APEX, N.C. — Boston-based Rockpoint has sold Building I at Apex Commerce Center, a four-building industrial park totaling 845,000 square feet in Apex, a city roughly 15 miles southwest of Raleigh. LaSalle Investment Management purchased the 233,818-square-foot facility for an undisclosed price. Dave Andrews and Pete Pittroff of JLL represented Rockpoint in the transaction. Building I at Apex Commerce Center was built in 2023 and was fully leased at the time of sale. The rear-load facility features 32-foot clear heights, ESFR sprinklers and LED lighting. Building I is the first of four buildings at Apex Commerce Center, which Rockpoint developed in partnership with Oppidan Investment Co.

North Carolina

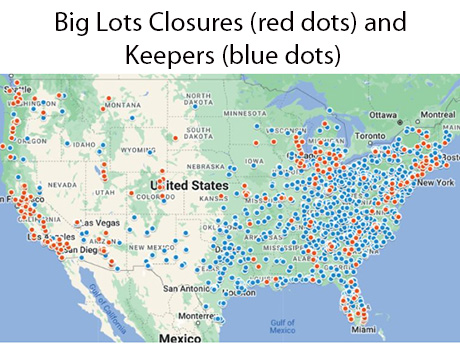

As someone who has closely observed retail trends in the Southeastern United States for decades, I’ve witnessed the inevitable ebb and flow of the industry. From periods of rapid expansion to challenging market corrections, and of course, global pandemics that disrupted every sector of real estate, it often feels as though I’ve ‘seen it all.’ Once again, I find myself watching the market adjust, particularly among big-box retailers, in high-growth areas like Raleigh. This ongoing shift signals both challenges and opportunities, reminding me of the resilience and adaptability required to thrive in this dynamic environment. When news broke in September that Big Lots Inc. had filed for Chapter 11 bankruptcy protection and that it would be closing more than 300 stores across the country, it wasn’t all that shocking, given the sheer number of Big Lots that one comes across just driving across their own towns. The Big Lots announcement follows similar moves by companies such as rue21, Express, The Body Shop, 99 Cents Only Stores, LL Flooring, Conn’s, and Red Lobster. Retailers like Rite Aid and Bed Bath & Beyond, which filed for bankruptcy last year, have closed hundreds of stores, causing vacancies in the retail real estate market. …

JLL Arranges $55.2M Acquisition Loan for Healthcare Real Estate Portfolio in North Carolina

by John Nelson

BURLINGTON, DURHAM AND GREENSBORO, N.C. — JLL has arranged a $55.2 million acquisition loan for a nine-property healthcare real estate portfolio in North Carolina. Travis Anderson and Anthony Sardo of JLL arranged the 10-year, fixed-rate loan with a life insurance company on behalf of the borrower, AW Property Co. The facilities span nearly 300,000 square feet and are located on or adjacent to hospital campuses in Burlington, Durham and Greensboro. The portfolio has an average vintage of 2006 and was 99 percent leased at the time of financing to healthcare systems and independent physician practices including Cone Health, Duke Health and UNC Health.

Crescent Communities Breaks Ground on 318-Unit Apartment Development in West Charlotte

by John Nelson

CHARLOTTE, N.C. — Locally based development firm Crescent Communities has broken ground on Novel River District, a 318-unit apartment community in west Charlotte. The property will serve as the first multifamily component within The River District, a 1,400-acre master-planned community that will eventually house approximately 2,350 apartment options and 2,300 single-family homes. UMB Bank provided an undisclosed amount of construction financing for Novel River District, which is set to welcome first residents in early 2026. The community will be the cornerstone of the future Westrow town center and feature a mix of studio, one- and two-bedroom apartments. The project is designed to achieve National Green Building Standard’s (NGBS) Silver level of sustainability. Crescent’s design-build partners for Novel River District include Cooper Carry (architect), Crescent Communities Construction (general contractor), Ellinwood + Machado (structural engineer), ENGR3 (MEP engineer), BB+M Architecture (interior design) and Land Design (landscape design and civil engineering).

CHARLOTTE, N.C. — The Fallon Co., along with locally based general contractor Edifice Construction, has broken ground on The Colwick, a 234-unit apartment community in Charlotte’s Cotswold neighborhood. The property will feature one-, two- and three-bedroom apartments. Designed by Axiom Architecture, The Colwick’s amenities will feature a coworking lounge with video conferencing rooms, resort-style saltwater pool, onsite pet spa and dog park, fitness center with a private yoga studio, outdoor grill stations and a pizza oven, bike storage, garden courtyard with activity lawn and fireside lounge, resident lounge and game room, golf simulator and an outdoor gaming lawn with bistro lighting. Santander Bank provided an undisclosed amount of construction financing for the project, which is set for completion in late 2026.

Cousins Properties to Acquire Vantage South End Office Development in Charlotte for $328.5M

by John Nelson

CHARLOTTE, N.C. — Atlanta-based office REIT Cousins Properties is under contract to acquire Vantage South End, a lifestyle office development in Charlotte’s South End neighborhood spanning 639,000 square feet. The Spectrum Cos. and Invesco sold the two-tower property in an off-market transaction for $328.5 million. Built in 2021 and 2022, Vantage South End was 97 percent leased at the time of sale to tenants with a weighted average lease term (WALT) exceeding nine years. Tenants include CBRE, Lending Tree and Grant Thornton, among others.

Welsh Semiconductor Manufacturer IQE Plans to Invest $305M for Expansion in Greensboro, North Carolina

by John Nelson

GREENSBORO, N.C. — IQE Inc., a global semiconductor manufacturer based in Wales, has announced plans to invest $305 million to expand its manufacturing facility in Greensboro to produce next-generation compound semiconductor material. The investment is subject to customer commitments and funding from the federal CHIPS Act. The expansion is expected to create 109 new jobs in North Carolina’s Piedmont Triad region, which sits between Charlotte and Raleigh-Durham along I-85. “IQE’s major reinvestment in Guilford County is a testament to the quality of our world-class workforce, the strength of our business climate and our leadership in clean energy and technology,” says North Carolina Gov. Roy Cooper. Operating in Greensboro for more than a decade and with 72 employees, IQE manufactures “epi wafers” using molecular beam epitaxy for the defense and aerospace industries. The new investment would add a complementary epitaxy called metal-organic chemical vapor deposition (MOCVD) and would provide a new clean technology for semiconductor chip production to help serve the electric vehicle (EV) market. North Carolina is growing its EV manufacturing base. For example, VinFast, an EV manufacturer based in Vietnam, is currently building out a $4 billion factory in nearby Chatham County.

Berkadia Secures Equity for Recapitalization of Two Multifamily Communities in Georgia, North Carolina

by John Nelson

AUGUSTA, GA. AND KANNAPOLIS, N.C. — Berkadia JV Equity & Structured Capital has arranged joint venture equity for the recapitalization of two multifamily properties in Georgia and North Carolina totaling 566 units. The sponsor is The Sterling Group and the properties include Argento at Riverwatch, a 296-unit community in Augusta, and Argento at Kellswater Bridge, a 270-unit property in Kannapolis. The joint venture equity partner and financing amount were not disclosed. Cody Kirkpatrick, Noam Franklin and Chinmay Bhatt led the Berkadia JV Equity & Structured Capital team in the recapitalization.

CHARLOTTE, N.C. — Northmarq has arranged the $41.8 million sale of South Tryon Apartments, a 216-unit multifamily community located at 7601 Holliswood Court in Charlotte. McDowell Properties acquired the asset from MAA. Andrea Howard, Allan Lynch, John Currin, Caylor Mark, Jeff Glenn and Austin Jackson of Northmarq’s Carolinas Multifamily Investment Sales team represented the seller in the transaction. Additionally, Faron Thompson, Grant Harris and Cabell Thomas of Northmarq secured a $24.8 million acquisition loan on behalf of the buyer. The permanent, fixed-rate loan features a five-year term with a 35-year amortization schedule. Built in 2002 and renovated in 2022, South Tryon Apartments features units in one-, two- and three-bedroom layouts. Amenities at the property include 36 detached garages, 42 storage spaces, a fitness center, pool, dog park, grilling area, car care center and playground. The community is situated roughly nine miles from both Charlotte Douglas International Airport and Uptown Charlotte.

CHARLOTTE, N.C. — CenterSquare has acquired Riverbend Village Shops, an 18,550-square-foot retail center located in Charlotte. Comprising four buildings, the development marks the final phase of Riverbend Village, a master-planned community totaling 62,000 square feet. Tenants at the property include First Watch, Jeremiah’s Italian Ice, GoHealth Urgent Care, Vitamin Shoppe, Nana Morrison’s Soul Food and Nothing Bundt Cake. The seller and sales price were not disclosed.