WARNER ROBINS, GA. — Berkadia has secured a $36.8 million loan for the refinancing of Pointe Grand Warner Robins, a recently completed, 288-unit apartment community located at 1601 Leverette Road in Warner Robins. Michael Weinberg and Wesley Moczul of Berkadia’s Orlando office arranged the two-year, floating-rate loan on behalf of the developer and borrower, Hillpointe. Situated about 20 miles south of Macon, Ga, the property comprises two-bedroom, 1,170-square-foot apartments across 10 three-story buildings. Amenities include a swimming pool, 24-hour fitness center and a business center. Hillpointe will use the financing to provide a return of equity to its fund and allow for more flexibility in placing permanent debt or selling the property.

Southeast

CUMMING, GA — Publix Super Markets Inc. has purchased Matt Town Center, an 81,077-square-foot shopping center located at 5310 Matt Highway in Cumming, roughly 40 miles northeast of Atlanta. Jim Hamilton, Brad Buchanan and Andrew Kahn of JLL represented the seller, Marietta, Ga.-based Retail Planning Corp., in the $30 million transaction. Publix anchors the property, which was built in 2020. Matt Town Center was 95 percent leased at the time of sale to tenants including Domino’s, Great Clips, North Shore Dry Cleaners, Grand Nails, Sage Dental, Reveille Café, The UPS Store, EasyVet, Dunkin’ and Zaxby’s. The sale also included roughly 3.9 acres of adjacent, undeveloped land that is zoned for retail and office space.

TAMPA, FLA. — CBRE has facilitated the sale of Sabal Pavilion, a 120,500-square-foot office property located at 3620 Queen Palm Drive in Tampa. Situated on 11.8 acres, the building is located at the entrance of Sabal Park, a master-planned business development. Amenities at the building include a cafeteria, fitness center and a tenant courtyard with an outdoor basketball court and grilling stations. Dale Peterson, Joe Chick, Courtney Snell and Nick Sharpe of CBRE Capital Markets represented the seller, CTO Realty Growth Inc., in the transaction. A Virginia-based private real estate company acquired the building for an undisclosed price. Ford Motor Credit has fully occupied the property since 2000. Recently, Ford Motor Credit executed a 91,401-square-foot sublease agreement with Cirkul Inc., a reusable water bottle manufacturer.

Hunt Capital Transfers Ownership of 76-Unit Affordable Seniors Housing Community in Biloxi, Mississippi

by John Nelson

BILOXI, MISS. — Hunt Capital Partners has transferred ownership of Cadet Point Senior Village, an affordable seniors housing community in Biloxi, back to Biloxi Community Development Corp., the nonprofit arm of the Biloxi Housing Authority. Developed in 2007, the property comprises 76 units. Hunt Capital transferred ownership back to the civic organization in late November following negotiations accounting for the operational expense challenges at the property. According to Hunt Capital, Cadet Point has experienced insurance premium increases totaling more than 65 percent over the past five years due to its exposure to hurricanes. Biloxi Community Development will have full control of development and operational decisions at Cadet Point.

APOLLO BEACH, FLA. — SRS Real Estate Partners has arranged the sale of Apollo Beach Shoppes, a retail strip center situated on 1.9 acres at 6588 N. U.S. Highway 41 in Apollo Beach, a city in the Tampa Bay metro area. A Florida-based private investor acquired the 9,000-square-foot property for $6.2 million. Patrick Nutt, William Wamble and Daniel Becker of SRS represented the seller, a Florida-based investment and development group, in the transaction. Retailers at the three-tenant property include Trulieve, AT&T and Tijuana Flats.

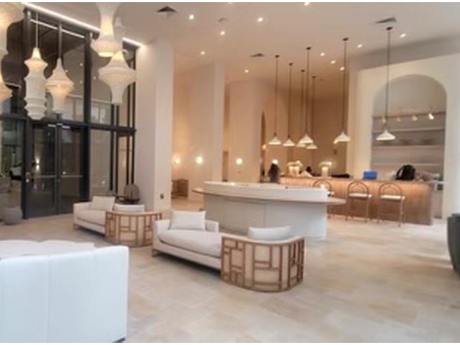

MIAMI — JLL has arranged a $115 million loan for the refinancing of Metro Edgewater, a new 32-story apartment tower in Miami’s Edgewater neighborhood. Jesse Wright, Elliott Throne, Kenny Cutler, Joshua Odessky and J.J. Hovenden of JLL arranged the financing through MF1 Capital on behalf of the borrower, a consortium between Lujeni Corp., Camino Capital Management and Building Block Realty. MF1’s team working on the deal included Michael Squires, Phil Pesant and Connor Pensabene. The 279-unit property comprises one-, two- and three-bedroom units averaging 955 square feet in size. Amenities include a hotel-style pool with cabanas and day beds, fitness center, live-work club room, sky lounge, private dining room and a coffee bar.

Cushman & Wakefield Brokers $35M Sale of Student Housing Community Near University of Florida

by John Nelson

GAINESVILLE, FLA. — Cushman & Wakefield has brokered the $35 million sale of The Pavilion on 62nd, a 312-unit student housing community located at 1000 S.W. 62nd Blvd. in Gainesville. A joint venture between Coastline Management Group and an entity doing business as RWW Gainesville LLC purchased the property from an undisclosed Delaware limited liability company. Mike Donaldson, Nick Meoli, Travis Prince and Victoria Marks Vagnier of Cushman & Wakefield represented the seller in the transaction. Situated about three miles from the University of Florida campus, The Pavilion on 62nd offers a unit mix consisting of mostly large four-bedroom floorplans. The property also includes two large clubhouses, two swimming pools, an indoor and outdoor basketball court, volleyball courts, movie theater, study lounge, separate cardio and weight training fitness rooms, a dog park and a computer lounge.

AIC Industrial Acquires 135,000 SF Manufacturing Facility in Metro Memphis in Sale-Leaseback Deal

by John Nelson

OLIVE BRANCH, MISS. — AIC Industrial has acquired a 135,000-square-foot light manufacturing facility located at 11085 Airport Road in Olive Branch, a Mississippi suburb of Memphis near the Olive Branch Airport. Natureplex Properties LLC, a pharmaceutical manufacturer, sold the facility to AIC Industrial in a sale-leaseback deal. Landon Williams and Katie Hargett of Cushman & Wakefield | Commercial Advisors represented the seller in the transaction. As part of the transaction, Austin, Texas-based AIC Industrial signed Natureplex to a long-term lease at the facility. The sales price and lease terms were not disclosed.

Newrock Signs Three New Retailers to Join Oaklyn Multifamily Development in South Florida

by John Nelson

OAKLAND PARK, FLA. — Newrock Partners has signed three new retailers to join the tenant mix at Oaklyn, a multifamily development underway in South Florida’s Broward County. The new tenants include fitness brand Pure Barre, fashion boutique Monkees and wellness spa Pause Studio. Pure Barre and Monkees plan to open on the ground level at Oaklyn in the first half of 2024, and Pause Studio plans to debut next summer. Situated at 3333 N. Federal Highway in Oakland Park, Oaklyn features 274 luxury apartments and more than 19,000 square feet of retail space. Newrock delivered the property in October.

MADISON AND HUNTSVILLE, ALA. — SRS Real Estate Partners has negotiated the $6 million portfolio sale of two newly developed gas station/convenience stores in Alabama. The assets are located at 8464 Madison Blvd. in Madison and 11010 Highway 231-431 N in Huntsville. Both properties span 5,200 square feet and have 15-year triple-net ground leases with Circle-K in place. Patrick Nutt and William Wamble of SRS represented the seller, a developer based in the Southeast, in the transaction. The California-based private buyer purchased the assets in a 1031 exchange. The unnamed investor purchased the fee-simple ownership of the land, which span about 2 acres for both locations, in both deals.