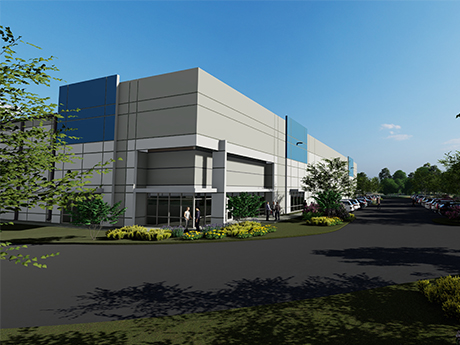

JOHNS CREEK, GA. — Dermody has broken ground on LogistiCenter at South Forsyth, a 93,960-square-foot industrial facility located at 7515 New Boyd Road in Johns Creek, a northern suburb of Atlanta. Located in the South Forsyth/North Fulton market, the Class A facility is situated on a 10-acre site within Johns Creek Technology Park. Reed Davis, Bob Currie, Brad Pope and Hannah Dillard of JLL are handling leasing for LogistiCenter at South Forsyth, which is available for preleasing and slated for occupancy in the fourth quarter. The facility will feature 2,500 square feet of speculative offices, 32-foot clear heights, 54- by 60-foot column spacing, 22 dock-high doors, two drive-in doors, 99 parking stalls, ESFR fire protection and LED lighting.

Southeast

Marcus & Millichap Capital Corp. Arranges $6.5M Refinancing for Industrial Park in Fort Mill, South Carolina

by John Nelson

FORT MILL, S.C. — Marcus & Millichap Capital Corp. (MMCC) has arranged a $6.5 million loan for the refinancing of Society Lane Industrial Park in Fort Mill, a South Carolina suburb of Charlotte. The 11-building property was fully leased at the time of financing to 13 tenants. Duke Dennis of MMCC’s Dallas office arranged the five-year loan through an undisclosed bank on behalf of the owner, Phoenix Industrial Redevelopment. The loan was structured at 250 basis points above the 5-year Treasury yield, with a 25-year amortization schedule and stepdown prepayment options.

ATLANTA — Centennial Yards Co. has executed a long-term lease with event promoter Live Nation to operate a new live music and entertainment venue in downtown Atlanta. The 5,300-seat venue will anchor the under-construction sports and entertainment district within Centennial Yards, a $5 billion mixed-use project set to transform a long-underutilized section of the city into a walkable destination. The Live Nation theater will showcase a range of performances across genres, from global touring acts to national headliners and local artists. The facility will complement the city’s existing entertainment landscape, including Tabernacle concert hall, Fox Theatre and Buckhead Theatre as well as Mercedes-Benz Stadium (home of the NFL’s Atlanta Falcons and MLS’ Atlanta United) and State Farm Arena (home of the NBA’s Atlanta Hawks). “Centennial Yards is poised to be the epicenter of sports and entertainment for the southeastern United States, where people of all ages can enjoy concerts, sporting events, bars, restaurants and retail stores — all in one vibrant mixed-use district,” says Brian McGowan, president of Centennial Yards Co. “Partnering with Live Nation brings us one step closer to creating a thriving hub where unforgettable experiences happen. This new Centennial Yards entertainment venue is exactly what our region …

Roche, Genentech to Develop $700M Pharmaceutical Manufacturing Facility in Holly Springs, North Carolina

by John Nelson

HOLLY SPRINGS, N.C. — Genentech, a Bay Area-based biotech firm and member of the Switzerland-based Roche Group, plans to develop a $700 million pharmaceutical manufacturing facility in Holly Springs, approximately 20 miles southwest of Raleigh. The new 700,000-square-foot facility will create 400 high-wage manufacturing jobs and 1,500 construction jobs. The new facility will support Roche and Genentech’s portfolio of next-generation obesity medicines. The construction timeline for the new factory was not disclosed. Roche and Genentech’s current U.S. footprint includes 13 manufacturing and 15 R&D sites across the company’s pharmaceutical and diagnostics divisions. The companies have 25,000 employees in 24 sites across eight U.S. states.

KEY BISCAYNE, FLA. — Locally based Gencom has begun the $100 million overhaul of The Ritz-Carlton Key Biscayne, Miami resort. The 13-story, 275,000-square-foot hotel is located on a 17-acre site at 455 Grand Bay Drive on Key Biscayne, a barrier island situated south of Miami. Originally built in 2001, the property offers 420 guestrooms and 600 feet of direct beach access. The design team for the resort’s first major renovation includes Hart Howerton (master), Design Agency (public spaces) and Chapi Chapo Design (guestrooms). The overhaul includes new exterior paint and façade elements, a new glass façade in the lobby, redesign of the spa and a new restaurant that will join the existing lineup of eateries that will be refreshed: RUMBAR, Cantina Beach, Dune, Scoop, Stefano’s and Key Pantry. Amenities that will be overhauled include the resort’s swimming pools, fitness center, The Club Lounge and the Cliff Drysdale Tennis Center, which is the largest tennis facility of any Ritz-Carlton resort. Gencom, which co-developed the hotel, expects the renovations to conclude by the end of the year.

CHARLOTTE, N.C. — McShane Construction Co., working on behalf of developer Flournoy Development Group, has completed Ellison Mallard Creek, a 397-unit apartment community located at 930 W. Mallard Creek Church Road in Charlotte. Situated on 24.6 acres, the wood-frame property features five apartment buildings and 10 townhome-style buildings that house one-, two- and three-bedroom units. Additionally, 10 units come with a downstairs workspace that allows residents to have an office or small storefront. Monthly rental rates range from $1,411 to $2,800, according to Apartments.com. Designed by Dynamik Design, amenities at Ellison Mallard Creek include a resident lounge with gaming and entertainment areas, a fitness and wellness center, coworking lounge, hobby and art studio, market, heated resort-style pool, courtyards with fire pits, green space, dog park, pet spa and electric vehicle charging stations. McShane Construction is currently building three other apartment communities on behalf of Flournoy.

Cronheim Hotel Capital Arranges $23.6M Refinancing for Holiday Inn Resort in Surfside Beach, South Carolina

by John Nelson

SURFSIDE BEACH, S.C. — Cronheim Hotel Capital has arranged a $23.6 million loan for the refinancing of Holiday Inn Resort, a 206-room, beachfront hotel in Surfside Beach, a city in the Myrtle Beach metropolitan area. The borrowers, Innisfree Hotels and RREAF Holdings, purchased the 11-story property as an independent hotel in late 2023 and invested capital to convert the asset to a Holiday Inn Resort. The direct lender was an undisclosed regional bank. According to the property website, the hotel features an onsite restaurant, fitness center, pool and a kids splash pad.

WASHINGTON, D.C. — Marx Realty has signed 16,000 square feet of new and expanded leases at The Herald, a 114,000-square-foot office building located at 1307 New York Ave. in Washington, D.C. The deals include two new leases: a 5,000-square-foot, eight-year lease with Auburn University’s non-partisan think tank McCrary Institute and a 3,200-square-foot, six-year deal with public policy strategy firm August Strategy Group. Additionally, an undisclosed government affairs agency has nearly doubled its footprint at The Herald, expanding by 7,800 square feet. The office building’s amenities include a rental 2023 Tesla Y car, 40-seat boardroom, café, lounge and a fitness center with boxing facilities, private workout rooms, Pelotons, Hydro rowers and a mirror fitness system.

ATLANTA — Affordable housing is facing a tumultuous second half of the year. Tariffs on building materials such as lumber, steel and aluminum are slowing development activity as they elevate construction costs. Investment sales are also likely to be impacted by unstable economic conditions in the affordable housing sector, where many transactions are conducted within a limited budget due to the nature of income restrictions for renters. Amid high costs and trade uncertainty, many investors are making the decision to stay on the sidelines or invest in markets with more stable conditions. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. “The most experienced, best qualified buyers are being careful about what they purchase,” said Kyle Shoemaker, a managing director at Affordable Housing Investment Brokerage. The Downers Grove, Illinois-based company arranges acquisitions and dispositions of Section 8, Section 42, low-income housing tax credit (LIHTC) and tax credit housing. “The affordable housing sector was heated in 2021,” Shoemaker continued. “At that point in time, we were getting more calls than ever from multifamily investors who were interested in entering the affordable …

FAIRFAX, VA. — Berkadia has secured $129 million for the refinancing of Amberleigh Apartments, a 752-unit multifamily community located in the Washington, D.C., suburb of Fairfax. Patrick McGlohn, Brian Gould, Miles Drinkwalter and Natalie Hershey of Berkadia arranged the financing on behalf of the locally based borrower, Redbrick LMD, which comprised a $113.8 million Freddie Mac loan and a $15.6 million preferred equity investment from an undisclosed source. Situated near the Dunn Loring-Merrifield Metro Station and adjacent to Inova Fairfax Hospital, Amberleigh Apartments features one-, two- and three-bedroom floorplans ranging in size from 861 square feet to 1,523 square feet, according to Apartments.com. Amenities at the property include a fitness center, sundeck, courtyard, swimming pool, clubhouse, conference room, playground and outdoor grilling stations and picnic areas.