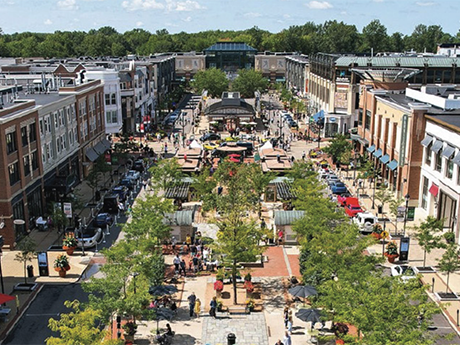

SMYRNA, TENN. — Equitable Property Co. has purchased 44 acres in Smyrna, with plans to develop a mixed-use district dubbed Sewart’s Landing. Situated about 24 miles southwest of Nashville, the project will comprise 250,000 square feet of ground-level retail space, in addition to two medical office buildings (MOBs) totaling 400,000 square feet; a 240-room hotel; and 75 for-sale townhomes. Sewart’s Landing is named after the former Sewart Air Force Base that operated from 1941 to 1971. The groundbreaking is scheduled for next month, with completion of Phase I expected in the first quarter of 2025. Tenants at the development’s first phase will include Starbucks Coffee, Wawa, Jonathan’s Grille and an undisclosed grocer. Equitable Property acquired the land for the project from the City of Smyrna, which helped the developer formulate the master plan for Sewart’s Landing. Kipper Worthington of JLL and Land Deleot of Equitable Property will lead leasing efforts at the development.

Southeast

Madison Communities, Heitman Obtain $44M Construction Loan for Southwest Florida Apartment Development

by John Nelson

BONITA SPRINGS, FLA. — Madison Communities and Heitman have obtained a $44 million construction loan for the development of Madison Bonita Springs, a 252-unit apartment development in Southwest Florida. Patterson Real Estate Advisors arranged the financing through First Citizens Bank on behalf of the developers. The Class A community will be located on Bonita Beach Road adjacent to the I-75 interchange. BenCo, Madison Communities’ in-house general contractor, plans to deliver Madison Bonita Springs by the end of 2025.

Southern Hospitality Breaks Ground on First Extended Stay America Select Suites Hotel in Central Florida

by John Nelson

WILDWOOD, FLA. — Southern Hospitality has broken ground on the first new construction of the Extended Stay America Select Suites prototype hotel. The four-story, 124-room hotel will be located in Wildwood, a city in Central Florida near The Villages master-planned community. The 50,000-square-foot property will be situated on less than two acres and feature apartment-like suites with full kitchens and onsite laundry services. Southern Hospitality and operator Extended Stay America plan to open the hotel in early 2025.

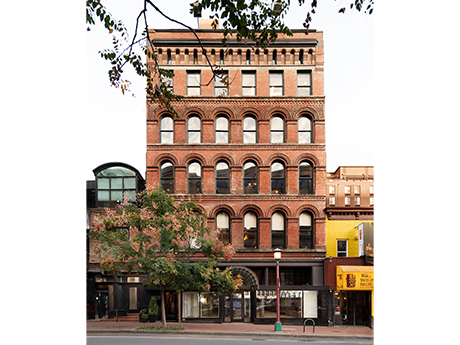

WASHINGTON, D.C. — Marx Realty has delivered The Grogan, a repositioned office building located at 819 7th St. NW in Washington, D.C.’s East End. The New York City-based developer purchased the 21,000-square-foot property in 2018. The renovated asset includes a new façade, canopy and entryways, as well as an upgraded lobby and mezzanine space of the penthouse that includes a café, delineated seating and access to a private terrace. Built in 1891, The Grogan features 12- to 15-foot wood ceilings, exposed brick, wood columns and arched windows, all of which have Marx Realty has restored.

HUNTSVILLE, ALA. — Ironside Realty has acquired a 7,500-square-foot industrial property located at 376 Dan Tibbs Road N.W. in Huntsville. The property was fully leased to United Rentals at the time of sale. A local broker represented the undisclosed seller in the transaction, and Jimmy Goodman of Chicago-based The Boulder Group represented Ironside. The sales price was not disclosed.

Advenir Capital Underway on $93.5M Build-to-Rent Residential Community in Metro Tampa

by John Nelson

SAN ANTONIO, FLA. — Miami-based Advenir Capital is underway on the development of LEO at Cypress Creek, a $93.5 million build-to-rent community in San Antonio, a suburb within the Tampa-St. Petersburg metropolitan area. Site work is currently underway, and vertical construction is scheduled to begin in June. Situated on 40 acres, the property will feature 315 units, with a mix of standalone cottages, duplexes and townhomes ranging from one bedroom and 728 square feet to three bedrooms and 1,510 square feet. Amenities at the community will include a swimming pool, clubhouse with a 24-hour fitness center, internet lounge, free Wi-Fi throughout the property, pocket parks and a pet washing station. Delivery of the first units is scheduled for June 2025, with completion expected by spring 2026. Nequette Architecture & Design designed LEO at Cypress Creek, and BBL Building Co. will serve as the general contractor.

Fifield Cos. Begins Construction of 210-Unit Wynwood Station Apartment Community in Miami

by John Nelson

MIAMI — Fifield Cos. has begun construction on Wynwood Station, a 210-unit transit-oriented apartment community development at 45 N.E. 27th St. in the Wynwood neighborhood of Miami. Upon completion, the building will span eight stories and feature 11,000 square feet of ground-floor retail space. Apartments will range from 567 to 1,036 square feet in size, with a mix of studio, one- and two-bedroom floorplans. Amenities at the community will include a resident lounge, party room, makers room, demonstration kitchen, fitness center, golf simulator, pet spa, remote work area, rooftop sun deck, soaking pool, hot tub and outdoor grills and dining areas. Completion is scheduled for April 2025. The project team includes MSA Architects, interior designer IDDI and general contractor Kast Construction.

HANOVER, MD. — JLL Capital Markets has brokered the sale of a 289-room dual-branded Aloft/Element Arundel Mills BWI Airport hotel in Hanover, a southern suburb of Baltimore. The Aloft comprises 142 rooms, and Element has 147 guest rooms. Amenities at the property include an indoor pool, fitness center, 24-hour market, guest laundry and a meeting space. Located off State Route 100, the property is situated about five miles from Baltimore/Washington International Thurgood Marshall Airport. Spark GHC acquired the hotel for an undisclosed price. Ketan Patel, KC Patel and Phil White of JLL arranged the sale on behalf of the undisclosed seller.

CHARLOTTE, N.C. — CBRE has arranged the $11 million sale of Scarlet Oak, an office/industrial flex building located at 8700-8702 Red Oak Blvd. in southwest Charlotte. A joint venture between Somerset Properties and ABR Capital Partners acquired the property. Built in 1981 and renovated in 2022, the property comprises 81,118 square feet and was 84 percent leased at the time of sale. Part of Griffin Partners’ The Oaks, a four-building industrial portfolio, the building features 245 parking spaces and 17 dock-high, drive-in doors. Recent upgrades to the property include a new outdoor amenity space, exterior improvements, new paint, a new backflow preventer and a newly resealed and restriped parking lot. Patrick Gildea, Robert Hardaway and Matt Smith of CBRE represented the seller in the transaction. Prior to the sale, Alek Salfia, Joe Franco and Kris Westmoreland of CBRE managed leasing at the property on behalf of the seller.

PINECREST, FLA. — Limestone Asset Management and Orion Real Estate Group have completed the $5 million renovation of Pinecrest Town Center, a 225,255-square-foot mixed-use property located at 12651 S, Dixie Highway in the south Miami suburb of Pinecrest. Renovations at the property, which features retail and office space, included upgrades to the façade and storefronts, the installation of impact windows, improved lighting and the addition of a rooftop parking area. General contractor Tim Majors of Suncon Inc. and architect Bruce Arthur of WHA Design led the project. Pinecrest Town Center was 90 percent leased at the time of renovations to tenants including Sage Dental, Coldwell Banker, Anacapri Italian Restaurant and Sea Siam. The property was previously renovated in 1994 and 2004. Limestone purchased the property, which was built in 1985, in 2021 for $32 million.