JACKSON, MISS. — Legacy Realty Group Advisors has arranged the sale of Westland Plaza, a 214,281-square-foot shopping center located in Jackson, for $11.8 million. Grocery Depot anchors the property, which is also home to a mix of additional tenants including Planet Fitness, Family Dollar, Hibbett Sports, Rent-A-Center, Rainbow Shops and City Gear. Jacob Baruch, Daniel Baruch and Ari Warshaw of Legacy Realty Group represented the buyer in the transaction. Beezie Landry and Justin Langlois of Stirling Investment Advisors represented the seller. Both parties requested anonymity.

Mississippi

SLIB Negotiates Sale of 140-Unit Seniors Housing Community in Ocean Springs, Mississippi

by John Nelson

OCEAN SPRINGS, MISS. — Senior Living Investment Brokerage (SLIB) has arranged the sale of a seniors housing community located in Ocean Springs along the Mississippi Gulf Coast. Totaling 140 units, the property features 18 independent living apartments, 60 assisted living residences and 62 memory care units. According to SLIB, the community was stabilized at the time of sale. The seller, the partnership that developed the asset, is exiting the seniors housing sector. A Southeast-based owner and operator with an existing presence in the state acquired the community for an undisclosed price. Daniel Geraghty and Bradley Clousing of SLIB brokered the transaction on behalf of the seller.

TSB Capital Advisors Arranges Refinancing for 531-Bed Student Housing Community Near Mississippi State University

by Abby Cox

STARKVILLE, MISS. — TSB Capital Advisors has arranged the refinancing for The Walk Starkville, a 531-bed student housing community located near the Mississippi State University campus in Starkville. TSB arranged the fixed-rate loan on behalf of Spaces Management. Terms of the financing were not released. Developed in 2023, The Walk Starkville offers 249 units in one-, two-, three-, four- and five-bedroom floorplans. Amenities include a resort-style swimming pool, fitness center and yoga studio, spa with a sauna and steam room, an entertainment courtyard with a TV and multiple lounge areas, as well as a clubhouse with a golf simulator, gaming lounge and private study areas.

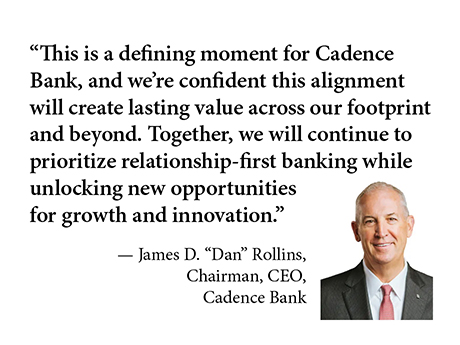

COLUMBUS, OHIO — Columbus, Ohio-based Huntington Bancshares Inc. (NASDAQ: HBAN) has entered into an agreement to acquire Cadence Bank (NYSE: CADE), which has headquarters in Houston and Tupelo, Miss., in an all-stock merger of regional banks that is valued at $7.4 billion. Under the terms of the agreement, Huntington will issue 2.475 shares of common stock for each outstanding share of Cadence common stock. Based on Huntington’s closing price of $16.07 per share on October 24, the last full day of trading before the deal was announced, the consideration implies a purchase price of $39.77 per share. Following the closing, which is expected to occur in the first quarter of 2026, Cadence Bank teams and branches will operate under the Huntington Bank name and brand. Cadence currently has about 390 locations across Texas and the surrounding Southern United States, and the new banking entity will have about $276 billion in assets under management. “This is an important next phase of growth for Huntington,” says Steve Steinour, chairman, president and CEO of Huntington Bancshares. “This partnership will extend the reach of our full franchise to 21 states and into new, high-growth markets for which we have a powerful playbook. Today’s announcement …

Cushman & Wakefield | Commercial Advisors Arranges Sale-Leaseback of Industrial Portfolio in Jackson, Detroit

by John Nelson

JACKSON, MISS. AND DETROIT — Cushman & Wakefield | Commercial Advisors has arranged the sale-leaseback of a five-property light-manufacturing industrial portfolio totaling 169,043 square feet. Four of the five assets are located in metro Jackson and one facility is located in metro Detroit. Landon Williams and Katie Hargett of Cushman & Wakefield | Commercial, along with Pratt Rogers of Kerioth Corp., represented the seller, an entity doing business as Multicraft Real Estate LLC. The buyer, an entity doing business as Harrison Cayden Holdings LLC, purchased the portfolio and leased it back on a 15-year term to Multicraft, which specializes in manufacturing equipment for the automotive, power tool and HVAC industries. Other terms of the transaction were not disclosed.

The Memphis industrial market stands at a pivotal juncture in mid-2025, navigating temporary headwinds while maintaining the fundamental strengths that have established it as one of the Southeast’s premier logistics hubs. Despite recent challenges from global trade uncertainties and tariff negotiations impacting project timelines, the market’s long-term outlook remains positive with a foundation built on unparalleled logistics infrastructure and strategic advantages. Global logistics advantage Memphis stands as the ultimate global logistics hub, with unrivaled multimodal infrastructure creating competitive advantages few markets can match. The “FedEx effect” remains one of Memphis’ most significant economic drivers. This powerful multiplier — named for the company’s massive impact on the regional economy — has transformed Memphis into a critical node in global supply chains. With its World Hub at Memphis International Airport, FedEx connects businesses to hundreds of countries across multiple continents, processing millions of shipments while employing thousands across the region. Recent initiatives, including Network 2.0, One FedEx and the new Automated Sorting Facility at the World Hub, represent strategic investments in efficiency and integration that are likely to boost the Memphis industrial real estate market. Additionally, Memphis International Airport ranks among the busiest cargo airports in the Western Hemisphere and the second …

Deven Group, Kayne Anderson Break Ground on 755-Bed Student Housing Community Near University of Mississippi

by John Nelson

OXFORD, MISS. — Development Ventures Group (Deven Group) and Kayne Anderson Real Estate have broken ground on a 755-bed student housing community located within a half-mile of the University of Mississippi’s (Ole Miss) campus. Situated on Anderson Road, the 243-unit property represents the first large-scale student housing project to be built within a mile of the Ole Miss campus since 2018. The design-build team includes BirdDog/Christa Development, Baker Barrios Architects and Montgomery Martin Contractors. BMO Bank is providing an undisclosed amount of construction financing. Set for completion in summer 2027, the unnamed community will span 370,000 square feet and offer one-, two-, three- and four-bedroom units. Amenities will include a resort-style pool with cabanas, jumbotron, beach volleyball court, pickleball court, indoor/outdoor fitness center, sauna, cold plunge, private study areas, sport simulator, a yoga/spin studio, food truck court and a 3,000-square-foot events venue.

Regions Bank Provides $117.3M in Financing for Three Affordable Housing Communities in Jackson, Mississippi

by Abby Cox

JACKSON, MISS. — Regions Bank’s affordable housing group has provided a combined $117.3 million in financing to Vitus Group LLC for the acquisition and rehabilitation of three existing affordable housing communities in Jackson. The properties include Village Apartments, Commonwealth Apartments and Madonna Manor, which are now part of Jackson Trio, a collection of townhomes, garden-style apartments and a 13-story high-rise apartment building for seniors. The portfolio totals 77 buildings and 613 units, with 149 of the units dedicated to age-restricted housing for people age 62 and older. Jackson Trio will provide affordable housing to renters earning between 50 percent and 80 percent of the area median income. Regions Affordable Housing provided approximately $36.6 million in federal Low-Income Housing Tax Credit (LIHTC) equity, a $19.7 million bridge loan and a $61 million Fannie Mae MTEB permanent loan. The properties feature a mix of one-, two-, three- and four-bedroom apartments with various amenities, including an exercise room, onsite property management and maintenance and kitchen appliances. Two developments also include playgrounds for children, and Madonna Manor includes free lunch by the City of Jackson for senior residents.

CBL Properties Sells 621,000 SF Promenade Shopping Center in D’Iberville, Mississippi for $83.1M

by John Nelson

D’IBERVILLE, MISS. — CBL Properties, a publicly traded owner and manager of malls and shopping centers, has sold The Promenade, a 621,000-square-foot power shopping center located in D’Iberville, roughly four miles north of Biloxi, Miss. An undisclosed investor purchased the center for $83.1 million. Built in 2009 by CBL Properties, The Promenade is anchored by national retailers including Target, Kohl’s, Best Buy, Dick’s Sporting Goods, Ulta Beauty, PetSmart and Marshall’s. Restaurants at The Promenade include Chick-fil-A, Newk’s Express Café, Buffalo Wild Wings and Olive Garden. According to the Biloxi SunHerald, the Target at The Promenade was the first Target to open in southern Mississippi.

Marcus & Millichap Brokers Sale of 164-Unit Apartment Community Near Mississippi State University

by Abby Cox

STARKVILLE, MISS. — Marcus & Millichap has brokered the sale of The Grove Apartments, a 164-unit community located in Starkville near Mississippi State University. Originally built in 1975, the property is situated on 10 acres and features a mix of one-, two- and three-bedroom floorplans ranging in size from 704 square feet to 1,028 square feet, according to ForRent.com. Amenities include laundry facilities and a dog park, as well as onsite management and maintenance. Josh Jacobs and Lloyd Escue of Marcus & Millichap marketed the property on behalf of the seller, MRKT Capital, and procured the buyer, Emerald City Associates, in the transaction. Mickey Davis was the firm’s broker of record in Mississippi.

Newer Posts