DURHAM, N.C. — Camden Property Trust (CPT) has opened Camden Durham, a 420-unit multifamily community located at 441 Dillard St. in downtown Durham. The property features one-, two- and three-bedroom apartments, as well as 14 one- and two-bedroom townhomes. Amenities at the community include a 24-hour athletic club, resident lounge and community workspace, swimming pool, barbecue grills and a lawn for gatherings. Additionally, the property features 5,945 square feet of ground-floor retail space available for lease. Monthly rental rates begin at $1,529, according to the community website.

Southeast

Ziegler Arranges $52.5M Bond Financing for Seniors Housing Development in Winchester, Virginia

by John Nelson

WINCHESTER, VA. — Ziegler has arranged $52.5 million in bond financing for Shenandoah Valley Westminster-Canterbury (SVWC), a senior housing development located in Winchester, approximately 70 miles west of the Washington, D.C. metro area. Constructed in 1982, the 87-acre property features 217 independent living units (164 apartments and 53 cottages), 48 assisted living units, 12 memory care units and 51 skilled nursing beds. Currently, an independent living villa apartment expansion project is underway at the development. Ziegler financed the first phase, which includes 48 new independent living villa apartments, in 2022. The second phase of the project is being financed with the new bonds and includes an additional 49 independent living villa apartments, for which SVWC issued two tranches of draw-down bank loans that were purchased by Atlantic Union Bank and Pinnacle Financial Partners. The two tranches include a $27.5 million, 10-year bank commitment period with an accreting swap that mitigates interest rate risk through the bank commitment period and a $25 million intermediate-term bond with a 30-month maturity to be repaid with entrance fees to the expansion.

MIAMI — A joint venture between Housing Trust Group (HTG) and AM Affordable Housing has broken ground on a $37 million affordable seniors housing project located at 18700 NE 25th Ave. in Miami. Dubbed Oasis at Aventura, the development will feature 95 one-bedroom units across eight stories reserved for residents age 62 years or older earning at or below 25, 33 and 60 percent of the area median income (AMI). Amenities at the community will include a community room, fitness center, business center, library and lounge and outdoor terrace. Monthly rents at the property will range from $484 to $1,161. Funding for the project includes $21 million in low-income housing tax credits (LIHTC) syndicated through Raymond James, a $19.3 million construction loan provided by JP Morgan Chase Bank, a permanent $7.5 million Freddie Mac loan secured through Berkadia, a $4.3 million Florida Housing Finance Corp. viability loan and a $2.4 million loan provided by the Miami-Dade County affordable housing surtax program. The project team includes Realization Architects, general contractor Ballast Construction, engineer Sun-Tech Engineering, interior designer B Pila Design Studio and landscape architect Witkin Hults + Partners. Completion of Oasis at Aventura is scheduled for spring 2025.

The Preiss Co. Secures Recapitalization for 600-Bed Student Housing Community Near Auburn University in Alabama

by John Nelson

AUBURN, ALA. — The Preiss Co. (TPCO) has recapitalized the Collective at Auburn, a 600-bed student housing community located near the Auburn University campus in Alabama. A multimillion-dollar renovation is planned for the property, which will include upgrading countertops, appliances and paint in select units; modernization of unit access controls; and fully furnishing 25 percent of units. Upgrades are scheduled to begin in spring 2025. The Collective at Auburn offers two-, three- and four-bedroom units with bed-to-bath parity. Amenities include a 24-hour fitness center, swimming pool, basketball court, tanning salon, volleyball court, game room, movie theater and a business center.

Louisville, perhaps the center of the universe for horses and bourbon, is a somewhat undiscovered gem lying at the northern edge of the Southeast. The metro, with a population of just under 1.4 million people, is a steady performer across virtually all measurables, producing consistent and predictable metrics that may not dazzle Wall Street but certainly have not disappointed the base of capital invested in this riverfront market. The Kentucky Derby, which ran for the 149th time this past May, produces $400 million in economic development annually and is likely the first mental image conjured up when the term “Louisville” is mentioned. Kentucky bourbon likely comes to mind next as a $9 billion industry across the state, with roots as deep as oak. However, there’s much more to the Louisville metro. Through the first half of 2023, the Louisville metro area had recovered virtually all of the more than 55,000 jobs the market lost in 2020. Interestingly but not surprisingly, arts, entertainment and recreation posted a net 7.5 percent increase in jobs from 2020 through 2022, more than erasing a blistering 2020 loss of 25.4 percent of the jobs in this sector. Less glamorous but perhaps more critical is transportation …

LIBERTY, N.C. — Toyota has announced plans to invest an additional $8 billion in Toyota Battery Manufacturing, North Carolina (TBMNC), an advanced manufacturing campus currently underway in Liberty, roughly 23 miles outside Greensboro. Toyota’s investment in the facility, which is expected to create more than 5,000 jobs, now totals roughly $13.9 billion. Scheduled to begin production in 2025, the facility will develop and produce batteries for use in electric vehicles. The new investment will allow for the addition of eight battery production lines, bringing the total to 10. The project, which was initially announced in 2021, will total 7 million square feet.

BREVARD, N.C. — Northmarq’s Atlanta office has brokered the $4.3 million sale of Shoppes at Brevard Place, a retail property located in Brevard, roughly 30 miles southwest of Asheville. Built in 2020, the property totals 11,801 square feet. Tenants at the center, which was 76 percent occupied at the time of sale, include Starbucks Coffee, Jersey Mike’s, Salsarita’s, Mommy & Me and AT&T. Billy Benedict of Northmarq represented both the buyer and seller in the transaction.

Colliers Arranges Acquisition Financing for Multifamily Portfolio Totaling 56 Units in Chattanooga

by John Nelson

CHATTANOOGA, TENN. — Colliers Mortgage has arranged financing for the acquisition of a two-property multifamily portfolio totaling 56 units in Chattanooga. The properties include Richwood Townhomes and Seminole Pathe. Located at 918 Donaldson Road, Richwood Townhomes was built in 1968 and comprises 24 units throughout four two-story buildings. Seminole Pathe features 32 units within one three-story building, as well as a one-story single-family residence that functions as a duplex. Built in 1925, the property is situated at 302 Dunlap Ave. The financing included the assumption of an existing Fannie Mae mortgage loan, as well as an additional Fannie Mae supplemental loan. Zach Shope of Colliers Mortgage’s Atlanta office secured the financing on behalf of the borrower, an entity doing business as East Ridge Flats and Townhomes LLC.

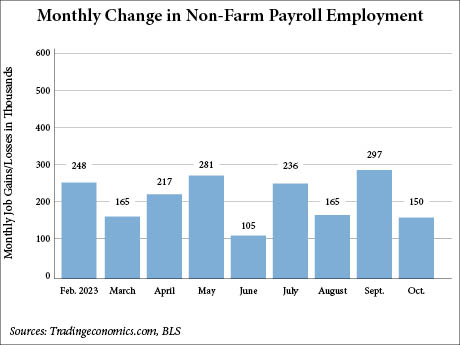

WASHINGTON, D.C. — Total nonfarm employment in the United States rose by 150,000 jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). This figure both marks a notable decline from September, which saw the addition of 297,000 jobs, and falls short of expectations for October. Previously, Dow Jones economists predicted a rise of 170,000 for the month, reports CNBC. October’s employment gain is also below the average monthly gain of 258,000 over the previous 12 months. While the sectors of healthcare, government and social assistance saw job gains, manufacturing jobs decreased, which the BLS report attributes to strike activity. Manufacturing employment decreased by 35,000 positions, including a decline of 33,000 in motor vehicles and parts manufacturing. Healthcare, government and social assistance added 58,000, 51,000 and 19,000 jobs, respectively. Construction employment also increased, with the addition of 23,000 jobs. Leisure and hospitality and professional business services saw more modest gains, adding 19,000 and 15,000 jobs, respectively. Other industries saw minimal changes. The unemployment rate ticked up from 3.8 percent in September to 3.9 percent in October, and is the highest unemployment rate since January 2022. Some experts predict that the cooler job market reflected in the report portends …

ST. PETERSBURG, FLA. — Mel Sembler, founder of St. Petersburg-based retail real estate development firm The Sembler Co., has passed away at the age of 93, according to a statement from the company. Sembler founded his eponymous real estate company in 1962. To date, it has completed more than 350 developments totaling 29 million square feet. Additionally, the company manages and leases 10 million square feet of retail real estate and has offices in St. Petersburg, Atlanta and Puerto Rico. In a prepared statement, The Sembler Co. stated “his indelible mark will continue to guide us as we honor his legacy. He was the truest friend and leader to all.” Currently, The Sembler Co.’s portfolio includes Belmont Shopping Center in Ruskin, Fla., and North Macon Plaza in Macon, Ga. Sembler is also underway on the development of The Preserve Marketplace in Odessa, Fla., and West Villages Marketplace in Venice, Fla. In metro Atlanta, the company developed The Prado in 2008 and Town Brookhaven in 2010. The retail centers total 345,000 and 441,217 square feet, respectively. Sembler also previously served as U.S. Ambassador to Australia and Nauru from 1989 to 1993 and to Italy from 2001 to 2005. He also served …