BOYNTON BEACH, FLA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Cross Creek Center, a 37,201-square-foot shopping center located in the Fort Lauderdale suburb of Boynton Beach. Built in 1988 and renovated in 2014, the center was 97 percent leased at the time of sale to tenants including Stanton Optical, The UPS Store, Smoothie King and Metro by T-Mobile. Drew Kristol and Kirk Olson of IPA represented the seller, Davie, Fla.-based Janoura Realty, and procured the buyer, Cincinnati-based Phillips Edison & Co., in the transaction. The sales price was not disclosed.

Southeast

Hendricks Commercial Properties Acquires Summit at Fritz Farm Mixed-Use Development in Lexington, Kentucky

by John Nelson

LEXINGTON, KY. — Hendricks Commercial Properties, a Wisconsin-based development and investment firm, has acquired The Summit at Fritz Farm, a mixed-use development in Lexington that opened in 2017. The development features a collection of more than 60 shops and restaurants that sit below modern offices and The Henry apartments. Some components of the development that were not included in the sale include the Origin Lexington hotel and a 192-unit seniors housing community, Legacy Reserve at Fritz Farm. Hendricks did not disclose the sales price or specific aspects of the acquisition beyond the commercial space. Hendricks acquired the development from a partnership between Swift Creek Real Estate Partners and Centennial Real Estate Management LLC, which has owned The Summit at Fritz Farm since acquiring the original developer, Birmingham, Ala.-based Bayer Properties, in 2022. “We are excited to add Fritz Farm to our portfolio,” says Rob Gerbitz, CEO of Hendricks Commercial Properties. “This acquisition aligns with our strategic vision of investing in high-quality, experiential mixed-use properties that serve as community hubs. We look forward to building upon the strong foundation established at Fritz Farm and continuing to enhance the experience for tenants and guests alike.” Whole Foods Market, Pottery Barn and Arhaus anchor …

Amazon to Expand Office Footprint at Nashville Yards, Begin Interior Work at Second Tower

by John Nelson

NASHVILLE, TENN. — Amazon has announced plans to expand at Nashville Yards, a 19-acre mixed-use development in downtown Nashville owned by Southwest Value Partners. The Seattle-based e-commerce giant has leased an entire floor at the development’s CAA Creative Office Building, which houses tenants including CAA, AEG Presents, Messina Touring, AXS and L-Acoustics. Several divisions of Amazon, including Amazon Music, will operate out of the Class A office building. Additionally, Amazon announced it is beginning the interior build-out of its second office tower at Nashville Yards, including a multi-story conference center and first-floor retail space. Amazon plans to occupy the second tower in 2026. Amazon’s new offices at Nashville Yards will sit adjacent to The Pinnacle, the development’s new indoor live music and event venue, and in close proximity to restaurants and other users including Ocean Prime, Fogo de Chão, Earls, Sweet Paris, Culaccino, Iconix Fitness and Hooky Entertainment. Amazon opened its first office tower at Nashville Yards in 2021.

FORT LAUDERDALE, FLA. — PMG, along with general contractor John Moriarty & Associates, has topped out the second phase of Society Las Olas, a 42-story apartment tower located at 140 S.W. 42nd St. in downtown Fort Lauderdale. The 563-unit community is situated in Fort Lauderdale’s historic riverfront district and will offer a mix of traditional apartment layouts and a small cluster of co-living options where residents can rent by the bedroom. Designed by FSMY Architects + Planners, Society Las Olas will also feature 1,625 square feet of ground-floor retail space and amenities including a coworking hub with private meeting rooms, pool deck with a yoga lawn and a large fitness center. PMG plans to deliver the tower in early 2026. Phase I of Society Las Olas was delivered in 2020 and sold in 2021. PMG received $226 million in construction financing for Phase II in July 2023.

Trademark, TriGate Capital Recapitalize Perkins Rowe Mixed-Use Village in Baton Rouge

by John Nelson

BATON ROUGE, LA. — Trademark Property Co. has recapitalized Perkins Rowe, a 518,830-square-foot mixed-use town center in Baton Rouge, with Dallas-based real estate investment manager TriGate Capital LLC. Terms of the recapitalization structure were not released. The property comprises 384,171 square feet of retail space and 134,659 square feet of Class A office space. Trademark and TriGate plan to refresh and revitalize Perkins Rowe with improvements to the public spaces, updated signage, modernized office common areas, fresh paint, landscaping and other placemaking enhancements. Trademark, which has operated Perkins Rowe since 2016, has recently attracted tenants such as Free People, Drago’s, Tacos del Cartel and Tecovas to the development, as well as extended leases with anchor tenants including The Fresh Market and Cinemark Theatres.

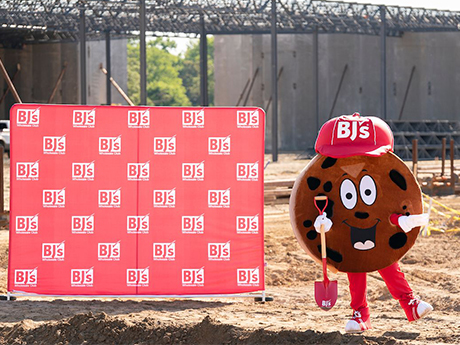

AdVenture Development Breaks Ground on 100,000 SF BJ’s Wholesale Club in Selma, North Carolina

by John Nelson

SELMA, N.C. — AdVenture Development LLC has broken ground on a BJ’s Wholesale Club located within the 400-acre master-planned community of Eastfield Crossing in Selma, about 30 miles southwest of Raleigh. The new store, which will feature an onsite BJ’s gas station, will total 100,000 square feet. Additional tenants at the 3 million-square-foot mixed-use development include Academy Sports + Outdoors, Hobby Lobby, Old Navy, Ulta Beauty, Marshalls, Ross Dress for Less, Burlington, Five Below and Chase Bank. Target is also under construction at Eastfield Crossing and anticipates opening in spring 2026. Eastfield Crossing includes a business park, retail and entertainment space, medical and office space, a hospitality component, senior living and multifamily units and single-family residences. Locally based AdVenture Development is the owner and master developer of Eastfield Crossing.

AUBURN, ALA. — Core Spaces has acquired The Union at Auburn, a 501-bed property located near the Auburn University campus in Alabama. The Chicago-based student housing owner-operator purchased the community from Boston-based WFI for an undisclosed price. Newmark brokered the acquisition. Shared amenities at The Union at Auburn include a clubhouse; two-story fitness center with a Barre, Yoga and TRX studio and on-demand fitness classes; cyber café and business center; rideshare lounge; resort-style swimming pool; outdoor kitchen and entertainment area; dog park; and study rooms.

JLL, HJ Sims Secure $134.3M Bond Financing for Seniors Housing Development in Orlando

by John Nelson

ORLANDO, FLA. — JLL and HJ Sims have arranged $134.3 million in tax-exempt bond financing for a seniors housing development currently underway in Orlando. Dubbed Millenia Moments Orlando, the community will feature 151 independent living, 78 assisted living and 32 memory care units. Trinity Community Development Foundation, a nonprofit formed by Trinity Broadcasting Network (TBN), is the developer and borrower. Completion of the facility, which will total 316,900 square feet, is scheduled for 2027. The community will feature floorplans in one- and two-bedroom layouts. Memory care residences will include 26 private and six companion units. Amenities at the community will include a fitness center, theater, library, business center, art studio, dog park, game rooms, a beauty salon and an outdoor pool area. Vitality Senior Living will operate the community. JLL Securities and HJ Sims, in collaboration with JLL Capital Markets’ seniors housing team, acted as co-underwriters and arranged the fixed-rate financing, which comprises tax-exempt senior series 2025A bonds with a final maturity of 40 years.

NASHVILLE, TENN. — Tishman Speyer has acquired 2010 West End Avenue, a 25-story apartment tower in Midtown Nashville, for $112 million. CA Ventures developed the 358-unit property in 2021. Tishman Speyer’s acquisition was financed in part by a $67.2 million loan from Corebridge. Situated within walking distance to Vanderbilt University, 2010 West End Avenue includes studio, one- and two-bedroom apartments, as well as 6,000 square feet of ground-floor retail space. Amenities include a rooftop pool, hot tub, fitness center and dog run. The asset is Tishman Speyer’s second acquisition in Nashville. In 2023, the firm purchased 133 Korean Veterans Boulevard, a 1.2-acre property in SoBro, before selling a portion of that site to T2 Hospitality.

WEST PALM BEACH, FLA. — Plaza Advisors has brokered the sale of Paradise Place, a 72,961-square-foot shopping center located on an 8.5-acre site in West Palm Beach. Built in 2003, the center was 98 percent leased at the time of sale to tenants including Publix, Sage Dental, Dunkin’ and Goodwill. Jim Michalak and Jeff Berkezchuk of Plaza Advisors represented the seller, Collett Capital, in the transaction. Forge Capital Partners purchased Paradise Place for an undisclosed price.