NASHVILLE, TENN. — Residential hospitality operator Sentral has been selected by master developer Southwest Value Partners to manage The Everett, the first of two residential towers to be developed at Nashville Yards, a 19-acre mixed-use project currently underway in Nashville. Amenities at the tower, which totals 361 units in one- and two-bedroom layouts, will include a third-floor deck with a pool, spa, lounge and grilling stations; a pet wash and dog park; fitness center and yoga area; game room; resident bar and coworking space. Move-ins at The Everett are scheduled to begin in December. Upon completion, Nashville Yards will also feature a 591-room Grand Hyatt Nashville hotel, concert venue, office buildings and retail and restaurant space, as well as plazas, courtyards and green spaces.

Southeast

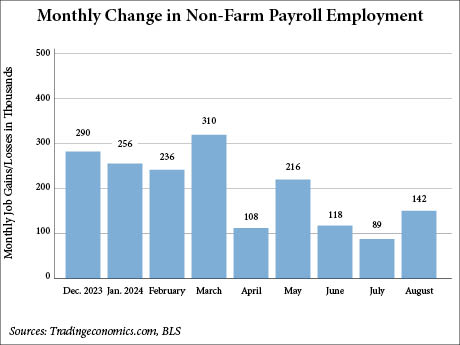

WASHINGTON, D.C. — The U.S. economy has added a total of 142,000 nonfarm payroll jobs in August, according to the U.S. Bureau of Labor Statistics (BLS). Though this marks an uptick relative to July’s revised figure of 89,000, CNBC reports that the number falls below expectations and reflects a slowdown in the labor market. Dow Jones economists previously predicted that the economy would add 161,000 jobs in August. Healthcare and construction saw notable gains in August, increasing by 31,000 and 34,000 jobs, respectively. Healthcare’s average monthly over the prior 12 months was 60,000. Employment gains in the social assistance sector slowed with 13,000 jobs added, which falls below the average monthly gain of 21,000. Employment in the manufacturing sector decreased by 24,000 positions, and other major industries saw little change. The unemployment rate changed little in August, falling to 4.2 percent. This aligns with predictions and marks a minimal decrease relative to the previous month, when the unemployment rate sat at 4.3 percent. Additionally, the BLS revised down the number of jobs added in June and July by a total of 86,000 fewer jobs. June was revised down from 179,000 to 118,000, and July was revised down from 114,000 to …

The commercial real estate market, particularly in the retail leasing sector, has been navigating a complex and dynamic landscape over the past few years. With a blend of high demand, limited supply and fluctuating economic variables, the Orlando market presents both challenges and opportunities for developers, landlords and tenants alike. High demand, limited supply One of the most prominent trends in the Orlando retail leasing market is the high demand for quality retail spaces. Retailers are eager to establish and expand their presence in this thriving market, driven by a growing population and increasing consumer spending. However, the inventory of quality existing retail bays is incredibly scarce. This scarcity has created a competitive environment where desirable locations are quickly snapped up, often at premium prices. The supply-demand imbalance has pushed developers to sharpen their pencils and critically analyze the feasibility of new projects. Despite the strong demand, many deals struggle to pencil out due to the high costs of construction materials and labor. These costs have remained elevated, making it challenging for developers to achieve a satisfactory return on investment. As a result, some projects are delayed or shelved, further constraining the supply of retail space. Housing spurs development The …

Rockefeller Group, Matan Cos. Break Ground on 5 MSF Industrial Development in Suffolk, Virginia

by John Nelson

SUFFOLK, VA. — Rockefeller Group and Matan Cos. have broken ground on the first phase of Port 460 Logistics Center, an industrial development that will comprise 5 million square feet in Suffolk, approximately 20 miles southwest of Norfolk with direct access to the Port of Virginia. The co-developers are completing the project in a joint venture with Mitsubishi Estate New York, Chuo Nittochi and Taisei USA LLC. The first phase will comprise 2.4 million square feet of industrial space across five buildings, with the first two buildings scheduled for completion next year. A second phase will deliver 2.6 million square feet of space. Gregg Christoffersen and Kristopher Kennedy of JLL are managing leasing at Port 460.

NASHVILLE, TENN. — The Preiss Co. (TPCO) has completed the development of Signature Music Row, a 105-unit multifamily community on Nashville’s Music Row. Located at 1005 16th Ave. S, the property was developed in partnership with Speedwagon Capital Partners. JLL arranged construction financing for the project through First Horizon. Signature Music Row offers apartments in one-, two- and three-bedroom layouts, with 3,000 square feet of amenity space. Monthly rental rates range from $1,450 to $3,846, according to Apartments.com. The property also includes 2,000 square feet of retail space, which will be occupied by Silver Fox Coffee, beginning in 2025. Amenities at the community include an outdoor pool, sky lounge, fitness center and electric vehicle charging stations.

FORT MYERS, FLA. — CBRE has brokered the $14.6 million sale of College Plaza, a retail center located at 7070 College Parkway in Fort Myers. An entity doing business as College Plaza Center LLC acquired the property from an entity doing business as College Venture 1 LLC. Jim Shiebler of CBRE represented both the buyer and seller in the transaction. Tenants at College Plaza, which totals 56,386 square feet, include Ada’s Natural Market, West Marine and Pet Supermarket. The center also features an outparcel occupied by Five Guys, Tijuana Flats and The Good Feet Store. College Plaza is situated within one mile of Florida Southern State College.

WALDORF, MD. — Marcus & Millichap has negotiated the $6.3 million sale of JSB Apartments, a 48-unit multifamily community located in Waldorf, a Maryland city near Washington, D.C. Marty Zupancic and Ryan Murray of Marcus & Millichap represented the seller, RGB Holding, in the transaction. JSB Apartments features one-bedroom units and is adjacent to the 150-acre Waldorf Station development, which will include a grocery store, fitness facility and retail space.

ROSWELL, GA. — Cushman & Wakefield has arranged a 55,869-square-foot lease renewal at Mansell Overlook, an office park located in Roswell, roughly 25 miles north of downtown Atlanta. Annie Gomez and Jon Mayeske of Cushman & Wakefield represented the tenant, SiteOne Landscape Supply Inc., in the lease negotiations. An entity doing business as Sun Belt Office I LLC is the landlord of Mansell Overlook, which comprises four buildings of Class A office space and is situated on 67 acres. Amenities at the property include outdoor seating, walking paths, a fitness center and a conference center.

CHICAGO — Core Spaces has completed six student housing communities totaling 4,549 beds across the United States. All six communities have opened to residents ahead of the 2024-2025 school year. The communities are all located near the campuses of major universities, including UC Berkeley, University of Cincinnati, Penn State, University of Wisconsin-Madison and Clemson University. The six new properties include: The communities feature a variety of high-end, student-focused amenities. For example, ōLiv Madison boasts a spa, sauna, fitness center, coworking spaces, private study rooms and a sprawling rooftop sundeck with pool and hot tub. Each property offers a diverse mix of floor plans and unit types to appeal to a range of resident needs and price points. “After years of work to bring a project to life, welcoming new residents home is one of the best parts of what we do,” said Marc Lifshin, CEO of Core Spaces. Core Spaces is a residential developer, owner and operator headquartered in Chicago. The company currently owns or manages more than 38,600 beds. The developer currently has a pipeline of approximately 43,000 beds. The pipeline includes an 800-bed project in Knoxville, Tennessee; three developments in Madison totaling 4,000 beds; a 665-unit, 2,195-bed project in …

NEWARK, N.J. — Newark-based PGIM Real Estate has sold a seven-property portfolio of grocery-anchored shopping centers in Florida. The buyer purchased the portfolio, which spans 608,314 square feet of retail space, for $223.9 million. Danny Finkle, Eric Williams, Jorge Portela and Kim Flores of JLL represented PGIM in the disposition. The buyer was not disclosed, but Business Observer reports that Publix Super Markets bought the portfolio from PGIM. The assets in the portfolio include Crestwood Square in Royal Palm Beach; Davie Shopping Center and Regency Square in Davie; Gladiolus Gateway in Fort Myers; Town Center at Orange Lake and Village Shops at Bellalago in Kissimmee; and Woods Walk Plaza in Lake Worth.