MORRISVILLE, N.C. — Foxfield has purchased 3503 Page Road, a newly built, 57,000-square-foot life sciences building located in Morrisville, about 14 miles west of Raleigh. The seller and sales price were not disclosed. Kryosphere, a biorepository solutions and cold chain logistics user, operates the facility under a 12-year net lease. The company has invested $5 million into the specialized build-out for pharmaceutical-grade cold storage infrastructure, with plans for an additional $5 million investment for equipment upgrades, according to Foxfield. Built in 2025, 3503 Page Road is situated within the World Trade Park industrial park and offers direct connectivity to I-40, I-540 and Raleigh-Durham International Airport. The building features industrial space, lab support and research-and-development space, as well as 24-foot clear heights.

Southeast

Sands Investment Group Brokers $23.4M Sale of Kroger-Anchored Center in Metro Atlanta

by John Nelson

LAWRENCEVILLE, GA. — Sands Investment Group has brokered the $23.4 million sale of River Exchange Shopping Center, a 273,023-square-foot, Kroger-anchored shopping center located in Lawrenceville, roughly 30 miles northeast of downtown Atlanta. Liam Rowan and Tyler Baughman of Sands represented the seller, a joint venture between BASH Capital, Dragonfly Investments and Baltimore-based America’s Realty LLC, and the buyer, an entity doing business as Vishal River Exchange LLC, in the transaction. SouthState Bank provided acquisition financing. River Exchange was 80 percent leased at the time of sale to tenants including Goodwill, ReStore, Citi Trends, Cato Fashions, Farmers Furniture, Subway, Riverside Pizza and Cosmetic Dental.

TAMPA, FLA. — Benderson Development has begun the transformation of 702 North Franklin Street, a 300,000-square-foot office building in downtown Tampa. The nine-story property was formerly the longtime corporate headquarters building for Tampa Electric (TECO) and Peoples Gas. Benderson has tapped CBRE to lease and market the building’s office space, while Benderson will lease the property’s 20,000 square feet of ground-level retail space. The renovations will include extensive work on the building’s façade, including new signage opportunities for future tenants, as well as interior upgrades.

DURHAM, N.C. — Atlanta Property Group (APG) has acquired North 70 Distribution Center, a 250,000-square-foot, vacant distribution facility located at 224 N. Hoover Road in Durham. This acquisition marks APG’s first industrial investment in the Durham submarket. The seller was not disclosed. Situated in Research Triangle Park along the I-40 corridor, North 70 Distribution Center spans 16 acres and features 26 dock-high doors, two drive-in doors, 22-foot clear heights, tilt-wall construction, LED warehouse lighting, parking spaces for cars and trailers and more than 3 acres of secured outdoor storage. The existing walls and office build-outs allow for single-tenant or multi-tenant configurations, with the ability to accommodate users ranging from approximately 50,000 to 250,000 square feet. Approximately 40 percent of the facility is air-conditioned.

GERMANTOWN, TENN. — A joint venture between locally based Fogelman Properties and Dallas-based Thackeray Partners has acquired The Vineyards, a 200-unit luxury apartment complex located in Germantown, roughly 21 miles southeast of Memphis. The seller and sales price were not disclosed. This transaction marks the 18th acquisition for the Fogelman-Thackeray partnership, which comprises more than 4,000 units. Built in 1997, The Vineyards offers one-, two- and three-bedroom apartments ranging in size from 778 to 1,661 square feet, according to Apartments.com. Amenities at the property include a fitness center, business center, clubhouse, swimming pool, picnic area and onsite maintenance, as well as walking and biking trails. Fogelman plans to renovate unit interiors, build a new pickleball court and enhance the clubhouse, fitness center, grilling pavilion and pool areas. The property, which was 93 percent occupied at the time of sale, is managed by Fogelman.

NEW ROCHELLE, N.Y. AND WEST PALM BEACH, FLA. — Private equity firm New State Capital Partners has acquired West Palm Beach-based Vast Coworking Group, which operates more than 200 coworking offices across the world, spanning roughly 2.7 million square feet and serving 70,000 members. The coworking company’s brands include VentureX, Office Evolution and the Intelligent Office. Jason Anderson will continue to serve as CEO of Vast. Morgan, Lewis & Bockius LLP was New State Capital’s legal counsel, while Ice Miller LLP and Boxwood Partners represented the seller, United Franchise Group. Additional terms of the transaction were not disclosed. This purchase marks New State Capital’s second major investment from its fourth investment fund.

Container Collective to Relocate to Morris Square Mixed-Use Development in Downtown Charleston

by Abby Cox

CHARLESTON, S.C. — The Container Collective, a holistic wellness center and coworking community for practitioners, will relocate to Morris Square, a mixed-use redevelopment in downtown Charleston. Formerly situated at 210 Coming St., The Container Collective has purchased a ground-floor condominium to relocate its wellness and massage therapy practice to 21 Jasper St. Renovations are expected to begin soon, with the new location opening upon completion. GiGi Gilden and Jack Owens of NAI Charleston represented The Container Collective in the transaction. Shea Robbins of Carolina One Real Estate represented the undisclosed seller. The sales price was also not disclosed.

As Nashville closes out 2025, the industrial market has solidified its reputation as a resilient powerhouse in the Southeast. With record investment volumes exceeding $2.2 billion and vacancy rates remaining well below national averages, the Nashville MSA continues to attract distributors, manufacturers, and data center-related businesses. This robust performance reflects a recalibration from pandemic-era highs while maintaining durable demand, setting the stage for balanced growth in 2026. Trends shaping the market Several macroeconomic trends are influencing Nashville’s industrial landscape. Nearshoring/onshoring and supply chain diversification have heightened the city’s appeal as a logistical hub. It is important to note that Nashville is strategically located within a day’s drive of over half the U.S. population. Locally, job growth has outpaced the national average, with Oxford Economics reporting a 1.1 percent increase in 2025, bolstered by gains in manufacturing, logistics and retail. Notably, Moody’s Analytics highlights transportation equipment manufacturing as a key driver, as automakers increase domestic production to mitigate tariffs. Further enhancing Nashville’s logistical capabilities, the planned expansion of air freight capacity at Nashville International Airport in 2027 is poised to solidify the region’s role in cargo throughput, supported by a robust highway network and a growing labor force. Despite broader economic …

The March 2 France Media webinar “Flood Zones & FEMA Compliance — How Developers Avoid Delays, Cut Insurance Costs & Increase Property Value,” hosted by France Media and sponsored by National Flood Experts, examined how flood zones and evolving regulatory requirements are shaping development and financing outlooks. Flood risk is often treated as a late-stage compliance issue, but it can influence site design, permitting timelines, construction costs (and cost expectations) and long-term insurance expenses. Flood maps established by federal and local authorities define development constraints such as base flood elevations and floodways. Because these maps are updated slowly and regulations vary by municipality, developers frequently encounter unexpected complications during permitting, including the need for additional engineering studies, modeling requirements and extended approval timelines. The webinar panelists emphasized ways that developers can mitigate these risks by approaching flood zones strategically and incorporating flood analysis earlier in the development lifecycle. Early collaboration can identify opportunities to cut costs and avoid delays. Watch this brief webinar to learn about common problems caused by flood zones, changes in regulatory needs and practical pathways to help reduce or eliminate flood zone requirements (to increase the value of properties). Click here to download the slide presentation. …

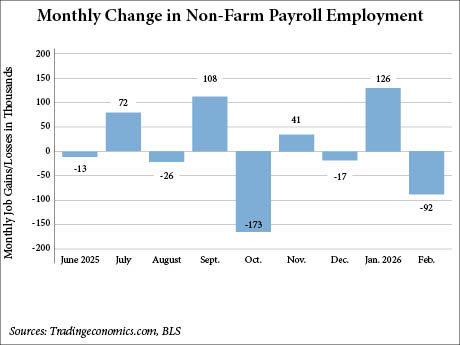

WASHINGTON, D.C. — The U.S. Bureau of Labor Statistics (BLS) has reported that the U.S. economy lost 92,000 jobs in February, compared to the previously estimated gain of roughly 50,000 by Dow Jones economists, according to CNBC. Meanwhile, the U.S. unemployment rate slightly increased to 4.4 percent. The BLS has also downwardly revised the December job gains from +48,000 to -17,000, a difference of 65,000. With the revision, the U.S. economy has now posted job losses in three of the past five months. (The BLS also revised January’s gains but only slightly, from +130,000 to +126,000 jobs.) The healthcare sector, which has been the primary growth driver in payrolls, saw a loss of 28,000 jobs in February, largely due to a strike at Kaiser Permanente in Hawaii and California. Offices of physicians lost 37,000 jobs in February, while hospitals added 12,000 jobs. Information services also lost jobs (-11,000), as part of a 12-month trend in which the sector has forfeited an average of 5,000 jobs per month, CNBC reported. Additionally, federal government employment declined by 10,000 for the month, and is down by 330,000 jobs since October 2024. The BLS reports that transportation and warehousing saw a reduction (-11,000), with …