TAMPA, FLA. — LyvWell Communities announces its latest build-to-rent development in Tampa: 115 new townhomes in the Deer Valley district. Land development is currently underway, with move-in dates available as early as summer 2024. LyvWell Communities caters to the health-conscious preferences of residents, developing properties with amenities such as pools, dog parks, outdoor fitness areas, Zen zones, community pavilions and community gardens. From fenced yards and garages to versatile living spaces equipped with air and water filtration systems, blackout shades for restful sleep, and circadian lighting, LyvWell Communities offers a comprehensive approach to well-being. According to Mike Bednarski, CEO of LyvWell Communities, “LyvWell Communities is driven by a mission that transcends traditional real estate. Our vision is to provide not just homes, but living experiences that emphasize wellness, community and self-preservation.” Community is a central pillar of the LyvWell Communities mission, and property managers host a wide variety of events and activities for their members such as group fitness classes, community barbecues and healthy cooking classes. LyvWell Communities’ development team has extensive experience in residential and multifamily development, investment and management and covers the Southeastern United States and Texas with their housing offerings.

Southeast

ATLANTA — Multifamily developers are bracing for the uncertainty of 2024 as their projects are delivering into a landscape where new supply is outpacing demand by a significant margin. In the third quarter, a total of 114,000 new multifamily units were delivered in the United States compared to 82,100 absorbed, according to research from CBRE. The absorption figure is technically rebounding as it represents the highest quarterly figure since early 2022, but there is still a sizeable delta compared to supply growth. The trailing four-quarter total for U.S. multifamily deliveries stands at 376,500 units, which CBRE reports is the highest since it began tracking the metric 27 years ago. “This is historic supply,” said Todd Oglesby, managing director of Alliance Residential Co.’s Southeast division. “It’s at the highest levels since the 1980s.” Oglesby made his comments as part of a panel of developers at France Media’s InterFace Multifamily Southeast, an annual conference held on Thursday, Nov. 30 at the Westin Buckhead hotel in Atlanta. Chad Riddle, senior project manager at Bohler, moderated the panel entitled “Given the Interest Rate & Debt Market Environment, How Are Developers Making New Projects Pencil?” Throughout the full-day conference, several panelists mentioned that their firms’ …

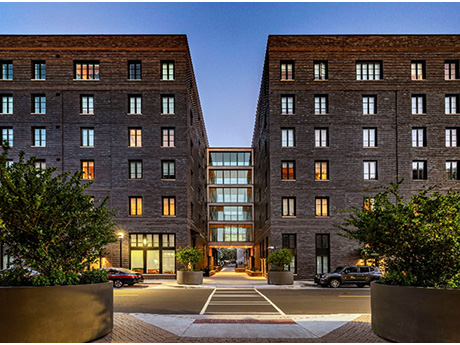

Tidal Delivers First Southeast Mass Timber Residential Project With 389-Unit Ann Street Lofts in Savannah

by John Nelson

SAVANNAH, GA. — Tidal Real Estate Partners, on behalf of investment vehicle Flank GP Fund I, has delivered Ann Street Lofts, a two-building residential development located at 110 Ann St. in downtown Savannah. The 389-unit property represents the first mass timber residential project in the Southeastern United States, according to Tidal. The developer and project architectural firm, LS3P, are targeting LEED Gold certification for Ann Street Lofts, which features a rooftop solar array and electric vehicle charging stations, as well as exposed timber columns, beams and ceilings throughout. Greystar manages the property, whose rental rates range from $1,712 to $3,902 per month, according to Apartments.com. Floor plans range from studios to four-bedroom apartments. Amenities include a pool, fitness center, clubhouse, movie theater, grilling areas, business center, onsite property management and maintenance, bicycle storage, pet play area and a pet washing station.

ATLANTA — Crescent Communities has opened Novel West Midtown, a 340-unit apartment community located at 1330 Fairmont Ave. in Atlanta. Situated in the city’s West Midtown district, the property features walking trails that connect to various hiking trails and a future connection to the Atlanta BeltLine; a dog park; saltwater pool with cabanas, hammocks and spa; outdoor kitchen; and a private courtyard with an elevated terrace view. Indoor amenities include a fitness center, coworking lounge, club room and a game room. The unit mix at Novel West Midtown includes studio, one-, two-, and three-bedroom residences, with 10 percent of homes designated as affordable housing. Rental rates range from $1,699 to $3,515 per month, according to Apartments.com.

CHARLOTTE, N.C. — Northmarq has arranged the $107 million sale of Alta Filament, a 352-unit luxury apartment community located at 525 E. 21st St. in Charlotte. The newly built property is situated in the city’s Mill District neighborhood near Optimist Hall food hall and the Lynx Blue Line Light Rail. Allan Lynch, Caylor Mark, Andrea Howard, John Currin, Jeff Glenn and Austin Jackson of Northmarq represented the seller, Wood Partners, in the transaction. The buyer was Mid-America Apartment Communities. Amenities at Alta Filament include a community clubhouse, conference room, grilling areas and fire pits, a 24/7 fitness club with a rollup door to an outdoor lawn, swimming pool, sundeck trellis, pet spa and wash and a package delivery service. The community also features two oversized courtyards, a podcast/content creator studio and 10 private offices rentable by the month.

Capstone Real Estate Sells Former Student Housing Community in Murfreesboro, Tennessee

by John Nelson

MURFREESBORO, TENN. — Capstone Real Estate Investment has sold Landmark Apartments, a 264-unit community located near the Middle Tennessee State University campus in Murfreesboro. The property was acquired as a student housing project by the company in 2020 and underwent significant renovations, including the transformation of the community into traditional multifamily. Landmark Apartments offers one-, two- and three-bedroom units. The buyer in the transaction was not disclosed.

FREDERICK, MD. — Power Solutions LLC, a commercial electrical contractor based in Bowie, Md., has signed a 93,800-square-foot lease at Arcadia Business Park in Frederick. The tenant signed the lease with Baltimore-based St. John Properties Inc., which represents the fourth lease transaction between the two firms. Danny Foit of St. John Properties represented the landlord internally in the deal, and Jon Casella of CBRE represented the tenant. Power Solutions plans to house 90 full-time employees at its new warehouse space at 4754 Arcadia Drive, which is about 43 miles northwest of Washington, D.C.

TITUSVILLE, FLA. — A partnership between Houston-based Hines and locally based Key Group has announced plans to develop Space Coast Innovation Park, a 3 million-square-foot industrial development in the Space Coast city of Titusville. Located in Brevard County, the three-phase development will be situated on 450 acres near Space Coast Regional Airport’s Exploration Spaceport and within a few miles of NASA’s Kennedy Space Center. Nearby space exploration and aerospace defense firms include SpaceX, Blue Origin, Boeing, Northrop Grumman and Lockheed Martin. This past summer, Amazon announced it is developing a $120 million satellite processing facility in nearby Cape Canaveral, Fla. Additionally, the U.S. Air Force recently selected Patrick Space Force Base as its preferred headquarters location for the U.S. Space Force’s Space Training and Readiness Command operations. “As the rapid commercialization and privatization of the aerospace industry continues, with the space economy expected to generate more than $1 trillion in annual sales by 2040, we believe now is the perfect time to create a best-in-class logistics hub for aerospace companies requiring more direct access to Kennedy Space Center and Cape Canaveral than properties located further south can offer,” says Ryan Wood, managing director at Hines. “We look forward to partnering …

HUNTSVILLE, ALA. — Tanger has acquired Bridge Street Town Centre, an open-air retail center located in Huntsville, for $193.5 million. Alabama-based Bayer Properties is the developer and former owner of the 825,000-square-foot development. Tenants at the property include lululemon athletica, Sephora, Main Event, a 14-screen Cinemark movie theater, Lovesac, Dry Goods, Victoria’s Secret, Athleta, Anthropologie, Altar’d State, Ulta Beauty, Barnes & Noble, Dick’s Sporting Goods, Old Navy, H&M and Belk, among others. The center was 93 percent occupied at the time of sale. This marks Tanger’s 39th property and first open-air lifestyle center.

BIRMINGHAM, ALA. — Dobbins Group will develop two apartment communities in Birmingham. The first community, Colina West Homewood, will comprise 310 units in one-, two- and three-bedroom floorplans at 80 West Oxmoor Road. Amenities at the property will include package lockers, grilling stations and outdoor kitchens, hiking trails, a fitness center, swimming pool, coworking space, car wash, lawn game area, central green space, dog spa and park, clubhouse with resident lounge and attached and detached garages. The property will also feature a Grab & Go Market. The second property, Colina Hillside, will total 475 apartments in one-, two- and three-bedroom layouts across four- and five-story buildings. Amenities at the property, which will be located at 1121 Colina St., will include two heated saltwater pools, private pool cabanas and an outdoor kitchen entertainment area, 24-hour fitness center, a pet spa and pet parks, greenspace, firepits, grilling stations, electric car charging stations, valet trash service, a 24-hour resident market and lounge and coworking spaces. Protective Life provided financing. LBYD will serve as civil engineer for both developments, with Lorberbaum McNair providing landscape architecture and Catori Design House overseeing interior design. Forestry Environmental is the sitework contractor, and Capstone Building Corp. will provide …