RALEIGH, N.C. — Barings has provided a $134 million loan for the refinancing of Smoky Hollow, a mixed-use property located in Raleigh. Travis Anderson, Colby Mueck and Warren Johnson of JLL arranged the five-year loan on behalf of the owner, a joint venture between locally based Kane Realty Corp., Williams Realty & Building Co. and Lionstone Investments. Smoky Hollow was completed in 2020 and is located in the state capital’s Glenwood South neighborhood. The property comprises The Line, a 283-unit apartment community, as well as a 229,000-square-foot office building known as 421 North Harrington and roughly 40,000 square feet of retail and restaurant space. The Line features studio, one-, two and three-bedroom apartments and amenities such as a pool, clubroom, social lounge, coworking space, fitness center, outdoor grilling and dining stations and a package delivery room. The office building rises nine stories and offers bike storage space and multiple outdoor terraces. Food-and-beverage users at Smoky Hollow include barbeque restaurant Midwood Smokehouse, ice cream and tea concept Milklab and cocktail bar The Crunkleton. The retail component houses other wellness-based users, such as Dose Yoga & Smoothie Bar, JetSet Pilates and FastMed Urgent Care. “Smoky Hollow is well-positioned to benefit from Raleigh’s …

North Carolina

DURHAM, N.C. — Developer Welcome Group has opened the first phase of Welcome Venture Park, a new business park situated on 160 acres in Durham. Upon completion, the project will total roughly 1.3 million square feet of space for industrial, flex and life sciences tenants. Phase I comprises four industrial buildings totaling 394,800 square feet. RW2 Development Co. is managing entitlements, development and project management on behalf of Welcome Group. Other members of the project team include Choate Construction, Withers Ravenel, Maurer Architecture and Sullivan Eastern. Colliers is handling leasing for the development, and U.S. Bank provided construction financing for the first phase.

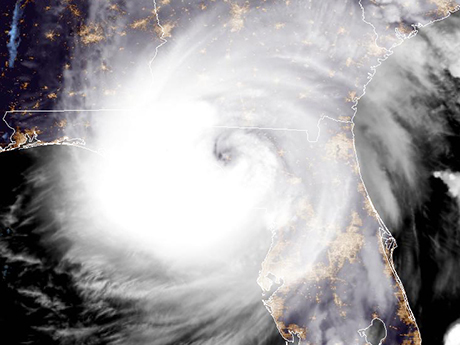

IRVINE, CALIF. — CoreLogic, a real estate information and analytics firm based in Irvine, has estimated that real estate property damages stemming from Hurricane Helene will fall between $30.5 billion to $47.5 billion. The storm made landfall around 11 pm on Thursday, Sept. 26 near Perry, Fla., and made its way through several Southeastern states, with its damage especially severe in western North Carolina. According to several national media outlets, the death toll from the storm stands at 227 across six states as of this writing with an unknown number reported missing. CoreLogic’s calculations include both residential and commercial real estate properties as well as automobiles in 16 states, but excludes damage to personal marine craft, offshore infrastructure, governmental structures and infrastructure such as roads and bridges. CoreLogic tabulates that losses from wind damage will fall between $4.5 billion to $6.5 billion; insured flood damage, both for inland flood situations and storm surges, will range from $1.5 billion to $4.5 billion for privately insured properties and $4.5 billion to $6.5 billion from the Federal Emergency Management Agency’s (FEMA) National Flood Insurance Program (NFIP); and $20 billion to $30 billion in uninsured floor damage. Insured loss represents the amount insurers and …

MATTHEWS, N.C. — Pappas Properties has broken ground on Cadia Matthews, an 82-acre mixed-use development in Matthews, a southeastern suburb of Charlotte. Upon completion, the community will feature residential units, 85,000 square feet of retail space and 18,000 square feet of office space. Amenities at the development will include a wellness center, multi-modal paths, a community park with a performance stage and additional open space. All residents will have access to the wellness center and other community amenities. Priority for the housing at Cadia Matthews will be given to first responders, teachers, active-duty and veteran military members, as well as those who work in Matthews. “The foundation of Cadia Matthews is based on our commitment to providing wellness-oriented, residential master-planned communities that promote health through social, environmental and physical wellness,” said Tom Walsh, managing director of Pappas Properties. Phase I of the project is currently underway and will comprise 45 single-family homes, 80 for-sale townhomes and 14 apartments. Additional residential space at the development will include active adult cottage homes and apartments, for-lease duplexes and market-rate apartments. A construction timeline for Cadia Matthews was not disclosed. Founded in 1999, Pappas Properties is based in Charlotte and has completed 14 master-planned …

MOORESVILLE, N.C. — Berkadia has brokered the $14.5 million sale of Townes at Lake Norman, a 116-lot townhome development site located at 752 River Highway in the northern Charlotte suburb of Mooresville. The seller is North Carolina-based Evolve Cos., which is developing an apartment community that includes the 116-lot townhome site called Evolve at Lake Norman. The developer plans to deliver first units later this month and has tapped Hawthorne Residential to operate the community. Caleb Troop, Thomas Colaiezzi and Matt Robertson of Berkadia represented the seller in the transaction. The buyer was not disclosed.

CARY, N.C. — Burns & McDonnell, a global engineering, construction and architecture firm, has expanded its office footprint to 17,000 square feet at Fenton, a 92-acre mixed-use development in the Raleigh suburb of Cary. Matt Winters and Ashley Ingram of JLL represented Burns & McDonnell in the lease transaction, nearly doubling the tenant’s square footage. The office is located at 25 Fenton Main and features an outdoor terrace overlooking the project’s Central Plaza. The owners of Fenton include Hines, Columbia Development and Affinius Capital.

FloridaGeorgiaMarket ReportsNorth CarolinaSouth CarolinaSoutheastSoutheast Market ReportsStudent Housing

Universities, Student Housing Properties in Southeast Contend with Hurricane Helene

by John Nelson

Hurricane Helene made landfall in Northwestern Florida on Thursday, Sept. 26, after being upgraded to a major Category 3 storm that afternoon. Widespread damage across a number of Southeastern states followed in its wake, with many areas experiencing flooding, downed trees, power outages and road closures. At least 175 people have died across six states, according to reports by CNN and The New York Times, and officials fear that the death toll is likely to rise with many remaining missing. Hundreds of roads remain closed across the Southeast — especially in Western North Carolina and East Tennessee, which were hit particularly hard by the hurricane — hampering the delivery of supplies, and more than 2 million customers remain without power. Student Housing Business reached out to universities, owners, operators and students across the Southeast to check in on how they fared during the storm and their experience in the aftermath. Owners, Operators Weigh In Denver-based Cardinal Group tracked its communities in Alabama, Arkansas, Florida, Georgia, Kentucky, North Carolina, South Carolina, Tennessee, Virginia and West Virginia through Hurricane Helene. “Of those communities, four experienced power outages and several had minor roof leaks and flooding, with the largest impact felt in Asheville and Boone, North Carolina,” says Jenn Cassidy, president of property operations …

RALEIGH, N.C. — KBS and Kane Realty Corp. have inked two office lease deals at Bank of America Tower, an 18-story, 300,322-square-foot office tower in Raleigh’s North Hills district. The deals include a 28,658-square-foot lease with Brightly Software for a full floor. The new space will also serve as the global headquarters of the tenant’s parent company, Siemens Industry Inc. The other lease is a 3,000-square-foot expansion for Eva Garland Consulting, bringing the tenant’s total footprint to the tower to nearly 15,000 square feet. Located at 4242 Six Forks Road, Bank of America Tower is LEED Gold-certified and features six levels of covered parking and a conference center.

HIGH POINT, N.C. — JLL has arranged the sale of a 234,224-square-foot logistics facility located at 720 Pegg Road in High Point, a city in North Carolina’s Triad submarket. The seller, Beacon Partners, delivered the Class A property in 2022 and subsequently leased the facility to three tenants, including Lowe’s Home Centers. Pete Pittroff, Dave Andrews, Michael Scarnato, Zachary Llyod, Michael Lewis and Allan Parrott of JLL represented the seller in the transaction. The buyer and sales price were not disclosed. The property features 32-foot clear heights, ESFR sprinklers, motion-sensored LED lighting, multiple storefronts and proximity to Piedmont Triad International Airport, I-40, I-73, I-74 and I-85.

Trinity Capital, Nuveen Sell 441,072 SF Industrial Portfolio in Research Triangle Park to Prologis

by John Nelson

DURHAM, N.C. — Trinity Capital Advisors and partner Nuveen Real Estate have sold Alexander Commerce Park, a three-building industrial property located along TW Alexander Drive in Durham’s Research Triangle Park. San Francisco-based Prologis acquired the park for an undisclosed price. Built in 2023, the development was fully leased at the time of sale to tenants including Upper Deck, Wolfspeed, Wesco and Running Logistics. The properties feature 32-foot clear heights, ESFR sprinklers, LED lighting and abundant auto and trailer parking. Pete Pittroff, Dave Andrews and Zachary Lloyd of JLL represented the seller in the transaction.