NEW ORLEANS — Gencom, a Miami-based investment firm, has acquired a portfolio of two connected hotels located in the historic French Quarter of New Orleans. The 758-room hospitality portfolio includes The Ritz-Carlton, New Orleans and the Courtyard by Marriott New Orleans French Quarter/Iberville. Situated along the city’s historic Canal Street, The Ritz-Carlton New Orleans comprises 528 hotel rooms and suites. The hotel features about 48,000 square feet of event space, a fitness center, indoor pool and a 25,000-square-foot spa. The Ritz-Carlton also offers Davenport Lounge, a jazz bar and lounge, and the M Bistro eatery. The property opened in 2000. The adjacent Courtyard by Marriott French Quarter/Iberville offers 230 rooms, as well as a coffee shop. The building was originally constructed in 1878 as a department store and was converted into a hotel in 2012. The property is located within walking distance of Bourbon Street, the Caesars Superdome and the New Orleans Ernest N. Morial Convention Center. Both hotels have recently undergone multi-year renovation programs. The Ritz-Carlton was refurbished with updates to guest rooms and public areas, including a $15 million upgrade to its Maison Orleans Club Level. Additionally, all guest accommodations and public spaces at The Courtyard by Marriott …

Southeast

Gateway Jax to Redevelop Historic Ambassador Hotel in Jacksonville as Part of $2B Pearl Square Project

by John Nelson

JACKSONVILLE, FLA. — Locally based development firm Gateway Jax plans to redevelop the historic Ambassador Hotel located at 420 N. Julia St. in downtown Jacksonville. The developer, along with hotelier The Indigo Road Hospitality Group, will restore the 1924-era property into a hotel with at least 100 guestrooms, a high-end restaurant and bar, conference space and other amenities for business and leisure travelers. In addition to the hotel, Gateway Jax purchased an adjacent land parcel where the company plans to deliver a 487-space parking garage, as well as the historic 404 N. Julia St. building that will be redeveloped in the future. The new hotel will be part of Gateway Jax’s eight-block, $2 billion Pearl Square mixed-use development. Gateway Jax, which is sponsored by DLP Capital and JWB Real Estate Capital, manages a private equity fund focused on downtown Jacksonville developments.

WASHINGTON, D.C. — A partnership between TPG Hotels & Resorts and Douglas Development has delivered Canal House of Georgetown, a 107-room hotel located along the Chesapeake & Ohio Canal in Washington, D.C.’s Georgetown district. Operating as a Tribute Portfolio hotel, the property represents the 1 millionth room in Marriott’s U.S. portfolio. The hotel is an adaptive reuse of a former office building and two historic townhomes and features a library lounge, private courtyard, fitness center and onsite restaurant C&O Lounge.

Solera Acquires 113-Unit Assisted Living, Memory Care Community in Bethesda, Maryland

by John Nelson

BETHESDA, MD. — Solera Senior Living has acquired Brightview Bethesda Woodmont, an assisted living and memory care community located in Bethesda, a suburb of Washington, D.C. Brightview Senior Living sold the eight-story property for an undisclosed price. Solera will rebrand the community, which totals 113 units, as Modena Reserve at Bethesda. Amenities include rooftop decks, a formal dining room, upscale pub, multipurpose room for entertainment and gatherings, private dining room, library, fitness center, beauty and barber shop, movie theater and 24-hour concierge services. Solera also plans to reopen the community’s café, which will feature craft-brewed coffee and local gourmet pastries. Denver-based Solera owns and operates independent living, assisted living and memory care communities across seven states.

ORLANDO, FLA. — Core Investment Management (CORE) has acquired Dellagio Town Center, a 109,489-square-foot retail center in Orlando, for $37.5 million. Located along the Dr. Phillips retail corridor, the multi-tenant center features 30 different brands including AdventHealth Medical Group, Nola’s Ice Cream, Fleming’s Prime Steakhouse & Wine Bar, Fred Astaire Dance Studios and Fifth Third Bank. CORE plans to enhance the property with an improved tenant mix and aesthetic renovations.

JACKSONVILLE, FLA. — Cushman & Wakefield has brokered the sale of a 587,815-square-foot industrial facility located on a 28-acre parcel at 5245 Commonwealth Ave. in Jacksonville’s Westside submarket. Rick Brugge, Mike Davis, Rick Colon and Dominick Montazemi of Cushman & Wakefield represented the seller, a fund managed by DRA Advisors, in the transaction. Treetop Cos. acquired the property for an undisclosed price. Situated near I-10 and I-295, the property includes a vacant 560,688-square-foot warehouse and a 27,127-square-foot outparcel building fully leased to Conlan Tire.

WASHINGTON, D.C. — Rising insurance costs are standing in the way of building more affordable housing. According to a survey from the National Multifamily Housing Council (NMHC), about 77 percent of owner/developer firms reported rate increases of up to 20 percent or more compared with 2023 costs. NMHC’s 2024 State of Multifamily Risk Report attributes the high costs to a variety of factors, including increased cost valuation, limited capacity within the reinsurance market, shrinking underwriting capacity and restricted availability of guaranteed cost/zero deductible programs. Previous NMHC research, such as the 2023 State of Multifamily Risk Report, indicated that supply chain issues and high inflation led to higher construction and replacement costs. As insurance costs rise, insurance companies increase the minimum amount a property must earn in revenue to remain financially viable. These costs can be especially detrimental to affordable housing providers who develop rate-capped units. However, while insurance rates remain significantly elevated compared with historical norms, the report also found that there was some stabilization in the property insurance market in 2024. Last year marked the first decline in rates since 2017, after 27 consecutive quarters of growth. The report attributes this temporary stability to increased capacity and competition in the property insurance …

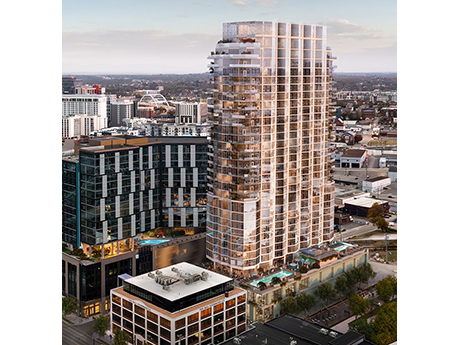

Walker & Dunlop Arranges $253M Construction Loan for Pendry Nashville Hotel and Condominium Tower

by John Nelson

NASHVILLE, TENN. — Walker & Dunlop (NYSE: WD) has arranged a $253 million construction loan for the development of the Pendry Nashville and Pendry Residences Nashville, a luxury 30-story hotel and condominium tower located in the city’s Gulch district. Pendry Hotels & Resorts, in partnership with investment and development firms SomeraRoad and Trestle Studios, plan to immediately break ground on the project. Upon completion, Pendry Nashville will include 180 guestrooms and suites, while 146 for-sale residences will be offered at Pendry Residences. The Pendry Nashville Hotel & Residences development is part of Phase III of the Paseo South Gulch master-planned micro-neighborhood, a 1 million-square-foot mixed-use district developed by SomeraRoad. Aaron Appel, Keith Kurland, Jonathan Schwartz, Adam Schwartz, Michael Diaz, Sean Bastian and Jackson Irwin of the Walker & Dunlop New York Capital Markets team arranged the loan. Bank OZK and InterVest Capital Partners provided the financing package on behalf of SomeraRoad and Trestle Studio. Jay Morrow and Carter Gradwell of the Walker & Dunlop Hospitality team represented SomeraRoad throughout the financing process, working in collaboration with the firm’s New York Capital Markets team. “Having worked with SomeraRoad to capitalize prior phases of their Paseo South Gulch master-planned development, we are …

NORTH LITTLE ROCK, ARK. — Dollar General opened its new distribution center in North Little Rock in February, the retailer’s first warehouse facility in Arkansas. The $160 million development is expected to create 300 new jobs at full capacity and support Dollar General’s traditional, DG Fresh and DG Private Fleet distribution channels. The facility spans more than 1 million square feet in Pulaski County. Dollar General opened its first store in Arkansas 50 years ago in 1975 and currently employs more than 5,700 Arkansans through its and store and distribution center presence.

Regency Centers Acquires Brentwood Place Shopping Center in Metro Nashville for $118.5M

by John Nelson

BRENTWOOD, TENN. — Regency Centers Corp. has acquired Brentwood Place, a 320,000-square-foot power retail center located in the south Nashville suburb of Brentwood. According to the Nashville Business Journal, the center sold for $118.5 million. The property was 95 percent leased at the time of sale and comprises more than 100,000 square feet of anchor retail space leased to Nordstrom Rack, Total Wine & More, T.J. Maxx/HomeGoods and Golf Galaxy. Originally developed in 1973, Brentwood Place is adjacent to the site of the future 350,000-square-foot Vanderbilt Medical Campus.