RICHMOND, VA. — BWE has arranged a $47 million loan to refinance Discovery Village at the West End, a senior living community located at 9801 Harmony Woods Way and 2422 University Blvd. in Richmond. Totaling 219 units, the property features independent living, assisted living and memory care residences situated on one contiguous campus. Amenities include restaurant-style dining, a Legends club and bar, wellness center, movie theater, concierge services and programming, including lectures, fitness classes and onsite therapy. The property was 93 percent occupied at the time of financing. Ryan Stoll and Taylor Mokris of BWE secured the financing on behalf of the borrower, an undisclosed private equity investor.

Southeast

Cushman & Wakefield Brokers $14.5M Sale of 8520 Pepco Place Industrial Property Near DC

by John Nelson

MARLBORO, MD. — Cushman & Wakefield has brokered the $14.5 million sale of 8520 Pepco Place, an industrial warehouse located in Marlboro, approximately 15 miles southeast of Washington, D.C. Jonathan Carpenter, Graham Savage, Dawes Milchling and James Check of Cushman & Wakefield represented the seller, TSI Corp., in the transaction. EQT Exeter was the buyer. TSI Corp. developed the facility in 2011. Totaling 75,000 square feet, the property features 25- to 26-foot clear heights, 120 parking spaces, five drive-in doors, two dock doors and a 125-foot building depth. The warehouse was fully leased to Harris Co., a national mechanical contractor, at the time of sale.

North America Sekisui House Breaks Ground on 35,000 SF Retail, Restaurant Development in Metro Charleston

by John Nelson

SUMMERVILLE, S.C. — An affiliate of North America Sekisui House (NASH) has broken ground on Marketplace at Nexton, a new retail and restaurant project at the company’s Nexton master-planned community in the Charleston suburb of Summerville. Upon completion, the development will total 35,000 square feet of retail and restaurant space across six one-story buildings ranging from 3,500 to 10,000 square feet in size. Tenants at Marketplace at Nexton will include Dunkin’, sweetFrog, El Patron, Rotolo’s Craft and Crust Pizza, Dance Moves of Charleston, Shimmer and a liquor store. SL Shaw & Associates is the project designer and builder. Bridge Commercial manages leasing for the project, which is scheduled to open in 2025.

BEAUFORT, S.C. — Three new tenants have opened at Beaufort Station, a shopping center situated about 30 miles north of Hilton Head Island in Beaufort. Hobby Lobby, Five Below and Rack Room Shoes have opened stores at the property, which is anchored by T.J. Maxx and HomeGoods. Additionally, Ross Dress for Less, PetSmart, Ulta Beauty, Old Navy, Aldi, Mattress Firm, Surcheros, Panda Express, Americas Best and Chicken Salad Chick have signed leases at the center. The Morgan Cos. is the landlord.

NEW KENT COUNTY, VA. — Matan Cos. has purchased 185 acres east of Richmond for the development of New Kent Logistics Center, a 2 million-square-foot industrial park. JLL arranged the land sale on behalf of Matan Cos. Located at the intersection of I-64 and Emmaus Church Road in New Kent County, the property will span four buildings and be situated between the industrial markets of Richmond and Hampton Roads, the latter of which houses the Port of Virginia. Matan has selected Gareth Jones, Chris Avellana and Charlie Polk of JLL to lease New Kent Logistics Center. The construction timeline was not disclosed.

CBRE Negotiates Sale of 894-Bed Student Housing Community Near Appalachian State University

by John Nelson

BOONE, N.C. — CBRE has negotiated the sale of The Cottages of Boone, an 894-bed student housing community located near the Appalachian State University campus in Boone. Jaclyn Fitts, William Vonderfecht and Casey Schaefer of CBRE’s national student housing team, in partnership with Kevin Kempf of the company’s Southeast multifamily group, represented the seller, Mapletree Global Student Accommodation Private Trust, in the transaction. Timberline Real Estate Ventures and a real estate fund managed by Ares Management acquired the property for an undisclosed price. The cottage-style community offers shared amenities including a fitness center, yoga studio, dry sauna, steam room, clubhouse, arcade games and sports tables, a bar, library, computer lounge, private conference room, swimming pool, hot tub, fire pit, grilling station and an outdoor fireplace.

Cushman & Wakefield, Greystone Arrange Sale of 247-Unit W Flats Apartments in East Charlotte

by John Nelson

CHARLOTTE, N.C. — A joint venture between Cushman & Wakefield and Greystone has arranged the sale of W Flats, a 247-unit apartment community located at 7200 Wallace Road in east Charlotte. Rise48 Equity LLC purchased the property from LIV Acquisitions for an undisclosed price. Paul Marley, John Phoenix, Alex McDermott and Gavin Conlon of Cushman & Wakefield represented the seller in the transaction. Donny Rosenberg and Daniel Kaweblum of Greystone originated a three-year, acquisition loan featuring two one-year extension options on behalf of the buyer. According to Apartments.com, W Flats features studio, one- and two-bedroom apartments ranging in size from 523 to 1,079 square feet. Amenities include a pool with a sundeck, fitness center, business center, laundry facilities, tenant lounge, onsite maintenance and package services.

NORFOLK, VA. — S.L. Nusbaum Realty Co. has brokered the $34.9 million sale of an industrial facility located at 3321 Princess Anne Road in Norfolk. Industrial Realty Group acquired the 298,126-square-foot warehouse from an entity doing business as 3321 Princess Anne LLC. Stephanie Sanker of S.L. Nusbaum represented the seller in the transaction. LION Power and Beckett Corp. currently occupy a combined 104,334 square feet at the facility, with the remaining space available for lease. Constructed in 2022, the building comprises two sections. Section A features 113,450 square feet with 36-foot clear heights, multiple dock doors with expansion potential, new racking, office space and restrooms. Section B totals 80,321 square feet with dock-level loading, 21- to 24-foot clear heights and 38- by 36-foot column spacing.

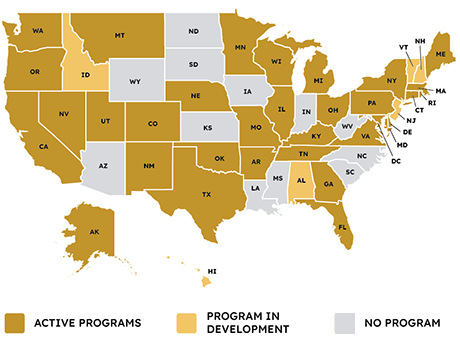

It may have taken more than a decade, but after starting out as a niche financing vehicle to create more energy-efficient and resilient buildings, the commercial property assessed clean energy (C-PACE) program has arguably achieved mainstream acceptance. Roughly 40 states and Washington, D.C., now either offer or are developing C-PACE programs. Over the last year alone, Georgia, Hawaii, New Mexico, Minnesota and Idaho passed legislation enabling or substantially improving the financing tool, points out Rafi Golberstein, CEO of PACE Loan Group, a direct lender of C-PACE headquartered in Minneapolis, Minn. What’s more, he adds, New Jersey and North Carolina are among states that in the coming months are expected to advance bills authorizing the use of C-PACE, or PACE for short. Given the current partisanship within the country, one of the most revealing characteristics of PACE’s growing appeal has been its ability to cross the political aisle, Golberstein observed. PACE’s popularity in particular has ascended over the last several months as developers have sought fresh capital to enhance their financial flexibility in a rising interest rate environment. “PACE is really turning out to be a bipartisan issue, as many state lawmakers are realizing that it is a great financing tool …

CORAL GABLES, FLA. — Locally based CMC Group has obtained a $69.9 million loan for the refinancing for 4000 Ponce, a mixed-use development located in Coral Gables, a western suburb of Miami. City National Bank of Florida provided the loan to CMC, whose affiliate Ugo Colombo developed the nine-story project in 2002. Paul Stasaitis, Paul Adams and Nicole Barba of JLL arranged the five-year, floating-rate loan on behalf of CMC Group. Situated at the intersection of Ponce de Leon Boulevard and Bird Road, 4000 Ponce features The Collection, a luxury car dealership whose brands include Ferrari, Aston Martin, Porsche, Maserati, Alfa Romeo, McLaren and Audi. The property also includes 150,000 square feet of office space and 32,000 square feet of retail space. 4000 Ponce was 90 percent leased at the time of sale to tenants including Steinway & Sons, Coldwell Banker, Hemisphere Media Group, Korn Ferry, Evensky & Katz, Pure Barre and Jetset Pilates.