four-year ownership period of Largo Town Center, Finmarc initiated capital improvements and executed multiple leases, including Burlington, Foot Locker and Urban Air Adventure, the latter of which is expected to open this fall. Other notable tenants are anchors Marshalls and Shoppers Food Warehouse, as well as Advanced Auto and Dollar Tree.

Maryland

ANNAPOLIS, MD. — District Hospitality Partners has purchased Westin Annapolis, a 225-room hotel located in historic downtown Annapolis. The property, which underwent an extensive renovation in 2020, is situated along the Chesapeake Bay near the United States Naval Academy, Navy-Marine Corps Memorial Stadium and Maryland State House. The seller and sales price were not disclosed. Westin Annapolis features 13 meeting rooms totaling 19,000 square feet, an indoor pool and a fitness center. HEI Hotels & Resorts will continue to manage the hotel on behalf of District Hospitality, which plans to make renovations to the property’s bar, restaurant and lobby. Eastdil Secured arranged an undisclosed amount of acquisition financing through Wells Fargo Bank on behalf of the buyer.

Chasen Cos. Adds Puttshack to The Whitney Mixed-Use Building in Baltimore’s Harbor East District

by John Nelson

BALTIMORE — Chasen Cos. has signed interactive mini-golf retail concept Puttshack to join the tenant roster at The Whitney, a five-story mixed-use building in Baltimore’s Harbor East neighborhood. The historic property was originally the home of the Meyer Seed Co. Set to open in late 2024, the Baltimore Puttshack will be the brand’s first location in Maryland. The almost 25,000 square-foot space will feature three nine-hole mini-golf courses, as well as private event space, two full-service bars and an outdoor patio space with seating for almost 50 patrons. Since opening its first location in 2018, Chicago-based Puttshack now has nine locations in the United States: Atlanta, Boston, Chicago, Miami, Denver, Houston, Pittsburgh, Scottsdale and St. Louis, as well as four in the United Kingdom. Puttshack plans to open Dallas and Nashville venues by the end of the year.

David S. Brown to Develop 120-Room Hotel at Metro Centre at Owings Mills in Metro Baltimore

by John Nelson

OWINGS MILLS, MD. — David S. Brown Enterprises will develop a new, 120-room extended-stay hotel at the Metro Centre at Owings Mills, a transit-oriented development roughly 20 miles outside Baltimore. The Element by Westin hotel will join a high-end, Marriott-branded hotel at the development, which will also feature more than 1,700 apartments; 560,000 square feet of office space; 150,000 square feet of retail space and 5,700 parking spaces upon completion. Crescent Hotels & Resorts will manage the Element by Westin hotel.

Method Co. to Open 81-Unit Roost Apartment Hotel at $5.5B Baltimore Peninsula Development

by John Nelson

BALTIMORE — Method Co. will soon open Roost Apartment Hotel, an 81-unit flexible living community located within the 235-acre Baltimore Peninsula project, which was formerly known as Port Covington. Located at 2460 Terrapin Way, Roost is part of the “Chapter 1” phase of the $5.5 billion Baltimore Peninsula development and is the waterfront project’s third residential property, joining Rye House and 250 Mission. Last week the development team, including Method, Weller Development, MAG Partners and MacFarlane Partners, hosted a ribbon cutting ceremony attended by Maryland Gov. Wes Moore and Sagamore Ventures CEO and Under Armour founder Kevin Plank. The Roost Apartment Hotel concept bridges the gap between a boutique hotel experience and apartment living, with floor plans ranging from one to three bedrooms. The units include features like a full-size kitchen, balconies and full-wall windows. Additionally, Roost will feature an open-air pool, 24/7 concierge and a fitness center with Peloton bikes. The design team for the Roost Baltimore location includes Hord Coplan Macht, Aumen Asner Inc. and Method Studios. Method Co., which operates other Roost-branded properties in Philadelphia, Cleveland, Detroit and Tampa, plans to open the Baltimore Peninsula location on Saturday, July 1.

EJF Capital, NRP Group Obtain $61M Construction Loan for Multifamily Community in Hyattsville, Maryland

by John Nelson

HYATTSVILLE, MD. — EJF Capital LLC and The NRP Group have obtained a $61 million construction loan for the development of a multifamily community in Hyattsville, a suburb of Washington, D.C. First National Bank and Flagstar Bank provided the financing. The five-story, 361-unit property will be situated within a 3.2-acre opportunity zone at the corner of Belcrest and Toledo roads. The unnamed property will have a six-level, 441-space parking garage, as well as a fitness center, bike room, pet wash area, courtyard, pool and multiple lounge spaces. EJF Capital and NRP Group expect to deliver the property in the third quarter of 2025.

MARYLAND — Restaurant chain Slim Chickens has signed a deal with Phoenix Foods LLC to open eight new locations in the Maryland counties of Anne Arundel, Baltimore, Carroll and Harford. Brad Hoag, franchisee and owner of Phoenix Foods, will operate the locations, which will join another 1,100 restaurants currently in development for the brand. Hoag, who is based in Baltimore, is a former developer and operator of 10 Qdoba Mexican Grill locations and currently operates 10 Burger King restaurants.

CAPITOL HEIGHTS, MD. — Newmark has arranged the $20.4 million sale of a distribution facility located at 8700 Ritchie Drive in Capitol Heights. The property, which comprises 103,193 square feet, was fully leased to HD Supply, REW Materials and The General Services Administration (GSA) at the time of sale. Cris Abramson, Ben McCarty and Nicholas Signor of Newmark represented the seller, a joint venture between The Pinkard Group and Principal Asset Management, in the transaction. LBA Realty acquired the property.

ABERDEEN, MD. — A joint venture between MCB Real Estate LLC, Artemis Real Estate Partners and principals of Ace Logistics Services Inc. has acquired Tower Logistics Center, an 859,900-square-foot warehouse at 1225 S. Philadelphia Road in Aberdeen. The facility, which will be rebranded Ace Logistics Center, is situated on 98.5 acres in Baltimore’s I-95 North submarket. The seller is a partnership between Merritt Properties and BentallGreenOak, which developed the property in 2021. Benjamin Meisels and Peter Hajimihalis of JLL represented the buyer and Ace Logistics in the lease deal. Bo Cashman and Jonathan Beard of CBRE represented the seller. Ace Logistics Center features clear heights of 40 feet, 189 cross docks, four drive-in doors, 310 trailer parking spaces and 130-foot truck court depths. Ace Logistics Services has signed a long-term lease for the building and expects to begin operations later this month. The firm provides cargo handling, warehousing and logistical services and currently operates eight facilities totaling 1.4 million square feet of space, as well as six outside storage/drop yards, all close to the Port of Baltimore.

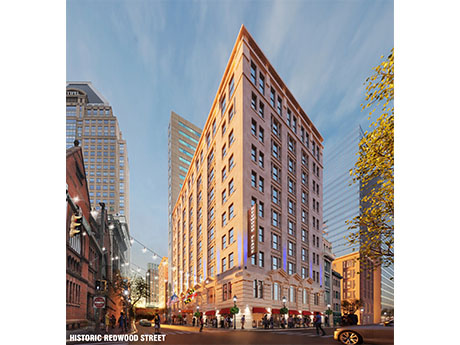

Byrnes & Associates to Lead $18.5M Hotel-to-Multifamily Conversion Project in Downtown Baltimore

by John Nelson

BALTIMORE — A group led by Byrnes & Associates Inc. has purchased Hotel RL Baltimore Inner Harbor located at 207 E. Redwood St. in downtown Baltimore. The locally based investment firm will lead the $18.5 million redevelopment strategy that will convert the 10-story hotel into a 130-unit apartment building. The units will comprise studios, “junior one-bedroom” and one-bedroom apartments spanning 400 to 800 square feet with modern furnishings. Byrnes & Associates expects to redevelop the building, which was first developed as an office building, and lease the units in 18 months. The development team includes Brad Byrnes and Kemp Byrnes of Byrnes & Associates; investors Jay Litke and Moe Krohn of Kove Group LLC who will be the general contractors performing all construction activities; and investor/asset manager Brendan Ferrara of Carm Capital LLC. Byrnes & Associates previously purchased and redeveloped the adjacent 225 and 233 E. Redwood St. buildings, which comprise a total of 90,000 square feet of office and retail space, including the reopening and rebranding of the historic Werner’s Diner & Pub.