NEWNAN, GA. — Thompson Thrift plans to develop Wrenly, a 214-unit apartment community in Newnan, a city approximately 40 miles southwest of downtown Atlanta. The Indiana-based developer expects to welcome residents by April 2027, with full completion slated for early 2028. The 29-acre community will comprise one-, two- and three-bedroom apartments within six residential buildings. Amenities will include a 24-hour fitness center, a pool with a waterfall feature, firepit with seating areas, grills, pickleball court, dog park and a business center.

Southeast

NASHVILLE, TENN. — Boyle Investment Co. has acquired Woodmont Centre, a two-building office park located at 102 and 104 Woodmont Blvd. in Nashville. The property is situated at near I-440 on the outskirts of the city’s Belle Meade neighborhood. The complex comprises a nine-story office building and a five-story office building connected by a shared lobby, along with a multi-level parking garage accommodating approximately 500 vehicles. The undisclosed seller began capital improvements to Woodmont Centre that Boyle Investment plans to complete. The sales price was not disclosed.

RICHMOND, VA. — Greenberg Gibbons has broken ground on Midtown64, a more than $500 million mixed-use development comprising 46 acres in Henrico County, located just outside downtown Richmond. Shamin Hotels is a joint venture partner for the project, which is being built on the former Genworth Financial headquarters campus. The personal finance firm signed a 175,000-square-foot office lease in late 2022 to move its headquarters to the SunTrust Business Center in the Richmond suburb of Glen Allen, Va. Located at the intersection of West Broad Street and I-64, Midtown64 will span 2 million square feet with up to 130,000 square feet of upscale retail, restaurant and entertainment space. Anchor tenants will include a grocery store and new-to-market fitness concept. The project will also include up to 300,000 square feet of Class A office space, an apartment community with nearly 1,000 units, 194 townhomes built by homebuilder Lennar and a 226-room, dual-branded hotel featuring Tempo by Hilton. Greenberg Gibbons says the development will feature contemporary architecture, landscaped plazas and convenient parking within a walkable environment. “Midtown64 builds on our track record of revitalizing properties into thriving mixed-use destinations, while marking an exciting expansion of our portfolio in Virginia,” says Brian Gibbons, …

Prestige, Brunetti Deliver 341-Unit Apartment Community at Hialeah Park Race Track & Casino in Metro Miami

by John Nelson

HIALEAH, FLA. — A partnership between Prestige Cos. and Brunetti Organization has completed Flamingo Village, a 341-unit apartment community located at 2200 E. Fourth Ave. within the 200-acre Hialeah Park Race Track & Casino campus. The community is situated on 13 acres and represents the largest development on the site since the casino opened in 2013. Brunneti is the master developer of Hialeah Park, which is located about 11.5 miles northwest of Miami. Centennial Bank provided a $60.7 million construction loan to the co-developers for Flamingo Village, which features floorplans ranging in size from 890 to 1,375 square feet in garden-style and townhome layouts. Monthly rental rates range from $2,600 to $3,375, according to Apartments.com. Amenities include two clubhouses, swimming pools, wide landscaped walkways, a fitness center with a yoga and meditation studio, business center, pet play area, a park and tanning deck. Flamingo Village is situated within walking distance of the Hialeah Metrorail station.

JLL Arranges $59M Loan for Refinancing of Affordable Housing Portfolio in Upstate South Carolina

by John Nelson

GREENVILLE, S.C. — JLL has arranged a $59 million loan for the cross-collateralized, cash-out refinancing of three affordable housing communities in the Upstate South Carolina region totaling 598 units. The properties include Paris Park and Terrain at Haywood in Greenville and Mauldin Meadows in Mauldin. Carter Wroblewski, Taylor Allison and Sydney Powell of JLL arranged the three-year, interest-only loan through Truist Bank. The borrower, Affordable Upstate, purchased the properties between December 2021 and September 2022 and has since invested $13.6 million in capital improvements. The company purchased each community using a similar equity structure, which allowed for the cross collateralization, according to JLL. The properties are managed by NOAH Property Management and feature self-imposed rent restrictions of 60 percent and 80 percent of the area median income (AMI).

Cushman & Wakefield Commercial Advisors Negotiates Sale of 169,272 SF Industrial Facility in Memphis

by John Nelson

MEMPHIS, TENN. — Cushman & Wakefield Commercial Advisors has negotiated the sale of a 169,272-square-foot industrial facility located at 4481 Distriplex Cove in Memphis. Olymbec USA LLC, a division of Montreal-based industrial owner Olymbec, purchased the property from tire manufacturer and distributor China Manufacturers Alliance LLC (CMA LLC) for an undisclosed price. Landon Williams and Katie Hargett of Cushman & Wakefield Commercial Advisors represented the seller in the transaction, and Brian Califf of NAI Saig represented the buyer.

CHICAGO — Vestian, a Chicago-based commercial real estate services firm, has recently secured three commercial leases in North Carolina for three global manufacturers. The deals include an industrial lease for HEYCO-Werk USA, a tech manufacturer for plastic injection and two-shot molding; a lease for a new experience center in Charlotte for corrugated box manufacturer BHS Corrugated; and an industrial lease for BICASA North America, a provider of technical lab furniture. Information on the landlords and specific locations were not released.

JACKSON, MISS. — Legacy Realty Group Advisors has arranged the sale of Westland Plaza, a 214,281-square-foot shopping center located in Jackson, for $11.8 million. Grocery Depot anchors the property, which is also home to a mix of additional tenants including Planet Fitness, Family Dollar, Hibbett Sports, Rent-A-Center, Rainbow Shops and City Gear. Jacob Baruch, Daniel Baruch and Ari Warshaw of Legacy Realty Group represented the buyer in the transaction. Beezie Landry and Justin Langlois of Stirling Investment Advisors represented the seller. Both parties requested anonymity.

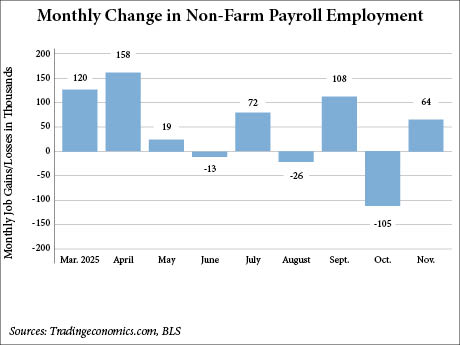

WASHINGTON, D.C. — The U.S. economy has added 64,000 non-farm payroll jobs in November and lost 105,000 jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). The BLS included the October figures into the November report due to complications with the federal government shutdown, which lasted for 44 days in October and early November. The bureau, which also delayed the release of the consumer price index and producer price index in October, plans to release the December jobs report on Jan. 9, 2026. The November figure was higher than the 45,000 estimate from Dow Jones economists, according to CNBC. The news outlet also reported that the economists didn’t make an official estimate for the October report but were largely anticipating a drop in employment. In addition to the delayed report, the BLS also revised downward the employment figures for August, from a loss of 4,000 jobs to -26,000, and September, from 119,000 jobs to 108,000. The U.S. unemployment rate also ticked up 20 basis points from September to 4.6 percent in November, its highest level since September 2021. Federal government employment continued to decrease in November with a loss of 6,000 jobs. This follows a decline of …

Shamin Hotels Breaks Ground on $160M Hilton-Branded Hotel, Conference Center in Richmond

by Abby Cox

RICHMOND, VA. — Virginia’s largest hotel owner and operator Shamin Hotels has broken ground on Hilton Richmond The Mondelle, a 270-room full-service hotel and conference center located in Chesterfield County. The $160 million project will anchor Springline at District 60, a $1 billion mixed-use development underway at the intersection of Midlothian Turnpike and Chippenham Parkway. The Mondelle will feature more than 30,000 square feet of meeting space, including a 12,600-square-foot grand ballroom. The 11-story hotel will also include a signature restaurant with outdoor dining, a second-floor indoor/outdoor executive meeting center with a biergarten, a rooftop restaurant and cocktail bar, as well as an infinity pool. Truist Bank provided construction and bond financing for the project, which represents the first full-service hotel and conference center to be constructed in the Richmond market since 2009.