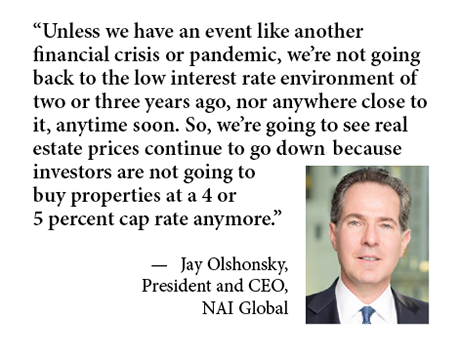

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …

Southeast

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

SAN DIEGO — JLL has secured a $149 million loan for the refinancing of a three-property multifamily portfolio in the Southeastern United States. Aldon Cole, Tim Wright and Bharat Madan of JLL’s San Diego office arranged the three-year, fixed-rate loan through a life insurance company on behalf of the borrower, Sunroad Enterprises. The properties in the portfolio include the 313-unit Verde Vista in Asheville, N.C.; the 288-unit Avenues at Verdier Point in Charleston, S.C.; and the 256-unit Adara at Godley Station in Savannah, Ga. San Diego-based Sunroad Enterprises acquired the three properties in 2021 and has since completed 100 percent of its planned exterior and common area renovations and 50 percent of interior renovations.

Jamestown Announces Details for 405-Unit Hospitality Tower at Ponce City Market in Atlanta

by John Nelson

ATLANTA — Jamestown has announced details about its 405-unit hospitality tower underway at Ponce City Market, a large-scale mixed-use development in Atlanta’s Old Fourth Ward district. The project, branded Scout Living, is part of Ponce City Market’s second phase, which also includes 619 Ponce and Signal House. The property will feature fully furnished one- and two-bedroom units for short-term and extended stays, including full kitchens, appliances and separate living and sleeping spaces. Rooftop amenities will include a pool, wellness studio, terrace, rentable livings rooms and a chef’s kitchen. Scout Living’s second floor will feature lounge, meeting and event spaces for guests. The property will also feature 12,000 square feet of retail space with 21-foot ceilings on the ground floor that will be occupied by a food-and-beverage concept and convenience shopping, as well as a courtyard that connects the property to other elements of Ponce City Market and the Atlanta BeltLine. When Phase II construction is complete, Ponce City Market will include five buildings offering more than 700,000 square feet of office space, 350,000 square feet of retail space and more than 800 residential and hospitality living units. Jamestown is aiming for all three components of Phase II to achieve LEED …

NORFOLK, VA. — Berkadia has negotiated the $38.5 million sale of Woodmere Trace, a 300-unit apartment community located at 6741 E. Tanners Creek Drive in Norfolk. Raleigh-based Fulton Peak Capital purchased the garden-style property from Enterprise Community Development, a nonprofit owner and developer of affordable housing in the Mid-Atlantic. Drew White, Carter Wood and Cole Carns of Berkadia represented the seller in the transaction. Additionally, Patrick McGlohn, Brian Gould, Miles Drinkwalter and Hunter Wood of Berkadia arranged a $25.5 million Fannie Mae acquisition loan on behalf of the buyer. Built in 1974, Woodmere Trace was renovated in 2014 and features one- and two-bedroom floor plans. Amenities include a swimming pool, laundry facility, fitness center, picnic pavilion with grilling stations, playground and a dog park.

OAKWOOD, GA. — BWE (formerly Bellwether Enterprise) has arranged a $29.5 million construction loan for the development of Imperium Oakwood, a 229-unit apartment development in Oakwood, about 48 miles northeast of Atlanta. Thomas Wiedeman, Alan Tapie, Hanley Long and Brad Walker of BWE arranged the fixed-rate loan through an unnamed community bank on behalf of the developer, Alpharetta, Ga.-based Imperium Development. The property will be situated adjacent to University of North Georgia’s Gainesville campus and will feature a clubhouse with fitness and office rooms, resort-style pool, fireplace, grill stations, covered lounge, game area, onsite parking and a dog park with a wash station. The construction timeline was not disclosed.

Feil Organization Signs New Tenant to 9,000 SF Office, Retail Lease in Metairie, Louisiana

by John Nelson

METAIRIE, LA. — The Feil Organization has signed FastPass Tag and Title LLC to a 9,000-square-foot lease in Metairie, a suburb of New Orleans. The tenant will occupy two suites at 3445 North Causeway Boulevard, a 10-story, 127,858-square-foot office building. One suite will include a retail space where customers can obtain and renew their drivers’ licenses and IDs, while the second space will be dedicated to the company’s back-of-house and office operations. Scott Graf of Corporate Realty represented Feil Organization in the lease transaction.

ELKTON, FLA. — KeHE Distributors is underway on the development of a 530,474-square-foot build-to-suit industrial facility in the St. Augustine suburb of Elkton, which will provide office and distribution space for the company. KeHE distributes natural and organic, specialty and fresh food products to more than 31,000 stores throughout North America. The project comprises a two-story, 30,000-square-foot executive office suite, as well as roughly 500,000 square feet of warehouse and distribution space. The new facility will replace the company’s older buildings, which are situated across the street from the development site. Completion of the development is scheduled for 2025. Design firm Ware Malcomb is providing architecture, interior design and branding services for the project, and Evans General Contractors is constructing the facility.

PALM COAST, FLA. — Greysteel has arranged $51 million in financing for Evolve Palm Coast, a 256-unit multifamily development underway in Palm Coast, about 27 miles south of St. Augustine via I-95. The financing package includes $37 million in construction financing and $14 million in preferred equity placement. North Carolina-based Evolve Cos. is the developer and borrower. Upon completion, which is scheduled for fall 2025, the property will feature apartments in one-, two- and three-bedroom layouts across 12 three-story buildings. Amenities at the community will include a clubhouse, saltwater pool, gas grills, fitness center, yoga room, dog park and a playground. Jeremy Slocumb and Chris Wilkins of Greysteel led the team that secured the financing. A regional bank provided the three-year, floating-rate construction loan, and an institutional real estate investment fund provided the preferred equity.

LEXINGTON, S.C. — Lowes Foods has signed a lease to anchor Platt Springs Crossing, a 50-acre mixed-use development currently underway in Lexington, a western suburb of Columbia, S.C. The Winston-Salem-based grocer will occupy 51,000 square feet at the development. Other tenants will include Chipotle Mexican Grill, Tidal Wave Car Wash, Panda Express and Planet Fitness. An affiliate of NAI Columbia doing business as LLDC Platt Springs LF LLC is the developer of the project, which is scheduled to begin opening early next year. Ben Kelly and Patrick Chambers of NAI Columbia represented the landlord in the lease negotiations with Lowes Foods. The grocery store is scheduled to open in the third quarter of 2025.

OCALA, FLA. — BroadRange Logistics has signed a lease to fully occupy Ocala Logistics Center, a 350,899-square-foot industrial building in Central Florida. Situated at the corner of N.W. 35th St. and N.W. 27th Ave. in Ocala, the property features 196 parking spaces, 96 trailer drops, ESFR sprinkler systems and 36-foot clear heights. Clay Witherspoon of Avison Young represented the landlord, MDH Partners, in the lease negotiations. John Gosnell of Strategic Real Estate Partners represented the tenant.