PORT ST. LUCIE, FLA. — Berkadia has arranged the sale of a 22-acre multifamily development site at 3043 S.E. Port St. Lucie Blvd. in Port St. Lucie, a city in South Florida. Development firm Ciprés acquired the parcel from Sympatico Real Estate for $8.5 million, with plans to develop a 324-unit community at the site. A construction timeline was not disclosed. Omar Morales, Jaret Turkell, Roberto Pesant and Yoav Yuhjtman of Berkadia arranged the transaction. Javier Herrera of Franklin Street acted as the land lender broker, and Vertix provided acquisition financing.

Southeast

STOCKBRIDGE, GA. — Thompson Thrift has announced plans to develop a 212-unit multifamily community at 2245 Jodeco Road in Stockbridge, a southeast suburb of Atlanta. Dubbed The Levi, the property will feature one-, two- and three-bedroom apartments averaging 1,100 square feet in size. Amenities at the community will include a 24-hour fitness scenter, swimming pool, firepits, outdoor grills, work suites, a pickleball court, dog park, pet spa and a Starbucks coffee bar. The Levi will be situated within the 158-acre master-planned Bridges at Jodeco development. A construction timeline was not disclosed.

NewPoint Provides $22.3M Freddie Mac Refinancing for Two Adjacent Apartment Communities in Metro DC

by John Nelson

TAKOMA PARK, MD. — NewPoint Real Estate Capital has provided $22.3 million in Freddie Mac Workforce Housing Preservation financing to NOVO Properties for the refinancing of two apartment communities in Takoma Park. Located adjacent to one another, the properties — Tudor Place Apartments and Canonbury Square Apartments — are situated roughly five miles outside downtown Washington, D.C. Tudor Place and Canonbury Square offer a mix of one- and two-bedroom apartments, comprising 134 and 95 units, respectively. The refinancing agreement includes a provision to designate 50 percent of the units as affordable housing for residents earning 80 percent or less of the area median income (AMI). NOVO will continue to manage the properties through its in-house property management division. Martin Fayer of NewPoint originated the financing, which features a five-year term with interest-only payments for the full term.

RALEIGH, N.C. — Blueprint Healthcare Real Estate Advisors has brokered the sale of a 143-unit independent living community in Raleigh. Opened in 2019, the seniors housing property features a variety of unit types. The seller was an unnamed national developer/investor. Focus Healthcare Partners and Solera Senior Living acquired the asset for an undisclosed price. Alex Florea and Kyle Hallion of Blueprint arranged the transaction.

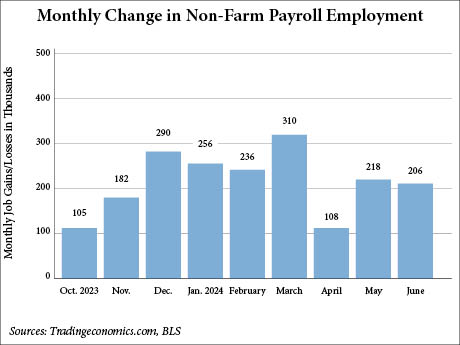

BLS Reports US Economy Adds 206,000 Jobs in June, Revises April and May Down Significantly

by John Nelson

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 206,000 jobs in June, according to the U.S. Bureau of Labor Statistics (BLS). This figure slightly surpasses the expectations of Dow Jones economists, which predicted an increase of 200,000, according to CNBC. The number does, however, fall below that of May, which the BLS revised down to 218,000 jobs. The BLS also significantly revised the employment gains for April, from 165,000 jobs to 108,000. Combined, the BLS revised the prior two months down by a combined 111,000 jobs. Government employment increased by 70,000 jobs in June, higher than the average monthly gain of 49,000 over the prior 12 months. Other sectors with noteworthy gains included healthcare (49,000 jobs), social assistance (34,000) and construction (27,000). Other major industries saw little change. Employment in professional and business services fell by 17,000 jobs month-over-month, led by losses in temporary services, a subcategory that has tumbled by 515,000 jobs since March 2022. The unemployment rate in June increased slightly, reaching 4.1 percent. This marks the highest level since October 2021. According to CNBC, forecasts had called for the rate to hold steady at 4 percent.

BALTIMORE — CBRE has negotiated the $140.5 million sale of Baltimore Crossroads, a six-building industrial portfolio totaling nearly 900,000 square feet in Baltimore’s East industrial submarket. EQT Exeter purchased the portfolio, which was 97 percent leased at the time of sale. Bo Cashman and Jonathan Beard of CBRE represented the undisclosed seller in the transaction. The assets within the Baltimore Crossroads portfolio are situated on nearly 200 acres along the I-95 corridor near the Port of Baltimore. Located at 1405, 1409 and 1411 Tangier Drive and 11501, 11503 and 11505 Pocomoke Court, the buildings range in size between 42,275 and 435,490 square feet.

Vista Residential Breaks Ground on 277-Unit Mixed-Use Apartment Community in Holly Springs, North Carolina

by John Nelson

HOLLY SPRINGS, N.C. — Vista Residential Partners has broken ground on Main Street Vista, a 277-unit mixed-use apartment community in Holly Springs, a southwest suburb of Raleigh. The 11.7-acre development site is located at the corner of North Main Street and Holly Springs Road. Main Street Vista will feature a mix of one-, two- and three-bedroom apartments averaging almost 1,050 square feet, as well as 19,000 square feet of retail space and 11,000 square feet of live-work space. Select apartments will have a ground-floor office space available for lease to prospective tenants who desire to work from home. Designed by Niles Bolton, Main Street Vista will feature a clubhouse, resort-style swimming pool, fitness center, central green area, pet park and 24/7 package concierge services. Dome Equities and two Ohio-based life insurance companies provided financing for the project. The construction timeline was not disclosed.

Octave Holdings Acquires 269,253 SF Belgate Shopping Center in Charlotte’s University District

by John Nelson

CHARLOTTE, N.C. — Octave Holdings and Investments LLC has purchased Belgate Shopping Center, a 269,253-square-foot power retail center in Charlotte’s University district. The Alpharetta, Ga.-based buyer’s investment fund, Octave Realty Fund IX LLC, acquired the center for an undisclosed price. The seller was also not disclosed. Located at the intersection of North Tryon Street and University City Boulevard, Belgate Shopping Center is situated within one mile of University of North Carolina – Charlotte, as well as near North Carolina’s only IKEA store. The property was fully leased at the time of sale to tenants including Hobby Lobby, T.J. Maxx, Burlington, Marshalls, PetSmart, Old Navy, Shoe Carnival and Ulta Beauty. Shadow anchors of the center include Topgolf and Walmart Supercenter. Octave’s in-house property management company, Pinnacle Leasing and Management, will operate Belgate Shopping Center.

Berkadia Arranges $39.9M Acquisition Loan for Brantley Pines Apartments in Fort Myers, Florida

by John Nelson

FORT MYERS, FLA. — Berkadia has arranged a $39.9 million acquisition loan for Brantley Pines Apartments, a 296-unit multifamily community located at 1801 Brantley Road in Fort Myers. Mitch Sinberg, Michael Basinski, Brad Williamson and Scott Wadler of Berkadia’s South Florida office arranged the five-year, fixed-rate Freddie Mac loan on behalf of the borrower, Boca Raton, Fla.-based Interface Properties. The seller was not disclosed. Built in two phases between 1988 and 1997, Brantley Pines is situated near Southwest Florida International Airport. The property features one-, two- and three-bedroom floor plans, as well as a 24-hour fitness center, pool, grills, business center, pickleball court and a pet park. Interface Properties plans to complete a light value-add program at the community during its ownership.

Marcus & Millichap Brokers $8.3M Sale of Adjacent Retail Properties in Milledgeville, Georgia

by John Nelson

MILLEDGEVILLE, GA. — Marcus & Millichap has brokered the $8.3 million sale of two retail properties located in Milledgeville. An undisclosed buyer acquired Town Central Shopping Center, a 140,097-square-foot retail center, and an adjacent single-tenant property totaling 54,765 square feet. Food Depot occupies the single-tenant property. Tenants at Town Central Shopping Center, which was fully leased at the time of sale, include Tractor Supply Co. Zach Taylor and Eric Abbott of Marcus & Millichap represented the seller of the shopping center, and Robby Pfeiffer of Marcus & Millichap represented the seller of the single-tenant, Food Depot property. Taylor, Abbott and Pfeiffer worked together to procure the buyer. “This sale is a prime example of the robust demand for grocery-anchored retail centers with below-market rents,” says Taylor.