SANFORD, FLA. — Working on behalf of Crescent Communities, Doster Construction Co. has completed Novel Parkway, a 325-unit apartment community situated along International Parkway in Sanford, a northeast suburb of Orlando. The property features a mix of one-, two- and three-bedroom apartments ranging in size from 656 to 1,527 square feet. Monthly rental rates range from $1,700 to $3,437, according to Apartments.com. Novel Parkway features 10,000 square feet of amenities, including a pool, fitness center, clubhouse, business center and walking/biking trails.

Southeast

Cortland Acquires 240-Unit Harbour Cove Apartments in South Florida, Plans Renovation

by John Nelson

PEMBROKE PINES, FLA. — Atlanta-based Cortland has acquired Harbour Cove, a 240-unit, Class B apartment community located in Pembroke Pines, a city in South Florida’s Broward County. Cortland has renamed the property as Cortland Harbour Cove. The community features two-bedroom apartments and three-bedroom units with dens, as well as a fitness center, clubhouse, playground, tennis courts and volleyball courts. Cortland plans to make capital improvements to the property, including full kitchen renovations, new lighting and plumbing fixtures, cosmetic upgrades to the clubhouse and fitness center and the addition of a new dog park and pickleball court. Nearby attractions to Cortland Harbour Cove include Pembroke Pines City Center and Miramar. The seller and sales price were not disclosed. With this acquisition, Cortland now owns and operates four assets in Broward County alone and 46 assets spanning more than 16,000 units across Florida.

MARIETTA, GA. — BWE has arranged a $35 million bridge loan for the refinancing of Sedgefield Apartments, a 280-unit multifamily community located at 1136 W. Commons Lane in Marietta, a northwest suburb of Atlanta. Alan Tapie, Thomas Wiedeman, Brad Walker and Hanley Long of BWE arranged the interest-only loan on behalf of the borrower, RPM Living. Sedgefield Apartments features one-, two- and three-bedroom floor plans, as well as a fitness center, playground, green space, swimming pool, laundry facility and a grilling area.

CHARLESTON, S.C. — Marcus & Millichap has brokered the $13.3 million sale of Courtyard North Charleston, a 123-room hotel located at 2415 Mall Drive in Charleston. Built in 1999, the hotel is situated near Charleston International Airport, Tanger Outlets Charleston and the Charleston Area Convention Center. The property features an outdoor swimming pool, fitness center, and meeting and banquet facilities. Jack Davis, Joce Messinger and Chase Dewese of Marcus & Millichap’s Charleston office procured the buyer, Baron Hospitality, in the transaction. The seller was not disclosed.

Dalfen Industrial, RGA Form Joint Venture for 253,055 SF Industrial Portfolio in Arizona, Georgia

by Amy Works

GILBERT, ARIZ., AND ALPHARETTA AND NORCROSS, GA. — Cushman & Wakefield has advised Dalfen Industrial in the disposition and recapitalization of a multi-tenant industrial portfolio, totaling 253,055 square feet across two projects in Atlanta and Phoenix metro markets. The dual-project portfolio was owned in Dalfen Industrial’s Value-Add Fund IV and was recapitalized in a joint venture between Dalfen Industrial and RGA ReCap Inc. on behalf of Reinsurance Group of America Inc. Terms of the transaction were not released. Located in Gilbert, Gilbert Distribution Center is a freestanding Class A industrial building at 1495 E. Baseline Road. Two tenants fully occupy the property, which features multiple points of ingress/egress, multiple storefronts, loading, functional column spacing and concrete truck aprons on a 140-foot truck court. The North Atlanta Infill Portfolio is a collection of four multi-tenant, rear-load, light industrial buildings located at 6205 and 6215 Shiloh Crossing in Alpharetta and 2915 Courtyards Drive and 3055 Northwoods Circle in Norcross. The properties are a combined 86 percent leased to eight tenants, three of which recently extended their lease terms. The buildings offer 18- to 22-foot clear heights, rear loading, a mix of drive-in and dock-high doors, and multiple glass store fronts. Will Strong, Michael …

Arey Group Begins Leasing 198-Unit Taylor Apartments in Historic Downtown Opelika, Alabama

by John Nelson

OPELIKA, ALA. — Arey Group has begun leasing The Taylor, a 198-unit apartment community underway at 411 S. 10th St. in historic downtown Opelika, about seven miles from Auburn, Ala. Designed by Geheber Lewis Associates, the property will feature one-, two- and three-bedroom apartments available at monthly rates starting at $1,250. Focus Design Interiors designed the apartments, which will feature stainless steel appliances, quartz countertops and black and wood tone accents. Amenities will include a fitness center and an entertainment area. Arey Group plans to deliver The Taylor in the third quarter.

Cushman & Wakefield Arranges Sale of 118,583 SF Shopping Center in Fort Myers, Florida

by John Nelson

FORT MYERS, FLA. — Cushman & Wakefield has arranged the sale of Market Square, a 118,583-square-foot shopping center located in Fort Myers. An affiliate of Centro Corp., a Florida-based shopping center owner and operator, purchased the asset for an undisclosed price. Mark Gilbert, Adam Feinstein and Mitchell Halpern of Cushman & Wakefield represented the seller, an affiliate of Nuveen Real Estate, in the transaction. Built in 1993, Market Square was fully leased at the time of sale to tenants including DSW, Total Wine and More and American Signature Furniture. The center is shadow-anchored by Super Target.

NewPoint-Sponsored Fund Provides $13.3M Bond Financing for Affordable Housing Rehab in Southeast D.C.

by John Nelson

WASHINGTON, D.C. — NewPoint Real Estate Capital’s NewPoint Impact Fund I has provided $13.3 million in 501(c)(3) bond financing for Ridgecrest Apartments Phase II, a 128-unit affordable housing community in southeast Washington, D.C.’s Anacostia submarket. The New York-based borrower, The NHP Foundation, will use the funds to acquire, rehabilitate and recapitalize the community. Bryan Dickson of NewPoint arranged and structured the tax-exempt construction-to-permanent phased bond financing. Other capital partners in the development include DC Green Bank, the Office of the Deputy Mayor for Planning and Economic Development, DC Department of Housing and Community Development (DCHD) and the District of Columbia Housing Authority. The new financing will be combined with $29.2 million in soft debt and grants from the DCHD. Ridgecrest Phase II was previously operated as part of the larger Ridgecrest Village, a 1951-built development that NHPF purchased in 2019. After recapitalization, 20 percent of the Phase II units will be restricted at 30 percent of the area median income (AMI) to serve as permanent supportive housing. The remaining 80 percent of units will be restricted at 50, 60 and 80 percent of AMI. The garden-style apartment community features a mix of two- and three-bedroom units ranging in size from …

CLEARWATER, FLA. — SRS Real Estate Partners has brokered the $3.1 million ground-lease sale of a 5,447-square-foot McDonald’s restaurant in Clearwater. The restaurant was built in 2014 on a 1.4-acre site at 2871 Gulf to Bay Blvd., about 17 miles west of Tampa. Sean Lutz and Dan Elliot of SRS’ Chicago office represented the seller, a private investor based in Florida, in the transaction. The buyer, a New York-based private investor, purchased the land in a 1031 exchange at a closing cap rate of 3.87 percent, which is the lowest cap rate for a McDonald’s property sold on a national basis this year according to CoStar Group.

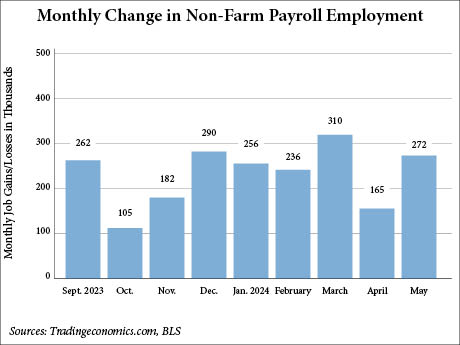

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 272,000 jobs in May, according to the U.S. Bureau of Labor Statistics (BLS). This figure exceeds the predictions of Dow Jones economists who anticipated a more modest increase of 190,000, according to CNBC. The May total also surpasses the rolling 12-month average of 232,000 jobs. The BLS also reports the U.S. unemployment rate rose slightly to 4 percent, the first time that the rate has eclipsed that mark since January 2022. Additionally, the BLS has made slightly downward revisions for employment in March and April, with 5,000 fewer reported in March (now 310,000 jobs total) and 10,000 fewer in April (now 165,000). Healthcare led all sectors in May, adding 68,000 jobs, which is in line with its average 64,000 jobs added over the prior 12 months. Within the healthcare category, employment grew in ambulatory health care services (+43,000), hospitals (+15,000) and nursing and residential care facilities (+11,000). Other employment sectors experiencing growth include government (+43,000); leisure and hospitality (+42,000); professional, scientific and technical services (+32,000, which is nearly double its monthly average of +19,000 over the prior 12 months); and social assistance (+15,000). Employment showed little or no …