RICHMOND, VA. — Chicago-based JLL Income Property Trust has purchased a 280,000-square-foot distribution center in Richmond for $40.7 million. The Class A property was delivered in 2022 and features a 200-foot truck court, 32-foot clear heights, truck storage spaces and cold storage areas. The property has direct access to I-895 and is located within two miles of Richmond International Airport and eight miles from I-95. Two unnamed, global tenants occupy the facility with a weighted average lease term (WALT) of 8.4 years.

Southeast

Greysteel Arranges Construction Financing for Venture at Port City Apartments in Wilmington, North Carolina

by John Nelson

WILMINGTON, N.C. — Greysteel has arranged construction financing for Venture at Port City, a 225-unit apartment development in Wilmington. The borrower and developer, Indianapolis-based Millstone, expects to deliver the midrise community in spring 2027. Chris Wilkins led the Greysteel team to secure a three-year, floating-rate loan through an unnamed regional bank and an undisclosed amount of joint venture equity from an institutional real estate investment fund for Millstone. Venture at Port City will offer one-, two- and three-bedroom apartments, as well as a resort-style saltwater pool, gas grilling stations, an upscale clubhouse and a large outdoor cabana with a poolside lawn area.

ROCK HILL, S.C. — Avison Young has brokered the $11.5 million sale of a 120,000-square-foot industrial facility located near I-77 at 2690 Commerce Drive in Rock Hill, a South Carolina suburb of Charlotte. Chris Loyd, Tom Tropeano and Ryan Kendall of Avison Young represented the seller, Graham Capital, in the transaction. The buyer, Dallas-based Leon Industrial, has tapped Avison Young to handle leasing of the property moving forward.

Ardent Acquires 1.1 MSF Seminole Towne Center Mall in Central Florida, Plans Mixed-Use Redevelopment

by John Nelson

SANFORD, FLA. — The Ardent Co. has acquired Seminole Towne Center Mall, a 1.1 million-square-foot regional mall located in Sanford, roughly 28 miles northeast of Orlando. The Atlanta-based investor plans to develop the property into a mixed-use development. According to several local media outlets, Ardent purchased the mall from Hollywood, Fla.-based 4th Dimension Properties for roughly $17.5 million. While plans for the 76-acre property will include the addition of new retailers, multifamily housing and a hotel, the center’s four anchor tenants — Dillard’s, JC Penney, Dick’s Sporting Goods and Elev8 — will remain at the property. Seminole Towne Center Mall originally opened in 1995 and officially closed for redevelopment in January.

Muinzer, Kayne Anderson Recapitalize 1,356-Bed Student Housing Portfolio Near University of Tennessee

by John Nelson

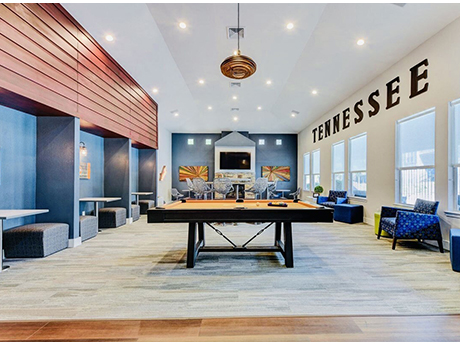

KNOXVILLE, TENN. — Private equity investment firm Muinzer has partnered with Kayne Anderson Real Estate to recapitalize a two-property student housing portfolio near the University of Tennessee in Knoxville. The 1,356-bed portfolio, which includes The Heights of Knoxville and University Park, was fully occupied at the time of the transaction. Scott Clifton, Kevin Kazlow and Teddy Leatherman of JLL arranged the recapitalization. Los Angeles-based Muinzer originally acquired the two student housing properties in 2021 in a partnership with T2 Capital Management. Further details of the company’s recapitalization with Kayne Anderson were not released.

Bixby Capital Management Purchases 222,382 SF Industrial Facility in Lebanon, Tennessee

by John Nelson

LEBANON, TENN. — California-based Bixby Capital Management has purchased a newly constructed industrial facility located at 212 Alligood Way in Lebanon, about 22 miles east of Nashville International Airport. Completed in 2024 and currently vacant, the 222,382-square-foot property features a rear-load configuration, 32-foot clear heights, an ESFR sprinkler system, 21 dock-high doors, two drive-in doors, 32 trailer parking spaces, 2,500 square feet of speculative office space and a 135- to 185-foot truck court. George Fallon, Frank Fallon and Trey Barry of CBRE brokered the transaction. The seller and sales price were not disclosed.

VIRGINIA BEACH, VA. — Alexandria, Va.-based Bonaventure has purchased Solace Apartments, a 250-unit multifamily community located at 400 S. Military Highway in Virginia Beach. The acquisition was made as an UPREIT transaction, an investment strategy where property owners contribute real estate to a REIT’s operating partnership in exchange for ownership interest in that partnership. Robert Prodan served as a contributor with Bonaventure’s REIT, Bonaventure Multifamily Income Trust (BMIT), in the UPREIT acquisition. The seller and sales price were not disclosed. Built in 2014, Solace features one- and two-bedroom apartments, as well as a pool, fitness center, grilling stations and a community clubhouse.

SMITHFIELD, N.C. — Legacy Realty Group Advisors LLC has arranged the sale of Centre Pointe Plaza, a 159,259-square-foot shopping center in Smithfield, approximately 30 miles southeast of Raleigh. An undisclosed buyer purchased the property for $11.6 million. Originally built in 1989, the shopping center is anchored by Belk. Additional tenants at the property include Bealls, Dollar Tree, Hibbett Sports, Subway and T-Mobile. Daniel Baruch of Legacy Realty represented the buyer, and Steve Shields of CBRE represented the undisclosed seller in the transaction.

Centurion Property Group Acquires 770-Bed Student Housing Community Near University of Florida

by John Nelson

GAINESVILLE, FLA. — Centurion Property Group has acquired CANOPY, a 770-bed student housing community located near the University of Florida campus in Gainesville. Originally built in 2008, the property offers a mix of two-, three- and four-bedroom floorplans. Amenities include a resort-style swimming pool, fitness center, study lounge, dog park, clubhouse, business center and a sand volleyball court. The new ownership plans to immediately begin making improvements to CANOPY. Newmark brokered the transaction. The seller and additional terms of the deal were not disclosed.

ATLANTA — Online retailer Wayfair will open a 150,000-square-foot store within The District at Howell Mill in Atlanta’s West Midtown district. Located at 1801 Howell Mill Road NW, the new Wayfair store will offer a range of furniture, home décor, housewares, appliances and home improvement products. This venue will mark Wayfair’s second large-format location — as well as its second physical retail store overall — following its first store in Wilmette, Ill., that opened in May 2024. JLL Income Property Trust, a division of LaSalle Investment Management, and Atlanta-based Selig Enterprises, own The District at Howell Mill shopping center. Fraser Gough and Benton Green of Retail Planning Corp. led lease negotiations in the transaction.