CHARLOTTE, N.C. — Four office tenants have signed leases at The Station at LoSo, Beacon Partners’ mixed-use development in the Lower South End (LoSo) of Charlotte. Dwell Design Studio will occupy 4,876 square feet at the property’s Station 3, beginning this quarter, and an additional, undisclosed tenant has also signed a 10,075-square-foot at Station 3, bringing the building to full occupancy. Gambling.com Group has also leased 10,413 square feet at the development, with plans to begin occupancy in the second quarter of this year. Chris Schaaf, Ross Howard and Conor Brennan of JLL represented Gambling.com Group in the lease negotiations, and Griff Sims of Lee & Associates and Mary Allison Mitchell York of NewLeaf Brokerage represented Dwell Design Studio. Additionally, Beacon Partners will move its headquarters into a 12,254-square-foot space within Station 4. Situated with direct access to the Rail Trail, The Station at LoSo comprises 350 residential units, as well as 200,000 square feet of office and retail space. Retail tenants at the development include The People’s Market, Taco Boy and Salata Salad Kitchen.

Southeast

MAUMELLE, ARK. — Health Dimensions Group (HDG) has opened Mira at Maumelle, which the developer asserts is the first senior living community in the Little Rock suburb of Maumelle. Mira at Maumelle provides independent living, assisted living and memory care services. The number of units was not disclosed. HDG manages the property, bringing its portfolio to 48 communities in eight states.

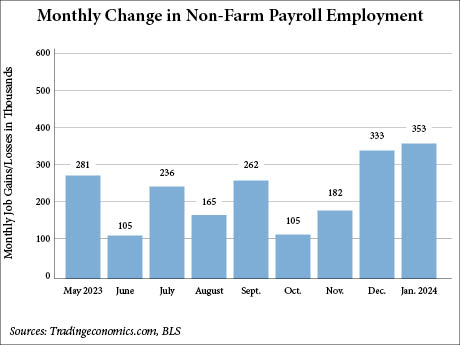

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 353,000 jobs in January, according to the U.S. Bureau of Labor Statistics (BLS). This hike nearly doubled the increased predicted by Dow Jones economists, who forecasted an increase of 185,000 jobs, reports CNBC. The unemployment rate held steady at 3.7 percent for the third month in a row. The BLS also made hefty revisions to its calculation of jobs gained in December 2023. The bureau revised December’s gains to 333,000, an increase of 117,000. The BLS also revised November jobs up by 9,000 jobs to 182,000. The average monthly gain in 2023 was 255,000. Employment growth in January was led by the professional and business services sector, which added 74,000 jobs last month. This far exceeds the sector’s average monthly gain of 14,000 jobs in 2023. Other industries that saw increases in January include healthcare (70,000), retail trade (45,000), government (36,000), social assistance (30,000) and manufacturing (23,000). Employment declined in the mining, quarrying and oil and gas extraction industry. The better-than-expected jobs report comes on the heels of the U.S. economy’s gross domestic product (GDP) posting a 3.3 percent annualized growth rate in fourth-quarter 2023. CNBC reports that …

GOODLETTSVILLE, TENN. — OSB Holdings LLC, an entity controlled by Nashville-based Gorney Realty Co., has acquired the Old Stone Bridge Industrial Portfolio at 300 Old Stone Bridge Road in Goodlettsville. Situated about 14 miles south of Nashville via I-65, the property comprises two shallow-bay service centers totaling 45,000 square feet. The buildings were 96 percent leased to 14 tenants at the time of sale. Steve Preston, Jack Armstrong and Will Goodman of CBRE represented the undisclosed seller in the transaction, and Gorney was self-represented. The sales price was not disclosed.

Essex Capital, Ascend Property Group Break Ground on Front Row Mixed-Use Development in Huntsville, Alabama

by Jeff Shaw

HUNTSVILLE, ALA. — A joint venture between Essex Capital and Ascend Property Group has broken ground on Front Row, an 11-acre mixed-use project in downtown Huntsville. The $220 million first phase of Front Row is now underway, following news last week that Banco Inbursa and a group led by Keel Point and Opportunity Alabama provided $115 million in construction financing. The first retail space is slated for delivery in late 2025, followed by apartments and office space in early 2026. Upon full build-out, the first phase of Front Row will comprise two six-story buildings featuring 545 apartments, 36,000 square feet of office space and 47,000 square feet of retail space. Further plans for the project — including a hotel, a class A office tower and luxury condos — will be disclosed at a later date, according to the developers. The development will be situated across from the Von Braun Center, a 170,000-square-foot entertainment center that opened its doors in 1975. The developers state that Front Row is intended to interlink the Von Braun Center with other key areas of the city, such as Big Spring Park, Fountain Circle, University of Alabama Huntsville and Downtown Greenway. The project’s team also includes …

AE Industrial Acquires 2.3 MSF Facility in Northwest Alabama, Plans Conversion to Aerospace Center

by John Nelson

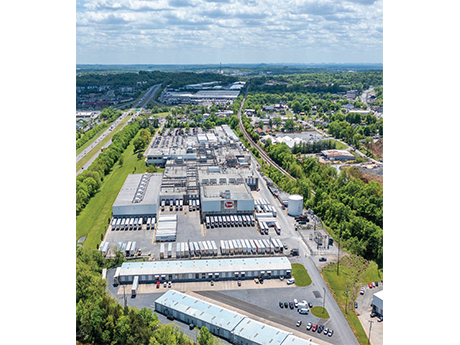

CHEROKEE, ALA. — An affiliate of AE Industrial Partners (AEI), a private equity firm specializing in aerospace investments, has purchased a vacant industrial facility in Cherokee spanning nearly 2.3 million square feet. The Retirement Systems of Alabama sold the facility to AEI for an undisclosed price. The property sits on a 638-acre site at 1200 Haley Drive in northwest Alabama’s Shoals area and was previously home to tenants including National Steel Car, Navistar and FreightCar America. AEI plans to renovate the facility to serve as an aerospace center and house the headquarters of aerospace suppliers, manufacturers and innovators. The company will also be partnering with Poarch Band of Creek Indians, a federally recognized tribe of Native Americans with reservation lands in lower Alabama, on the project. The facility sits roughly 75 miles west of NASA Marshall Space Flight Center and the U.S. Space and Rocket Center in Huntsville, Ala.

HIALEAH, FLA. — Terra and New Valley have obtained a $127 million loan for the refinancing of Natura Gardens, a newly built multifamily community located in Miami’s West Hialeah neighborhood. The co-developers are using the loan, which was provided by an affiliate of MF1 Capital, to pay off and refinance a $65 million construction loan that Bank OZK provided in 2021. Keith Kurland, Aaron Appel, Jon Schwartz, Adam Schwartz and Michael Diaz of Walker & Dunlop’s New York Capital Markets team arranged the refinancing. Delivered in 2023, Natura Gardens is a 460-unit, garden-style apartment community that was more than 97 percent occupied at the time of refinancing.

JLL Arranges $29M Sale of Lowes Foods-Anchored Shopping Center in Summerville, South Carolina

by John Nelson

SUMMERVILLE, S.C. — JLL has arranged the $29 million sale of Oakbrook Station, a Lowes Foods-anchored shopping center located at 10020 Dorchester Road in Summerville, a suburb of Charleston. Brad Buchanan, Tom Kolarczyk, Jim Hamilton and Andrew Michols of JLL represented the seller, LBX Investments, in the transaction. New York City-based Kempner Properties purchased the property in partnership with Peter Braus and James Wacht of Lee & Associates. Built in 1997 and renovated in 2017, Oakbrook Station spans 138,137 square feet and was 99 percent leased at the time of sale to tenants including the U.S. Postal Service, Community Thrift and Dollar Tree.

GAINESVILLE, FLA. — CBRE has brokered the sale of Social 28, a 592-bed student housing property located across the street from the University of Florida campus in Gainesville. Nimes Real Estate acquired the community and has partnered with Timberline Real Estate Ventures to begin repositioning efforts. CBRE National Student Housing’s Jaclyn Fitts, William Vonderfecht and Casey Schaefer represented the undisclosed seller in the transaction, in partnership with CBRE Jacksonville Multifamily. Located at 311 SW 13th St., Social 28 offers fully furnished units and shared amenities including a fitness center with a yoga room; two social lounges; private study rooms; and a rooftop amenity space including a resort-style swimming pool, spa, fireplace and grilling station.

GASTONIA, N.C. — Growth Capital Partners (GCP) has preleased 56,280 square feet of industrial space in metro Charlotte to WRH Manufacturing, a subsidiary of Decima Corp. Henry Lobb, Abby Rights and Christopher Skibinski of Avison Young represented GCP in the lease transaction. Casey Mulhern of Foundry Commercial represented WRH Manufacturing, which produces and distributes raw and finished wood products serving the homebuilding and woodworking industries. GCP broke ground in 2022 on Northwest Gateway Logistics Park, a two-building industrial park spanning nearly 300,000 square feet. The Birmingham, Ala.-based developer is building the park on a speculative basis at 1215 Jenkins Road in Gastonia, which is situated directly off I-85. GCP plans to deliver the park in the first quarter of this year. WRH Manufacturing will occupy space within a 132,395-square-foot warehouse. Both facilities feature 32-foot clear heights, a combined 57 dock-high doors and a shared 200-foot truck court. GCP is developing Northwest Gateway Logistics Park in partnership with Phelan Bennet.