CLARKSVILLE, TENN. — Oakley Group, a multifamily investment firm based in Birmingham, Ala., has purchased Pro Park, a 96-unit apartment community located at 850 Professional Park Drive in Clarksville. The three-building, newly built property is situated on a 4.4-acre site roughly 46 miles northwest of Nashville. Developer Bert Singletary sold the community to Oakley Group for an undisclosed price, and Synovus Bank provided an undisclosed amount of acquisition financing for the purchase. The new owner has selected locally based NextGen Properties to operate Pro Park, which is being rebranded to The Oakley at Pro Park. Completed in 2024, the property offers one- and two-bedroom units ranging from 879 to 1,200 square feet in size, as well as a clubhouse, fitness center swimming pool, 20 garages and 64 storage units. The community was 63 percent occupied at the time of sale.

Southeast

WASHINGTON, D.C. — The Federal Housing Finance Agency (FHFA) has increased the multifamily loan purchase caps for Fannie Mae and Freddie Mac for their 2025 production. The two government-sponsored enterprises (GSEs) will each have caps of $73 billion, or $146 billion combined, which is a 4 percent increase from the 2024 caps of $70 billion apiece. Bob Broeksmit, president and CEO of the Mortgage Bankers Association (MBA), says that the move to increase the cap is fitting due to recent moves by the Federal Reserve, which has twice reduced the federal funds rate in recent months. “The 4 percent increase in the multifamily loan purchase caps to $73 billion for each GSE is appropriate, given the slightly improved market conditions and lending activity that’s expected next year due to the slow decline in interest rates,” says Broeksmit. The FHFA will continue to exclude multifamily loans that finance workforce housing communities from the 2025 cap and require the GSEs to have at least 50 percent of their multifamily originations finance “mission-driven” affordable housing. The FHFA will continue to monitor the multifamily mortgage market and “maintains the ability to raise the caps further if necessary to support liquidity in the market.” If …

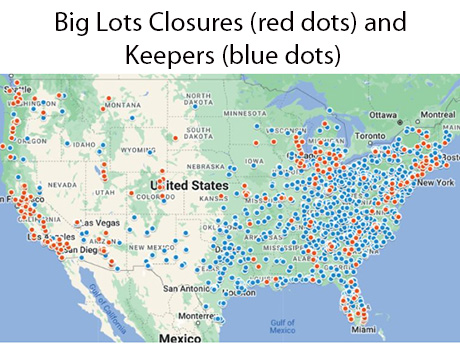

As someone who has closely observed retail trends in the Southeastern United States for decades, I’ve witnessed the inevitable ebb and flow of the industry. From periods of rapid expansion to challenging market corrections, and of course, global pandemics that disrupted every sector of real estate, it often feels as though I’ve ‘seen it all.’ Once again, I find myself watching the market adjust, particularly among big-box retailers, in high-growth areas like Raleigh. This ongoing shift signals both challenges and opportunities, reminding me of the resilience and adaptability required to thrive in this dynamic environment. When news broke in September that Big Lots Inc. had filed for Chapter 11 bankruptcy protection and that it would be closing more than 300 stores across the country, it wasn’t all that shocking, given the sheer number of Big Lots that one comes across just driving across their own towns. The Big Lots announcement follows similar moves by companies such as rue21, Express, The Body Shop, 99 Cents Only Stores, LL Flooring, Conn’s, and Red Lobster. Retailers like Rite Aid and Bed Bath & Beyond, which filed for bankruptcy last year, have closed hundreds of stores, causing vacancies in the retail real estate market. …

LOUISVILLE, KY. — Stellar Snacks, a snack manufacturer based in Carson City, Nev., has officially opened its new $137 million pretzel bakery in west Louisville. The company held a ribbon cutting ceremony attended by various dignitaries, including Kentucky Gov. Andy Beshear and Louisville Mayor Craig Greenberg. The new Stellar Snacks factory is located within an existing 434,000-square-foot industrial building at 1391 Dixie Highway. The factory will create 350 full-time jobs over the next 10 years, which makes it the largest economic development project in west Louisville over the past 20 years. Stellar Snacks currently operates its original 101,000-square-foot facility in Carson City, where it employs more than 170 people. The company was founded in 2019 by mother-daughter duo Elisabeth and Gina Galvin, making Stellar Snacks the first woman-owned pretzel manufacturer in the United States. The pretzel maker distributes products to more than 5,000 grocery and retail stores nationwide.

Portman, CapitaLand Ascendas REIT Break Ground on 549,000 SF Industrial Park Near Charleston

by John Nelson

SUMMERVILLE, S.C. — A partnership between Portman and CapitaLand Ascendas REIT has broken ground on Summerville Logistics Center, a two-building industrial campus located along U.S. Highway 78 in Summerville, a Charleston suburb within Dorchester County. The site will include two rear-load facilities — one 313,000 square feet and the second 236,000 square feet — with a shared truck court that will be constructed simultaneously. The park will be situated near I-26 and roughly 25 miles from the Port of Charleston. Truist Bank is providing an undisclosed amount of construction financing, and Lee & Associates will lead the leasing efforts for Summerville Logistics Center. The project team also includes general contractor Frampton Construction, civil engineer Seamon Whiteside and architect McMillan Pazdan Smith. Portman and CapitaLand Ascendas REIT plan to deliver Summerville Logistics Center by the end of 2025.

JLL Arranges $55.2M Acquisition Loan for Healthcare Real Estate Portfolio in North Carolina

by John Nelson

BURLINGTON, DURHAM AND GREENSBORO, N.C. — JLL has arranged a $55.2 million acquisition loan for a nine-property healthcare real estate portfolio in North Carolina. Travis Anderson and Anthony Sardo of JLL arranged the 10-year, fixed-rate loan with a life insurance company on behalf of the borrower, AW Property Co. The facilities span nearly 300,000 square feet and are located on or adjacent to hospital campuses in Burlington, Durham and Greensboro. The portfolio has an average vintage of 2006 and was 99 percent leased at the time of financing to healthcare systems and independent physician practices including Cone Health, Duke Health and UNC Health.

Matthews Brokers Sale of 141,577 SF Crosswinds Shopping Center in St. Peterburg, Florida

by John Nelson

ST. PETERSBURG, FLA. — Matthews Real Estate Investment Services has brokered the sale of Crosswinds Shopping Center, a 141,577-square-foot retail center located in the Tampa suburb of St. Petersburg. Tenants at the property, which was fully leased at the time of sale, include Marshalls, Michaels, Bealls and Havertys. Wallace Enterprises and Crim & Associates acquired the center from an entity doing business as Crosswinds St. Pete LLC for an undisclosed price. Pierce Mayson, Kyle Stonis and Boris Shilkrot of Matthews represented the seller in the transaction.

Preiss, Crow Holdings Acquire 440-Bed Student Housing Community Near University of Alabama

by John Nelson

TUSCALOOSA, ALA. — The Preiss Co. has acquired Riverfront Village, a 440-bed student housing community located near the University of Alabama campus in Tuscaloosa. Preiss purchased the 92-unit community in partnership with Crow Holdings Capital. The buyers are planning capital improvements, including renovations to select units, a clubhouse redesign, upgrades to the swimming pool and comprehensive technological updates. The seller and sales price were not disclosed.

Canadian Solar’s e-Storage to Develop $712M Battery Manufacturing Facility Near Louisville, Kentucky

SHELBYVILLE, KY. — Shelbyville Battery Manufacturing, a subsidiary of e-Storage, has announced plans to develop a $712 million project in Kentucky, establishing a 6-gigawatt hour battery cell, module and packaging manufacturing facility. Based in Canada, e-Storage is a subsidiary of Canadian Solar — a battery energy storage systems design, manufacturing and integration company. Upon completion, the development will comprise a 1 million-square-foot building located on Logistics Drive in Shelbyville, roughly 35 miles east of Louisville. Shelbyville Battery Manufacturing will produce self-contained energy storage systems at the facility that will be packaged into modular, containerized utility-scale batteries. “The new plant will allow us to provide our U.S. customers with cutting-edge, American-made battery energy storage products,” says Colin Parkin, president of e-Storage. According to a press release issued by the office of Kentucky Gov. Andy Beshear, the project will create 1,572 permanent jobs and marks the third-largest project for job creation during Beshear’s administration, which began in 2019. In August, the Kentucky Economic Development Finance Authority (KEDFA) preliminarily approved a 15-year incentive agreement with Shelbyville Battery Manufacturing to provide up to $35 million in tax incentives. The authority also approved the manufacturer for up to $5 million in tax incentives through the …

WASHINGTON, D.C. — PRP has obtained a $291 million CMBS loan for the refinancing of a national logistics portfolio totaling more than 4.5 million square feet. Eastdil Secured arranged the single-asset single-borrower (SASB) loan through JP Morgan. The portfolio spans five newly constructed buildings in the industrial markets of Houston; Greenville-Spartanburg, S.C.; St. Louis, Ill.; and Birmingham, Ala. The properties were fully leased at the time of financing including to tenants including a global online retailer, a home improvement company and power tool manufacturer, according to Washington, D.C.-based PRP.