SPRING HILL, FLA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the $17 million sale of Seven Hills Plaza, an 87,286-square-foot retail center located roughly 50 miles north of Tampa in Spring Hill. Planet Fitness and Walgreens anchor the center, which was fully occupied at the time of sale. Additional tenants include Altitude Trampoline Park, AFC Urgent Care, Rehability, Okinawa Ramen Restaurant, GNC and Nails So Happy. Kirk Olson and Drew Kristol of IPA represented the seller, Baltimore-based Continental Realty Corp. (CRC), and procured the buyer, Bezrat H. Corp., in the transaction.

Southeast

AUSTELL, GA. — Lee & Associates has arranged a 103,776-square-foot industrial lease at 7815 Third Flag Parkway in Austell, a suburb in Atlanta’s I-20 West submarket. Earnest Machine Products, an industrial fastener distributor based in Cleveland, signed the lease with the landlord, Link Logistics, an industrial real estate owner founded by Blackstone in 2019. Mike Sutter and Rick Tumlin of Lee & Associates’ Atlanta office negotiated the lease deal.

ATLANTA — Portman has delivered Ten Twenty Spring, a new 530,000-square-foot office tower in Midtown Atlanta. The Class A office building is part of the locally based developer’s Spring Quarter mixed-use development that comprises the office tower, an apartment high-rise called Sora that opened last fall, street-level retail space and the historic H.M. Patterson Home and Gardens. Ten Twenty Spring features 32,000-square-foot floor plates and 10-foot floor-to-ceiling windows, as well as 15,000 square feet of private terraces and 20,000 square feet of amenity space. Sozou, a new Japanese restaurant from Chef Fuyuhiko Ito, will open at the office tower’s ground floor in summer 2025. The restaurant group will also open Omakase by Ito on the office tower’s eight-floor rooftop. Portman has tapped Glenn Kolker, Preston Menning and Malik Leaphart of Stream Realty Partners to lease Ten Twenty Spring.

Inland Acquisitions Buys 673-Bed Student Housing Community Near University of South Carolina

by John Nelson

COLUMBIA, S.C. — Inland Real Estate Acquisitions has purchased the Sawyer on Lincoln, a 673-bed student housing community located adjacent to the University of South Carolina campus in Columbia. Inland acquired the newly delivered property on behalf of an affiliate. The seller and sales price were not disclosed. Delivered in 2023, the 277-unit Sawyer on Lincoln features one-, two- and three-bedroom, fully furnished apartments with bed-to-bath parity. Shared amenities include private and group study rooms, a 24-hour fitness center, gated resident parking garage with 525 parking spaces, package locker system for parcels, social lounge with kitchen and TVs, resort-style pool with lounge seating and a hot tub and an outdoor courtyard with games. The Sawyer on Lincoln was fully occupied at the time of sale.

Kolter Multifamily Breaks Ground on 300-Unit Alton Nexus Apartments in Gallatin, Tennessee

by John Nelson

GALLATIN, TENN. — Kolter Multifamily LLC, along with its affiliates, has broken ground on Alton Nexus, a 300-unit apartment community in Gallatin, a Middle Tennessee city approximately 30 miles northeast of Nashville. The project represents the first apartment development outside of Florida for Kolter Multifamily, a subsidiary of Delray Beach, Fla.-based The Kolter Group. Alton Nexus will feature a mix of one-, two- and three-bedroom apartments, as well as a resort-style swimming pool with outdoor firepits, clubroom with a bar, coworking spaces and a fitness center with a yoga studio. The project is part of the Nexus master-planned development that features a business park, shops and restaurants. Kolter Multifamily expects to deliver Alton Nexus in winter 2026.

Trader Joe’s to Open 13,500 SF Grocery Store at Halcyon Mixed-Use Development in Metro Atlanta

by John Nelson

ALPHARETTA, GA. — RocaPoint Partners has announced that Trader Joe’s will open a new 13,500-square-foot grocery store at Halcyon, a mixed-use development in the north Atlanta region of Forsyth County. Located in Alpharetta near the Big Creek Greenway trail, the grocery store will be situated next to the new Chick-fil-A as part of the third phase of Halcyon, which recently celebrated its fifth anniversary of operation. Other committed tenants of Halcyon’s Phase III include Chewy Vet Care, Chase Bank and Five Guys. Halcyon also includes The Village Green central gathering space for events, offices for Morgan Stanley, an Embassy Suites by Hilton hotel, CMX CInebistro, X-Golf, a food hall, Cherry Street Brewpub and several shops and restaurants. The new Halcyon store will bring the number of Trader Joe’s locations in metro Atlanta to eight.

MADISON, TENN. — JLL has brokered the $9.8 million sale of Rivergate Square, an 81,935-square-foot shopping center located at 1584 Gallatin Pike N in Madison, a suburb of Nashville. Jim Hamilton and Brad Buchanan of JLL represented the seller, Albanese Cormier, in the transaction. The buyer was not disclosed. Rivergate Square was fully leased at the time of sale to tenants including Dollar General, Office Depot, dd’s Discounts and Jimmy John’s.

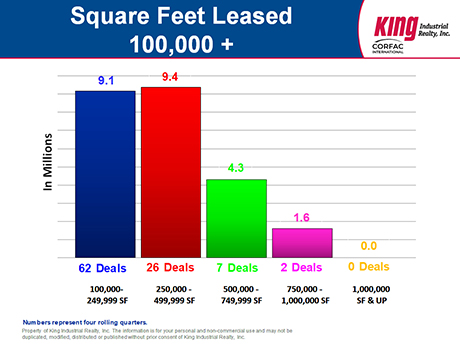

As the Atlanta industrial market continued its slowdown as of the end of the second quarter in 2024, there were three main stories to consider. First, the biggest news was that the Atlanta industrial market experienced four quarters of negative net absorption of 8.8 million square feet during this past year (we have had five quarters in a row.) At the same time in 2023, we reported 17.2 million square feet of positive net absorption, and in 2022, we reported 42.7 million square feet of positive net absorption, so these latest negative absorption numbers were a huge drop from the previous positive absorption numbers. The second biggest news story was that the Atlanta industrial market saw a dramatic slowdown in big-box deals. There were only nine transactions that were consummated over the past four quarters that were 500,000 square feet or larger, and none of those deals were over 1 million square feet. In contrast, in 2023, 21 big-box transactions were completed that were over 500,000 square feet, and 11 of those deals were 1 million square feet or larger. The year-over-year decline was 15 million square feet less. The third biggest news story was that the new construction …

Some commercial real estate developers work primarily with architects and engineers to establish a project’s scope and expected cost, leaving the selection of a general contractor or project manager until they are nearly ready to break ground. And by following this traditional approach, they may be leaving money on the table. A better practice is to engage contractors during project planning, industry experts advise. That’s because experienced contractors can provide practical insight into pricing and availability of materials and labor, informing critical planning decisions. Those same builders can be a sounding board for site civil engineers mapping out site preparation, utility installation, access and sequencing for the various tradespeople working on a project. “Involving a general contractor early is particularly beneficial for large-scale or phased construction projects,” says Daniel Hines, a principal in Bohler’s Charlotte office. “It enables us to approach the design more strategically, reduce costs and deliver more accurate timelines.” “The overall goal of getting a general contractor and an engineer working together is to maintain your schedule and your budget,” agrees Jeff Mitchell, director in the Charlotte, North Carolina office of Duffey Southeast Construction Inc. “Engineers are the experts at designing projects, but ultimately it is the …

TAMPA, FLA. — Baltimore-based Continental Realty Corp. (CRC) has acquired Henley Tampa Palms, a 315-unit apartment community located at 15350 Amberly Drive in Tampa. 29th Street Capital sold the asset to CRC for $82 million. Berkadia represented the seller in the transaction. CRC purchased the community on behalf of one of its sponsored private equity funds called Value-Add Multifamily I LP. Built in 1997, Henley Tampa Palms was 94 percent occupied at the time of sale. The property features a mix of one-, two- and three-bedroom apartments averaging 1,375 square feet in size, as well as a large clubhouse and fitness center with an indoor racquetball court, conference room, laundry room, package retrieval system, a resort-style swimming pool, picnic area, dog park and a car wash. CRC intends to implement a multi-year property improvement strategy at Henley Tampa Palms to enhance the exterior curb appeal, address exterior deferred maintenance and upgrade common area amenities as well as unit interiors. The previous owner recently completed interior upgrades to approximately 25 percent of the units.