CHARLESTON, S.C. — The Container Collective, a holistic wellness center and coworking community for practitioners, will relocate to Morris Square, a mixed-use redevelopment in downtown Charleston. Formerly situated at 210 Coming St., The Container Collective has purchased a ground-floor condominium to relocate its wellness and massage therapy practice to 21 Jasper St. Renovations are expected to begin soon, with the new location opening upon completion. GiGi Gilden and Jack Owens of NAI Charleston represented The Container Collective in the transaction. Shea Robbins of Carolina One Real Estate represented the undisclosed seller. The sales price was also not disclosed.

Southeast

As Nashville closes out 2025, the industrial market has solidified its reputation as a resilient powerhouse in the Southeast. With record investment volumes exceeding $2.2 billion and vacancy rates remaining well below national averages, the Nashville MSA continues to attract distributors, manufacturers, and data center-related businesses. This robust performance reflects a recalibration from pandemic-era highs while maintaining durable demand, setting the stage for balanced growth in 2026. Trends shaping the market Several macroeconomic trends are influencing Nashville’s industrial landscape. Nearshoring/onshoring and supply chain diversification have heightened the city’s appeal as a logistical hub. It is important to note that Nashville is strategically located within a day’s drive of over half the U.S. population. Locally, job growth has outpaced the national average, with Oxford Economics reporting a 1.1 percent increase in 2025, bolstered by gains in manufacturing, logistics and retail. Notably, Moody’s Analytics highlights transportation equipment manufacturing as a key driver, as automakers increase domestic production to mitigate tariffs. Further enhancing Nashville’s logistical capabilities, the planned expansion of air freight capacity at Nashville International Airport in 2027 is poised to solidify the region’s role in cargo throughput, supported by a robust highway network and a growing labor force. Despite broader economic …

The March 2 France Media webinar “Flood Zones & FEMA Compliance — How Developers Avoid Delays, Cut Insurance Costs & Increase Property Value,” hosted by France Media and sponsored by National Flood Experts, examined how flood zones and evolving regulatory requirements are shaping development and financing outlooks. Flood risk is often treated as a late-stage compliance issue, but it can influence site design, permitting timelines, construction costs (and cost expectations) and long-term insurance expenses. Flood maps established by federal and local authorities define development constraints such as base flood elevations and floodways. Because these maps are updated slowly and regulations vary by municipality, developers frequently encounter unexpected complications during permitting, including the need for additional engineering studies, modeling requirements and extended approval timelines. The webinar panelists emphasized ways that developers can mitigate these risks by approaching flood zones strategically and incorporating flood analysis earlier in the development lifecycle. Early collaboration can identify opportunities to cut costs and avoid delays. Watch this brief webinar to learn about common problems caused by flood zones, changes in regulatory needs and practical pathways to help reduce or eliminate flood zone requirements (to increase the value of properties). Click here to download the slide presentation. …

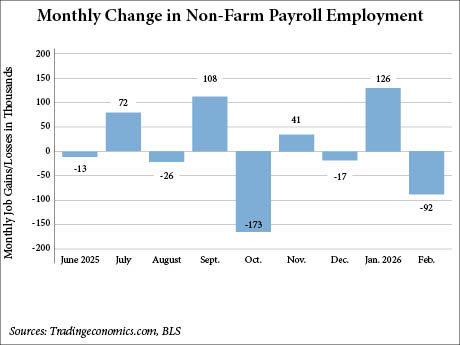

WASHINGTON, D.C. — The U.S. Bureau of Labor Statistics (BLS) has reported that the U.S. economy lost 92,000 jobs in February, compared to the previously estimated gain of roughly 50,000 by Dow Jones economists, according to CNBC. Meanwhile, the U.S. unemployment rate slightly increased to 4.4 percent. The BLS has also downwardly revised the December job gains from +48,000 to -17,000, a difference of 65,000. With the revision, the U.S. economy has now posted job losses in three of the past five months. (The BLS also revised January’s gains but only slightly, from +130,000 to +126,000 jobs.) The healthcare sector, which has been the primary growth driver in payrolls, saw a loss of 28,000 jobs in February, largely due to a strike at Kaiser Permanente in Hawaii and California. Offices of physicians lost 37,000 jobs in February, while hospitals added 12,000 jobs. Information services also lost jobs (-11,000), as part of a 12-month trend in which the sector has forfeited an average of 5,000 jobs per month, CNBC reported. Additionally, federal government employment declined by 10,000 for the month, and is down by 330,000 jobs since October 2024. The BLS reports that transportation and warehousing saw a reduction (-11,000), with …

Alliance Residential Acquires Land Near Battery Atlanta, Plans 300-Unit Multifamily Development

by Abby Cox

ATLANTA — Alliance Residential has acquired nearly 3.7 acres in Atlanta’s Vinings/Smyrna submarket near The Battery Atlanta, the mixed-use village surrounding Truist Park, home of the Atlanta Braves. The Arizona-based developer is planning to develop Broadstone Lola, a 300-unit luxury apartment community, on the site. Designed by locally based Brock Hudgins Architects, Broadstone Lola will offer one- and two-bedroom floorplans ranging in size from 600 to 1,100 square feet. Along with a Parisian-inspired aesthetic, Broadstone Lola will feature amenities such as a resort-style saltwater swimming pool with a landscaped deck with grills, a grab-and-go market, fitness center, gaming lounge, clubroom with an indoor fireplace, private work spaces, conference room, pet spa and a secured parking garage with electric vehicle charging stations and dedicated bike storage. Alliance Residential expects to begin welcoming residents to Broadstone Lola in the summer of 2027.

CHARLOTTE, N.C. — Riverside Investment & Development and Woodfield Development have opened Vivian at Queensbridge Collective, a 42-story apartment tower in Charlotte. Goettsch Partners served as the architect for the project. Situated within the larger Queensbridge Collective mixed-use development, the 409-unit apartment tower offers studio, one-, two- and three-bedroom floorplans ranging in size from 558 to 2,180 square feet. Amenities at the complex are distributed across multiple levels of the building, including a ninth-floor fitness center with indoor/outdoor elements, a 10th floor resident lounge featuring bowling and virtual golf and a 42nd-floor rooftop pool deck with grilling stations and skyline views. Riverside and Woodfield began leasing Vivian in late 2025 and welcomed its first residents this month. Monthly rental rates range from $1,792 to $16,744, according to Apartments.com. This fall, Guard and Grace, the Michelin-recommended steakhouse led by chef Troy Guard, is scheduled to open on the 10th floor of Vivian. The 10,224-square-foot restaurant will include a 2,000-square-foot outdoor terrace, private dining areas and direct connections to both the public and residential components of the development. Additionally, the apartment building will be joined by a 43-story mixed-use office and residential tower under construction at 1111 S. Tyron St. that will comprise 20,000 square …

BONITA SPRINGS, FLA. — The Zuckerman Group has signed leases with two new national retailers at Midtown at Bonita, a 68-acre mixed-use development under construction in Bonita Springs, about 15 miles north of Naples. T.J. Maxx and Ulta Beauty will join the lineup at Midtown at Bonita, bringing the amount of leased retail space to 100,000 square feet. Other committed tenants include Chipotle Mexican Grill, Panera Bread, The Hangry Bison, Club Pilates, Good Vets, Jeff’s Bagel Run, Noire the Nail Bar, Bonita Beach Wine & Spirits, Gelato&Co., LowBrow Pizza & Beer, Mathnasium, a dental office operated by Pacific Dental Services, Cold Stone Creamery, The UPS Store, Mason’s Famous Lobster Rolls and Three Sixteen Cafe, among others. Construction of the development’s retail component broke ground in November, with the first tenants expected to move in this spring. Upon full build-out, Midtown at Bonita will feature a 165-room boutique hotel, a luxury apartment complex and 30 acres of preserved open space, in addition to the shops, restaurants and service retailers.

CHARLOTTE, N.C. AND KANSAS CITY, MO. — Charlotte-based Six Flags Entertainment Corp. (NYSE: FUN), the world’s largest regional theme park operator, has entered into a definitive agreement to sell seven of its amusement parks for $331 million in cash. Kansas City-based EPR Properties (NYSE: EPR), an experiential and entertainment real estate investment trust, was the buyer. The parks total more than 1,600 acres combined and draw approximately 4.5 million visitors annually. “Consistent with our strategy, this divestiture enables us to concentrate our capital, leadership and operational focus on the properties that we believe generate the strongest returns and offer the greatest long-term upside,” says John Reilly, president and CEO of Six Flags. Six Flags will sell a list of parks including Valleyfair in Minneapolis; Worlds of Fun in Kansas City; Michigan’s Adventure in Grand Rapids, Mich.; Schlitterbahn Waterpark Galveston in Galveston, Texas; Six Flags St. Louis in St. Louis; Six Flags Great Escape in Queensbury, N.Y.; and Six Flags La Ronde in Montreal. Florida-based Enchanted Parks, a newly formed owner-operator entity that was formerly known as Innovative Attraction Management, is partnering with EPR Properties to lease and operate the six U.S. parks, while La Ronde Operations Inc. will lease and operate …

Atlantic Cos. Secures Construction Financing, Breaks Ground on Mixed-Use Project in Roswell, Georgia

by John Nelson

ROSWELL, GA. — The Atlantic Cos. has secured construction financing and commenced construction on Hillrose Market, a seven-acre mixed-use development in downtown Roswell, a northern suburb of Atlanta. The financing included debt from SouthState Bank and a revenue bond issued by the Roswell Downtown Development Authority. Patterson Real Estate Advisory Group arranged the financing. Located adjacent to City Hall with a walking trail connection to the city’s Canton Street district, Hillrose Market will comprise a six-building, 75,000-square-foot retail village surrounding a central greenspace, as well as an office building dubbed 25 Hill along Atlanta Street and an adaptive reuse of the former Roswell Police Department dubbed Station 37 that will feature ground-floor retail space and a second-level workplace. The overall development will also include 143 luxury rental flats and 16 two-story brownstone townhomes. Atlantic Cos. plans to deliver the project in the second half of 2027. The design-build team includes ASD | SKY (architect), Westbridge (commercial consultant), New South Construction Co. (general contractor), Kimley-Horn (civil engineer) and Crosby Design Group (interior design for the multifamily component). Bridger Properties is handling the development’s retail leasing assignment, and Cushman & Wakefield is handling office leasing.

GOODLETTSVILLE AND SMYRNA, TENN. — CBRE has arranged $58 million in acquisition financing for a last-mile industrial portfolio in metro Nashville spanning more than 600,000 square feet. Mike Ryan, Richard Henry, J.P. Cordeiro and Taylor Crowder of CBRE’s Debt & Structured Finance team arranged the financing through Starwood on behalf of the borrower, Raith Capital Partners. The properties in the portfolio include: 300 Oak Bluff Lane in Goodlettsville (207,080 square feet); 100 Northfork Lane in Goodlettsville (67,000 square feet); 200 Northfork Lane in Goodlettsville (100,500 square feet); and 801 Swan Drive in Smyrna (229,504 square feet). Delivered between 1993 and 1998, the properties were fully leased at the time to five tenants and feature clear heights ranging from 24 to 30 feet.