FAIRFAX, VA. — KLNB has negotiated the $7.9 million sale of a multi-tenant medical office building in Fairfax, 14 miles outside Washington, D.C. Joe Friedman and Josh Norwitz of KLNB represented the seller and procured the buyer in the transaction. Both parties were not disclosed. Totaling 54,085 square feet, the property was 40 percent leased at the time of sale by medical tenants including sports rehab, post-op rehab, dentistry and behavioral health groups. Located at 8500 Executive Park Ave., the property is situated in a medical office cluster near major healthcare facilities such as Children’s National Hospital and Inova Fairfax Hospital.

Southeast

For all Top 50 NMHC third-party management firms, the subject of managing rising operating costs is a topic that has come to be front and center in many recent client conversations. “As 2025 budget discussions were taking center stage toward the end of 2024, our clients increasingly highlighted the issues of rising operating costs,” says Lisa Narducci-Nix, director of business development at Drucker + Falk. “This trend”, she adds, “underscores our need for strategic planning and cost management to navigate the continued challenges ahead.” The multifamily sector is facing unprecedented headwinds as operating costs continue to rise, driven by factors ranging from inflation and labor shortages to increased insurance premiums and energy expenses. As a result, multifamily operators are working to find ways to maintain profitability while providing quality living spaces for their residents. “In this challenging environment, it is clear to us that adapting to these rising costs will require a multifaceted approach — one that blends innovation, strategic marketing, operational efficiency and technological adoption,” says Narducci-Nix. Challenges of rising costs Across its 11-state footprint spanning over 42,000 units, Drucker + Falk has seen operating costs for many of its managed assets surge in recent years. The supply chain …

BREMEN, GA. — Southwire plans to open a new 1.2 million-square-foot distribution center in Bremen, located 45 miles west of Atlanta via I-20. The new center will combine operations with three existing distribution sites in Villa Rica, Ga., serving as a centralized distribution center for customers across the organization. Upon completion, the center will rank as one of Southwire’s largest facilities for its distribution and shipping operations in the West Georgia region. The facility is scheduled to be completed by the third quarter of 2026. Southwire opened its most recent distribution center in the Dallas-Fort Worth area in August 2024.

LEBANON, TENN. —Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the $52 million sale of Stonehenge, a 228-unit multifamily property in Lebanon, roughly 20 miles east of downtown Nashville. Completed in 2023, the property is situated on 13 acres and offers units ranging in size from one- to three-bedrooms. Amenities include a saltwater swimming pool, clubhouse, fitness center and an entertainment lounge. David Stollenwerk, Will Balthrope and Drew Garza of IPA represented the seller and secured the buyer in the transaction. The buyer and seller were not disclosed. Brian Eisendrath, Cameron Chalfant and Jake Vitta of IPA Capital Markets arranged acquisition financing for the buyer. Jody McKibben served as Marcus & Millichap’s broker of record in Tennessee for the deal.

MOBILE, ALA. — JLL Capital Markets has arranged the sale of Mobile Portside, a two-building industrial property totaling 373,015 square feet in Mobile. The two facilities were fully leased at the time of sale and feature 32- to 36-foot clear heights, 180- to 185-foot truck courts, ESFR sprinkler systems and dock doors. Jim Freeman, Britton Burdette and Dennis Mitchell of JLL represented the seller, Burton Property Group, in the transaction. One Liberty Properties Inc. was the buyer. The sales price was not disclosed. Built in 2023, Mobile Portside comprises Buildings D and N and is situated within the South Alabama Logistics Park, the largest master-planned industrial development between Texas and Georgia. The property offers access to the Port of Mobile and spans more than 1,000 developable acres. Upon completion, the park will offer approximately 11.1 million square feet of industrial space.

TEMPLE TERRACE, FLA. — SRS Real Estate Partners has brokered the $4 million sale of Telecom Village, a 6,323-square-foot, multi-tenant retail property in the Tampa suburb of Temple Terrace. At the time of sale, the property was fully occupied by four tenants: Foxtail Coffee Co., Zoom Tan, Hummus Republic and Barberitos. Located at 7021 E. Fletcher Ave., the asset sits on roughly 1.1 acres. Patrick Nutt and William Wamble of SRS represented the seller, a Florida-based private investor, in the transaction. The buyer was a Tampa-based private investor who purchased the property at a 6.2 percent cap rate. Both parties requested anonymity.

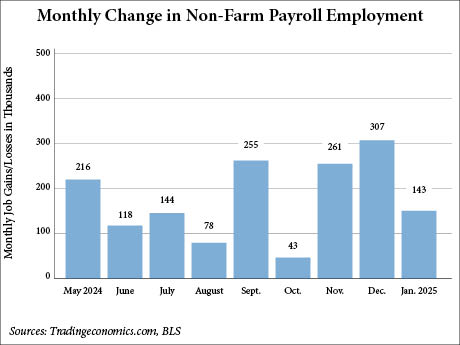

WASHINGTON, D.C. — The U.S. economy added 143,000 jobs in January, falling short of the 169,000 figure projected by economists surveyed by The Wall Street Journal. The U.S. Bureau of Labor Statistics (BLS) reports that employers added 111,000 private sector jobs, while government sector employment grew by 32,000. Meanwhile, the unemployment rate in January was 4 percent, down from 4.1 percent the prior month. The BLS noted that neither the wildfires in Southern California that began in early January nor the cold weather across much of the country for a significant portion of the month had any discernable impact on national payroll employment, hours and earnings. In January, job gains occurred in healthcare, retail trade and social assistance. Employment declined in the mining, quarrying, and the oil and gas extraction industry. More specifically, the healthcare sector added 44,000 jobs in January, including gains in hospitals (+14,000), nursing and residential care facilities (+13,000), and home health care services (+11,000). Job growth in healthcare averaged 57,000 per month in 2024. Retail trade employment increased by 34,000 in January. Job gains occurred in general merchandise retailers (+31,000) and furniture and home furnishings retailers (+5,000). Electronics and appliance retailers lost 7,000 jobs. Retail trade …

BRASELTON, GA. AND MEMPHIS, TENN. — CBRE has arranged the sale of a two-property industrial portfolio in Braselton and Memphis totaling more than 1.6 million square feet. The facilities include a 613,440-square-foot cross-dock warehouse in Braselton, a city on the northeast outskirts of the metro Atlanta area, and a 1 million-square-foot cross-dock warehouse in Memphis. The Braselton facility was built in 2016 and is fully leased to a large e-commerce company, and the Memphis property was built in 2021 and is fully occupied by Medtronic. Frank Fallon, Trey Barry, José Lobon, Royce Rose, George Fallon, Ryan Bain, Zach Graham and Bentley Smith of CBRE represented the seller, JW Mitchell Co., in the transaction. The buyer and sales price were not disclosed. Additionally, Brian Linnihan, Mike Ryan, Richard Henry and Taylor Crowder of CBRE’s debt and structured finance team in Atlanta arranged a $69.9 million acquisition loan through Wells Fargo on behalf of the buyer.

WASHINGTON, D.C. — Freshfields US LLP has signed a 117,000-square-foot lease at Midtown Center, a two-tower, 869,000-square-foot office property in downtown Washington, D.C. The global law firm will relocate its D.C. office from 700 13th St. NW to occupy floors six through eight in the West Tower at Midtown Center. Amy Bowser and Brooks Brown of CBRE represented the landlord, Carr Properties, in the lease negotiations, along with internal staffers Kaitlyn Rausse and Ryan Lopez. Rob Copito and Harry Stephens of CBRE represented Freshfields in the lease. Built in 2017, Midtown Center is now 80 percent occupied. Carr plans to add new amenities to the West Tower, including a rooftop penthouse and new conference and entertainment facilities. Existing amenities and features at Midtown Center include pedestrian bridges connecting the two towers, a two-level fitness center, rooftop terrace and restaurants on the ground level including Shoto, Grazie Nonna, Dauphines and Blue Bottle.

TALLAHASSEE, FLA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the $24 million sale of Westend Square, a 152,335-square-foot shopping center in Tallahassee. Douglas Mandel of IPA represented the seller, Steven Leoni, and procured the buyer, New York-based Milbrook Properties, in the deal. Mandel says the shopping center has upside potential as the property’s current rental rates are 25 percent below market rates. Situated within a mile from Florida State University’s campus, Westend Square was 98 percent leased at the time of sale to tenants including Five Below, Planet Fitness, Pet Supermarket, Aaron’s Rent To Own, Little Caesars Pizza, the U.S. Post Office and Citi Trends. Aldi shadow-anchors the center, which was renovated in 2022.