ROSEDALE, MD. — KLNB has brokered the $7.2 million sale of Kenwood Shopping Center, a 90,961-square-foot retail center located at 6200 Hazelwood Ave. in Rosedale, a suburb of Baltimore. Pikesville, Md.-based America’s Realty and investment partners purchased the center from a private family that has owned the property since it was developed more than 40 years ago. Chris Burnham, Vito Lupo, Andy Stape and Jake Furnary of KLNB represented the seller in the transaction. Kenwood Shopping Center was 92 percent leased at the time of sale to tenants including Advance Auto Parts, Goodwill and a mix of service and food-and-beverage tenants.

Maryland

SILVER SPRING, MD. — 29th Street Capital (29SC) has purchased Solaire Apartments, a 232-unit multifamily community located in Silver Spring. Amenities at the six-building community include a 24-hour fitness center, swimming pool and sundeck, community room and a courtyard patio with a grilling station. 29SC plans to make upgrades to the property, which will be rebranded as Maven at Wheaton. Brian Crivella, Walter Coker, Bill Gribbin and Yalda Ghamarian of Berkadia represented the undisclosed seller in the transaction. Haven Residential, a company owned by 29SC, will oversee the leasing and management of the property. The sales price was not disclosed.

GAITHERSBURG, MD. — Edge Commercial Real Estate has secured the $4.1 million sale of a 32,000-square-foot office building located at 811 Russell Ave. in Gaithersburg, a suburb of Washington, D.C. Joe Friedman, Joshua Norwitz and Ken Fellows of Edge represented the seller, an affiliate of Finmarc Management Inc., in the transaction. Larry Rosen of Commercial & Investment Realty Associates LLC represented the buyer, an entity doing business as Russell Plaza LLC. Built in 1997 near I-270, the three-story suburban office building was leased to both office tenants and retail businesses at the time of sale.

WASHINGTON, D.C., AND ROCKLEDGE, MD. — KLNB has acquired Edge Commercial Real Estate, a Rockledge-based brokerage with offices in Maryland, Virginia and Washington, D.C. The move increases the size of the Washington, D.C.-based commercial real estate brokerage firm by 20 percent and serves as KLNB’s entry into the multifamily brokerage arena. KLNB is adding 32 total employees, 18 of which are brokers who specialize in multiple facets of office, industrial, tenant representation and multifamily investment sales. Six of the brokers will be immediately installed as principal partners at KLNB. “The acquisition of Edge fits perfectly in our timeline for smart and disciplined progression,” says Marc Menick, president of KLNB. “By acquiring Edge, we will be able to do virtually everything we’re already known for, but at an even higher level and a wider reach. And in the case of multifamily, this opportunity brings the KLNB customer experience to a whole new sector that we have wanted to approach for some time.” Additionally, KLNB will fold Edge’s property management division, which oversees a 1 million-square-foot portfolio, into its KLNB Asset Services platform, a joint venture between KLNB and Divaris Real Estate. Terms of the transaction were not disclosed.

SJC Ventures Adds 11 New Tenants to Beacon Square Mixed-Use Development in Annapolis, Maryland

by John Nelson

ANNAPOLIS, MD. — SJC Ventures has announced 11 new tenants joining Beacon Square, a mixed-use development underway in Annapolis. New tenants signing leases include Arhaus, Circa Lighting, Firebirds Wood Fired Grill, Mighty Quinn’s BBQ, Meg Fox Aesthetics, GNC, Aspen Dental, Inspire Nails, Cold Stone Creamery, Eggspectation and Jersey Mikes. The first openings are projected for late 2024. Additionally, Beacon Square will be anchored by a 43,000-square-foot grocery tenant that has not yet been announced. Atlanta-based SJC Ventures has tapped Ray Schupp, Suzanne Katz and Bryan Davis of H&R Retail to lease Beacon Square. In addition to the 52,000 square feet of shops and restaurants, Beacon Square will feature office space and 508 multifamily units. SJC Ventures and partner AvalonBay Communities purchased the land in early 2022 and began construction last August.

MIAMI — JLL has arranged a $193 million permanent loan for the refinancing of a nine-property industrial portfolio totaling 1.7 million square feet. The properties are located on infill sites in South Florida, Texas, North Carolina, Alabama and Maryland. Chris Drew, Melissa Rose and Christopher Gathman of JLL arranged the five-year, fixed-rate, non-recourse loan through TIAA Bank on behalf of the borrower, Adler Real Estate Partners. The assets were constructed between 1981 and 2001 and were leased to 145 separate tenants at the time of financing. The properties included: • Riverchase Center in Hoover, Ala. • 1001 Broken Sound Parkway in Boca Raton, Fla. • Prospect Park I & II in Fort Lauderdale, Fla. • Delray North Business Center in Delray Beach, Fla. • Rivers Business Park I & II in Columbia, Md. • South Point Business Park in Charlotte, N.C. • Parkwest I & II in Raleigh, N.C. • Addison Tech Center in Addison, Texas • Kramer 1-5 at Braker Center in Austin, Texas

Colliers Arranges 110,000 SF Industrial Lease in Metro D.C. for Co-Warehousing Provider ReadySpaces

by John Nelson

LANDOVER, MD. — Colliers has arranged a 110,000-square-foot warehouse lease at 3341 75th Ave. in Landover, about 10 miles east of Washington, D.C. The tenant is ReadySpaces, a co-warehousing provider that recently launched three other East Coast locations in New Jersey and New York. Mike Davis and Mike McGugen of Colliers represented ReadySpaces in the lease negotiations. The landlord was not disclosed. The Landover deal brings ReadySpaces to 33 locations nationwide. The company provides flexible warehousing and office space ideally suited for small businesses. Each ReadySpaces location provides users with Wi-Fi, loading docks, forklifts, a shared conference room and kitchen and lounge areas, as well as a monthly pricing model.

ANNAPOLIS, MD. — UC Funds has provided a $20 million first mortgage for a multifamily project located in the Washington, D.C.-Baltimore market near Annapolis. Upon completion, the development will feature 60 units and 19,000 square feet of retail space. Further details on the project and construction timeline were not disclosed.

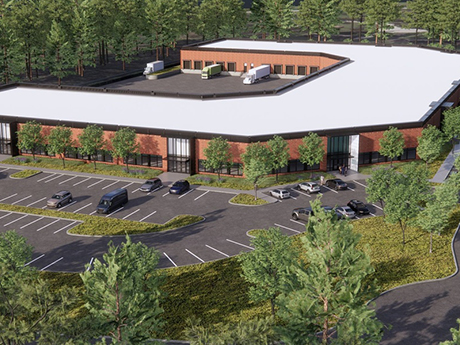

GLEN BURNIE, MD. — Brennan Investment Group has purchased 15.8 acres along Solley Road in Glen Burnie, a suburb of Baltimore. The Chicago-based firm plans to develop an 80,275-square-foot industrial facility on the site. The building is slated for completion later this year and is intended to be the first of several investments for Brennan in the Washington-Baltimore corridor. The property, which will offer tenants interstate access via I-695, is situated 12 miles from Baltimore-Washington International Airport. The building is designed to accommodate one or two tenants, according to Brennan.

Affordable HousingDistrict of ColumbiaMarket ReportsMarylandMultifamilySoutheastSoutheast Market ReportsVirginia

More Affordable Housing Options Needed in Greater D.C. Region, Says Fossi of Enterprise Community Development

by John Nelson

WASHINGTON, D.C. — In 2019, the Metropolitan Washington Council of Governments issued a report stating that the D.C. region — comprising the city, Northern Virginia and suburban Maryland — needed to add 320,000 more housing units between 2020 and 2030, and that at least 75 percent of this new housing should be affordable to low- and medium-income households. Rob Fossi, senior vice president of real estate development at Enterprise Community Development, says the figure has only climbed in recent years due to macroeconomic and local challenges. “In the three years since that report was issued, this demand has only intensified while supply chain interruptions, interest rate spikes and competing resource challenges precipitated by the COVID-19 pandemic have all been challenges to maintain pace,” says Fossi. Enterprise Community Development, an affiliate of Enterprise Community Partners, is the top nonprofit owner and developer of affordable homes in the Mid-Atlantic with a portfolio spanning about 13,000 apartments that house more than 22,000 residents. The firm is actively developing and preserving affordable housing across the region in order to address the demand, which Fossi says shows no signs of abating anytime soon. “There is little doubt that the demand for quality affordable housing will …