TAKOMA PARK, MD. — Cushman & Wakefield has brokered the sale of Takoma Langley Crossroads, a 125,245-square-foot, grocery-anchored shopping center in Takoma Park, a city in suburban Maryland’s Montgomery County. Granite Canyon Partners purchased the grocery-anchored center for an undisclosed price. Cushman & Wakefield’s John Owendoff represented the unnamed seller in the transaction. The recently renovated shopping center was nearly fully leased at the time of sale to tenants including Aldi, Walgreens, Citibank, Taco Bell and 7-Eleven. Situated on nearly 10 acres at the intersection of University Boulevard and New Hampshire Avenue, Takoma Langley is located across the street from the Takoma Langley Transit Center, the largest non-Metrorail transfer point in the metro Washington, D.C., region and the future home of a Purple Line Metro stop.

Maryland

TAMPA, FLA. — JLL has provided $262 million in Freddie Mac loans for the refinancing of a portfolio of six Southeastern multifamily properties totaling 1,494 units. Tampa-based Carter Multifamily owns the properties, which are located in Maryland, Virginia and Alabama. The portfolio comprises all garden-style assets, including: the 326-unit Park at Kingsview Village in Germantown, Md. the 240-unit Stonecreek Club in Germantown, Md. the 336-unit Hunt Club in Gaithersburg, Md. the 220-unit Springwoods at Lake Ridge in Woodbridge, Va. the 180-unit Windsor Park in Woodbridge, Va. the 192-unit Oaks of St. Clair in Moody, Ala. Melissa Marcolini Quinn and Lee Weaver of JLL originated the debt through Freddie Mac. Each of the loans was features a seven-year term and a floating interest rate. JLL, which will service the loans, also secured $40 million in new equity as part of the larger recapitalization of the portfolio. The equity partner was not disclosed. “Despite turbulent debt markets, we were able to facilitate a refinance of the portfolio with favorable senior financing from Freddie Mac, which was attracted to the deal due to the portfolio’s contribution to its mission and the borrower’s strong track record,” says Quinn. — Taylor Williams

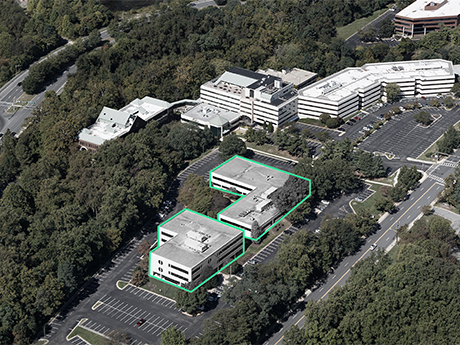

Syndicated Equities Trades Johns Hopkins Laboratory Building in Laurel, Maryland for $53M

by John Nelson

LAUREL, MD. — Syndicated Equities, a private real estate investment firm based in Chicago, has sold the Johns Hopkins University Applied Physics Laboratory in Laurel. An unnamed, Florida-based investor purchased the building for $53 million in a 1031 exchange. The property is situated within Montpelier Research Park near Johns Hopkins University’s Laurel campus. Syndicated Equities purchased the property in January 2011 in a joint venture with Middleton Partners, which is also based in Chicago. During its ownership, Syndicated Equities executed two long-term leases and made significant improvements to the asset, including installing new roofs.

Syndicated Equities Trades Johns Hopkins Laboratory Building in Laurel, Maryland for $53M

by John Nelson

LAUREL, MD. — Syndicated Equities, a private real estate investment firm based in Chicago, has sold the Johns Hopkins University Applied Physics Laboratory in Laurel. An unnamed, Florida-based investor purchased the property for $53 million in a 1031 exchange. Syndicated Equities purchased the laboratory facility in January 2011 in a joint venture with Middleton Partners, which is also based in Chicago. During its ownership, Syndicated Equities executed two long-term leases and made significant improvements to the asset, including installing a new roof.

Walker & Dunlop Provides $105M Acquisition Loan for Affordable Housing Community in Metro D.C.

by John Nelson

LANDOVER HILLS, MD. — Walker & Dunlop has provided a $105 million acquisition loan for The Verona at Landover Hills, a 727-unit multifamily community located in the Washington, D.C., suburb of Landover Hills in Prince George’s County. Walker & Dunlop’s John Gilmore and his team structured the acquisition financing through Fannie Mae’s Multifamily Affordable Housing platform on behalf of the buyer, a joint venture between Dantes Community Partners and the Urban Investment Group (UIG) within Goldman Sachs Asset Management. Built in 1966, The Verona previously operated as a traditional market-rate community but Dantes and UIG entered into an agreement with Prince George’s County Department of Housing & Community Development at closing where new affordability restrictions were placed on the asset. The 30-acre property consists of 25 four-story apartment buildings with 91 separately addressed entryways. Units feature new stainless steel appliances and upgraded cabinetry and countertops.

Klein Enterprises, Evolv to Develop 74-Unit Build-to-Rent Community in Waldorf, Maryland

by John Nelson

WALDORF, MD. — Klein Enterprises and Evolv LLC, an affiliate of Fraser Forbes Real Estate Services, have acquired land in Waldorf to construct 74 build-to-rent (BTR) townhomes. The duo are acquiring lots in two phases via an assignment agreement with Dream Finder Homes, a homebuilder based in Jacksonville. Klein and Evolv plan to break ground in August on Phase I, with construction estimated to last 15 months and homes be delivered on a rolling monthly basis. The community will be situated in Waldorf’s Scotland Heights neighborhood, about 25 miles south of Washington, D.C.

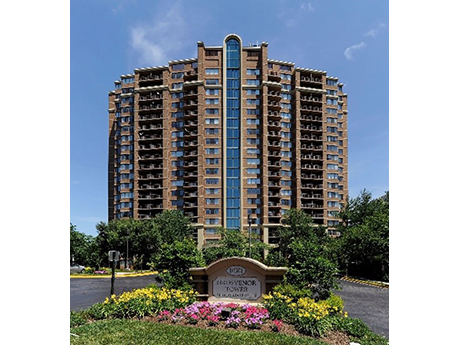

BETHESDA, MD. — Grosvenor and an unnamed investment partner have acquired a 21-story apartment tower in North Bethesda that coincidentally shares a name with the private investor. Grosvenor Tower is located at 10301 Grosvenor Place and features 237 apartments. The acquisition price was not disclosed, but the Washington Business Journal reports that the asset traded for $95 million and that Grosvenor plans to invest $10 million to upgrade the property. The property was originally built in 1987, renovated in 2008 and includes 80 one-bedroom, one-bath apartments and 157 two-bedroom, two-bath apartments. Grosvenor has engaged Bozzuto Management to oversee day-to-day property management. The buyer plans to enhance energy and water efficiency at Grosvenor Tower as part of its $10 million value-add program.

OWINGS MILLS, MD. — Continental Realty Corp. (CRC) has sold Riverstone at Owings Mills, a 324-unit apartment community located at 4700 Riverstone Drive in Owings Mills. Carter Funds purchased the property for $92.9 million, which is approximately $31 million more than what CRC paid for the community in 2016. Christine Espenshade and Robert Garrish of Newmark represented the Baltimore-based seller in the transaction. Situated at the northwest part of Baltimore County adjacent to Owings Mills Town Center, Riverstone features a newly renovated fitness center, clubhouse, leasing office and pool deck. According to Apartments.com, the property features one- to three-bedroom units ranging in size from 692 to 1,419 square feet.

ODENTON, MD. — San Francisco-based Hamilton Zanze has purchased Echelon at Odenton Apartments, a 244-unit garden-style multifamily community located at 315 Nevada Ave. in Odenton, a suburb of Baltimore. Built in 2016, the apartment community was 97 percent occupied at the time of sale. The seller and sales price were not disclosed. Situated on 6.6 acres, Echelon at Odenton comprises two five-story residential buildings housing units ranging from 759 to 1,456 square feet, as well as a single-story clubhouse. Amenities include a theater, barbecue and grilling areas, clubhouse, TV lounge and bar, playground, game room, pool and covered bike storage.

ROCKVILLE, MD. — CBRE has negotiated the $25.5 million sale of Research Square, a two-building office complex located at 1500 and 1550 Research Blvd. in Rockville, a suburb of Washington, D.C. The seller is Westat, an employee-owned research company based in Rockville. Tommy Cleaver, Dan Grimes and Stuart Kenny of CBRE represented Westat in the transaction. The buyer was not disclosed. CBRE says that the properties, which were fully vacated at the time of sale, represent a “premier life sciences conversion opportunity” as the Washington-Baltimore Corridor ranked No. 2 in CBRE’s Life Sciences Research Talent 2022 report.