By Christine Espenshade of Newmark Baltimore is an often-overlooked gem of a city along the Northeast Corridor between Washington, D.C., and New York City. This waterfront town is home to two major sports teams, a world-class symphony and art museums that rival those in the best cities around the world. Baltimore is more often referenced as the location for various crime TV shows rather than being known as home to two of the top medical facilities in the world — Johns Hopkins Hospital and the University of Maryland Medical System — Johns Hopkins University, and headquarters for famous companies such as Under Armour, T. Rowe Price and McCormick Spices. The multifamily market in Baltimore is also often overlooked by investors in favor of larger cities. However, to spur the development of top-quality rental products, Baltimore City and Baltimore County offer lucrative property tax abatements for new developments. The region continually sees consistent population growth due to the “eds and meds” nature of the economy, and the lower cost of living when compared to D.C. or Philadelphia attracts a well-educated workforce looking to enjoy the live-work-play lifestyle. The popularity of Baltimore for employers and employees is evident when considering the 35,000 …

Southeast

ORLANDO, FLA. — The Cordish Cos. has announced plans for a 73,000-square-foot dining and entertainment destination in Orlando. Dubbed Live! at the Pointe Orlando, under the company’s hospitality and entertainment brand, the property will feature a 4,800-square-foot cocktail lounge; 4,600-square-foot bar; and anchor venues Sports & Social and PBR Cowboy Bar. Sports & Social, a restaurant and bar concept, will span 11,700 square feet across two levels, with an LED display for viewing sporting events and social games including skee-ball, foosball, arcades games and shuffleboard. The 8,400-square-foot PBR Cowboy Bar will feature multiple signature bars, private VIP booths and a mechanical riding bull. Live! at the Pointe Orlando is scheduled to open this fall.

NEW ORLEANS — Cushman & Wakefield has brokered the $73 million sale of two hotels located in the Arts/Warehouse District of New Orleans. The properties include Courtyard by Marriott, which comprises 202 rooms, and SpringHill Suites by Marriott, which totals 208 rooms. A group led by Robert Guidry, along with Guidry Land Partners and David Bansmer, acquired the hotels, which are located at 300 Julia St. and 301 St. Joseph St. Bill Murney, Alyson Murney and Craig Hey of Cushman & Wakefield represented the undisclosed seller in the transaction.

JACKSONVILLE, FLA. — Presidium has completed Presidium Park, a 342-unit multifamily community located at 8181 AC Skinner Parkway in Jacksonville. The development features apartments in one-, two- and three-bedroom layouts, ranging from 616 to 1,703 square feet in size. Monthly rents at the community range from $1,450 to $2,875. Amenities at the property include a club room, game lounge, golf simulator and theater room, billiards room, fitness center, coworking lounge, coffee lounge and podcast rooms, situated within an 11,000-square-foot leasing and amenity center. The 400,000-square-foot community also features a rooftop terrace and lounge area, indoor and outdoor fireplaces, grilling stations, a swimming pool, electric vehicle charging stations, a car wash area, dog park and spa and bike storage and repair stations. Dwell Design Studio designed the property.

WASHINGTON, D.C. — Taicoon Property Partners has acquired 1899 L, a 152,000-square-foot office building situated along Restaurant Row in Washington, D.C. The property was renovated in 2022, with improvements to the main lobby, elevator cabs, HVAC, conference center, fitness center and bike room. The buyer plans to implement further renovations, including an updated façade, enhanced restrooms and common areas, redesigned retail storefronts and modernization of the amenities and infrastructure. Charlie Smiroldo and Matt Pacinelli of Stream Realty Partners represented Taicoon in the transaction. Stream also serves as the leasing agent for the building, which features available suites ranging from 2,500 to 13,000 square feet. Collins Ege and Bradley Allen of Eastdil Secured represented the undisclosed seller. The sales price was also not disclosed.

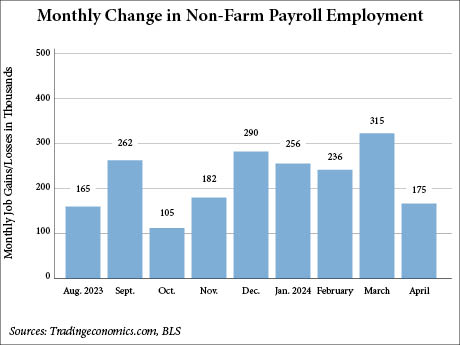

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 175,000 jobs in April, according to the U.S. Bureau of Labor Statistics (BLS). This marks a departure from the predictions of Dow Jones economists who anticipated a more robust increase of 240,000, according to CNBC. The unemployment rate increased to 3.9 percent, defying expectations that it would remain at 3.8 percent. This brings the rate to its highest since January 2022. The April number falls far below the employment figures of March — which were revised up by 12,000, reaching a new total of 315,000 jobs — as well as the average monthly gain of 242,000 over the prior 12 months. Total nonfarm employment figures for February were revised down by 34,000, leaving the figure at 236,000. Healthcare saw the most significant increase, adding 56,000 jobs. Transportation and warehousing and retail trade were the only other sectors with notable changes. Transportation and warehousing added 22,000 jobs, and the retail trade increased employment by a similar 20,000. Government and construction employment changed little in April, adding 8,000 and 9,000 jobs, respectively. Other major industries, including mining, quarrying, and oil and gas extraction; manufacturing; wholesale trade; information; financial activities; professional …

NASHVILLE, TENN. — Host Hotels & Resorts Inc. has purchased the fee simple interest in a two-hotel complex in downtown Nashville. The properties in the $530 million acquisition include 1 Hotel Nashville, a 215-room hotel, and the 506-room Embassy Suites by Hilton Nashville Downtown. Affiliates of Starwood Capital Group, Crescent Real Estate LLC and High Street Real Estate Partners sold the hotels, which they built in 2022. Situated adjacent to Bridgestone Arena and across from the Music City Convention Center, the hotels feature a combined 721 rooms averaging approximately 500 square feet in size, as well as seven food-and-beverage options, including Harriott’s Rooftop. Amenities include a spa with six treatment rooms, two fitness centers, a yoga studio and 33,000 square feet of shared meeting space, including a 9,400-square-foot ballroom and 9,300 square feet of pre-function space.

CHARLOTTE, N.C. — Stream Realty Partners has executed 70,000 square feet of leases at The Grove, a four-building office park located at 8520-8615 Cliff Cameron Drive in Charlotte, over the past 18 months. The landlord, B Group Capital Management, recently completed extensive renovations at the 260,000-square-foot property, which it purchased in fall 2022. These include the implementation of Google Fiber and physical upgrades to common areas and a new spec office suite. Grant Keyes and Holden Brayboy of Stream Realty represented the landlord in the lease negotiations. The deals include leases and/or lease extensions with Alliance Health, Bridge to Achievement, Autism Living Experience and Keller Williams.

RALEIGH, N.C. — SRS Real Estate Partners has brokered the ground-lease sale of a newly built, 2,775-square-foot retail property located at 615 Oberlin Road in Raleigh. Fifth Third Bank occupies the single-tenant property, which features a drive-thru ATM, on a 20-year lease. Matthew Mousavi and Patrick Luther of SRS’ Newport Beach, Calif., office represented the seller, a private developer, in the $6.9 million sale. A New York-based private investor purchased the asset at a 4.86 percent cap rate.

CHARLOTTE, N.C. — JLL has arranged the sale of CBI Distribution Center, a 60,000-square-foot industrial facility located at 2817 Westinghouse Blvd. in Charlotte. Built in 2017 within two miles of the I-485/I-77 interchange, the distribution center was fully leased at the time of sale to CBI Workplace Solutions, with 6.5 years of lease term remaining. An unnamed family investment company based in Charlottesville, Va., purchased the asset for an undisclosed price. Dave Andrews, Pete Pittroff, Josh McArdle and Michael Lewis of JLL represented the seller, an affiliate of Zurich Alternative Asset Management, in the transaction.