CHARLOTTE, N.C. — Avison Young has negotiated the sale of a 123,140-square-foot industrial facility located at 6000 Old Concord Road in Charlotte. Chris Skibinski, Henry Lobb, Abby Rights and Jewell Gentry of Avison Young represented the buyer, Stonelake Capital Partners, in the transaction. Will Jenkins, Marc Hedrick and Jack Harvey also represented Stonelake on an internal basis. Scott Hensley of Piedmont Properties represented the seller. The sales price was not disclosed. The property was built in 1984, according to LoopNet Inc.

Southeast

Colliers Mortgage Arranges $10.4M HUD-Insured Loan for Seniors Housing Community in Parkville, Maryland

by John Nelson

PARKVILLE, MD. — Colliers Mortgage has arranged a $10.4 million HUD-insured loan for the refinancing of The Cottages of Perry Hall, a 64-unit seniors housing community in Parkville. Situated on 3.2 acres about seven miles northeast of Baltimore, the property features four cottages that provide assisted living and memory care living arrangements. Services and amenities at The Cottages of Perry Hall include 24-hour care, full-service dining, housekeeping, community and activities rooms, beauty salon, fully landscaped courtyards and secure outdoor space. Christopher Fenton and Catherine Eby of the Lenox, Mass., office of Colliers Mortgage, in partnership with Health Financing Consultants, arranged the financing on behalf of Charter Senior Living. The loan carries a 35-year term and amortization schedule.

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates Report: Final Quarter 2024 Net Absorption Trends in Industrial, Office Likely Temporary; Multifamily, Retail Net Absorption Trajectories Stickier

Lee & Associates’ 2024 Q4 North America Market Report looks back at the tenant demand, absorption rates and vacancy trends for industrial, office, retail and multifamily sectors nationwide to extrapolate what might be on the horizon for 2025 and beyond. While net absorption in industrial and retail is down from the same period in 2023, the reasons — too much supply in the pipeline versus too little — are opposite for each sector. Similar mirroring due to reverse factors can be seen in the net positive absorption last quarter in office and multifamily. Net industrial absorption was down 45 percent in the last quarter of 2024, compared to the same quarter in 2023. However, vacancy rates are likely to decline this year due to a lower volume of construction starts completing in 2025. New in-office policies among prominent companies contributed to the office market’s second consecutive quarter of positive absorption, but overall, office vacancy numbers are expected to continue rising until 2026. Low vacancy and factors challenging development meant very few options for retail tenants seeking new, high-quality space. Retail tenants in the food and beverage arena have been taking advantage of increased national spending on food outside the home …

IPA Secures $165.9M Acquisition Financing for 678-Unit Apartment Community in Alexandria, Virginia

by John Nelson

ALEXANDRIA, VA. — IPA Capital Markets, a division of Marcus & Millichap, has arranged $165.9 million in acquisition financing for Town Square at Mark Center, a 678-unit apartment and townhome community located at 1459 N. Beauregard St. in Alexandria, about nine miles south of Washington, D.C. The borrower, Boston-based DSF Group, purchased the community from an undisclosed seller. IPA’s Los Angeles office arranged the financing, which was underwritten at a 70 percent loan-to-value ratio with a 35-year amortization schedule. Built in 1996, Town Square at Mark Center was 98 percent occupied at the time of financing.

Lingerfelt Sells 239,448 SF Port 801 Industrial Facility in Colonial Heights, Virginia

by John Nelson

COLONIAL HEIGHTS, VA. — Lingerfelt has sold Port 801, a 239,448-square-foot industrial facility located at 801 Port Walthall Drive in Colonial Heights, a suburb of Richmond. The buyer and sales price were not disclosed. JLL represented Lingerfelt, which delivered Port 801 in 2022, in the sale. The property was fully leased at the time of sale to two investment-grade tenants. Last fall, Lingerfelt executed a 106,376-square-foot lease with PECO Pallet at Port 801.

NAGS HEAD, N.C. — The Keith Corp. has acquired Outlets Nags Head, an 82,161-square-foot outlet mall located in North Carolina’s Outer Banks Region. The Charlotte-based investment and development firm has tapped Ignite Retail Partners to lead marketing and leasing efforts for the property. Singerman Real Estate sold the outlet mall for an undisclosed price. Tenants at Outlets Nags Head include Aerie, Eddie Bauer, Michael Kors, Talbots and Vera Bradley, as well as a collection of local retailers like Salt Coast Outfitters, Outer Banks Olive Oil and BROS.

Cushman & Wakefield Arranges Sale of 368-Bed Student Housing Community Near Auburn University

by John Nelson

AUBURN, ALA. — Cushman & Wakefield has arranged the sale of The HUB at Auburn, a 368-bed student housing community located at 626 Shug Jordan Parkway near the Auburn University campus in Alabama. Travis Prince, Shawn Lubic and Victoria Marks of Cushman & Wakefield’s student housing capital markets team represented the seller, FPA Multifamily, in the transaction. The property was acquired by Capstone Real Estate Investments for an undisclosed price. Developed in 1989, the community consists of six three-story buildings that were 96 percent occupied at the time of sale. The property offers 96 units in two- and four-bedroom configurations, including townhomes. Shared amenities include a fitness center, resort-style pool, shared study spaces and a complimentary coffee bar.

ATLANTA — Several key performance indicators are trending positively for the extended-stay hotel sector, according to research from Atlanta-based The Highland Group. Extended-stay hotels are lodging properties that have flexible rental options for guests, many of whom choose to rent for weeks or months at a time. In the fourth quarter of 2024, revenue per available room (RevPAR) and room revenue for the extended-stay sector increased by 3 percent and 6.1 percent year-over-year, respectively. Additionally, total occupancy in the fourth quarter hovered at 72.7 percent, which is the highest fourth-quarter occupancy rate in the past three years and a full 12 percentage points above the overall U.S. hotel sector. “Extended-stay demand growth in fourth-quarter 2024 was the largest quarterly increase in three years and well ahead of the accelerating gain in supply,” says Mark Skinner, partner at The Highland Group.

ALEXANDRIA, VA. — Carr Properties has formed an equity joint venture with Barings for the development of 425 Montgomery Street, a $131 million project to transform a former office building into multifamily units in Alexandria, roughly seven miles south of Washington, D.C. The partnership subsequently received an $84 million construction loan from real estate investment firm Kennedy Wilson. Cushman & Wakefield served as advisor for both the equity and debt financings. The development site, located adjacent to Montgomery Park in the city’s Old Town Alexandria neighborhood, formerly housed a vacant office building. The eight-story, 250,000-square-foot project will feature 237 apartment units in studio, one-, two- and three-bedroom layouts. Amenities will include an outdoor pool and a resident lounge/amenity center, as well as a performing arts venue leased to CityDance. About one-third of the units will offer views of the Potomac River. Carr acquired the project site (formerly 901 N. Pitt St.) in spring 2024. Construction has commenced, and a groundbreaking ceremony is scheduled for next month. The project is slated for completion by late 2026. “We look forward to partnering with Carr Properties on this exciting residential investment that we believe will benefit from several tailwinds, including the region’s strong …

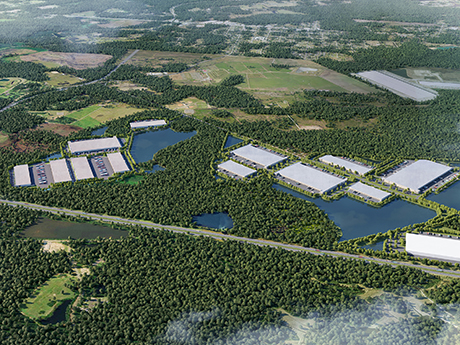

SAVANNAH, GA. — Barings and Charlotte-based Trinity Capital have broken ground on Phase II of Horizon 16 Industrial Park, a logistics park located at Jimmy Deloach Parkway and I-16 in Savannah. The second phase will span six buildings totaling 1.5 million square feet. Phase I of the park spans 1.1 million square feet across three buildings and is currently 74 percent leased to tenants including Ferguson and Harbor Freight. The design-build team for Phase II includes general contractor Evans and architectural firm Atlas. The co-developers have tapped William Lattimore of CBRE to lease the second phase of Horizon 16. Barings and Trinity Capital previously partnered to develop 85 Exchange, a 1.3 million-square-foot industrial park near Charlotte that is leased to tenants including Amazon.