SWEETWATER, FLA. — Development firm CREI Holdings has received a $41 million loan for the refinancing of Li’l Abner II apartments in Sweetwater, a South Florida city just west of Miami. Marc Suarez led the Lument team that provided the funds. The project was completed in April 2023. Designed by Burgos Lanza Architects and Planners, an architectural firm based in Coral Gables, Fla., the eight-story building is situated adjacent to its 87-unit sibling, Li’l Abner I. Li’l Abner II consists of 244 one- and two-bedroom units dedicated to affordable and workforce housing. Among these, 40 percent cater to low-income seniors, while the remainder is allocated to residents earning up to 120 percent of the area’s median income (AMI). The building is near full occupancy, according to CREI Holdings.

Southeast

Landmark Properties Recapitalizes 1,364-Bed Student Housing Community Near University of Georgia

by John Nelson

ATHENS, GA. — Landmark Properties has recapitalized The Mark Athens, a 1,364-bed student housing property located at 130 Hickory St. near the University of Georgia campus. The property was developed in two phases, with the first phase completed in 2017 and the second phase completed in 2022. The community offers studio through six-bedroom apartments, alongside 67,000 square feet of retail space and 46,734 square feet of offices, with locally based Landmark occupying over 90 percent of the office space. The Mark also features 55,000 square feet of shared amenity space, including a rooftop pool and sundeck with views of the university’s campus, Sanford Stadium and downtown Athens; study spaces; a fitness center; golf simulator; racquetball court; and an indoor basketball court. Details of the refinancing were not disclosed.

LAGRANGE, GA. — Zach Taylor of Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the $16 million sale of a newly built shopping center located in LaGrange, a Georgia city near the Georgia-Alabama border along I-85. The center’s anchor, Publix, has a 10-year lease on the store. Taylor represented the seller, a developer based in Atlanta, as well as sourced the 1031 exchange buyer in the transaction. Both parties requested anonymity. “This sale faced the market headwinds of increasing interest rates and low transactional velocity,” says Taylor. “Thankfully, we found a 1031 buyer attracted to the quality of the tenant mix and the growth of the submarket. We were able to clear the market at a very attractive cap rate.”

DORAL, FLA. — CBRE has arranged the sale of The Offices at Doral Square, a 141,246-square-foot office building located at 8600 N.W. 36th St. in Doral, a suburb of Miami. The Class A property is the office component of Doral Square, a mixed-use development that also features 150,000 square feet of shops and restaurants. A partnership comprising “several Miami families” purchased the asset from the undisclosed seller. The sales price was also not disclosed. Christian Lee, Sean Kelly, Amy Julian, Andrew Chilgren, Marcos Minaya, Tom Rappa, James Carr and Matthew Lee of CBRE represented the seller in the transaction.

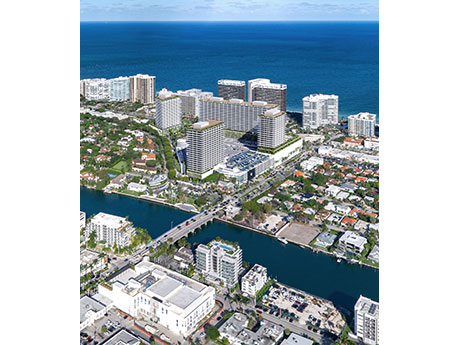

MIAMI — Whitman Family Development has submitted plans for a mixed-use project at its Bal Harbour Shops in Miami’s Bal Harbour village. Plans call for 600 apartment units, 40 percent of which are earmarked for workforce housing and 60 percent of which will be luxury housing. There will also be a 70-room, 20-story hotel and an additional 45,700 square feet of retail space. Bal Harbour Shops comprises more than 100 shops, restaurants and entertainment options. The open-air, luxury retail center, which is home to brands such as Chanel, Gucci, Tiffany & Co. and Valentino, is currently undergoing a $550 million retail expansion that will add about 250,000 square feet, nearly doubling the center’s current retail space. The expansion will accommodate the addition of 35 new upscale stores and restaurants. The new housing development is made possible by Florida’s Live Local Act, a bipartisan bill passed by the Florida legislature last year in response to the critical need for affordable and attainable housing statewide. The legislation enables developers to build at higher density and building heights, so long as they commit to including attainable housing units. The law requires that local municipalities approve mixed-use residential projects in any area zoned commercial …

TAMPA, FLA. — Cushman & Wakefield has brokered the $55.6 million sale of Tampa Airport Logistics, a newly constructed industrial park in Tampa’s Airport submarket spanning nearly 300,000 square feet. The two-building property is located at 5450 Johns Road and 5416 W. Sligh Ave., about six miles north of Tampa International Airport. Tampa Airport Logistics was fully leased at the time of sale and features 32- to 36-foot clear heights, 52- by 50-foot column spacing, ESFR fire protection and a 192-foot shared truck court. Clarion Partners purchased the property on behalf of a separate client from PCCP LLC. Rick Brugge, Mike Davis, Rick Colon, Dominic Montazemi, Ryan Jenkins and Chloe Strada of Cushman & Wakefield represented the seller in the transaction.

CARY, N.C. — Two new retailers and five office users have signed on to join the tenant roster at Fenton, a 92-acre mixed-use development in the Raleigh suburb of Cary. The nearly $1 billion development is co-owned by Hines and Columbia Development. The new retailers, Brewery Bhavana and Vega Vitality, plan to open their locations at Fenton before the end of the year. Two other retailers opened in late 2023: Johnny Was and Rejuvenation. Bruce Koniver of Odyssey Retail Advisors is leading Fenton’s retail leasing, which is currently 94 percent committed. The five companies that signed office leases at Fenton include Cushman & Wakefield, IPS, Prologis, AIMA and Surety Systems. The property’s office component currently spans 200,000 square feet, with future phases allowing up to 1 million square feet.

HUNTSVILLE, ALA. — An affiliate of grocer Food City has purchased two acres in Huntsville from The Beach Co. The entity is Marathon Realty Corp., a real estate subsidiary of Food City parent company K-VA-T Food Stores Inc. The site is located between The Foundry, The Range and Stovehouse along Governors Drive and will be connected to the developments via a 10-foot-wide pedestrian sidewalk. Marathon Realty plans to break ground on the new store next quarter with plans for an early 2025 opening. Last year Marathon Realty entered into a development agreement with the City of Huntsville to develop six new Food City grocery stores in the greater Huntsville area.

MIAMI BEACH, FLA. — Rentyl Resorts plans to develop a 44-unit boutique hotel at 2814 Collins Ave. in Miami Beach. Upon completion, the hotel will feature ground-level restaurants and entertainment venues, as well as direct beach access. The project is a partnership between Rentyl, DaVinci Hospitality Group and Ferrari Group. The construction timeline and name for the new hotel were not disclosed.

VIRGINIA BEACH, VA. — KPMG LLP, one of the “Big Four” audit, tax and advisory firms, has leased 13,044 square feet of office space at Town Center of Virginia Beach, a 25-acre mixed-use district in Virginia Beach. The firm will move into its space at the development’s 23-story office tower this month. Divaris Real Estate represented the landlord and developer, locally based Armada Hoffler, in the lease negotiations. Cushman & Wakefield | Thalhimer represented KPMG. The new lease brings Town Center of Virginia Beach’s office component, which spans 800,000 square feet, to 98 percent occupancy, according to Armada Hoffler.