CHARLOTTE, N.C. — CP Group has executed nearly 70,000 square feet of lease deals this year at Harris Corners, a three-building office campus situated off I-77 on the north end of Charlotte. Five new tenants are joining the office campus, including Alight Solutions (4,011 square feet); Southern National Roofing (9,676 square feet); Fidelity National Title Insurance Co. (2,602 square feet); Adams Outdoor Advertising (4,490 square feet); and Well Care Home Health (3,744 square feet). The lease deals also comprise three renewals, which include Sunstate Security (2,373 square feet); Dewberry (13,917 square feet); and Quint Events (28,278 square feet). Jennifer Kurz and Tim Arnold of Trinity Partners represented CP Group in all eight lease transactions. The Florida-based landlord has owned Harris Corners since summer 2021.

Southeast

PETERSBURG, VA. — Bruce Smith Enterprise and The Cordish Cos. have responded to a request for proposal issued by the City of Petersburg with plans to co-develop a $1.4 billion mixed-use project. Plans call for a gaming and entertainment district anchored by a Live!-branded casino and hotel. The project site is located at the intersection of Wagner Road and I-95 in Petersburg, about 24 miles south of Richmond. The partners intend to quickly open an initial Phase I casino within a year to begin creating jobs, vendor opportunities and economic benefits for the city. This first phase will include 1,000 slot machines, 23 table games, a 15-table poker room, casino bar and casual restaurant, and more than 1,500 free parking spots. Upon full build-out, Live! Casino & Hotel Virginia would feature more than 400,000 square feet of gaming, hotel and dining space; 35,000 square feet of meeting and convention space; a 200-room hotel; 1,600 slot machines; 46 table games; a sportsbook; 3,000-seat entertainment venue; and eight food options. The project is expected to create 7,500 new jobs, including 6,000 construction jobs and 1,500 “living-wage” jobs averaging $70,000 in annual compensation, according to the development team. In its first 10 years, …

Mast Capital, AvalonBay Complete 254-Unit Avalon Merrick Park Apartment Community in Miami

by John Nelson

MIAMI — Mast Capital and Avalon Bay Communities have completed the development of Avalon Merrick Park, a 254-unit apartment community located at 3811 Shipping Ave. in the Coral Gables neighborhood of Miami. The property, which was constructed by general contractor First Florida, features studio, one-, two- and three-bedroom apartments, ranging from 456 to 1,530 square feet. Amenities at the community include a swimming pool, fitness center, resident lounge with coworking spaces and a pet spa. Arquitectonica designed the property. Rental rates at Avalon Merrick Park begin at $2,340, according to Apartments.com.

VERO BEACH, FLA. — Thompson Thrift plans to develop a new 276-unit multifamily community in Vero Beach. Dubbed Verity, the project is scheduled for completion in summer 2026. The property will comprise apartments across three-story buildings, with units in one-, two- and three-bedroom layouts averaging 1,400 square feet in size. Amenities at the community, which will span 18 acres, will include a clubhouse, fitness center, 24-hour social hub, work-from-home suites, resident conference room, swimming pool, electric firepits, grilling areas, a pickleball court, dog run and pet spa. The property will also feature an Amazon package hub and valet trash service.

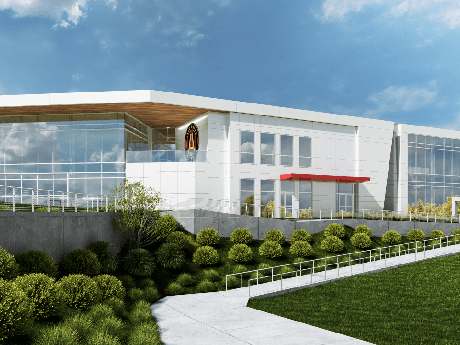

MARIETTA, GA. — Major League Soccer (MLS) club Atlanta United has announced plans for a $23 million expansion to its Children’s Healthcare of Atlanta Training Ground headquarters facility in Marietta, roughly 20 miles northwest of Atlanta. The two-story, 20,000-square-foot addition will connect to the east wing of the existing facility and feature 4,000 square feed designated for its second team (ATL UTD 2) and the club’s five Academy teams. The space will also feature a dedicated gym, locker room and office space for Atlanta United’s six development teams and 20-plus staff members, as well as a dedicated classroom, two new digital content studios, a new podcast and esports studio and a press conference room. The expansion will bring the total footprint of the facilities to 50,000 square feet, with a total investment of $85 million. Completion of the project is scheduled for summer 2025.

St. John Properties Signs Clinical Research Firm to 116,000 SF Lease Expansion in Frederick, Maryland

by John Nelson

FREDERICK, MD. — St. John Properties has signed a lease extension and expansion with Precision for Medicine at Riverside Tech Park, a 70-acre business and research and development (R&D) property in Frederick. Precision for Medicine, a clinical research organization, has occupied space at the park since 2006. Precision for Medicine currently occupies 75,000 square feet at 8425 Precision Way. With the new agreement, the tenant will occupy an additional 41,040 square feet at 8440 Broadband Drive, a new 52,080-square-foot flex R&D building at the development, utilizing the building for office and laboratory space. St. John Properties recently completed construction at Riverside Tech Park, which comprises more than 750,000 square feet across 14 buildings. The development is located adjacent to the National Cancer Institute (NCI) and is within a mile of the Frederick Municipal Airport.

NASHVILLE, TENN. — Video game developer Iron Galaxy Studios has signed a 25,000-square-foot office lease at 333 Commerce in Nashville. The company, which has studios in Chicago and Orlando, will be relocating from UBS Tower, where it occupied space on a temporary basis. Kevin Ziomek, Corey Siegrist and Jim Rose of JLL represented the tenant in the lease negotiations. Amenities at the building include an 8,000-square-foot fitness center, outdoor courtyards and recently renovated lobby and common areas.

Wegmans to Open 110,000 SF Grocery Store at Ballantyne Campus in Charlotte, North Carolina

by John Nelson

CHARLOTTE, N.C. — Wegmans Food Markets Inc., a Rochester, N.Y.-based grocer, plans to open a 110,000-square-foot store in Charlotte. Located along North Community House Road, the grocery store will be situated within Ballantyne, Northwood Investors’ 2,000-acre master-planned development on the south side of Charlotte adjacent to the South Carolina border. Wegmans aims to open the new store by the third quarter of 2026. The store will feature all traditional Wegmans departments, including produce, seafood, meat, bakery, deli, cheese and wine and beer. Additional offerings will include Meals2Go and catering, online shopping capabilities, a floral shop, coffee and home goods. The store will also have a market café with indoor and outdoor seating for customers dining at one of Wegmans’ multiple food outlets. “We’ve received hundreds of requests from locals asking for a store in their area, and we’ve spent years looking for exactly the right location,” says Dan Aken, vice president of real estate and store planning at Wegmans. The new Wegmans will be located on the east side of Ballantyne and half a mile from Northwood’s The Bowl at Ballantyne mixed-use development, which is currently under construction. The project will feature a wide array of retail and restaurant tenants …

GW Real Estate, Griffin Capital Break Ground on 250-Unit Apartment Community in Charlottesville, Virginia

by John Nelson

CHARLOTTESVILLE, VA. — GW Real Estate Partners and capital partner Griffin Capital Co. have broken ground on The Arrowood Charlottesville, a 250-unit apartment community located at 463 Rio Road W in Charlottesville. Situated two miles from The Shops at Stonefield and a short drive to University of Virginia, the property features studio to three-bedroom layouts, as well as a clubhouse with a fitness center, coworking space, resort-style swimming pool and a grill/lounge area. Fifth Third Bank provided construction financing for the project. The design-build team includes general contractor GW Builders, Heffner Architects, civil engineer Collins Engineering, structural engineer Cates Engineering, MEP engineer GTP Consulting Engineers and landscape architect LandDesign. The developers expect first buildings at The Arrowood to be ready for occupancy in mid-2025, with full community completion expected by March 2026.

Dermody Properties Acquires Two Industrial Facilities at Gillem Logistics Center in Atlanta Totaling 548,040 SF

by John Nelson

ATLANTA — Dermody Properties has purchased two industrial facilities within Gillem Logistics Center, an industrial park in south Atlanta. The developer, locally based Robinson Weeks Partners, sold the assets for an undisclosed price. The properties include Building 700, a 169,520-square-foot facility, and Building 1200, a 378,520-square-foot building. Wes Hardy represented Dermody in the transaction on an internal basis, and Trey Barry of CBRE represented Robinson Weeks.