ATLANTA — HR solutions company TriNet has signed a 150,000-square-foot office lease at High Street, a $2 billion mixed-use district located within the Central Perimeter neighborhood of Atlanta. TriNet’s move is expected to create 750 jobs over the next five years. Jeff Taylor and Adam Viente of JLL represented the landlord, while Tony Guglielmi, Rich Branning, Josh Hirsh, Dom Wyant, Terry McGuirk and Brennan Koslow of JLL represented the tenant in the lease negotiations. GID Development Group recently completed its $415 million Phase I at High Street, which includes two luxury apartment buildings, 320,000 square feet of office space, 150,000 square feet of retail, restaurant and entertainment space and a central lawn for residents, workers and visitors. Upon full buildout of High Street, the 36-acre development will feature 672,000 square feet of office space, a 400-room hotel, 400,000 square feet of retail, dining, fitness and entertainment space and 3,000 residential units.

Southeast

RIVERDALE, GA. — Atlanta-based RADCO has acquired a 615-unit multifamily community located at 750 Chateau Lane in the Atlanta suburb of Riverdale. Formerly known as Legacy at Riverdale, Rhythm at Riverdale offers studio, one-, two- and three-bedroom apartments spread across 57 low-rise residential buildings. Amenities at the property include multiple swimming pools, tennis and pickleball courts, laundry facilities and grade-level parking. The property rebrand was overseen by Unmaker Studio, RADCO’s internal full-service branding agency. Rhythm at Riverdale is the first property in RADCO’s portfolio to employ the Rhythm name, which is the company’s new brand for value-add properties. RADCO plans to complete capital improvements at the property, including renovations to the apartment units, exterior upgrades, building and mechanical repairs and enhancements to the common areas. Matt White and Scott Bray of Berkadia represented the undisclosed seller in the transaction. The sales price was also not disclosed.

ORLANDO, FLA. — Tavistock Development Co. has signed five new tenants to join Lake Nona West, a 405,000-square-foot lifestyle shopping center located within Orlando’s master-planned community of Lake Nona. The tenants include Cañonita Mexican Restaurant, Nordstrom Rack, Barnes & Noble, discount retailer HomeSense and Total Wine & More. The new round of lease signings bring the total preleased space at the property to more than 300,000 square feet, which includes a 150,000-square-foot Target anchor store. Situated on 54 acres, Lake Nona West will include wide, shaded walkways, art-lined plazas and community greenspaces. In collaboration with Mercedes-Benz High-Power charging, the center will also offer 20 Level 3 electric vehicle chargers. Tavistock, master developer of Lake Nona, expects to open Lake Nona West in spring 2026.

Marcus & Millichap Arranges $4.5M Sale of Retail Property in Ocala, Florida Leased to Firestone

by John Nelson

OCALA, FLA. — Marcus & Millichap’s Taylor-McMinn Retail Group in Atlanta has arranged the $4.5 million sale of a single-tenant retail property located at 30 Bahia Ave. in Ocala, about 72 miles north of Orlando and 48 miles south of Gainesville, Fla. Built in 2024, the 6,723-square-foot building was occupied by automotive services provider Firestone on a 15-year triple-net lease at the time of sale. Firestone is a subsidiary of Bridgestone Retail Operations LLC with more than 1,700 tire and car care locations nationwide. Don McMinn of Taylor-McMinn Retail Group represented the seller, an undisclosed, Georgia-based development firm, in the transaction. The buyer was not disclosed. Ryan Nee served as Marcus & Millichap’s broker of record in Florida for the deal. “New construction Firestone properties continue to achieve aggressive pricing, fueled by strong credit, limited inventory and growing demand from an expanding pool of 1031 exchange buyers,” says McMinn.

WASHINGTON, D.C. — Between 2020 and July 1, 2024, Miami experienced a significant population surge, according to the latest estimates from the U.S. Census Bureau. The South Florida city’s population was 487,014 residents in 2024, which is a 10.1 percent increase from 2020 Census figures. In the same time frame, Atlanta saw a 4.3 percent rise in population, while Raleigh experienced an uptick of 6.8 percent. Washington, D.C. saw a 1.8 percent increase since 2020, and Nashville saw a 2.3 percent gain in residents. All of the above except Raleigh ranked in the top 10 nationally for new downtown apartments developed between 2020 and 2024, according to a report from RentCafe. Leading the pack was Washington, D.C., which has added nearly 23,000 apartments to the downtown supply since the pandemic. To calculate population growth within a city or town, the Census Bureau uses updated county-level data on housing units, as well as average household sizes in the surrounding county, to estimate the population of each city and town within that county. The estimate for people living in group quarters (such as dorms or nursing homes) is then included to the household population estimate to obtain the total resident population.

Atlanta’s retail market is proving it knows how to adapt, evolve and outperform, even in the face of macroeconomic headwinds. Despite a moderation in leasing and investment sales activity in recent quarters, the city’s fundamentals remain strong. Vacancy rates are at historic lows, rent growth is outpacing the national average and population and income growth continue to fuel long-term demand. Demand and demographics With vacancy rates consistently under 4 percent, Atlanta remains one of the tightest retail markets in the country. The appetite for well-located retail space hasn’t waned, even as broader economic uncertainty has slowed transaction velocity. In fact, strong absorption numbers and a limited supply pipeline have bolstered landlord confidence and pricing power across the metro. What’s driving this resilience? A booming population, rising household incomes and a steady influx of corporate relocations. Employers like Microsoft, Google and Cisco are expanding their footprints, bringing with them jobs, workers and spending power. Some of this growth has been particularly noticeable in Midtown. Redevelopment playbook Instead of ground-up development, Atlanta’s growth strategy has increasingly focused on reinventing aging retail centers in prime locations. With construction costs high and land increasingly scarce, developers opt to reimagine what already exists. These projects …

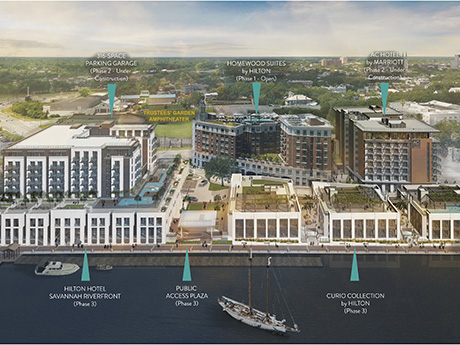

North Point Hospitality Completes $105M Second Phase of River Street East Development in Savannah

by John Nelson

SAVANNAH, GA. — North Point Hospitality has completed the $105 million Phase II of River Street East, a three-phase mixed-use district located along the Savannah River. The second phase includes a 171-unit AC Hotel by Marriott Savannah Historic District hotel and a 316-space public parking garage, which is now open. Additionally, 3,300 square feet of street-level retail space is available for lease. AC Hotel by Marriott features a rooftop restaurant and bar, as well as flexible meeting spaces. Phase I of the development included the Homewood Suites by Hilton Savannah Historic District/Riverfront hotel, which was delivered in 2015 and renovated in 2024. Phase III of River Street East will include a 300-unit full-service, dual branded luxury and lifestyle hotel, which will feature a ballroom for private events, world-class spa and multiple dining experiences.

Housing Trust Group Opens $100M Mixed-Use Affordable Housing Development in Hollywood, Florida

by John Nelson

HOLLYWOOD, FLA. — Housing Trust Group (HTG) has opened the Apartments at University Station, a $100 million mixed-used affordable housing community located in downtown Hollywood. The development features 216 income-restricted units of affordable and workforce housing — 108 one-bedroom and 108 two-bedroom apartments — ranging in size from 621 square feet to 899 square feet. The property’s affordable component will apply to all households earning between 22 and 80 percent of the area median income. The complex comprises two residential towers, a 635-space public-private parking garage, more than 2,000 square feet of retail space and a new 12,210-square-foot campus for Barry University’s College of Nursing and Health Services. Amenities at the complex include a multipurpose room with a catering kitchen and bar, fitness center, resort-style swimming pool and a game room, as well as elevated pedestrian bridges connecting the residential buildings to the parking garage. Developed in a public-private partnership with the City of Hollywood, the project team includes general contractor ANF Group Inc., Corwil Architects, HSQ Group (civil engineer), B. Pila Design Studio (interior design), Witkin Hults + Partners (landscape architect), BNI Engineers (structural engineer), RPJ Inc. (MEP engineer) and Kaller Architecture (Barry University interiors). Financing sources for the development …

Carr Properties Receives Site Plan Approval for Office-to-Multifamily Conversion Project in Metro D.C.

by John Nelson

CLARENDON, VA. — Carr Properties has received site plan approval for the redevelopment of 3033 Wilson Blvd. in the Washington, D.C., suburb of Clarendon. Situated across from the Clarendon Metro Station, the former 160,000-square-foot office building will be transformed into a 309-unit multifamily complex with 6,000 square feet of ground level retail space. Carr Properties will participate in Arlington’s Green Building Incentive Program while also aiming for LEED Gold certification for 3033 Wilson. Architecture firm SK+I and interior design firm Edit Lab by Streetsense will design the redeveloped property, which will include a fitness center, coworking lounge, rooftop pool deck, clubroom, landscaped courtyard and 324 underground parking spaces with 13 electric vehicle charging stations. The project team also includes landscape architect ParkerRodriguez, civil engineer Bohler DC and McGuireWoods as land-use counsel. 3033 Wilson is anticipated to break ground in early 2026, with completion slated for 2027.

CHARLOTTE, N.C. — Deriva Energy, formerly known as Duke Energy Renewables, has relocated to a 33,606-square-foot office space at One South on the Plaza, a 40-story office tower located in Uptown Charlotte. The new office will serve as the headquarters for Deriva, which plans to move in by late fall. Chris Schaaf and Jamie Boast of JLL represented Deriva Energy in the lease negotiations, while Rhea Greene of Trinity Partners represented the undisclosed landlord. One South on the Plaza totals 850,000 square feet and features a 22,000-square-foot tenant amenity level on the third floor, street-level retail space housing tenants such as Tupelo Honey and Eddie V’s and a connection to the Overstreet Mall. Since 2015, ownership has invested $100 million to renovate the building’s lobby, plaza and exterior. More than 92,000 square feet of office leases have been executed at One South on the Plaza, including Dole Food’s U.S. headquarters, Shumaker, Robert Half, Protiviti, Huntington National Bank, The Siegfried Group, Krazy Curry, Ace No. 3 and Pet Wants.