MIAMI — Marcus & Millichap has arranged the $17.7 million sale of a Days Inn hotel located at 7250 N.W. 11th St. in Miami. The 103-room hotel, which includes an onsite Beat Culture Brewery & Restaurant, is situated on the campus of Miami International Airport. Leo Reilly and Robert Hunter of Marcus & Millichap’s Fort Lauderdale office represented the seller, a private investor, in the transaction. The team also procured the Massachusetts-based buyer. Both parties requested anonymity.

Southeast

FORT LAUDERDALE, FLA. — CBRE has secured a $17 million loan for the refinancing of Galt Ocean Marketplace, a 105,589-square-foot shopping center located at 3700-4032 N. Ocean Blvd. in Fort Lauderdale. Winn-Dixie anchors the property, which was built in 1988 and was 96 percent occupied at the time of sale. Other tenants at the center include CVS/pharmacy, Holy Cross Hospital and McDonald’s. Palm Beach Gardens, Fla.-based Kitson & Partners acquired the property in 2006. Paul Ahmed and Mackenzie Lampman of CBRE arranged the financing through a regional bank on behalf of the borrower.

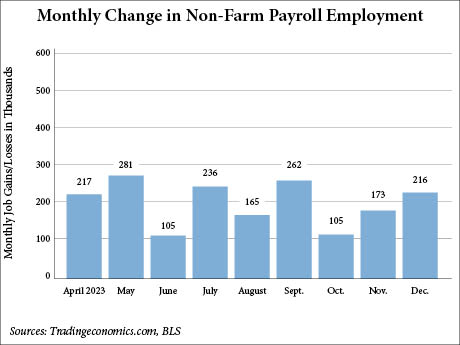

WASHINGTON, D.C. — Total nonfarm employment in the United States increased by 216,000 jobs in December 2023, according to the U.S. Bureau of Labor Statistics (BLS). This jump significantly exceeds the one predicted by Dow Jones economists, who expected an increase of 170,000, according to CNBC. This number falls slightly below the 2023 monthly average increase of 225,000, and the unemployment rate remained unchanged at 3.7 percent. Government employment comprised a significant portion of the total, with 52,000 positions added. Growth occurred primarily at a local level as municipal governments added 37,000 jobs, whereas the federal government added 7,000. The BLS calculates the monthly average for government employment growth in 2023 was 56,000 jobs, which is more than double the average of 23,000 in 2022. Ryan Severino, managing director, chief economist and head of U.S. research at BentallGreenOak (BGO), says that government entities were challenged in 2022 because workers had the upper hand in the labor market as the private sector was actively hiring across various categories, which led to more mobility for employees. He says the government sector experienced a market correction of sorts in 2023. “People aren’t leaving jobs as quickly as they once were, and the slowdown …

ST. PETERSBURG, FLA. — Black Salmon and LD&D plan to co-develop Gallery Haus, a 23-story multifamily tower in the Tampa Bay city of St. Petersburg. The $115 million project will be located at 155 17th St. S, which is adjacent to the upcoming $6.5 billion overhaul of Tropicana Field, the home ballpark of the Tampa Bay Rays. Black Salmon and LD&D purchased the 0.8-acre site last month for a little more than $9 million. The duo plan to break ground on Gallery Haus in the fourth quarter. The project will include 10,000 square feet of amenities and coworking space, as well as 5,000 square feet of ground-level retail space.

Lionstone Investments Trades 12-Story Midtown Plaza Office Building in Raleigh’s North Hills District

by John Nelson

RALEIGH, N.C. — Lionstone Investments has sold Midtown Plaza, a 12-story office building located in Raleigh’s North Hills submarket. The buyer and sales price were not disclosed, but the Triangle Business Journal reported the asset traded for $132 million. Completed in 2017, the 329,747-square-foot property was fully leased at the time of sale to tenants including Altera, Gilead Sciences and Fifth Third Bank. Ryan Clutter, Richard Reid, Daniel Flynn, C.J. Liuzzo, Sarah Holloway and Woody Flythe of JLL represented Lionstone, which was working on behalf of an institutional investor.

Harrison Street, Michaels Sell 551-Bed Student Housing Community Near University of West Florida

by John Nelson

PENSACOLA, FLA. — A joint venture between Harrison Street and The Michaels Organization has sold The Next, a 551-bed student housing community located near the University of West Florida campus in Pensacola. CBRE National Student Housing’s Jaclyn Fitts, William Vonderfecht and Casey Schaefer represented the seller, in partnership with CBRE Jacksonville Multifamily’s Ryan Hixon. WFI acquired the property for an undisclosed price. The Next offers fully furnished units with bed-to-bath parity. Shared amenities include a clubhouse, game room, computer center, tanning station, resort-style swimming pool, fitness center and study rooms on each floor.

EASTON, MD. — Synergy Investment Fund has acquired Tred Avon Square, a 147,668-square-foot retail center located in Easton, a city on east side of Chesapeake Bay near the Maryland-Delaware border. ACME, Big Lots, Easton Cinemas, Rent-A-Center, Sherwin-Williams, My Eye Dr., Osteria Alfredo, Ship and Print, Subway, Hong Kong Kitchen, Nails & Spa, Lendmark, Chincheck Sports Locker, T-Mobile, Admiral Cleaners, Rusty Hook Bait and Tackle, Spin Groove Records and Dunkin’ are tenants at the property. SVN | Miller Commercial Real Estate represented the buyer in the transaction. Ross Benincasa and Ryan Finnegan of SVN | Miller will oversee leasing at the center.

ALCOA, TENN. — SRS Real Estate Partners has brokered the $7.2 million sale of Alcoa Commons, a newly built retail center in Alcoa, a city roughly 14.5 miles south of Knoxville, Tenn. Situated at 1010-1020 Alcoa Market St., the 13,890-square-foot property was fully leased at the time of sale to tenants including Orangetheory Fitness, Eyeglass World, The Joint Chiropractic and a freestanding outparcel building occupied by First Watch. Patrick Nutt and William Wamble of SRS represented the seller, a Tennessee-based developer, in the transaction. The private buyer, a Chicago-based company, purchased Alcoa Commons in a 1031 exchange.

The term “adaptive reuse” in real estate circles typically conjures images of repurposing old, obsolete commercial buildings. Meanwhile, academic buildings, administrative offices and other properties on college campuses rarely come to mind. But NAI has noted a growing need among higher learning institutions with vacant or underused assets, particularly as a result of growing online learning options, says Larry Gautier, senior vice president of NAI Miami | Fort Lauderdale. As a result, the brokerage is focused on finding solutions for schools. “NAI hasn’t historically been involved with higher institutions of learning — we’ve typically focused on conventional real estate transactions,” Gautier acknowledges. “But a few years ago, when students weren’t going in to class, colleges and universities were facing a challenge: what do you do with facilities — that were built for thousands of students — in a remote-learning setting? For many schools, remote learning is here to stay.” Options include leasing buildings to commercial users or entering a joint venture with, for example, an aerospace or engineering company for educational programs, he adds. Colleges that suddenly have vast unused parking lots could also enter into long-term leases with multifamily, office or mixed-use developers. “Our position is to help these schools create …

Pebb Capital Obtains $173M Construction Loan for Sundy Village Development in South Florida

by John Nelson

DELRAY BEACH, FLA. — Pebb Capital has obtained a $173 million construction loan for Sundy Village, a mixed-use development underway at 22 W. Atlantic Ave. in Delray Beach, a city in South Florida’s Palm Beach County. Monroe Capital and J.P. Morgan provided the construction loan. Pebb Capital broke ground on the $240 million development in early 2023 with plans for a summer 2024 opening. Sundy Village will feature more than 28,000 square feet of experiential retail space and 180,000 square feet of Class A offices, of which Pebb Capital has preleased 141,400 square feet. The tenant roster includes restaurants Barcelona Wine Bar and Double Knot and office tenant Vertical Bridge. Joe Freitas and John Criddle of CBRE oversee Sundy Village’s office leasing and Sara Wolfe of Vertical Real Estate handles retail leasing. The design-build team includes general contractor Bluewater Builders.