OWINGS MILLS, MD. — Locally based David S. Brown Enterprises has signed three new leases at Metro Centre Owings Mills, a mixed-use, transit-oriented development under construction in the Baltimore suburb of Owings Mills. Bakery-café chain Paris Baguette, Miss Toya’s Creole House and Royalty Dental are all scheduled to debut in 2026. In addition to the new lease signings, Japanese restaurant Chiimii Sushi & Sando recently opened at the property. Current tenants at the center include The Tillery, Hook & Reel, Toastique, World of Beer, Bee Inspired Goods, Club Pilates, Eggspectation and King Fu Tea. Upon completion of the mixed-use development, Metro Centre Owings Mills is expected to offer 150,000 square feet of retail and restaurants, 560,000 square feet of office space and 1,700 luxury apartments, along with a full-service hotel.

Southeast

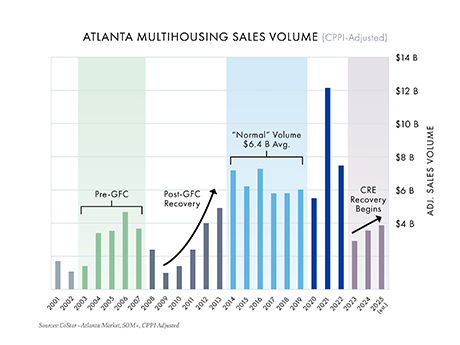

Atlanta’s multifamily market has been in a slump that would even make Braves fans wince. After peaking with record-breaking sales in 2021, volumes slid as borrowing costs climbed and supply piled up. But just like any good ballclub, the fundamentals matter, and the data suggests momentum is quietly building for a 2026 comeback season. Sales volume trends According to research from CoStar Group, institutional multifamily sales in Atlanta (transactions of $50 million or more) peaked in 2021 at $12.8 billion, driven by record pricing, historically low borrowing costs and robust rent growth. Since then, record supply, rising expenses and a sharp increase in borrowing costs have pushed sales volumes down by more than 70 percent, averaging just $3.5 billion annually over the past three years. While the broader U.S. economy has surged since 2022 — the S&P 500 has climbed 45 percent since fourth-quarter 2022 — commercial real estate has been searching for its bottom. Data now suggests that Atlanta has reached this inflection point, and history indicates increased activity and rising values in the years ahead. Parallels to the GFC Looking back at the global financial crisis (GFC) provides valuable context. The chart above (inflation-adjusted using Real Capital Analytics’ …

13th Floor, Key International Break Ground on 327-Unit Skye Apartment Community in Delray Beach, Florida

by Abby Cox

DELRAY BEACH, FLA. — 13th Floor Investments and Key International have broken ground on Skye, a 327-unit apartment community located in Delray Beach, approximately eight miles north of Boca Raton, Fla. CIBC Bank USA is providing a $79.2 million construction loan to finance the project. The Skye apartment complex is the second residential phase of the 50-acre Parks at Delray mixed-use development, following the debut of Savio, a 420-unit apartment complex. Skye is slated for completion in 2027. Designed by MSA Architects, Skye will offer studios, one-, two- and three-bedroom floorplans ranging in size from 560 to 1,410 square feet, as well as three-bedroom townhome options spanning up to 1,770 square feet. Amenities at the complex will include a beach-entry swimming pool with cabanas and a pool bar, parks with jogging trails and outdoor BBQs and an outdoor “tot lot” and children’s playroom. Additional amenities include a 24-7 fitness center, yoga room, dog park, coworking spaces with a business center, lounge, social club room with a kitchen and a bar. Residents also have access to package rooms, select garages, covered parking and complimentary Wi-Fi in common areas.

NEW SMYRNA BEACH, FLA. — GBT Realty Corp. has unveiled plans to develop Shops at New Smyrna, a 55,273-square-foot, grocery-anchored neighborhood shopping center located in New Smyrna Beach. Construction of the project is scheduled to begin in summer 2026, with completion set for summer 2027. A 23,273-square-foot Sprouts Farmers Market will anchor the development, which will also feature an additional 35,000 square feet of junior anchor and inline retail space across two buildings, as well as two one-acre outparcels. The tenant roster is expected to include fitness and restaurant users and soft goods services, among others.

BEL AIR, MD. — PMZ Realty Capital has arranged a $12 million bridge loan for Hilton Garden Inn Bel Air, an 83-room hotel located in Bel Air, roughly 30 miles northeast of Baltimore. A private lender provided the financing for the new bridge loan, which will replace the previous loan. The Hilton Garden Inn Bel Air features a heated indoor swimming pool, fitness center, complimentary Wi-Fi, free parking, electric vehicle charging stations, the Garden Grill & Bar hotel restaurant and 2,200 square feet of flexible meeting and event space.

SRS Brokers $5.4M Sale of Retail Property in Suburban Orlando Leased to The Learning Experience

by Abby Cox

DAVENPORT, FLA. — SRS Real Estate Partners has brokered the $5.4 million sale of a single-tenant retail property located in Davenport, roughly 25 miles southwest of Orlando. The Learning Experience, an early childhood education and childcare center, occupies the 10,000-square-foot building on a 20-year lease with 19 years remaining. The building also features a 5,000-square-foot outdoor play area. Built in 2024, the single-tenant property is situated within a larger retail development along U.S. Highway 27. William Wamble and Patrick Nutt of SRS Capital Markets represented the seller, a national commercial real estate investment and development company, in the transaction. The buyer was a Central Florida-based private investor. Both parties requested anonymity.

Colliers Negotiates 100,125 SF Industrial Lease at Washington Highway Logistics Center in Glen Allen, Virginia

by Abby Cox

GLEN ALLEN, VA. — Colliers has negotiated a 100,125-square-foot industrial lease at Washington Highway Logistics Center in the northern Richmond suburb of Glen Allen. The tenant is Riverside Logistics, a third-party logistics and supply chain management company that manages a 1 million-square-foot warehouse portfolio. This lease joins the company’s recent signing at 200 Orleans St. in Richmond. Rob Dirom of Colliers represented the tenant in the lease negotiations. The landlord was not disclosed. Washington Highway Logistics Center totals 400,500 square feet across two buildings.

Ackerman & Co. Secures $117M Acquisition Financing for Lincoln Road Retail Redevelopment Project in Miami Beach

by Abby Cox

MIAMI BEACH, FLA. — Ackerman & Co. has secured $117 million in financing on behalf of locally based Comras Co. for the acquisition of five buildings to complement the north end of Lincoln Road, the retail high street of Miami Beach. Dubbed NoLi (North Lincoln Road), the redevelopment will include 150,000 square feet of boutique retail, dining, wellness and lifestyle concepts, as well as 1,700 square feet of street frontage. Completion of the project is anticipated for the first quarter of 2027. Jonathan Rice of Atlanta-based Ackerman & Co. arranged the financing through ACORE Capital. The sellers of the five properties were affiliates of Morgan Stanley and Terranova Corp. “NoLi promises to be another transformative development by Comras in Miami Beach, alongside recently completed projects like the CocoWalk redevelopment in Coconut Grove and the retail component of Miami Worldcenter,” says Jonathan Rice, executive vice president of capital markets at Ackerman & Co. Situated along Lincoln Road and North Lincoln Lane, NoLi will be converted into a new micro-district that will comprise more than 40 inline retail spaces. NoLi will reuse the existing buildings and repurpose the outdated floorplans to create boutique-sized spaces, with layouts ranging in size from 400 square feet …

Lument Securities Arranges $140M Sale of Four Long-Term Healthcare Communities in West Virginia

by John Nelson

NEW YORK CITY — Lument Securities has arranged the $140 million sale of four long-term healthcare communities in West Virginia. Marx Development Group (MDG) purchased the 511-bed portfolio and has selected its subsidiary, Majestic Care, to operate the communities. Laca Wong-Hammond of Lument Securities represented the seller, the State of West Virginia, in the transaction. The properties include Hopemont Hospital in Terra Alta, Jackie Withrow Hospital in Beckley, John Manchin Sr. Health Care Center in Fairmont and Lakin Hospital in West Columbia. In addition to funding the purchase, the closing provides for a minimum of another $80 million that MDG has committed to using for the construction of three to five new long-term care communities in the coming years.

Bridge Industrial to Redevelop South Florida Office Park Into 268,702 SF Industrial Complex

by John Nelson

DORAL, FLA. — Bridge Industrial has recently received approval to redevelop a 16-acre office park located at 7775 N.W. 48th St. in Doral into Bridge Point Doral 826, a 268,702-square-foot, two-building industrial complex. The conversion project will transform the 1970s-era suburban office park in metro Miami’s Airport West submarket into a LEED-certified logistics hub. Bridge Industrial has begun preliminary site preparations at the property and will plan to deliver the project in first-quarter 2027. Bridge Point Doral 826 represents the second office-to-industrial conversion project in South Florida as the company recently redeveloped the former Ryder Systems headquarters into Bridge Point Flagler Station.