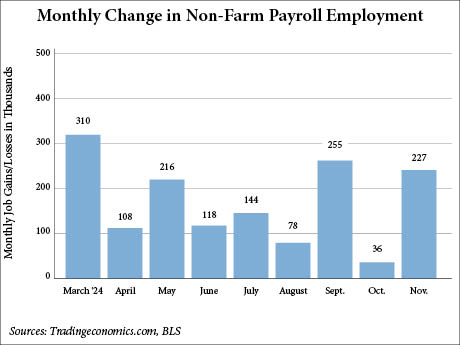

WASHINGTON, D.C. — The U.S. economy added 227,000 jobs in November, according to the U.S. Bureau of Labor Statistics (BLS). The figure is a strong rebound from October when the economy added 36,000 jobs, which is an upward revision by the BLS from its previous report of 12,000 jobs for the month. CNBC and other media outlets cite impacts from Hurricane Milton and the Boeing strike as reasons why the October total fell so far short of expectations. In addition to the October revision, the BLS revised September’s job total upward to 255,000, which brings net employment for the two months 56,000 jobs higher than previously reported. The November total also surpassed Dow Jones economists’ expectations of 214,000 jobs for the month, according to CNBC. The most actively expanding employment sectors in November included healthcare, which added 54,000 jobs, and leisure and hospitality, which added 53,000 jobs. The healthcare total is in line with the sector’s 59,000 average over the prior 12 months, but the leisure and hospitality figure more than doubled its 12-month average of 21,000 jobs, according to the BLS. Other sectors that added jobs in November include government (+33,000), transportation equipment manufacturing (+32,000) and social assistance (+19,000). …

Southeast

JLL Arranges Sale of 286-Unit Pier 33 Apartments in Downtown Wilmington, North Carolina

by John Nelson

WILMINGTON, N.C. — JLL has arranged the sale of Pier 33, a 286-unit apartment community located at 901 Nutt St. in downtown Wilmington. Middle Street Partners purchased the luxury community from Dewitt Carolinas Inc. for an undisclosed price. John Mikels, John Gavigan, Niki Dewberry and William Martin of JLL represented the seller in the transaction. Additionally, Ward Smith and Brad Woolard of JLL originated a Fannie Mae acquisition loan on behalf of Middle Street. Built in 2021, Pier 33 features 21,000 square feet of retail space, including concepts Bonita Latin Fusion, Megarounds and Nautical Bowls. The property also features studio, one-, two- and three-bedroom apartments, as well as a resort-style pool, pet spa, sky lounge, fitness center and coworking spaces.

Miller Construction, Foundry Break Ground on Two South Florida Warehouse Projects Totaling 832,000 SF

by John Nelson

OPA LOCKA AND BOYNTON BEACH, FLA. — Miller Construction, working on behalf of Orlando-based commercial real estate services and development firm Foundry Commercial, has begun construction on two warehouse projects in South Florida totaling 832,000 square feet. The facilities, which combined for $68 million in value, include Meek International Business Park Phase IV (375,000 square feet) in Opa Locka, and Egret Point Logistics, a two-building park (457,000 square feet) in Boynton Beach. The project team for Meek International include Arcadis (architect), Puga & Associates (MEP engineer), DDA (structural engineer) and Langan (civil engineer). Arcadis and DDA were also part of the project team for Egret Point, which also included B&K Engineering (MEP engineer) and Kimley-Horn (civil engineer).

NICHOLASVILLE, KY. — Michigan-based Schostak Brothers Co. has acquired a 125,000-square-foot industrial facility located at 101 Etter Drive in Nicholasville, roughly 14 miles south of Lexington, Ky. The seller and sales price were not disclosed. The warehouse and manufacturing facility marks the second Kentucky acquisition for Schostak Brothers.

CHATTANOOGA, TENN. — Matthews Real Estate Investment Services has brokered the sale of Hurricane Creek, a 62,590-square-foot shopping center located in Chattanooga. Publix anchors the property, which was built in 2007. Southeast U.S. Retail Fund LP sold the center to an entity doing business as Hurricane Creek Center LLC for an undisclosed price. Kyle Stonis, Pierce Mayson and Boris Shilkrot of Matthews arranged the transaction.

Marcus & Millichap Negotiates Sale of Gas Station, Store Near Mobile Ground Leased to Wawa

by John Nelson

ROBERTSDALE, ALA. — Marcus & Millichap’s Taylor McMinn Retail Group in Atlanta has brokered the sale of a newly built gas station and convenience store in Alabama ground leased to Wawa. Delivered earlier this year, the 6,119-square-foot retail property is located on a 2.2-acre site at 18535 County Road 48 in Robertsdale, a suburb of Mobile. The property is situated across from a Walmart Supercenter and features a 20-year ground lease featuring rent increase and extension options. Don McMinn and Andrew Koriwchak of Marcus & Millichap represented the seller, a Florida-based developer, in the transaction. The locally based buyer purchased the location all-cash in an exchange. “This was the second Wawa location in the state of Alabama, and more are coming as Wawa continues its Southeast expansion into Alabama, Georgia and North Carolina,” says McMinn. The Robertsdale location is the second Wawa in Alabama that McMinn and Koriwchak brokered, the first of which was a store in Fairhope.

By David DiRienzo, director — business development, at Talonvest Capital, Inc. This is part two of a two-part series discussing the key drivers behind transaction volume and the steps owners can take to ensure they are well positioned going forward. As highlighted in part one, despite substantial changes in the market over the past few years, the capital markets continue to offer quality financing solutions for real estate owners. Part two of this article series delves into two key drivers of current financing activity: elective refinancing to optimize the capital stack and the initiation of new business plans. Given the plethora of value-add projects in the pipeline and the interest in undertaking new business plans as equity capital returns to the market, these financing strategies are taking on greater importance than in past years. Interestingly, elective refinancing and starting a new business plan are two scenarios where the borrower’s actions are optional because an impending maturity is not a consideration. For this reason, it is important that borrowers understand the nuances behind these strategies as well as the approach that a capital expert might take. Elective Refinancing to Maximize Investment Performance While loan maturities trigger many refinancings, owners run into a …

JBG Smith Launches Leasing for 420-Unit Zoe Apartments at National Landing in Northern Virginia

by John Nelson

ARLINGTON, VA. — JBG Smith has launched leasing at The Zoe, a 420-unit luxury apartment building situated within the National Landing district in Northern Virginia. The 19-story tower, which features 10,000 square feet of street-level retail space, is located at 2051 S. Bell St. in Arlington. Designed by STUDIOS, The Zoe will feature a mix of studio, one- and two-bedroom apartments, as well as a rooftop amenity space, fitness center, concierge services, coworking space, conference rooms, pet spa with a grooming station, bike parking and electric vehicle charging stations. Monthly rental rates at The Zoe will range from $2,020 to $6,750, according to Apartments.com. SK+I served as the architect of record for The Zoe. JBG Smith is targeting LEED Gold certification for the property. Headlined by the Amazon HQ2, National Landing features restaurants, shops, the Water Park, the Crystal City Metro station and a planned pedestrian bridge linking National Landing to Ronald Reagan Washington National Airport. JBG Smith delivered two other apartment developments at National Landing earlier this year totaling 808 units — The Grace and Reva. The Bethesda, Md.-based developer is also underway on an adjacent 25-story apartment tower to The Zoe called Valen, which will begin leasing in …

LOS ANGELES — Gelt Ventures LLC has sold an eight-property self-storage portfolio in Tennessee and Mississippi totaling 3,999 units. The facilities are mostly situated in the metro Memphis market, with five assets in Memphis, two in Olive Branch, Miss., and one in Nesbit, Miss. Canadian-based investor Minimal Storage Properties purchased the 487,000-square-foot portfolio for an undisclosed price. Gelt Ventures originally acquired the portfolio in June 2020 for $41 million. The single-story properties were built between 1972 and 2006 and feature commercial office space, manager’s apartments and a mix of drive-up, indoor and climate-controlled units averaging 141 square feet in size. During its ownership period, Los Angeles-based Gelt Ventures carried out capital improvements on the self-storage assets, improved the tenant mix and implemented a revenue management strategy.

SOUTHAVEN, MISS. AND BUFORD, GA. — JLL has negotiated the $25 million sale of a hotel portfolio in the Memphis suburb of Southaven, as well as the $11 million sale of a hotel in Buford. The properties included the Courtyard Memphis Southaven (85 rooms), the Residence Inn Southaven (78 rooms) and the Fairfield Inn & Suites Buford (94 rooms). C.J. Kelly and Bobby Norwood of JLL represented the buyer, Woodvale Opportunity Fund I, in the transaction. The seller was Chartwell Hospitality.